Applicability Of Accounting Standards: Notes | Accounting for CA Intermediate (Old Scheme) PDF Download

| Table of contents |

|

| Chapter Overview |

|

| Status Of Accounting Standards: |

|

| Applicability Of Accounting Standards: |

|

| Summary |

|

| What you've learned? |

|

Chapter Overview

Status Of Accounting Standards:

- It has already been mentioned in chapter 1 that the standards are developed by the Accounting Standards Board (ASB) of the Institute of Chartered Accountants of India and are issued under the authority of its Council which are approved by the MCA (Ministry of Corporate Affairs). The standards cannot override laws and local regulations. The Accounting Standards are nevertheless made mandatory from the dates notified by the MCA and are generally applicable to all enterprises, subject to certain exception as stated below. The implication of mandatory status of an Accounting Standard depends on whether the statute governing the enterprise concerned requires compliance with the Standard, e.g., the Ministry of Corporate Affairs have notified Accounting Standards for companies incorporated under the Companies Act, 1956 (or the Companies Act, 2013).

- In assessing whether an accounting standard is applicable, one must find correct answer to the following three questions.

(a) Does it apply to the enterprise concerned? If yes, the next question is:

(b) Does it apply to the financial statement concerned? If yes, the next question is:

(c) Does it apply to the financial item concerned?

The preface to the statements of accounting standards answers the above questions.

Enterprises to which the accounting standards apply?

Accounting Standards apply in respect of any enterprise (whether organised in corporate, co-operative or other forms) engaged in commercial, industrial or business activities, whether or not profit oriented and even if established for charitable or religious purposes. Accounting Standards however, do not apply to enterprises solely carrying on the activities, which are not of commercial, industrial or business nature, (e.g., an activity of collecting donations and giving them to flood affected people). Exclusion of an enterprise from the applicability of the Accounting Standards would be permissible only if no part of the activity of such enterprise is commercial, industrial or business in nature. Even if a very small proportion of the activities of an enterprise were considered to be commercial, industrial or business in nature, the Accounting Standards would apply to all its activities including those, which are not commercial, industrial or business in nature.

Implication of mandatory status:

- Where the statute governing the enterprise does not require compliance with the accounting standards, e.g. a partnership firm, the mandatory status of an accounting standard implies that, in discharging their attest functions, the members of the Institute are required to examine whether the financial statements are prepared in compliance with the applicable accounting standards. In the event of any deviation from the accounting standards, they have the duty to make adequate disclosures in their reports so that the users of financial statements may be aware of such deviations. It should nevertheless be noted that responsibility for the preparation of financial statements and for making adequate disclosure is that of the management of the enterprise. The auditor’s responsibility is to form his opinion and report on such financial statements.

- Section 129 (1) of the Companies Act, 2013 requires companies to present their financial statements in accordance with the accounting standards notified under Section 133 of the Companies Act, 2013 (refer Note below). Also, the auditor is required by section 143(3)(e) to report whether, in his opinion, the financial statements of the company audited, comply with the accounting standards referred to in section133 of the Companies Act, 2013. Where the financial statements of a company do not comply with the accounting standards, the company should disclose in its financial statements, the deviation from the accounting standards, the reasons for such deviation and the financial effects, if any, arising out of such deviations as per Section 129(5) of the Companies Act, 2013. Provided also that the financial statements should not be treated as not disclosing a true and fair view of the state of affairs of the company, merely by reason of the fact that they do not disclose-

(a) in the case of an insurance company, any matters which are not required to be disclosed by the Insurance Act, 1938, or the Insurance Regulatory and Development Authority Act, 1999;

(b) in the case of a banking company, any matters which are not required to be disclosed by the Banking Regulation Act, 1949;

(c) in the case of a company engaged in the generation or supply of electricity, any matters which are not required to be disclosed by the Electricity Act, 2003;

(d) in the case of a company governed by any other law for the time being in force, any matters which are not required to be disclosed by that law.

Note: As per the Companies Act, 2013, the Central Government may prescribe standards of accounting or addendum thereto, as recommended by the Institute of Chartered Accountants of India, in consultation with NFRA. Till date, the Central Government has notified all the existing accounting standards* except AS 30, 31 and 32 on Financial Instruments.

