Bank Reconciliation Statement ( Part - 5) | Accountancy Class 11 - Commerce PDF Download

Page No 12.48:

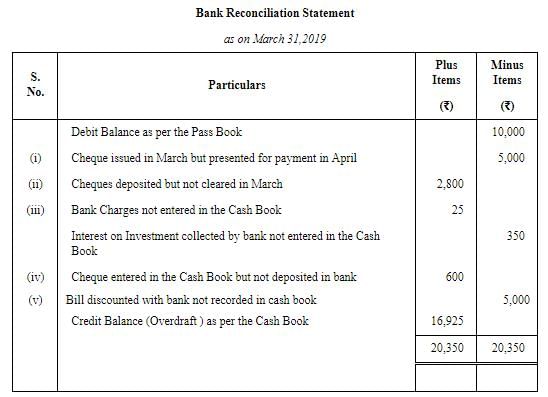

Question 21: On 31st March, 2019, Pass Book of Shri Bhama Shah shows debit balance of ₹ 10,000. From the following particulars, prepare Bank Reconciliation Statement.

(i) Cheques amounting to ₹ 8,000 drawn on 25th March of which cheques of ₹ 5,000 cashed in April, 2019.

(ii) Cheques paid into bank for collection of ₹ 5,000 but cheques of ₹ 2,200 could only be collected in March 2019.

(iii) Bank charges ₹ 25 and dividend of ₹ 350 on investment collected by bank could not be shown in the Cash Book.

(iv) A cheque of ₹ 600 debited in the Cash Book omitted to be banked.

(v) Bill of ₹ 5,000 discounted with Bank but was not recorded in the Cash Book.

ANSWER:

Page No 12.49:

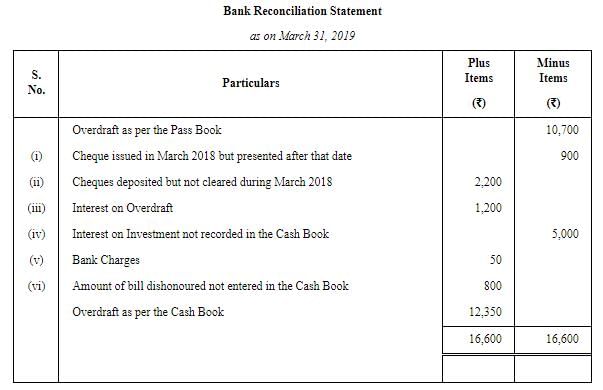

Question 22: On 31st March, 2019, Bank Pass Book of Naresh & Co. showed an overdraft of ₹ 10,700. From the following particulars, prepare Bank Reconciliation Statement:

(i) Cheques issued before 31st March, 2019 but presented for payment after that date amounted to ₹ 900.

(ii) Cheques paid into the bank but not collected and credited until 31st March, 2019 amounted to ₹ 2,200.

(iii) Interest on overdraft amounting to ₹ 1,200 did not appear in the Cash Book.

(iv) ₹ 5,000 being interest on investments collected by the bank and credited

in the Pass Book were not shown in the Cash Book.

(iv) Bank charges of ₹ 50 were not entered in the Cash Book.

(v) ₹ 800 in respect of dishonoured cheque were entered in the Pass Book but not in the Cash Book.

ANSWER:

Page No 12.49:

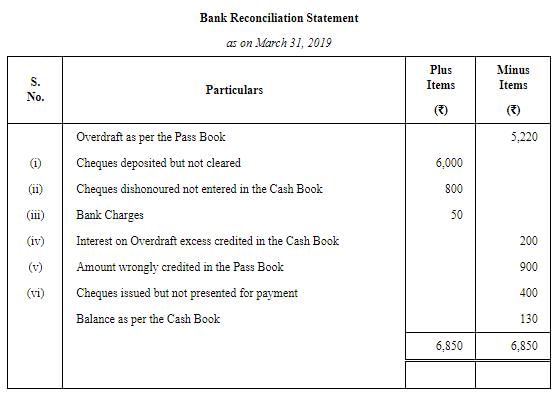

Question 23: On checking the Bank Pass Book it was found that it showed an overdraft of ₹ 5,220 as on 31st March, 2019, while as per Ledger it was different. The following differences were noted:

(i) Cheques deposited but not yet credited by the bank ₹ 6,000.

(ii) Cheques dishonoured and debited by the bank but not given effect to it in the Ledger ₹ 800.

(iii) Bank charges debited by the bank but Debit Memo not received from the bank ₹ 50.

(iv) Interest on overdraft excess credited in the Ledger ₹ 200.

(v) Wrongly credited by the bank to account, deposit of some other party ₹ 900.

(vi) Cheques issued but not presented for payment ₹ 400.

