Short Notes & Important Questions - Forms of Business Organisation | Business Studies (BST) Class 11 - Commerce PDF Download

What is a Business Enterprise?

Meaning: A business enterprise is an institutional arrangement to form any business activity.

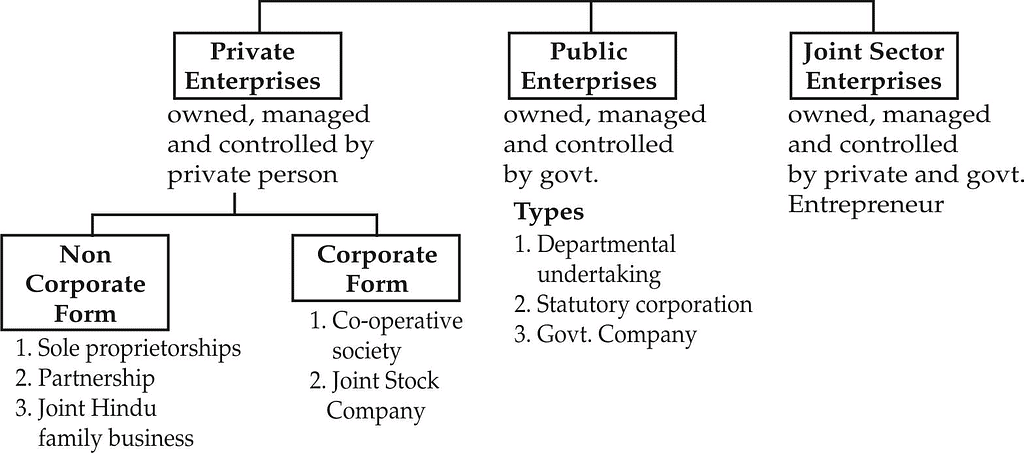

Classification: On the basis of ownership business enterprises can broadly be classified into the following categories.

Forms of Business Enterprise

In the case of corporate form of private enterprises the identity of the enterprise is separate from that of the owner and in the case of non-corporate form, the identity of the enterprise is not different from that of its owners.

Sole Proprietorship

A sole proprietorship is a business owned, financed, and controlled by a single person who is the recipient of all profits and bearer of all risks. It is suitable for personalised services like beauty parlours, hair-cutting saloons, and small-scale activities like retail shops.

Features

1. Single ownership: It is wholly owned by one individual.

2. Control: The sole proprietor has full power of decision-making.

3. No Separate Legal Entity: Legally there is no difference between business and businessman.

4. Unlimited Liability: The liability of the owner is unlimited. In case the assets of the business are not sufficient to meet its debts, the personal property of the owner can be used to pay debts.

5. No legal formalities: are required to start, manage and dissolve such a business organisation.

6. Sole risk bearer and profit recipient: He bears the complete risk and there is nobody to share profit/loss with him.

Merits

1. Easy to start and close: It can be easily started and closed without any legal formalities.

2. Quick decision-making: A sole trader is not required to consult or inform anybody about his decisions.

3. Secrecy: He is not expected to share his business decisions and secrets with anybody.

4. Direct incentive: A direct relationship between efforts & reward provides an incentive to the sole trader to work hard.

5. Personal touch: The sole trader can maintain personal contact with his customers and employees.

6. Social Utility: It provides employment to persons with limited money who are not interested in working under others. It prevents the concentration of wealth in a few hands.

Limitations

1. Limited financial resources: Funds are limited to the owner's personal savings and borrowing capacity.

2. Limited Managerial ability:- A sole trader can not be good in all aspects of business and he can not afford to employ experts either.

3. Unlimited liability:- Unlimited liability of sole trader compels him to avoid risky and bold business decisions.

4. Uncertain life:- Death, insolvency, lunacy or illness of a proprietor affects the business and can lead to its closure.

5. Limited scope for expansion:- Due to limited capital and managerial skills, it cannot expand to a large scale.

Suitability

A sole proprietorship is suitable where:

- personal attention to the customer is required as in tailoring, beauty parlour.

- goods are unstandardised like artistic jewellery.

- modest capital & limited managerial skills are required as in the case of retail stores.

Joint Hindu Family Business

It is owned by the members of an undivided joint Hindu family and managed by the eldest member of the family known as KARTA. It is governed by the provisions of Hindu law. The basis of membership is birth in a particular family.