Financial items to which the accounting standards apply :

The Accounting Standards are intended to apply only to items, which are material. An item is considered material, if its omission or misstatement is likely to affect economic decision of the user. Materiality is not necessarily a function of size; it is the information content i.e. the financial item which is important. A penalty of ₹ 50,000 paid for breach of law by a company can seem to be a relatively small amount for a company incurring crores of rupees in a year, yet is a material item because of the information it conveys. The materiality should therefore be judged on case-to-case basis. If an item is material, it should be shown separately instead of clubbing it with other items. For example it is not appropriate to club the penalties paid with legal charges.

Accounting Standards and Income tax Act, 1961:

- Accounting standards intend to reduce diversity in application of accounting principles. They improve comparability of financial statements and promote transparency and fairness in their presentation. Deductions and exemptions allowed in computation of taxable income on the other hand, is a matter of fiscal policy of the government.

- Thus, an expense required to be charged against revenue by an accounting standard does not imply that the same is always deductible for income tax purposes. For example, depreciation on assets taken on finance lease is charged in the books of lessee as per AS 19 but depreciation for tax purpose is allowed to lessor, being legal owner of the asset, rather than to lessee. Likewise, recognition of revenue in the financial statements cannot be avoided simply because it is exempted under section 10 of the Income Tax Act, 1961.

Income Computation and Disclosure Standards:

Section 145(2) empowers the Central Government to notify in the Official Gazette from time to time, income computation and disclosure standards to be followed by any class of assessees or in respect of any class of income. Accordingly, the Central Government has, in exercise of the powers conferred under section 145(2), notified ten income computation and disclosure standards (ICDSs) to be followed by all assessees (other than an individual or a Hindu undivided family who is not required to get his accounts of the previous year audited in accordance with the provisions of section 44AB) following the mercantile system of accounting, for the purposes of computation of income chargeable to income-tax under the head “Profit and gains of business or profession” or “ Income from other sources”, from A.Y. 2017-18. The ten notified ICDSs are:

- ICDS I : Accounting Policies

- ICDS II : Valuation of Inventories

- ICDS III : Construction Contracts

- ICDS IV : Revenue Recognition

- ICDS V : Tangible Fixed Assets

- ICDS VI : The Effects of Changes in Foreign Exchange Rates

- ICDS VII : Government Grants

- ICDS VIII : Securities

- ICDS IX : Borrowing Costs

- ICDS X : Provisions, Contingent Liabilities and Contingent Assets

Applicability Of Accounting Standards:

- For the purpose of compliance of the accounting Standards, the ICAI had earlier issued an announcement on ‘Criteria for Classification of Entities and Applicability of Accounting Standards’. As per the announcement, entities were classified into three levels. Level II entities and Level III entities as per the said Announcement were considered to be Small and Medium Entities (SMEs).

- However, when the accounting standards were notified by the Central Government in consultation with the National Advisory Committee on Accounting Standards*, the Central Government also issued the 'Criteria for Classification of Entities and Applicability of Accounting Standards' for the companies.

- According to the ‘Criteria for Classification of Entities and Applicability of Accounting Standards’ as issued by the Government, there are two levels, namely, Small and Medium-sized Companies (SMCs) as defined in the Companies (Accounting Standards) Rules, 2006 and companies other than SMCs. Non-SMCs are required to comply with all the Accounting Standards in their entirety, while certain exemptions/ relaxations have been given to SMCs.

- Consequent to certain differences in the criteria for classification of the levels of entities as issued by the ICAI and as notified by the Central Government for companies, the Accounting Standard Board of the ICAI decided to revise its “Criteria for Classification of Entities and Applicability of Accounting Standards” and make the same applicable only to non-corporate entities. Though the classification criteria and applicability of accounting standards has been largely aligned with the criteria prescribed for corporate entities, it was decided to continue with the three levels of entities for non-corporate entities vis-à-vis two levels prescribed for corporate entities as per the government notification.

- “Criteria for Classification of Entities and Applicability of Accounting Standards” for corporate entities and non-corporate entities have been explained in the coming paragraphs.

➤ Criteria for classification of non-corporate entities as decided by the Institute of Chartered Accountants of India:

Level I Entities

Non-corporate entities which fall in any one or more of the following categories, at the end of the relevant accounting period, are classified as Level I entities:

- Entities whose equity or debt securities are listed or are in the process of listing on any stock exchange, whether in India or outside India.

- Banks (including co-operative banks), financial institutions or entities carrying on insurance business.

