Andhra Pradesh Budget Analysis 2023-24 | APPSC State Specific Preparation Course - APPSC (Andhra Pradesh) PDF Download

The Finance Minister of Andhra Pradesh, Mr. Buggana Rajendranath, presented the Budget for the state for the financial year 2023-24 on March 16, 2023.

Budget Highlights

- The Gross State Domestic Product (GSDP) of Andhra Pradesh for 2023-24 (at current prices) is estimated to reach Rs 14,49,501 crore, showing a growth of 10% compared to 2022-23.

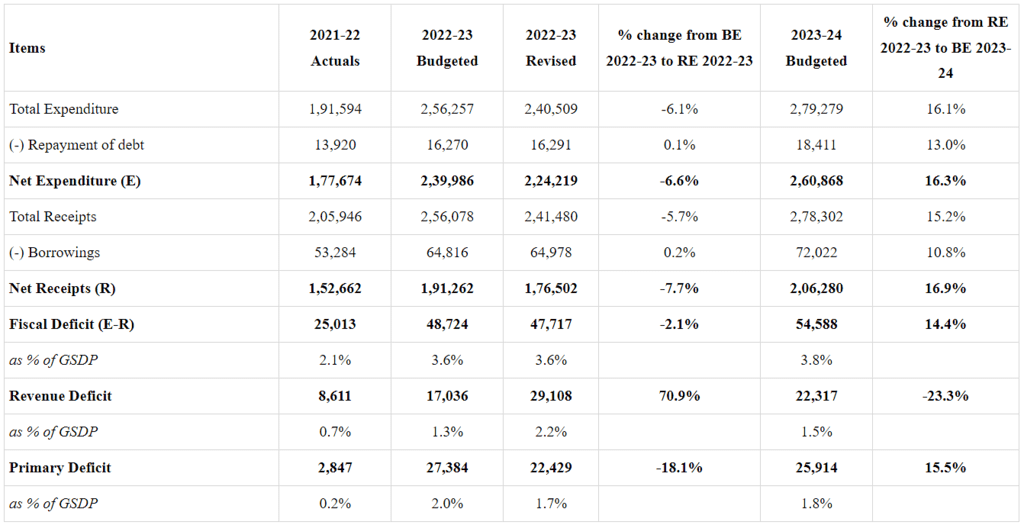

- Expenditure (excluding debt repayment) in 2023-24 is projected to be Rs 2,60,868 crore, marking a 16% increase from the revised estimates of 2022-23. Additionally, the state plans to repay a debt of Rs 18,411 crore.

- Receipts (excluding borrowings) for 2023-24 are expected to reach Rs 2,06,280 crore, reflecting a 17% increase from the revised estimate of 2022-23. However, in 2022-23, receipts (excluding borrowings) are anticipated to decline by 7.7% at the revised stage.

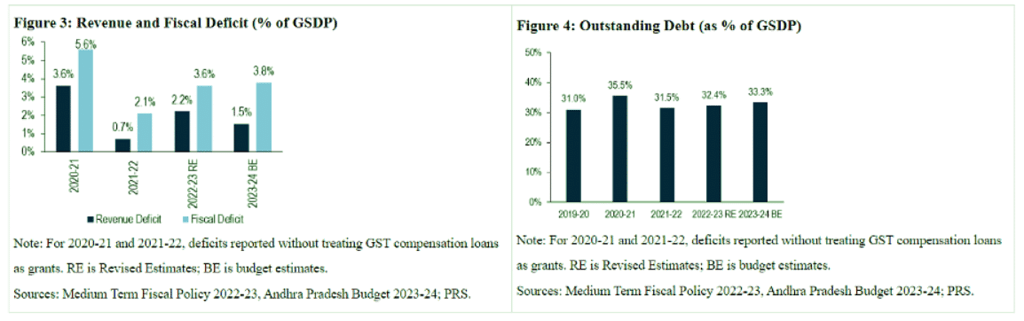

- Revenue deficit in 2023-24 is projected to be 1.5% of GSDP (Rs 22,317 crore), which is lower than the revised estimates for 2022-23 (2.2% of GSDP). In 2022-23, the revenue deficit is anticipated to surpass the budget estimate (1.3% of GSDP).

- Fiscal deficit for 2023-24 is aimed at 3.8% of GSDP (Rs 54,588 crore). In 2022-23, based on the revised estimates, the fiscal deficit is predicted to be 3.6% of GSDP, matching the budget estimates for the year.

