Books of Original Entry- Journal (Part - 1) - Commerce PDF Download

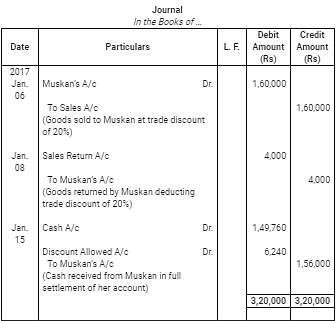

Page No 9.59:

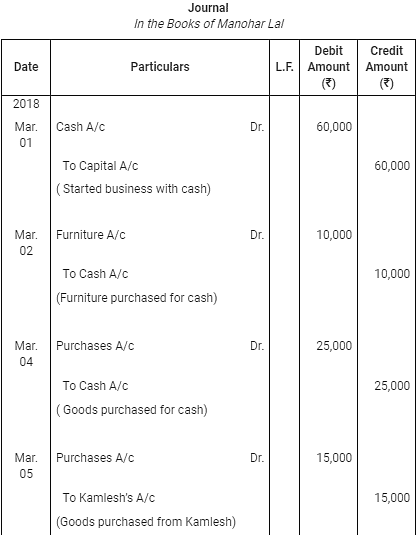

Ques 1: Enter the following transactions in the Journal of Manohar Lal & Sons.:

Ans:

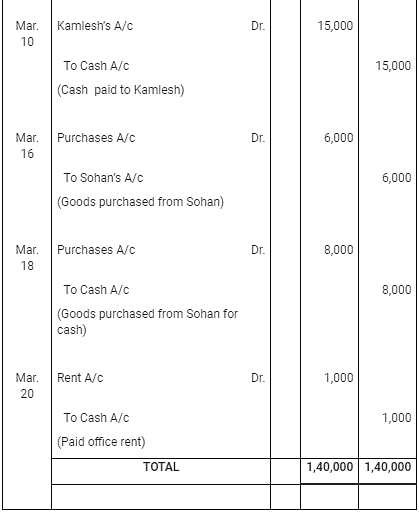

Ques 2: Enter the following transactions in the Journal of M/s Tripathi Bros.:-

Ans:

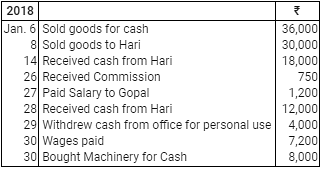

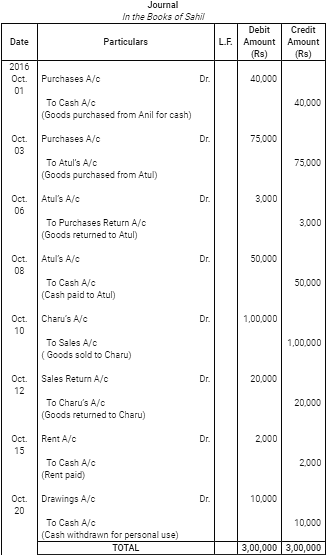

Ques 3: Enter the following transactions in the Journal of Sahil Bros.:

Ans:

Page No 9.60:

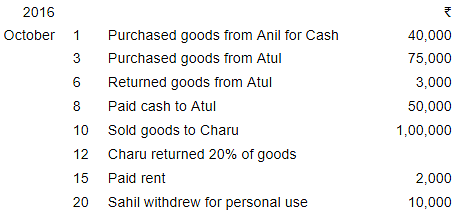

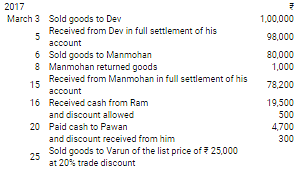

Ques 4: Enter the following transactions in the Journal of Ganesh Bros.:-

Ans:

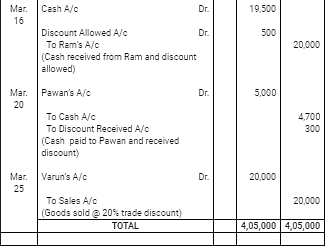

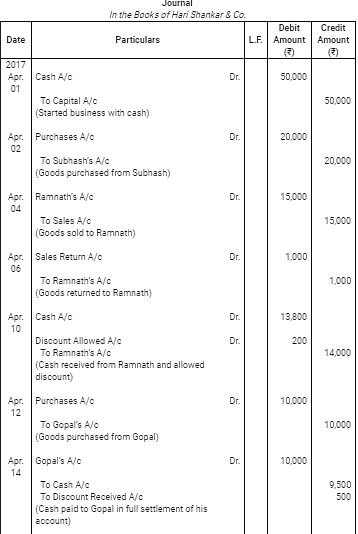

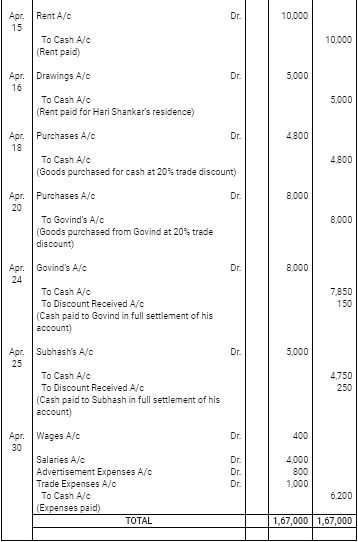

Ques 5: Pass Journal entries in the books of Hari Shankar & Co. from the following:

Ans:

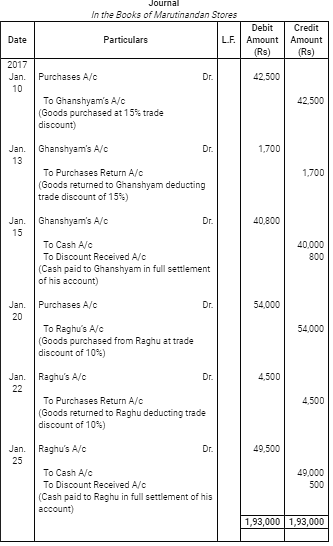

Ques 6: Enter the following transaction in the Journal of Marutinandan Stores:

Ans:

Page No 9.61:

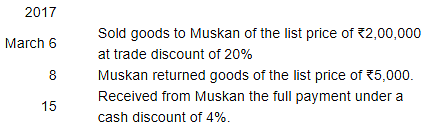

Ques 7: Pass Journal Entries for the following transactions:

Ans:

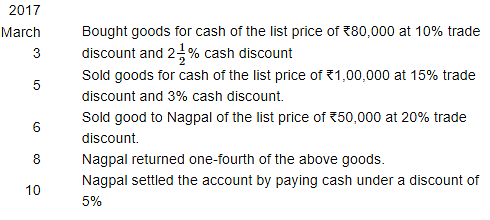

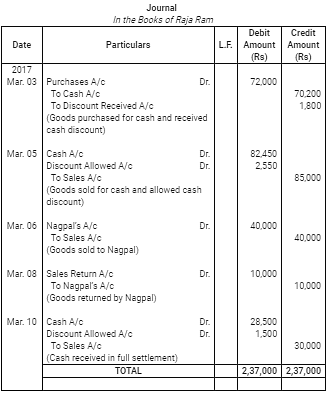

Ques 8: Give Journal Entries for the following transactions in the books of Raja Ram & Co.:

Ans:

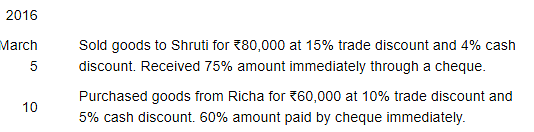

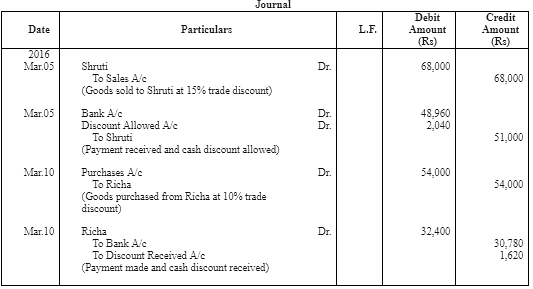

Ques 9: Journalise the following transactions:

Ans:

Working Notes:

1. Amount of goods sold would be Rs 68,000 (80,000 - 15% of 80,000) and cash discount would be Rs 2,040, it would be calculated on amount received Rs 51,000 i.e., 75% of Rs 68,000.