- All commercial, industrial and business reporting entities, whose turnover (excluding other income) exceeds rupees fifty crore in the immediately preceding accounting year.

- All commercial, industrial and business reporting entities having borrowings (including public deposits) in excess of rupees ten crore at any time during the immediately preceding accounting year.

- Holding and subsidiary entities of any one of the above.

Level II Entities (SMEs)

Non-corporate entities which are not Level I entities but fall in any one or more of the following categories are classified as Level II entities:

- All commercial, industrial and business reporting entities, whose turnover (excluding other income) exceeds rupees one crore* but does not exceed rupees fifty crore in the immediately preceding accounting year.

- All commercial, industrial and business reporting entities having borrowings (including public deposits) in excess of rupees one crore but not in excess of rupees ten crore at any time during the immediately preceding accounting year.

- Holding and subsidiary entities of any one of the above.

Level III Entities (SMEs)

Non-corporate entities which are not covered under Level I and Level II are considered as Level III entities.

Additional requirements

- An SME which does not disclose certain information pursuant to the exemptions or relaxations given to it should disclose (by way of a note to its financial statements) the fact that it is an SME and has complied with the Accounting Standards insofar as they are applicable to entities falling in Level II or Level III, as the case may be.

- Where an entity, being covered in Level II or Level III, had qualified for any exemption or relaxation previously but no longer qualifies for the relevant exemption or relaxation in the current accounting period, the relevant standards or requirements become applicable from the current period and the figures for the corresponding period of the previous accounting period need not be revised merely by reason of its having ceased to be covered in Level II or Level III, as the case may be. The fact that the entity was covered in Level II or Level III, as the case may be, in the previous period and it had availed of the exemptions or relaxations available to that Level of entities should be disclosed in the notes to the financial statements.

- Where an entity has been covered in Level I and subsequently, ceases to be so covered, the entity will not qualify for exemption/relaxation available to Level II entities, until the entity ceases to be covered in Level I for two consecutive years. Similar is the case in respect of an entity, which has been covered in Level I or Level II and subsequently, gets covered under Level III.

- If an entity covered in Level II or Level III opts not to avail of the exemptions or relaxations available to that Level of entities in respect of any but not all of the Accounting Standards, it should disclose the Standard(s) in respect of which it has availed the exemption or relaxation.

- If an entity covered in Level II or Level III desires to disclose the information not required to be disclosed pursuant to the exemptions or relaxations available to that Level of entities, it should disclose that information in compliance with the relevant Accounting Standard.

- An entity covered in Level II or Level III may opt for availing certain exemptions or relaxations from compliance with the requirements prescribed in an Accounting Standard: Provided that such a partial exemption or relaxation and disclosure should not be permitted to mislead any person or public.

- In respect of Accounting Standard (AS) 15, Employee Benefits, exemptions/ relaxations are available to Level II and Level III entities, under two sub-classifications, viz., (i) entities whose average number of persons employed during the year is 50 or more, and (ii) entities whose average number of persons employed during the year is less than 50. The requirements stated in paragraphs (1) to (6) above, mutatis mutandis, apply to these sub-classifications.

Example: M/s Omega & Co. (a partnership firm), had a turnover of ₹ 1.25 crores (excluding other income) and borrowings of ₹ 0.95 crores in the previous year. It wants to avail the exemptions available in application of Accounting Standards to non-corporate entities for the year ended 31.3.20X1. Advise the management of M/s Omega & Co in respect of the exemptions of provisions of ASs, as per the directive issued by the ICAI.

The question deals with the issue of Applicability of Accounting Standards to a noncorporate entity. For availment of the exemptions, first of all, it has to be seen that M/s Omega & Co. falls in which level of the non -corporate entities. Its classification will be done on the basis of the classification of non-corporate entities as prescribed by the ICAI. According to the ICAI, non -corporate entities can be classified under 3 levels viz Level I, Level II (SMEs) and Level III (SMEs).

An entity whose turnover (excluding other income) exceeds rupees fifty crore in the immediately preceding accounting year, will fall under the category of Level I entities. Non-corporate entities which are not Level I entities but fall in any one or more of the following categories are classified as Level II entities:

- All commercial, industrial and business reporting entities, whose turnover (excluding other income) exceeds rupees one crore but does not exceed rupees fifty crore in the immediately preceding accounting year.