The Gross State Domestic Product (GSDP) of Andhra Pradesh for 2023-24 (at current prices) is forecasted to be Rs 14,49,501 crore, showing a growth of 10% over 2022-23.

Financial Estimates for 2023-24

- Expenditure Increase:

- Projected expenditure for 2023-24, excluding debt repayment, is Rs 2,60,868 crore, marking a 16% rise from 2022-23's revised estimates.

- The state plans to repay debts amounting to Rs 18,411 crore during the financial year.

- Receipts Growth:

- Expected receipts, excluding borrowings, for 2023-24 are projected at Rs 2,06,280 crore, showing a 17% increase from the revised estimates of 2022-23.

- Comparatively, in 2022-23, receipts were anticipated to decline by 7.7% during the revised stage.

- Revenue Deficit Changes:

- The revenue deficit for 2023-24 is estimated at 1.5% of GSDP (Rs 22,317 crore), lower than the 2.2% of GSDP in 2022-23's revised estimates.

- In 2022-23, the revenue deficit was expected to surpass the budget estimate, reaching 1.3% of GSDP.

- Fiscal Deficit Targets:

- The fiscal deficit target for 2023-24 is set at 3.8% of GSDP (Rs 54,588 crore).

- Comparatively, in 2022-23, the fiscal deficit is expected to match the budgeted 3.6% of GSDP as per the revised estimates.

Policy Highlights

- YSR Aasara Scheme: The YSR Aasara scheme, initiated in 2020, focuses on forgiving outstanding bank loans for women self-help groups. An allocation of Rs 6,700 crore is set aside for this program in 2023-24.

- Urban Development and Housing: Allocating Rs 9,381 crore in 2023-24, the government prioritizes municipal administration and urban development. Through the Pedalandariki Illu Scheme, it aims to provide 30.21 lakh permanent houses by 2023, with 4.4 lakh already completed. A budget of Rs 5,600 crore is dedicated to this initiative.

- Livestock Insurance: The YSR Pasu Bhima Yojana, recently sanctioned, focuses on offering livestock insurance to farmers. It covers a wide range of animals, including improved, indigenous, and nondescript breeds.

- Pension Enhancement: With a vision to raise pension amounts to Rs 3,000 for various pensioners in the state, the government has allocated Rs 21,434 crore to the YSR Pension Kanuka in 2023-24.

Andhra Pradesh's Economic

- Livestock Insurance: The YSR Pasu Bhima Yojana has been sanctioned to offer insurance coverage to farmers for their livestock, encompassing both improved and indigenous as well as nondescript animal breeds.

- Pension Enhancement: The state government aims to elevate the pension amount for various categories of pensioners to Rs 3,000 in the upcoming years. An allocation of Rs 21,434 crore has been earmarked towards YSR Pension Kanuka for the fiscal year 2023-24.

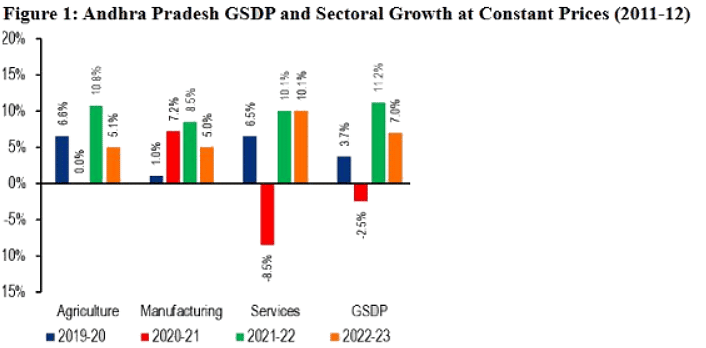

- Economic Growth: In the fiscal year 2022-23, Andhra Pradesh's Gross State Domestic Product (GSDP) is predicted to expand by 7% at constant prices, mirroring the national GDP growth rate for the same period.

- Sectoral Development: The services sector exhibited a growth of 10% in 2022-23 from a lower base, while the manufacturing and agriculture sectors saw a growth rate of 5% each. The projected contributions to the economy by agriculture, manufacturing, and services sectors in 2022-23 stand at 39%, 21%, and 40% respectively, at current prices.

- Per Capita GSDP: The estimated per capita GSDP of Andhra Pradesh for the financial year 2021-22, at current prices, amounts to Rs 2,19,518.