Features

1. Formation- For a Joint Hindu Family business, there should be at least two members in the family and some ancestral property to be inherited by them.

2. Membership- Membership is by virtue of birth in the family.

3. Control- In it, control lies with the eldest member of a family known as Karta. All other members can give only advice.

4. Liability- The liability of Karta is unlimited but of all other members is limited to the extent of their share in the property.

5. Continuity- The business is not affected by the death or incapacity of Karta as in such cases the next senior male member becomes the Karta.

6. Minor members- A minor can also become a full-fledged member of the Family business.

Merits

1. Effective control- The Karta can promptly make decisions as he has absolute decision-making power.

2. Continued business existence- The death, Lunacy of Karta will not affect the business as the next eldest member will then take up the position.

3. Limited liability- The liability of all members except Karta is limited. It gives them a relief.

4. Secrecy- Complete secrecy regarding business decisions can be maintained by Karta.

5. Loyalty and co-operation- It helps in securing better co-operation and greater loyalty from all the members who run the business.

Limitations

1. Limited capital- There is a shortage of capital as it is limited to the ancestral property.

2. Unlimited liability of Karta- It makes him less enterprising.

3. Dominance of Karta- Karta manages the business and sometimes he ignores the valuable advice of other members. This may cause conflict among members and may even lead to the breakdown of the family unit.

4. Hasty decisions- As Karta is overburdened with work. So sometimes he makes hasty and unbalanced decisions.

5. Limited managerial: Limited managerial skills of Karta also pose a serious problem. The joint Hindu family business is on the decline because of the diminishing no. of Joint Hindu families in the country.

Partnership

Meaning: Partnership is a voluntary association of two or more persons who agree to carry on some business jointly and share its profits and losses. The partnership was evolved to overcome the shortcomings of sole proprietorship and Joint Hindu Family business.

Features

1. Two or more persons- There must be at least two persons to form a partnership. The maximum no. of persons is 10 in the banking business and 20 in the non-banking business.

2. Agreement- It is an outcome of an agreement among partners which may be oral or in writing.

3. Lawful business- It can be formed only to carry on some lawful business.

4. Decision-making & control- Every partner has a right to participate in the management & decision-making of the organisation.

5. Unlimited liability- Partners have unlimited liability.

6. Mutual Agency- Every partner is an implied agent of the other partners and of the firm. Every partner is liable for acts performed by other partners on behalf of the firm.

7. Lack of continuity- A firm's existence is affected by the death, Lunacy and insolvency of any of its partners. It suffers from a lack of continuity.

Merits

1. Ease of formation & closure- It can be easily formed. Only an agreement among the partners is required.

2. Larger financial resources- There are more funds as capital is contributed by no. of partners.

3. Balanced Decisions- Decisions are taken jointly by partners after consulting each other.

4. Sharing of Risks- In it, risk gets distributed among partners which reduces anxiety, burden and stress on individual partners.

5. Secrecy- Secrecy can be easily maintained about business affairs as they are not required to publish their accounts or to file any report to the govt.

Limitations

1. Limited resources- There is a restriction on the number of partners and hence capital contributed by them is also limited.

2. Unlimited liability- The liability of partners is unlimited and they are liable individually as well as jointly. It may prove to be a big drawback for those partners who have greater personal wealth. They will have to repay the entire debt in case the other partners are unable to do so.

3. Lack of continuity- Partnership comes to an end with the death, retirement, insolvency or lunacy of any of its partners.

4. Lack of public confidence- Partnership firms are not required to publish their reports and accounts. Thus they lack public confidence.

Types of Partners

1. General / Active Partner - Such a partner takes an active part in the management of the firm.

2. Sleeping or Dormant Partner- He does not take an active part in the management of the firm. Though he invests money, and shares profit & loss, has unlimited liability.

3. Secret Partner- He participates in business secretly without disclosing his association with the firm to the general public. His liability is also unlimited.

4. Nominal Partner- Such a partner only gives his name and goodwill to the firm. He neither invests money nor takes profit. But his liability is unlimited.

5. Partner by Estoppel- He is the one who by his words or conduct gives the impression to the outside world that he is a partner of the firm whereas actually, he is not. His liability is unlimited towards the third party who has entered into dealing with the firm on the basis of his presentation.

6. Partner by holding out- He is the one who is falsely declared partner of the firm whereas actually, he is not. And even after becoming aware of it, he does not deny it. His liability is unlimited towards the party who has dealt with the firm on the basis of this declaration.