- All commercial, industrial and business reporting entities having borrowings (including public deposits) in excess of rupees one crore but not in excess of rupees ten crore at any time during the immediately preceding accounting year.

- Holding and subsidiary entities of any one of the above.

As the turnover of M/s Omega & Co. is more than ₹ 1 crore, it falls under 1st criteria of Level II non -corporate entities as defined above. Even if its borrowings of ₹ 0.95 crores is less than ₹ 1 crores, it will be classified as Level II Entity. In this case, AS 3, AS 17, AS 21 (Revised), AS 23, AS 27 will not be applicable to M/s Omega & Co. Relaxations from certain requirements in respect of AS 15, AS 19, AS 20, AS 25, AS 28 and AS 29 (Revised) are also available to M/s Omega & Co.

➤ Criteria for classification of Companies under the Companies (Accounting Standards) Rules, 2006:

Small and Medium-Sized Company (SMC) as defined in Clause 2(f) of the Companies (Accounting Standards) Rules, 2006:

“Small and Medium Sized Company” (SMC) means, a company-

- whose equity or debt securities are not listed or are not in the process of listing on any stock exchange, whether in India or outside India;

- which is not a bank, financial institution or an insurance company;

- whose turnover (excluding other income) does not exceed rupees fifty crore in the immediately preceding accounting year;

- which does not have borrowings (including public deposits) in excess of rupees ten crore at any time during the immediately preceding accounting year; and

- which is not a holding or subsidiary company of a company which is not a small and medium-sized company.

Explanation: For the purposes of clause 2(f), a company should qualify as a Small and Medium Sized Company, if the conditions mentioned therein are satisfied as at the end of the relevant accounting period.

Non-SMCs

Companies not falling within the definition of SMC are considered as Non-SMCs.

Instructions:

- SMCs should follow the following instructions while complying with Accounting Standards under these Rules:

(i) The SMC which does not disclose certain information pursuant to the exemptions or relaxations given to it should disclose (by way of a note to its financial statements) the fact that it is an SMC and has complied with the Accounting Standards insofar as they are applicable to an SMC on the following lines: “The Company is a Small and Medium Sized Company (SMC) as defined in the General Instructions in respect of Accounting Standards notified under the Companies Act Accordingly, the Company has complied with the Accounting Standards as applicable to a Small and Medium Sized Company.”

(ii) Where a company, being an SMC, has qualified for any exemption or relaxation previously but no longer qualifies for the relevant exemption or relaxation in the current accounting period, the relevant standards or requirements become applicable from the current period and the figures for the corresponding period of the previous accounting period need not be revised merely by reason of its having ceased to be an SMC. The fact that the company was an SMC in the previous period and it had availed of the exemptions or relaxations available to SMCs should be disclosed in the notes to the financial statements.

(iii) If an SMC opts not to avail of the exemptions or relaxations available to an SMC in respect of any but not all of the Accounting Standards, it should disclose the standard(s) in respect of which it has availed the exemption or relaxation.

(iv) If an SMC desires to disclose the information not required to be disclosed pursuant to the exemptions or relaxations available to the SMCs, it should disclose that information in compliance with the relevant accounting standard.

(v) The SMC may opt for availing certain exemptions or relaxations from compliance with the requirements prescribed in an Accounting Standard:

Provided that such a partial exemption or relaxation and disclosure should not be permitted to mislead any person or public.

Other Instructions

Rule 5 of the Companies (Accounting Standards) Rules, 2006, provides as below:

An existing company, which was previously not a Small and Medium Sized Company (SMC) and subsequently becomes an SMC, should not be qualified for exemption or relaxation in respect of Accounting Standards available to an SMC until the company remains an SMC for two consecutive accounting periods.”