Note: The figures presented are based on constant prices (2011-12), indicating that the growth rates have been adjusted for inflation.

Sources: Economic Survey of Andhra Pradesh 2022-23; PRS.

Budget Estimates for 2023-24

- Total Expenditure Overview

- The total expenditure (excluding debt repayment) for 2023-24 is aimed at Rs 2,60,868 crore, marking a 16.3% increase from the revised estimate of 2022-23.

- This spending will be covered through receipts (excluding borrowings) of Rs 2,06,280 crore and net borrowings of Rs 53,611 crore.

- Total receipts for 2023-24 (excluding borrowings) are projected to grow by 16.9% compared to the revised estimate of 2022-23.

- Deficit Figures

- Revenue deficit for 2023-24 is expected to be 1.5% of GSDP (Rs 22,317 crore), lower than the revised estimates for 2022-23, which stood at 2.2% of GSDP.

- Fiscal deficit in 2023-24 is targeted at 3.8% of GSDP (Rs 54,588 crore), higher than the revised estimates for 2022-23 at 3.6% of GSDP.

Table 1: Budget 2023-24 - Key figures (in Rs crore)

Note: BE is Budget Estimates; RE is Revised Estimates.

Sources: Annual Financial Statement, Andhra Pradesh Budget 2023-24; PRS.

Expenditure in 2023-24

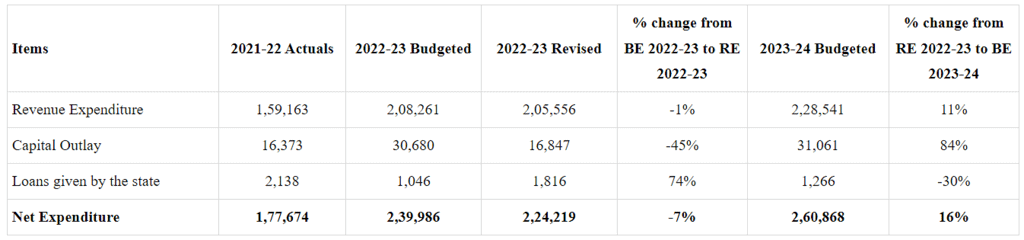

- Revenue Expenditure: The proposed revenue expenditure for the upcoming fiscal year includes allocations for salaries, pensions, interest payments, grants, and subsidies, with a notable 11% increase from the previous year.

- Capital Outlay: The capital outlay for the next fiscal year is aimed at asset creation and has seen a substantial 84% increase from the previous year's estimates, indicating a focus on infrastructure development.

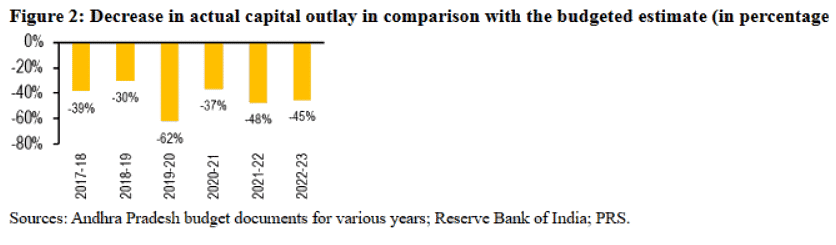

Estimation of Capital Outlay Trends

- A consistent trend of overestimation in capital outlay and a noteworthy reduction in actual expenditure have been evident over time.

- Actual spending on capital outlay tends to decrease when revenue falls short of expectations. This reduction is primarily due to the inability to immediately curtail revenue expenses like pension and interest payments.

- For the upcoming fiscal year 2023-24, approximately 24% of the projected revenue receipts are allocated for pension and interest payments.

Table 2: Expenditure budget 2023-24 (in Rs crore)

Table 2: Expenditure budget 2023-24 (in Rs crore)

Sources: Annual Financial Statement, Andhra Pradesh Budget 2023-24; PRS.

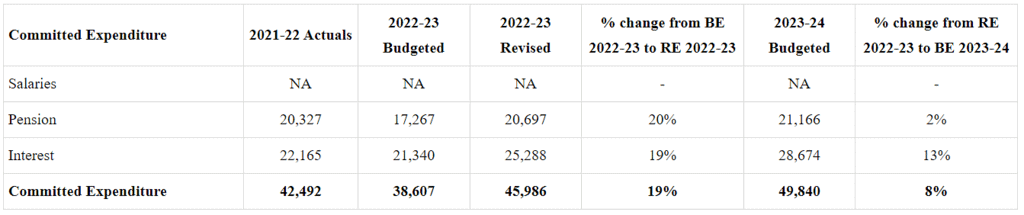

Committed Expenditure in Andhra Pradesh

Committed Expenditure includes:

- Pension: 10% of revenue receipts

- Interest Payments: 14% of revenue receipts

- Importance of Committed Expenditure:

- Committed expenditure limits the state's flexibility to allocate budget for other priorities like capital outlay.