ANSWER:

Page No 12.49:

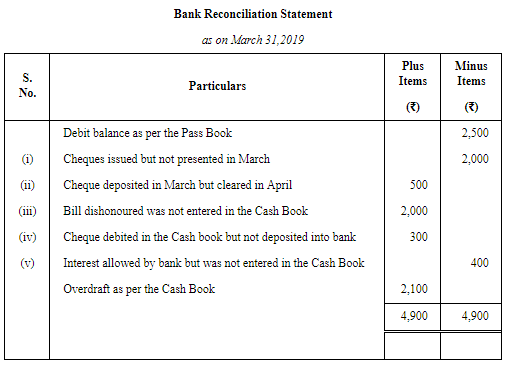

Question 24: Prepare Bank Reconciliation Statement from the following particulars as on 31st March, 2019 when Pass Book shows a debit balance of ₹ 2,500:

(i) Cheque issued for ₹ 5,000 but up to 31st March, 2019 only ₹ 3,000 could be cleared.

(ii) Cheques deposited for ₹ 5,500 but cheques of ₹ 500 were collected on 10th April, 2019.

(iii) A discounted Bill of Exchange dishonoured ₹ 2,000.

(iv) A cheque of ₹ 300 debited in Cash Book but omitted to be banked.

(v) Interest allowed by bank ₹ 400 but no entry was passed in the Cash Book.

ANSWER:

Page No 12.49:

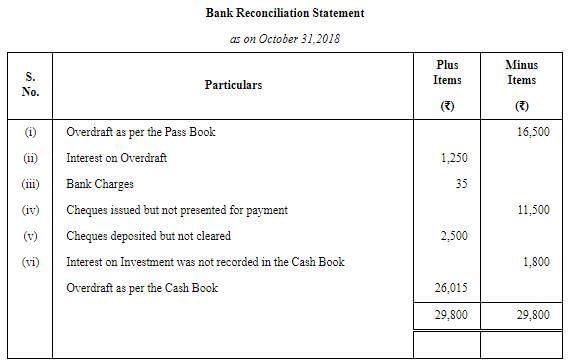

Question 25: From the following particulars, you are required to ascertain the bank balance as would appear in the Cash Book of Ramesh as on 31st October, 2018:

(i) Bank Pass Book showed an overdraft of ₹ 16,500 on 31st October.

(ii) Interest of ₹ 1,250 on overdraft up to 31st October, 2018 has been debited in the Bank Pass Book but it has not been entered in the Cash Book.

(iii) Bank charges debited in the Bank Pass Book amounted to ₹ 35.

(iv) Cheques issued prior to 31st October, 2018 but not presented till that date, amounted to ₹ 11,500.

(v) Cheques paid into bank before 31st October, but not collected and credited up to that date, were for ₹ 2,500.

(vi) Interest on investment collected by the bankers and credited in the Bank Pass Book amounted to ₹ 1,800

ANSWER:

Page No 12.50:

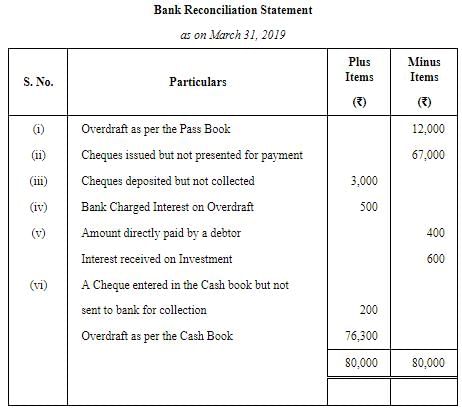

Question 26: Prepare Bank Reconciliation Statement as on 31st March, 2019 from the following particulars:

(i) R's overdraft as per Pass Book ₹ 12,000 as on 31st March.

(ii) On 30th March, cheques had been issued for ₹ 70,000 of which cheques amounting to ₹ 3,000 only had been encashed up to 31st March.

(iii) Cheques amounting to ₹ 3,500 had been paid into the bank for collection but of these only ₹ 500 had been credited in the Pass Book.

(iv) Bank has charged ₹ 500 as interest on overdraft and the intimation of which has been received on 2nd April, 2019.

(v) Bank Pass Book shows credit for ₹ 1,000 representing ₹ 400 paid by debtor of R direct into the bank and ₹ 600 collected directly by the bank in respect of interest on R's investment. R had no knowledge of these items.

(vi) A cheque for ₹ 200 has been debited in the bank column of Cash Book by R but it was not sent to the bank at all.

ANSWER:

|

64 videos|153 docs|35 tests

|

FAQs on Bank Reconciliation Statement ( Part - 5) - Accountancy Class 11 - Commerce

| 1. What is a bank reconciliation statement? |  |

| 2. Why is bank reconciliation important for businesses? |  |

| 3. What are the common reasons for discrepancies between the bank statement and book balance? |  |

| 4. How often should bank reconciliation be performed? |  |

| 5. What steps should be followed to prepare a bank reconciliation statement? |  |

|

Explore Courses for Commerce exam

|

|