Banker's Discount: Important Formulas | Quantitative Aptitude for SSC CGL PDF Download

| Table of contents |

|

| Introduction |

|

| Important Formulas |

|

| Solved Examples |

|

| Tips and Tricks |

|

Introduction

- Suppose merchant A purchases goods worth of saying Rs.5000 from another merchant B at a credit of a certain period say 4 months. Then B draws up a draft i.e., prepares a special type of bill called "Hundi" or Bill of Exchange.

- On the receipt of the goods, A gives an agreement dually signed on the bill stating that he has accepted the bill and money can be withdrawn from his bank account after 4 months of the date of the bill.

- On this bill, there is an order from A to his bank asking to pay Rs.5000 to B after 4 months. Moreover, 3 more days (known as grace days) are added to the date (called nominally due date) of expiry of 4 months, and on the date so obtained (called the legally due date), the bill can be presented to the bank by B to collect Rs.5000 from A‘s account.

- Suppose the bill is drawn on 5th January at 4 months, then the nominally due date is 5th May and the legally due date is 8th May. The amount given on the draft or bill is called the face value which is Rs.5000 in this case.

- Let's say, B needs the money for this bill earlier than 8th May, say, on 3rd March. In such a case, B can sell the bill to a banker or a broker who pays him the money against the bill but somewhat less than the face value.

- Now the natural questions are, as how much cash the banker should pay to B on 3rd March to 8th May, he gains nothing. So in order to make some profit, the banker deducts from the face value. The simple interest on the face value for the unexpired time i.e, from 3rd March to 8th May. This deduction is known as Banker’s Discount (B.D.) or commercial discount.

- Thus B.D. is the S.I. on face value for the period from the date on which the bill was discounted and the legally due date. The money paid by the banker to the bill holder is called the discountable value.

- Also, the difference between the banker’s discount and the true discount for the unexpired time is called the Banker’s Gain (B.G.). Thus, Banker’s Gain

B.G. = (B.D.) - (T.D.)

Remark: When the date of the bill is not given, grace days are not to be added.

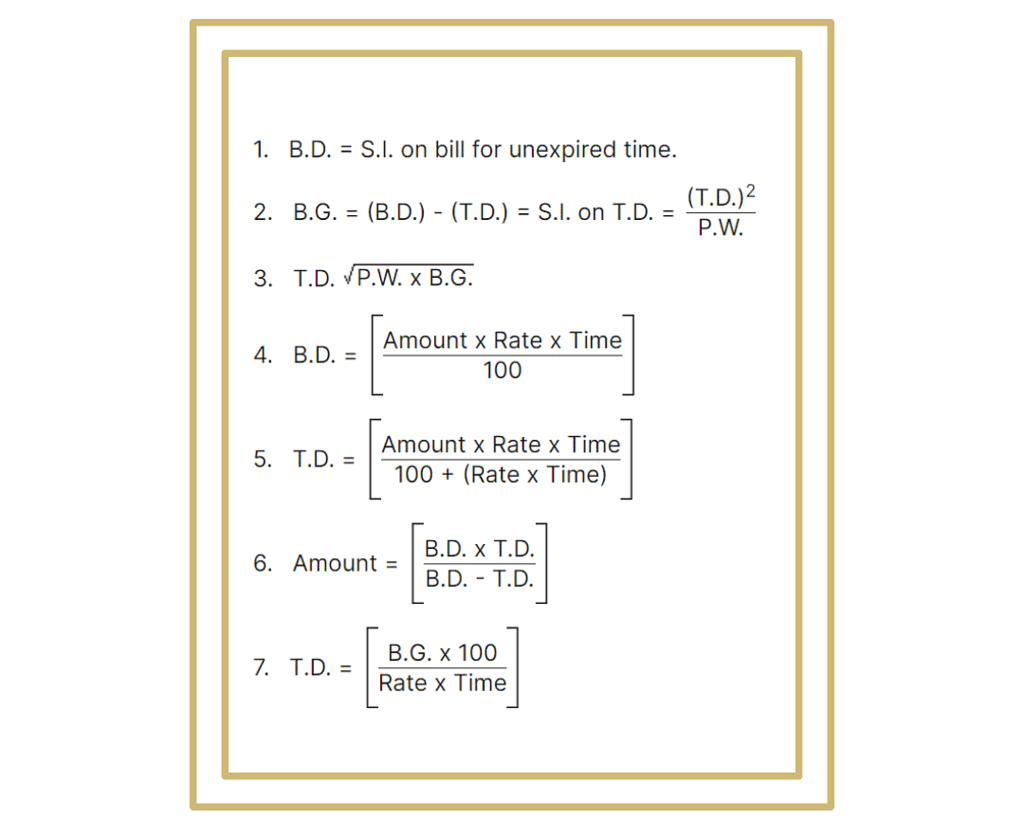

Important Formulas

Solved Examples

Question 1. The true discount on a bill Rs.1860 due after 8 months is Rs.60. Find the rate, the banker’s discount and the banker’s gain.

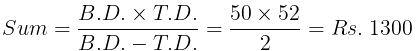

Amount = Rs.1860, T.D. = Rs.60

∴ P.W. = Rs.(1860-60) = Rs. 1800

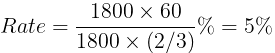

S.I. on Rs. 1800 for 8 months = Rs.60

B.D. = (T.D.) + (B.G.) = Rs. (60+2) = Rs. 62

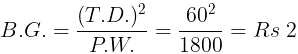

Question 2. The present worth of a bill due sometime hence is Rs. 1100 and the true discount on the bill is Rs. 110. Find the banker’s discount and the extra gain the banker would make in the transaction.