- Example: In 2023-24, Andhra Pradesh plans to spend Rs 49,840 crore on committed expenditure, accounting for 24% of its revenue receipts.

- Comparison: In 2022-23, 26% of revenue receipts were spent on committed expenditure, lower than the 28% in 2021-22.

Table 3: Committed Expenditure in 2023-24 (in Rs crore)

Sources: Annual Financial Statement, Andhra Pradesh Budget 2023-24; PRS.

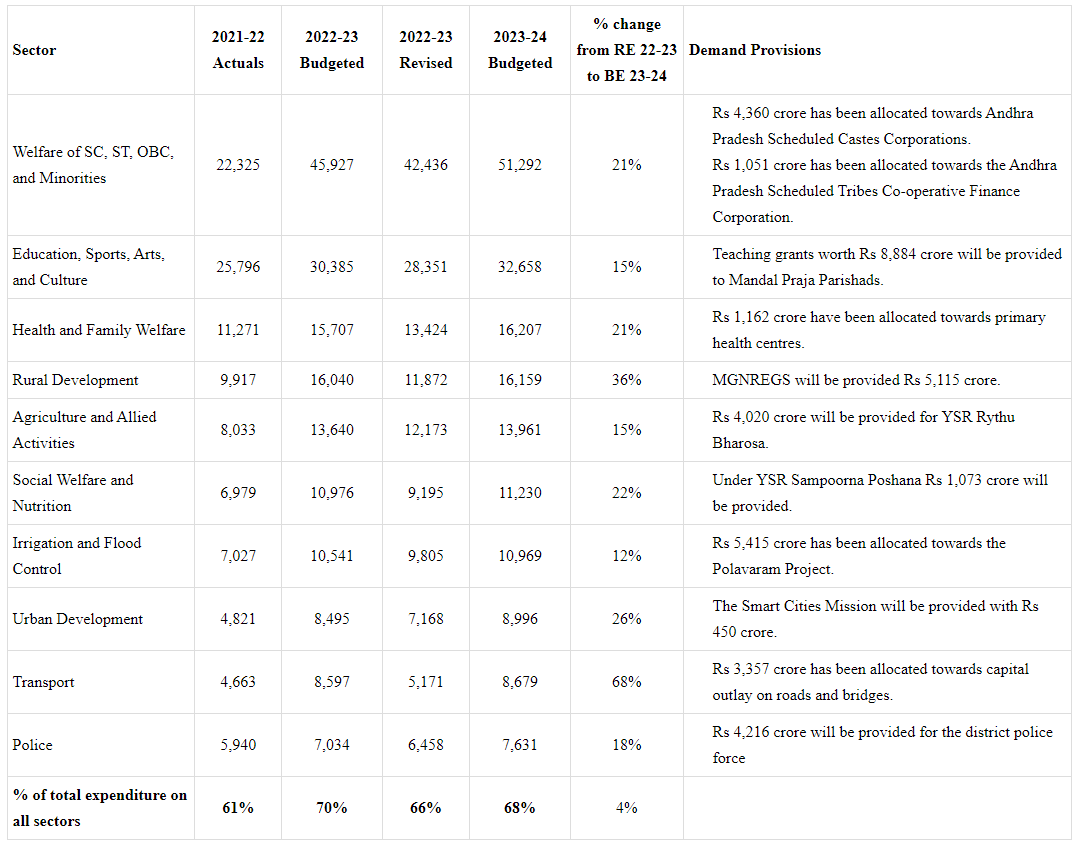

Sector-wise expenditure: The sectors listed below account for 68% of the total expenditure on sectors by the state in 2023-24. A comparison of Andhra Pradesh’s expenditure on key sectors with that by other states is shown in Annexure 1.

Table 4: Sector-wise expenditure under Andhra Pradesh Budget 2023-24 (in Rs crore)

Sources: Annual Financial Statement, Andhra Pradesh Budget 2023-24; PRS.