Partnership Deed

Definition- The written agreement on stamped paper that specifies the terms and conditions of the partnership is called the partnership deed.

Features- It generally includes the following aspects-

- Name of the firm.

- Location / Address of the firm.

- Duration of business.

- Investment made by each partner.

- The profit-sharing ratio of the partners.

- Terms relating to Salaries, Drawing, Interest on capital and Interest on Drawing of partners.

- Duties and obligations of partners.

- Terms governing admission, retirement and expulsion of a partner.

- Preparation of accounts and their auditing.

- Method of solving disputes.

Registration of Partnership

Registration is not compulsory, it is optional. However, it is always beneficial to get the firm registered.

The consequences of non-registration of a firm are as follows-

1. A partner of an unregistered firm cannot file suit against the firm or other partner.

2. The firm cannot file a suit against a third party.

3. The firm cannot file a case against its partner.

Co-operative Society

A cooperative society is a voluntary association of persons of moderate means, who unite together to protect and promote their common economic interests.

Features

1. Voluntary association- Everyone having a common interest is free to join a cooperative society and can also leave the society after giving proper notice.

2. Legal status- Its registration is compulsory and it gives it a separate legal identity.

3. Limited liability- The liability of the member is limited to the extent of their capital contribution to society.

4. Democratic control- Management and control lie with the managing committee elected by the members by giving a vote. Every member has one vote irrespective of the number of shares held by him.

5. Service motive- The main aim is to serve its members and not to maximize the profit.

6. State control- They have to abide by the rules and regulations framed by govt. for them.

7. Distribution of surplus- The profit is distributed on the basis of the volume of business transacted by a member and not on the basis of the capital contribution of the member.

Merits

1. Ease of formation- It can be started with a minimum of 10 members. Registration is also easy as it requires very few legal formalities.

2. Limited liability- The liability of members is limited to the extent of their capital contribution.

3. Stable Existence- Due to registration it is a separate legal entity and is not affected by the death, Lunacy or insolvency of any of its members.

4. Economy in operations- Due to the elimination of middlemen and voluntary services provided by its members.

5. Government Support- The government provides support by giving loans at lower interest rates, and subsidies & by charging less taxes.

6. Social utility- It promotes personal liberty, social justice and mutual cooperation. They help to prevent the concentration of economic power in a few hands.

Limitations

1. Shortage of capital- It suffers from a shortage of capital as it is usually formed by people with limited means.

2. Inefficient management Co-operative society- is managed by elected members who may not be competent and experienced. Moreover, it cannot afford to employ expert and experienced people at high salaries.

3. Lack of motivation- Members are not inclined to put in their best efforts as there is no direct link between efforts and reward.

4. Lack of Secrecy- Its affairs are openly discussed in its meetings which makes it difficult to maintain secrecy

5. Excessive govt. control- it suffers from excessive rules and regulations of the govt. It has to get its accounts audited by the auditor and has to submit a copy of its accounts to the registrar.

6. Conflict among members- The members are from different sections of society with different viewpoints. Sometimes when some members become rigid, the result is conflict.

Types of Co-operative Societies

1. Consumers Co-operative Society- It seeks to eliminate middlemen by establishing a direct link with the producers. It purchases goods of daily consumption directly from manufacturers or wholesalers and sells them to the members at reasonable prices.

2. Producers Co-operative Society- The main aim is to help small producers who cannot easily collect various items of production and face some problems in marketing. These societies purchase raw materials, tools, equipment and other items in large quantities and provide these things to their members at reasonable prices.

3. Marketing Co-operative Society- It performs various marketing functions such as transportation, warehousing, packing, grading, marketing research etc. for the benefit of its members. The production of different members is pooled together and sold by society at a good price.

4. Farmers Co-operative Society- In such societies, small farmers join together and pool their resources for cultivating their land collectively. Such societies provide better quality seeds, fertilizers, machinery and other modern techniques for use in the cultivation of crops. It provides them the opportunity to cultivate on a large scale.

5. Credit co-operative Society- Such societies protect the members from exploitation by money lenders. They provide loans to their members at easy terms and reasonably low rates of interest.

6. Cooperative Housing Society- The main aim is to provide houses to people with limited means/income at reasonable prices.

Joint Stock Company

Meaning- A joint stock company is a voluntary association of persons having a separate legal existence, perpetual succession and common seal. Its capital is divided into transferable shares.