∴ B.D. = B.G. + T.D. = Rs. (11+110) = Rs. 121

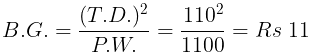

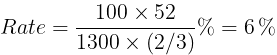

Question 3. The banker’s discount and the true discount on a sum of money due 8 months hence are Rs. 52 and Rs. 50, respectively. Find the sum and the rate per cent.

∴ B.D. is S.I. on sum due.

⇒ S.I. on Rs. 1300 for 8 months is Rs. 52

Thus,

Question 4. The banker’s discount on Rs. 1800 at 5% is equal to the true discount on Rs. 1830 for the same time and at the same rate, Find the time.

S.I. on Rs. 1800 = T.D.on Rs. 1830

∴ P.W. of Rs. 1830 is Rs. 1800

i.e., Rs. 30 is S.I. on Rs. 1800 at 5%

∴ Time = (100 × 30)/(1800 × 5) = 1/3 years = 4 months

Question 5. If the true discount on a certain sum due 6 months hence at 6% is Rs. 36, what is the banker’s discount on the same sum for the same time and at the same rate ?

B.G.= S.I. on T.D.= Rs.(3600×6×0.5)/100 = Rs.1.08

∴ (B.D.) – (T.D.) = Rs. 1.08

i.e. B.D.=(T.D.)+Rs.1.08 = Rs.(36+1.08) = Rs.37.08

Tips and Tricks

Tip #1: Understand the concepts in Banker’s Discount clearly

Scenario: Suppose A has borrowed Rs 1000 from B and this amount should be returned with interest after 1 year. Let us assume that the market interest rate is 5% per year [Simple Interest]. A hands over to B a note with a Face Value of Rs 1050, promising repayment after 1 year. [1000 + (1000 x 0.05 x 1yr) = 1050]

After 6 months, B decides that he needs the money immediately and cannot wait till the due date which is 6 months away. B approaches a bank and hands over the note from A with Face Value of Rs 1050 due after 6 months.

Calculating True Discount:

The present value (or true value) of the note from A is calculated as follows:

PV x (1 + r x t) = FV [Here, PV is the present value, r is the rate of simple interest, t is time and FV is the Face Value of the note.]

Present Value (or True Value) = 1050/(1.025) = Rs. 1024.4

True discount = Face Value – Present Value = 1050 – 1024.4 = Rs. 25.6

But, if the bank paid out Rs 1024.4 to B in exchange for the note, the bank would not make a profit. The bank does not use True Discount but uses another formula to calculate the discount called Banker’s Discount.

Calculating Banker’s Discount:

Banker’s Discount: The Simple Interest on the Face Value of the debt for the time period between the legally due date and the date on which the bill is discounted is called Banker’s Discount.

Banker’s Discount = FV x r x t = 1050 x 0.05 x (1/2) = Rs 26.25

Note:

True Discount = FV – [FV / (1 + r x t)] = FV [r x t / (1 + r x t)] < FV x r x t

⇒ True Discount < Banker’s Discount

Instead of discounting True Discount, the Bank discounts the Banker’s Discount from the Face Value and pays out Rs 1050 – 26.25 = Rs. 1023.75

Banker’s Gain = Present Value of the Note – Actual Payout

= (Face Value – True Discount) – (Face Value – Banker’s Discount)

= Banker’s Discount – True Discount [This figure is always positive]

Example 1: The banker's gain on a sum due 3 years hence at 12% per annum is Rs. 270. What is the banker’s discount?

Sol:

Banker’s Discount = FV x r x t = 0.36 x FV

True Discount = FV – PV = FV – FV / [1 + (r x t)] = FV – FV / 1.36

= 0.36 x FV / 1.36 = Banker’s Discount / 1.36

Banker’s Gain = Banker’s Discount – True Discount = BD - BD/1.36 = 270

⇒ Banker’s Discount, BD = 270 x 1.36 / 0.36 = Rs. 1020

Moving on, we come to the formulae in Banker’s Discounts.

Example 2: The banker's discount on a certain sum due 2 years hence is 11/10 of the true discount. What is the rate?

Sol:

BD = FV x r x t

TD = FV – PV = FV – FV / [1 + (r x t)] = FV x r x t / [1 + (r x t)]

BD/ TD = 1 + (r x t) = 11/10

2r = 1/10

⇒ r = 1/20 = 0.05 or 5%

Tip #2: For transactions that do not involve a bank, use True Value

Example 1: A man purchased a cow for Rs. 3000 and sold it the same day for Rs. 3600, allowing the buyer a credit of 2 years. If the rate of interest be 10% per annum, then what is his gain?

Sol:

Present Value = 3600/[1+(0.10 x 2)] = Rs 3000

Gain = Present Value – Cost = 0

Example 2: A trader owes a merchant Rs. 10,028 due 1 year hence. The trader wants to settle the account after 3 months. If the rate of interest 12% per annum, how much cash should he pay?

Sol:

Face Value = Rs. 10028, r = 12% p.a.

Present Value after 9 months = 10028/[1+(0.12*9/12)] = Rs 9200

|

342 videos|298 docs|185 tests

|

FAQs on Banker's Discount: Important Formulas - Quantitative Aptitude for SSC CGL

| 1. What is Banker's Discount and how is it different from simple interest? |  |

| 2. How is Banker's Discount calculated? |  |

| 3. What is the formula to find the Banker's Gain in a transaction involving Banker's Discount? |  |

| 4. How is Banker's Discount used in real-life scenarios? |  |

| 5. Can Banker's Discount be negative? |  |