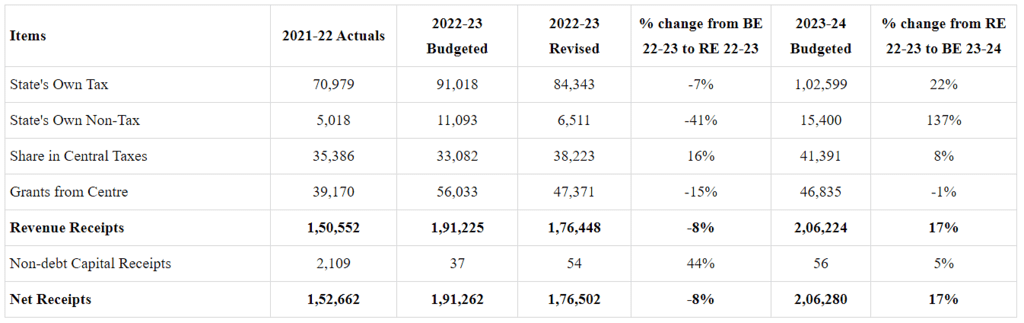

Receipts in 2023-24

- Total Revenue Receipts: Estimated at Rs 2,06,224 crore, with 57% from state resources and 43% from the center.

- Resources from the Center: Includes state's share in central taxes and grants.

- State's Own Tax Revenue: Expected to be Rs 1,02,599 crore, constituting 7% of GSDP in 2023-24.

- Own Tax Revenue Percentage: Showing an increase over previous years, with 5.9% in 2021-22 and 6.4% in 2022-23.

State Financial Overview

- Devolution: In the fiscal year 2023-24, the state is expected to receive Rs 41,391 crore from central taxes, marking an 8% increase from the previous year.

- Grants from the Center: The state is estimated to receive grants totaling Rs 46,835 crore in 2023-24, with a significant difference from the previous budgeted amount.

State Own Tax Revenue

- Andhra Pradesh's total own tax revenue for 2023-24 is projected to reach Rs 1,02,599 crore, showing a notable 22% increase from the revised figures of 2022-23.

- Own Tax Revenue Percentage: The own tax revenue as a percentage of the Gross State Domestic Product (GSDP) is expected to be 7% in 2023-24, showing an upward trend from the previous estimates. In 2021-22, this percentage was 5.9%.

Table 5: Break-up of the state government’s receipts (in Rs crore)

Breakdown of State Government Receipts

- Table 5 provides a detailed breakdown of the state government's receipts, showcasing actuals for 2021-22, budgeted figures for 2022-23, revised estimates for the same year, and the budgeted amounts for 2023-24.

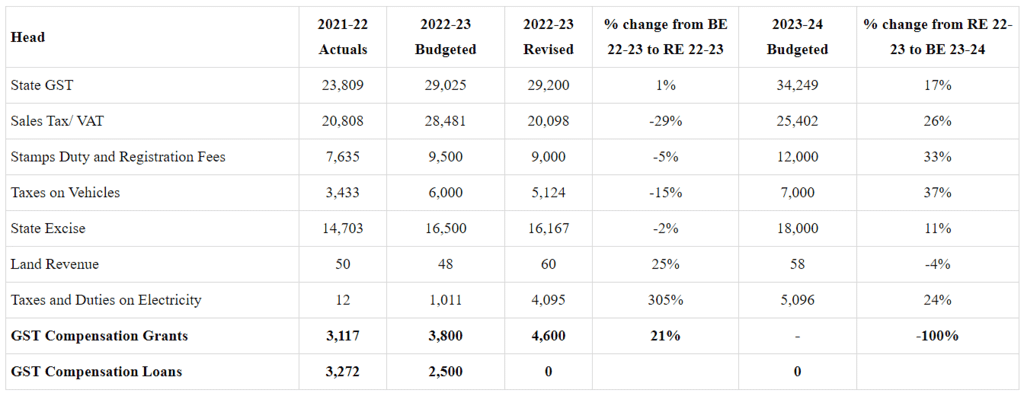

State GST and Sales Tax/VAT Analysis

- In 2023-24, State GST is predicted to be the largest source of own tax revenue, constituting a 33% share.

- State GST revenue is expected to grow by 17% compared to the previous year.

- Sales Tax/VAT contributes significantly to own tax revenue, accounting for a 25% share.

- Revenue from Sales Tax/VAT is projected to increase by 26% in the upcoming year.

