Blocked Input Tax Credit, Reversal & Reconciliation of ITC | Taxation for CA Intermediate PDF Download

As per amended Section 17 subsection 5 of CGST Act which is applicable from 01-02-2019, a registered taxpayer is not entitled to avail of the credit of taxes paid in respect of certain goods or services, even if these goods or services are used in the course or furtherance of business.

1. F-Food Beverages & Other No ITC on the following supply when supplied to Employees – Food and beverages, outdoor catering, beauty treatment, health services, cosmetic treatment (Unless Obligatory).

2. M-Motor Vehicles for Passengers Transportation No ITC allowed for Motor Vehicles for transportation of persons if seating capacity is up to 13 persons. However,

- ITC is allowed if seating capacity up to 13 persons and used for further taxable supply of such vehicles

- ITC is allowed if seating capacity up to 13 persons and used for transportation of passengers which are taxable

- ITC is allowed if seating capacity up to 13 persons and used for imparting taxable training

- Moreover No ITC allowed on general insurance, servicing and repair and maintenance services used in relation to the motor vehicles on which ITC is blocked.

- ITC of Motor vehicles used in Goods Transportation is always allowed. Also, ITC of general insurance, servicing, repair and maintenance is also allowed in this case, provided;

- Freight is being charged in the invoice & levying GST on forward charges basis in invoice or

- Selling the products in inclusive freight price model where GST charged on bundle price or

- Not charging an y Freight and using vehicle just for goods transportation for traders business purpose only e.g. goods delivery to customer door step without charging anything Or pick up of raw material or moving goods from one place to another or any other purpose.

Moreover, ITC will be available in respect of motor vehicles if they are used for transportation of money for or by a banking company or a financial institution.

3. C-Construction No ITC of Works contract services when supplied for construction of immovable property: ITC not available to a registered person for the tax paid on the inward supply of works contract services used for the construction of immovable property. This is not applicable to the construction of plant and machinery. Also, where inward supplies used for further supplying of a works contract service, ITC is available.

4. G-Goods Lost No ITC would be made available for goods lost, stolen, destroyed, written off. Moreover no ITC for Goods disposed off by way of gifts or free samples.

5. P-Personal Expenses or Other Purpose No ITC of goods or services or both used for personal consumption. Moreover, when goods or services or both are used partly for Business purpose and also other purpose then ITC should be proportionately disallowed for other purpose.

6. E-Exempted Supply No ITC where the tax paid on goods or services or both are used by the registered person for making exempt supplies. Moreover, when goods or services or both are used partly for effecting taxable supply and partly for exempted supplies, ITC should be proportionately disallowed for exempted supplies.

Reversal of Input Tax Credit

ITC can be availed only on goods and services for business purposes. If they are used for nonbusiness (personal) purposes, or for making exempt supplies ITC cannot be claimed. Apart from these, there are certain other situations where ITC will be reversed.

ITC will be reversed in the following cases

- Non-payment of invoices in 180 days– ITC will be reversed for invoices which were not paid within 180 days of issue.

- Credit note issued to ISD by seller– This is for ISD. If a credit note was issued by the seller to the HO then the ITC subsequently reduced will be reversed.

- Inputs partly for business purpose and partly for exempted supplies or for personal use – This is for businesses which use inputs for both business and non-business (personal) purpose. ITC used in the portion of input goods/services used for the personal purpose must be reversed proportionately.

- Capital goods partly for business and partly for exempted supplies or for personal use – This is similar to above except that it concerns capital goods.

- ITC reversed is less than required- This is calculated after the annual return is furnished. If total ITC on inputs of exempted/non-business purpose is more than the ITC actually reversed during the year then the difference amount will be added to output liability. Interest will be applicable. The details of reversal of ITC will be furnished in GSTR-2.

Reconciliation of ITC

ITC claimed by the person has to match with the details specified by his supplier in his GST return. Details are obtained through valid returns filed by both supplier and recipient. In case of any mismatch, the supplier and recipient would be communicated regarding discrepancies after the filling of GSTR-3 (monthly returns).

- FORM GSTR-1 and FORM GSTR-2A Details of outward supply of goods and services are filed by supplier in form GSTR-1, which would be available to recipient in FORM GSTR-2A

- FORM GSTR-2 and FORM GSTR-1A Details of inward recipient of goods and services are filed by recipient in form GSTR-2, which would be available to supplier in FORM GSTR-1A for him to accept or modify the changes.

- FORM GSTR-3 Monthly return to be filed by a registered person mentioning details of inward and outward supply of goods and/or services, ITC claimed along with taxes payable and paid thereof.

- Discrepancy of ITC arises in the following situations:

- ITC claimed by recipient is in excess of the tax declared by the supplier, or

- The outward supply is not declared by the supplier, or

- There is a duplication of claim of ITC by the recipient

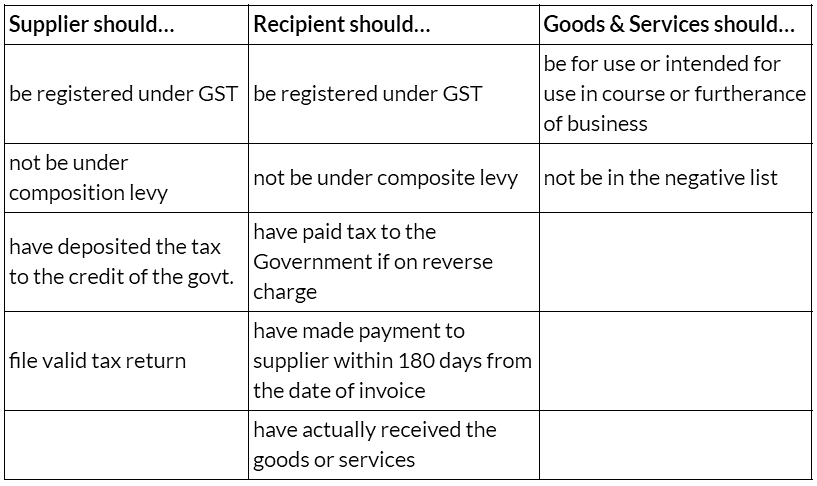

Key principles for eligibility of tax credits

|

42 videos|98 docs|12 tests

|

|

Explore Courses for CA Intermediate exam

|

|