➤ Applicability of Accounting Standards to Companies:

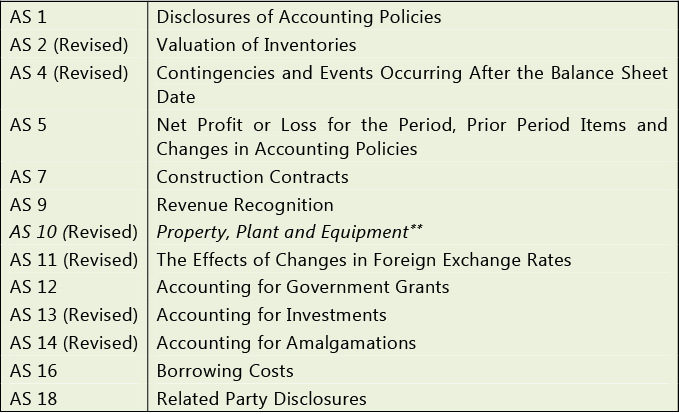

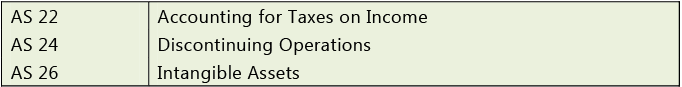

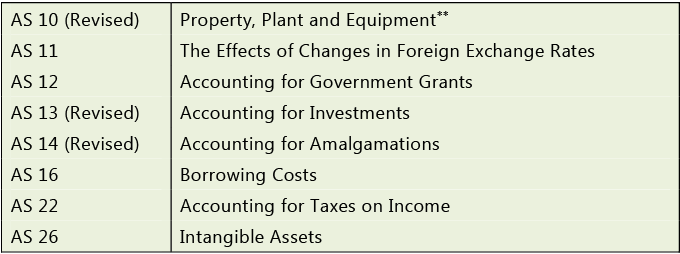

- Accounting Standards applicable to all companies in their entirety for accounting periods commencing on or after 7th December, 2006

- Exemptions or Relaxations for SMCs as defined in the Notification

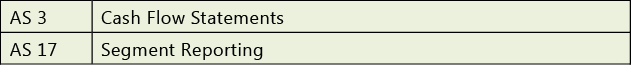

(a) Accounting Standards not applicable to SMCs in their entirety:

AS 3 Cash Flow Statements

AS 17 Segment Reporting

Note:

Under Section 129 of the Companies Act, 2013, the financial statement, with respect to One Person Company, small company and dormant company, may not include the cash flow statement. As per the Amendment, under Chapter I, clause (40) of section 2, an exemption has been provided vide Notification dated 13th June, 2017 under Section 462 of the Companies Act 2013 to a startup private company besides one person company, small company and dormant company. As per the amendment, a startup private company is not required to include the cash flow statement in the financial statements.

Thus the financial statements, with respect to one person company, small company, dormant company and private company (if such a private company is a start-up), may not include the cash flow statement.

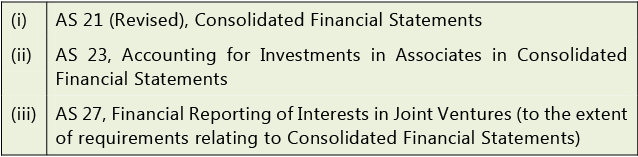

(b) Accounting Standards not applicable to SMCs since the relevant Regulations require compliance with them only by certain Non-SMCs*:

(i) AS 21 (Revised), Consolidated Financial Statements

(ii) AS 23, Accounting for Investments in Associates in Consolidated Financial Statements

(iii) AS 27, Financial Reporting of Interests in Joint Ventures (to the extent of requirements relating to Consolidated Financial Statements)

(c) Accounting Standards in respect of which relaxations from certain requirements have been given to SMCs:

(i) Accounting Standard (AS) 15, Employee Benefits:

(a) paragraphs 11 to 16 of the standard to the extent they deal with recognition and measurement of short-term accumulating compensated absences which are non-vesting (i.e., short-term accumulating compensated absences in respect of which employees are not entitled to cash payment for unused entitlement on leaving);

(b) paragraphs 46 and 139 of the Standard which deal with discounting of amounts that fall due more than 12 months after the balance sheet date;

(c) recognition and measurement principles laid down in paragraphs 50 to 116 and presentation and disclosure requirements laid down in paragraphs 117 to 123 of the Standard in respect of accounting for defined benefit plans. However, such companies should actuarially determine and provide for the accrued liability in respect of defined benefit plans by using the Projected Unit Credit Method and the discount rate used should be determined by reference to market yields at the balance sheet date on government bonds as per paragraph 78 of the Standard. Such companies should disclose actuarial assumptions as per paragraph 120(l) of the Standard; and

(d) recognition and measurement principles laid down in paragraphs 129 to 131 of the Standard in respect of accounting for other long term employee benefits. However, such companies should actuarially determine and provide for the accrued liability in respect of other long-term employee benefits by using the Projected Unit Credit Method and the discount rate used should be determined by reference to market yields at the balance sheet date on government bonds as per paragraph 78 of the Standard.