- However, at the revised stage, this revenue is estimated to be 29% lower than the budget estimates.

Non-Tax Revenue

- Andhra Pradesh aims to generate Rs 15,400 crore from non-tax revenue in 2023-24. In the previous fiscal year, the non-tax revenue at the revised stage stood at Rs 6,511 crore, marking a 41% shortfall from the budgeted estimate.

- An uptick in non-tax revenue could be linked to an increase in income from mining royalty. The royalty earned from major minerals is anticipated to reach Rs 2,144 crore, nearly three times the revised estimates of 2022-23.

- In 2022-23, receipts from mining royalty dropped by 48% compared to the budgeted estimates of the same fiscal year, indicating a significant decline in this revenue source.

Table 6: Major sources of state’s own-tax revenue (in Rs crore)

Sources: Annual Financial Statement, Revenue Budget, and Andhra Pradesh Budget 2023-24; PRS.

Deficits, Debt, and FRBM Targets for 2023-24

- Andhra Pradesh Fiscal Responsibility Act, 2005: This act lays down yearly objectives to gradually decrease the outstanding liabilities, revenue deficit, and fiscal deficit of the state government.

- Revenue deficit: It represents the variance between revenue expenditure and revenue receipts. A revenue deficit suggests that the government must borrow to cover expenses that do not enhance its assets or lessen its liabilities. The budget forecasts a revenue deficit of Rs 22,317 crore (equivalent to 1.5% of the GSDP) for 2023-24.

- Fiscal deficit: This denotes the surplus of total expenditure over total receipts. This difference is usually funded by government borrowings, resulting in a rise in total liabilities. For 2023-24, the fiscal deficit is predicted to be 3.8% of the GSDP. The central government has allowed states a fiscal deficit of up to 3.5% of GSDP for 2023-24, with an extra 0.5% of GSDP accessible only after implementing specific power sector reforms. Revised estimates for 2022-23 show the state's fiscal deficit expected to be 3.6% of GSDP.

- Off-budget borrowings: These funds are not reflected in a state's budget and are not under legislative oversight. They typically involve resources raised by PSUs, with the state government repaying the principal and interest. As of March 2021, Andhra Pradesh's off-budget borrowings amounted to Rs 86,260 crore. The state's outstanding liability, excluding off-budget borrowings, was Rs 3.5 lakh crore. Including such borrowings would raise it to Rs 4.3 lakh crore, equivalent to 44% of the GSDP, as opposed to the reported 35.5% by the state.

Outstanding Debt Explanation

- Outstanding debt reflects the total borrowings at the end of a financial year, including any liabilities on the public account.

- By the end of 2023-24, the estimated outstanding liabilities are 33.3% of GSDP, higher than the revised estimate for 2022-23 at 32.4% of GSDP.

- Comparatively, outstanding liabilities have risen from the 2019-20 level of 31% of GSDP.

Government Guarantees

- States like Andhra Pradesh hold liabilities that may not be immediately apparent, such as guarantees on borrowings of State Public Sector Enterprises (SPSEs). As of March 31, 2022, Andhra Pradesh's outstanding guarantees amount to Rs 1,38,875 crore, with a significant portion allocated to the power sector.

- These guarantees constitute about 12% of Andhra Pradesh's Gross State Domestic Product (GSDP) for the fiscal year 2021-22.

