Capital Budgeting Analysis: Techniques & Importance | Crash Course for UGC NET Commerce PDF Download

Conventional Techniques of Capital Budgeting Analysis

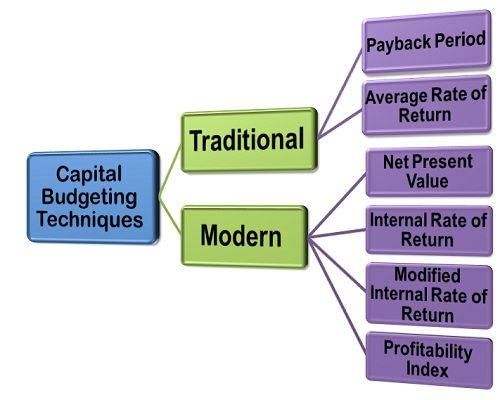

Capital budgeting techniques are essential tools that firms use to evaluate potential investment projects, enabling them to make decisions that optimize capital costs and maximize value and returns. The primary conventional methods are outlined below:

Capital budgeting techniques are essential tools that firms use to evaluate potential investment projects, enabling them to make decisions that optimize capital costs and maximize value and returns. The primary conventional methods are outlined below:

Payback Period Method: This approach calculates the time required for a project’s cash inflows to recover the initial investment. Although simple and intuitive, it overlooks cash flows occurring after the payback period, which may result in the rejection of profitable projects if used in isolation.

Net Present Value (NPV): NPV involves discounting all future cash flows of a project to their present value using a discount rate, usually the cost of capital. A project with a positive NPV adds value and is financially attractive. NPV is widely regarded as the most accurate technique for capital budgeting.

Internal Rate of Return (IRR): The IRR is the discount rate that makes the NPV of a project's cash flows zero. It indicates the efficiency of an investment, with projects having an IRR above the firm’s required rate of return being considered desirable.

Additional methods include the Profitability Index, which assesses the ratio of the present value of cash flows to the initial investment, and the Average Accounting Return, which examines average annual profits without discounting future cash flows. The Discounted Payback Period method addresses some of the limitations of the simple payback period by incorporating discounting.

Advantages of Conventional Techniques of Capital Budgeting Analysis

The advantages of conventional capital budgeting techniques are as follows:

Payback Period Method: This method is straightforward and easy to understand. It serves as a measure of liquidity by indicating the number of years required to recover the initial investment.

Net Present Value (NPV): NPV accounts for the time value of money by discounting future cash flows, providing an accurate financial assessment of an investment. It is considered the most reliable technique.

Internal Rate of Return (IRR): IRR also considers the time value of money, reflecting the efficiency and profitability of an investment. Projects with an IRR exceeding the firm’s required rate of return are particularly attractive.

Profitability Index (PI): This index offers a ratio that demonstrates how much a project is expected to increase profits relative to the initial investment. A ratio above 1 signifies a favorable project.

Average Accounting Return: This method measures the average profits generated by an investment, offering a simple and easy-to-calculate indicator of profitability.

Discounted Payback Period: This approach improves upon the limitations of the simple payback period by considering the time value of money. It provides a more accurate estimate of a project's liquidity and risk.

Disadvantages of Conventional Techniques of Capital Budgeting Analysis

The disadvantages of conventional capital budgeting techniques are as follows:

Payback Period Method: This method overlooks cash flows that occur after the payback period, potentially leading to the rejection of investments that could be profitable in the long term.

Net Present Value (NPV): Calculating and understanding NPV can be challenging for some, as it requires an accurate discount rate to be effective.

Internal Rate of Return (IRR): IRR assumes that cash flows can be reinvested at the same rate, which may not always be realistic. Additionally, it can lead to the acceptance of mutually exclusive projects with similar IRRs.

Profitability Index (PI): PI does not take into account the size of investments, which can distort comparisons between projects of different scales.

Average Accounting Return: This method ignores the time value of money, making it an imprecise measure of a project’s performance.

Discounted Payback Period: The use of a subjective discount rate in this method can influence the results, potentially leading to biased decisions.

Conclusion

In conclusion, firms rely on conventional capital budgeting techniques to evaluate investment projects and make optimal fund allocation decisions. Although each method has its strengths and weaknesses, NPV and IRR are generally considered the most accurate because they factor in the time value of money. However, it's essential to apply judgment in interpreting results and considering non-financial factors. By combining different methods, firms can achieve a more comprehensive analysis, ultimately helping to maximize long-term value. The primary objective is to select projects that yield returns greater than their costs.

|

157 videos|236 docs|166 tests

|

FAQs on Capital Budgeting Analysis: Techniques & Importance - Crash Course for UGC NET Commerce

| 1. What are the different capital budgeting techniques commonly used in financial analysis? |  |

| 2. How is the payback period calculated and what does it signify in capital budgeting analysis? |  |

| 3. What is the importance of using capital budgeting techniques in financial decision-making? |  |

| 4. How does net present value (NPV) differ from internal rate of return (IRR) as capital budgeting techniques? |  |

| 5. How can profitability index be used in capital budgeting analysis to rank investment projects? |  |