(ii) AS 19, Leases

Paragraphs 22 (c),(e) and (f); 25 (a), (b) and (e); 37 (a) and (f); and 46 (b) and (d) relating to disclosures are not applicable to SMCs.

(iii) AS 20, Earnings Per Share

Disclosure of diluted earnings per share (both including and excluding extraordinary items) is exempted for SMCs.

(iv) AS 28, Impairment of Assets

SMCs are allowed to measure the ‘value in use’ on the basis of reasonable estimate thereof instead of computing the value in use by present value technique. Consequently, if an SMC chooses to measure the ‘value in use’ by not using the present value technique, the relevant provisions of AS 28, such as discount rate etc., would not be applicable to such an SMC. Further, such an SMC need not disclose the information required by paragraph 121(g) of the Standard.

(v) AS 29 (Revised), Provisions, Contingent Liabilities and Contingent Assets

Paragraphs 66 and 67 relating to disclosures are not applicable to SMCs.

(e) AS 25, Interim Financial Reporting, does not require a company to present interim financial report. It is applicable only if a company is required or elects to prepare and present an interim financial report. Only certain Non-SMCs are required by the concerned regulators to present interim financial results, e.g, quarterly financial results required by the SEBI. Therefore, the recognition and measurement requirements contained in this Standard are applicable to those Non-SMCs for preparation of interim financial results.

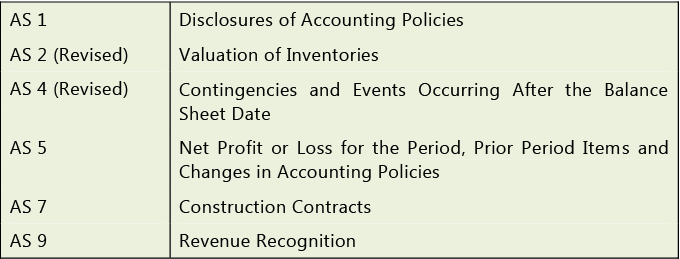

➤ Applicability of Accounting Standards to Non-corporate Entities:

- Accounting Standards applicable to all Non-corporate Entities in their entirety (Level I, Level II and Level III)

- Exemptions or Relaxations for Non-corporate Entities falling in Level II and Level III (SMEs):

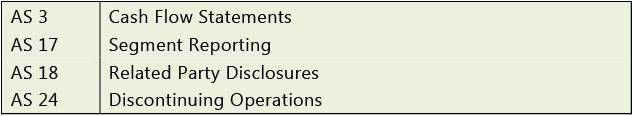

(a) Accounting Standards not applicable to Non-corporate Entities falling in Level II in their entirety:

(b) Accounting Standards not applicable to Non-corporate Entities falling in Level III in their entirety:

(c) Accounting Standards not applicable to all Non-corporate Entities since the relevant Regulators require compliance with them only by certain Level I entities:

(d) Accounting Standards in respect of which relaxations from certain requirements have been given to Non-corporate Entities falling in Level II and Level III (SMEs):

(i) Accounting Standard (AS) 15, Employee Benefits

Level II and Level III Non-corporate entities whose average number of persons employed during the year is 50 or more are exempted from the applicability of the following paragraphs:

(•) paragraphs 11 to 16 of the standard to the extent they deal with recognition and measurement of short-term accumulating compensated absences which are non-vesting (i.e., short-term accumulating compensated absences in respect of which employees are not entitled to cash payment for unused entitlement on leaving);

(•) paragraphs 46 and 139 of the Standard which deal with discounting of amounts that fall due more than 12 months after the balance sheet date;

(•) recognition and measurement principles laid down in paragraphs 50 to 116 and presentation and disclosure requirements laid down in paragraphs 117 to 123 of the Standard in respect of accounting for defined benefit plans. However, such entities should actuarially determine and provide for the accrued liability in respect of defined benefit plans by using the Projected Unit Credit Method and the discount rate used should be determined by reference to market yields at the balance sheet date on government bonds as per paragraph 78 of the Standard. Such entities should disclose actuarial assumptions as per paragraph 120(l) of the Standard; and

(•) recognition and measurement principles laid down in paragraphs 129 to 131 of the Standard in respect of accounting for other long-term employee benefits. However, such entities should actuarially determine and provide for the accrued liability in respect of other long-term employee benefits by using the Projected Unit Credit Method and the discount rate used should be determined by reference to market yields at the balance sheet date on government bonds as per paragraph 78 of the Standard.