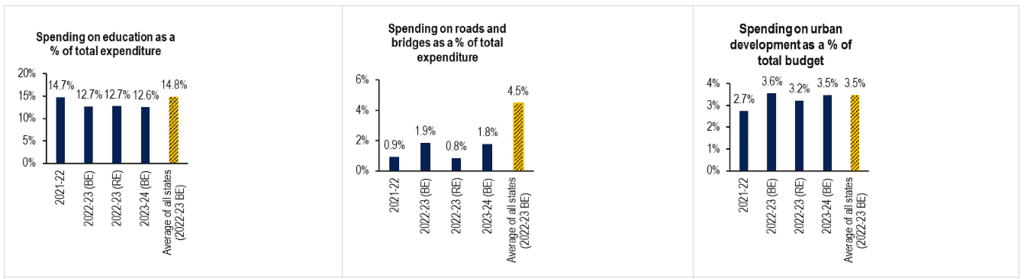

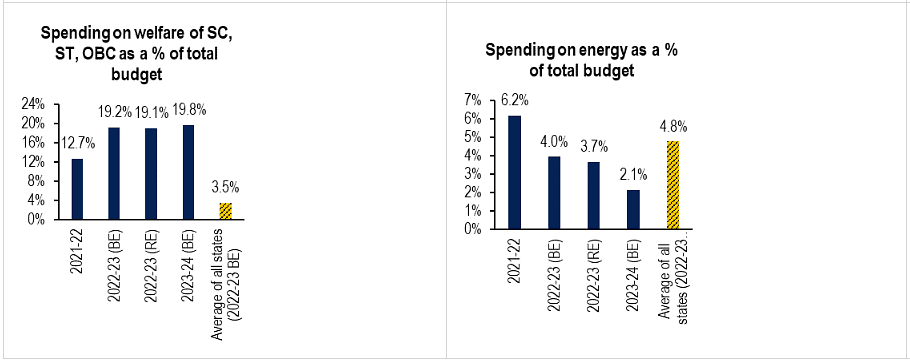

Comparison of Expenditure on Key Sectors

- Education: In the fiscal year 2023-24, Andhra Pradesh has earmarked 12.6% of its total expenditure for education, which falls below the average allocation made by states in the previous fiscal year (2022-23).

- Roads and Bridges: Allocating 1.8% of its total expenditure to roads and bridges, Andhra Pradesh's investment in this sector is lower compared to the average allocation by other states.

- Urban Development: With 3.5% of its expenditure dedicated to urban development, Andhra Pradesh's commitment aligns with the average allocation across states.

- Welfare of SC, ST, and OBC: Andhra Pradesh has allocated a significant 19.8% of its expenditure towards the welfare of Scheduled Castes (SCs), Scheduled Tribes (STs), and Other Backward Classes (OBCs), surpassing the average state allocation.

- Energy: Devoting 2.1% of its total expenditure to the energy sector, Andhra Pradesh's investment falls below the average state expenditure on energy.

- Police: Allocating 2.9% of its total expenditure to the police department, Andhra Pradesh's commitment is lower compared to the average state allocation towards this sector.

Note: 2021-22, 2022-23 (BE), 2022-23 (RE), and 2023-24 (BE) figures are for Andhra Pradesh.

Sources: Annual Financial Statement, Andhra Pradesh Budget 2023-24; various state budgets; PRS.

[1] The 31 states include the Union Territories of Delhi, Jammu and Kashmir, and Puducherry.