2. Amount of goods purchased would be Rs 54,000 (60,000 - 10% of 60,000) and cash discount would be Rs 1,620, it would be calculated on amount paid Rs 32,400 i.e., 60% of Rs 54,000

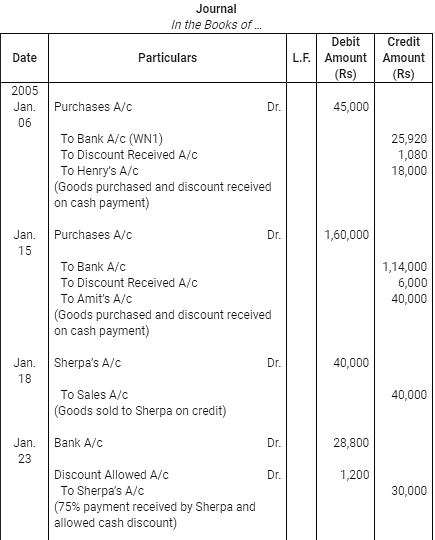

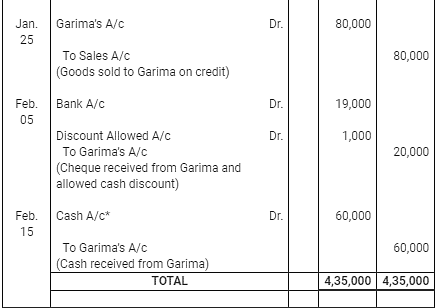

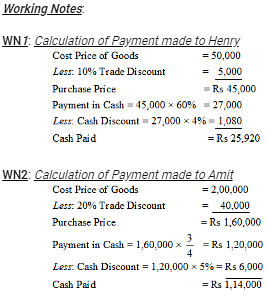

Ques 10: Pass journal entries for the following:

Ans:

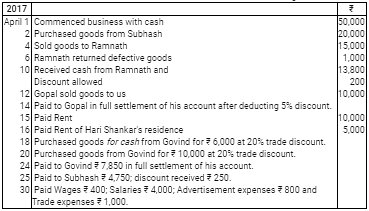

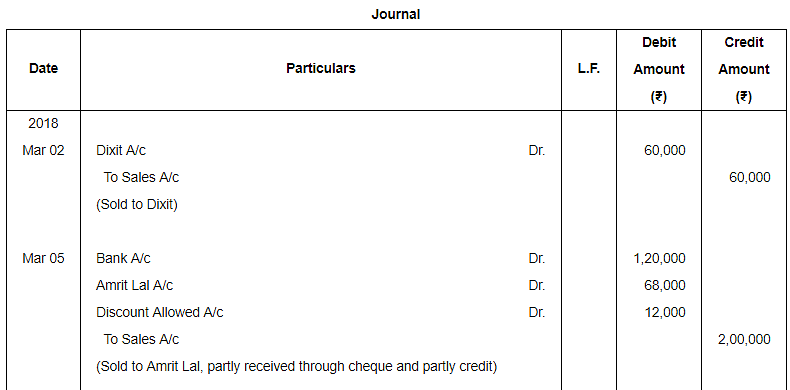

Question 11:

Journalise the following transactions in the books of Dixit & Sons. :

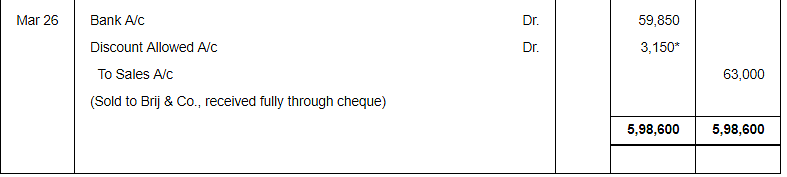

ANSWER:

Note: There is a misprint in the book, the amount of cash discount for the entry dated Mar 26 should be 3,150 (not 2,150).

FAQs on Books of Original Entry- Journal (Part - 1) - Commerce

| 1. What is a journal in accounting? |  |

| 2. What are the types of journals in accounting? |  |

| 3. What is the purpose of a journal in accounting? |  |

| 4. How is a journal entry recorded? |  |

| 5. What is the difference between a journal and a ledger in accounting? |  |

|

Explore Courses for Commerce exam

|

|