Level II and Level III Non-corporate entities whose average number of persons employed during the year is less than 50 are exempted from the applicability of the following paragraphs:

(•) paragraphs 11 to 16 of the standard to the extent they deal with recognition and measurement of short-term accumulating compensated absences which are non-vesting (i.e., short-term accumulating compensated absences in respect of which employees are not entitled to cash payment for unused entitlement on leaving);

(•) paragraphs 46 and 139 of the Standard which deal with discounting of amounts that fall due more than 12 months after the balance sheet date;

(•) recognition and measurement principles laid down in paragraphs 50 to 116 and presentation and disclosure requirements laid down in paragraphs 117 to 123 of the Standard in respect of accounting for defined benefit plans. However, such entities may calculate and account for the accrued liability under the defined benefit plans by reference to some other rational method, e.g., a method based on the assumption that such benefits are payable to all employees at the end of the accounting year; and

(•) recognition and measurement principles laid down in paragraphs 129 to 131 of the Standard in respect of accounting for other long-term employee benefits. Such entities may calculate and account for the accrued liability under the other long-term employee benefits by reference to some other rational method, e.g., a method based on the assumption that such benefits are payable to all employees at the end of the accounting year.

(ii) AS 19, Leases

Paragraphs 22 (c),(e) and (f); 25 (a), (b) and (e); 37 (a) and (f); and 46 (b) and (d) relating to disclosures are not applicable to non-corporate entities falling in Level II. Paragraphs 22 (c),(e) and (f); 25 (a), (b) and (e); 37 (a), (f) and (g); and 46 (b), (d) and (e) relating to disclosures are not applicable to Level III entities.

(iii) AS 20, Earnings Per Share

Diluted earnings per share (both including and excluding extraordinary items) is not required to be disclosed by non-corporate entities falling in Level II and Level III and information required by paragraph 48(ii) of AS 20 is not required to be disclosed by Level III entities if this standard is applicable to these entities.

(iv) AS 28, Impairment of Assets

Non-corporate entities falling in Level II and Level III are allowed to measure the ‘value in use’ on the basis of reasonable estimate thereof instead of computing the value in use by present value technique. Consequently, if a non-corporate entity falling in Level II or Level III chooses to measure the ‘value in use’ by not using the present value technique, the relevant provisions of AS 28, such as discount rate etc., would not be applicable to such an entity. Further, such an entity need not disclose the information required by paragraph 121(g) of the Standard.

(v) AS 29 (Revised), Provisions, Contingent Liabilities and Contingent Assets Paragraphs 66 and 67 relating to disclosures are not applicable to noncorporate entities falling in Level II and Level III.

(e) AS 25, Interim Financial Reporting, does not require a non-corporate entity to present interim financial report. It is applicable only if a non-corporate entity is required or elects to prepare and present an interim financial report. Only certain Level I non-corporate entities are required by the concerned regulators to present interim financial results e.g., quarterly financial results required by the SEBI. Therefore, the recognition and measurement requirements contained in this Standard are applicable to those Level I non-corporate entities for preparation of interim financial results.

Note: The Accounting standards (AS) covered in the syllabus of this paper at Intermediate Leve (AS 1; AS 2 (Revised); AS 3; AS 10 (Revised); AS 11(Revised); AS 12; AS 13 (Revised); and AS 16) have been discussed in detail in the succeeding unit of this chapter.

Summary

- According to the ‘Criteria for Classification of Entities and Applicability of Accounting Standards’ as issued by the Government, there are two levels, namely, Small and Medium-sized Companies (SMCs) as defined in the Companies (Accounting Standards) Rules, 2006 and companies other than SMCs. Non-SMCs are required to comply with all the Accounting Standards in their entirety, while certain exemptions/ relaxations have been given to SMCs.

- Criteria for classification of entities for applicability of accounting standards for corporate and non-corporate entities have been prescribed as per the Govt. notification.

What you've learned?

- Comprehend the status of Accounting Standards;

- Understand the applicability of Accounting Standards.

|

42 videos|34 docs

|