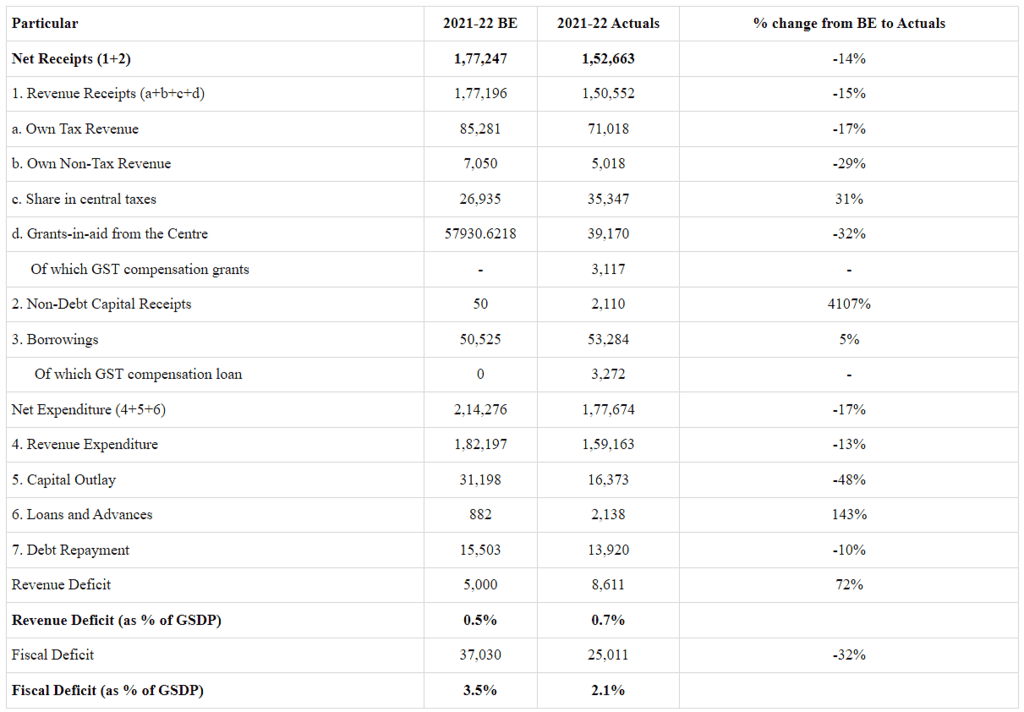

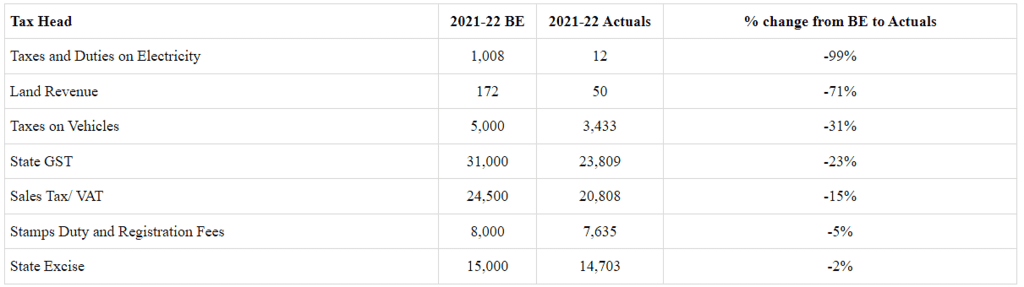

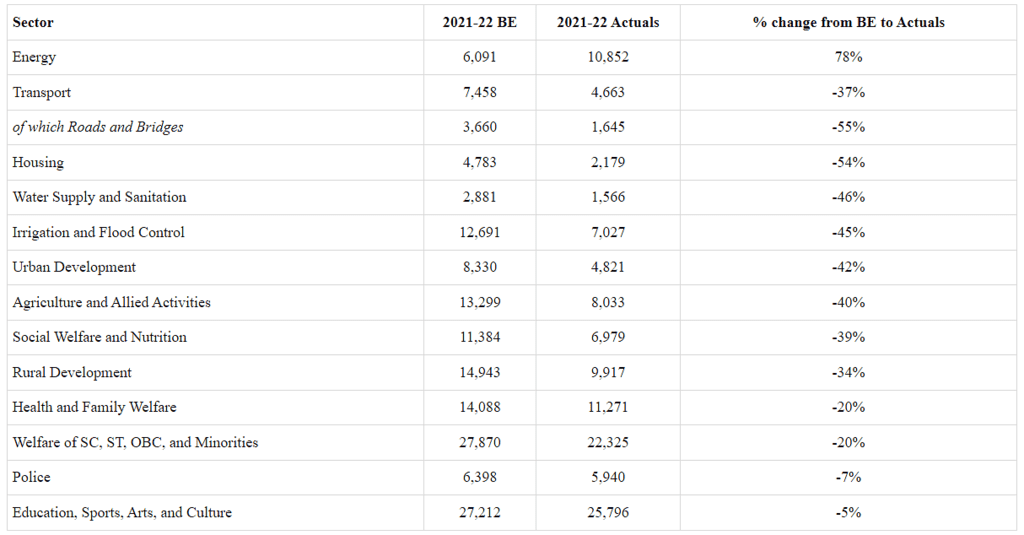

Annexure 2: Comparison of 2021-22 Budget Estimates and Actuals

The following tables compare the actuals of 2021-22 with budget estimates for that year.

Table 7: Overview of Receipts and Expenditure (in Rs crore)

Sources: Andhra Pradesh Budget Documents of various years; PRS.

Table 8: Key Components of State's Own Tax Revenue

Source: Andhra Pradesh Budget Documents of various years; PRS.

Table 9: Allocation towards Key Sectors

Sources: Andhra Pradesh Budget Documents of various years; PRS.

|

128 docs|94 tests

|

FAQs on Andhra Pradesh Budget Analysis 2023-24 - APPSC State Specific Preparation Course - APPSC (Andhra Pradesh)

| 1. What are the key highlights of the budget estimates for Andhra Pradesh? |  |

| 2. How is the expenditure structured in the Andhra Pradesh budget? |  |

| 3. What are the expected sources of receipts for the Andhra Pradesh budget? |  |

| 4. What is the significance of deficits and debt in the Andhra Pradesh budget? |  |

| 5. How does the Andhra Pradesh government plan to manage committed expenditures? |  |