Features

1. Separate Legal Existence - It is created by law and it is a distinct legal entity independent of its members. It can own property, enter into contracts, can file suits in its own name.

2. Perpetual Existence- Death, insolvency and insanity or change of members has no effect on the life of a company It can come to an end only through the prescribed legal procedure.

3. Limited Liability- The liability of every member is limited to the nominal value of the shares bought by him or to the amount guaranteed by him.

4. Transferability of shares - Shares of public Co. are easily transferable. But there are certain restrictions on the transfer of shares of private Co.

5. Common Seal- It is the official signature of the company and it is affixed on all important documents of the company.

6. Separation of ownership and control - Management of a company is in the hands of elected representatives of shareholders known individually as directors and collectively as a board of directors.

Merits

1. Limited Liability- Limited liability of the shareholder reduces the degree of risk borne by him.

2. Transfer of Interest - Easy transferability of shares increases the attractiveness of shares for investment.

3. Perpetual Existence - The existence of a company is not affected by the death, insanity, Insolvency of a member or change of membership. The company can be liquidated only as per the provisions of the Companies Act.

4. Scope for expansion - A company can collect a huge amount of capital from an unlimited no. of members who are ready to invest because of limited liability, easy transferability and chances of high return.

5. Professional management A company can afford to employ highly qualified experts in different areas of business management.

Limitations

1. Legal formalities- The procedure of formation of Co. is very long, time-consuming, expensive and requires a lot of legal formalities to be fulfilled.

2. Lack of secrecy- It is very difficult to maintain secrecy in the case of a public company, as the company is required to publish and file its annual accounts and reports.

3. Lack of Motivation- Divorce between ownership and control and the absence of a direct link between efforts and reward lead to a lack of personal interest and incentive.

4. Delay in decision making- Redtapism and bureaucracy do not permit quick decisions and prompt actions. There is little scope for personal initiative.

5. Oligarchic management- The company is said to be democratically managed but actually managed by a few people i.e. board of directors. Sometimes they make decisions keeping in mind their personal interests and benefits, ignoring the interests of shareholders and the Company.

Choice of Form of Business Organisation

The following factors are important for making decisions about the form of organisation.

1. Cost and Ease in Setting up the Organisation - A sole proprietorship is the least expensive and can be formed without any legal formalities to be fulfilled. Company is most expensive with a lot of legal formalities,

2. Capital Consideration - Businesses requiring less amount of finance prefer sole proprietorship and partnership form, whereas business activities requiring huge financial resources prefer company form.

3. Nature of Business- If the work requires personal attention such as a tailoring unit, or hair-cutting saloon, it is generally set up as a sole proprietorship. Units engaged in large-scale manufacturing are more likely to be organised in company form.

4. Degree of Control Desired- A person who desires full and exclusive control over business prefers proprietorship rather than partnership or Company because control has to be shared in these cases.

5. Liability or Degree of Risk- Projects that are not very risky can be organised in the form of sole proprietorship & partnership, whereas risky ventures should be done in a company form of organisation because the liability of shareholders is limited.

Formation of a Company

Formation of a company means bringing a company into existence and starting its business. The steps involved in the formation of a company are:-

(i) Promotion

(ii) Incorporation

(iii) Capital subscription

(iv) Commencement of business

A private company has to undergo only the first two steps but a public company has to undergo all four stages.

I. Promotion:- Promotion means conceiving a business opportunity and taking the initiative to form a company. Steps in Promotion are:-

1. Identification of Business Opportunity: The first and foremost function of a promoter is to identify a business idea e.g. production of a new product or service.

2. Feasibility Studies: After identifying a business opportunity the promoters undertake detailed studies of the technical, Financial, and Economic feasibility of a business.

3. Name Approval: After selecting the name of the company the promoters submit an application to the Registrar of Companies for its approval.

4. Fixing up signatories to the Memorandum of Association: Promoters have to decide about the director who will be signing the memorandum of Association.

5. Appointment of professionals: Promoters appoint merchant bankers, auditors etc.

6. Preparation of necessary documents: The promoters prepare certain legal documents such as Memorandum of Association, Articles of Association which have to be submitted to the Registrar of the companies.

II.Incorporation:- Incorporation means the registration of the company as a body corporate under the Companies Act 1956 and receiving a certificate of Incorporation.

Steps for Incorporation

1. Application for incorporation:- Promoters make an application for the incorporation of the company to the Registrar of Companies.

2. Filing of necessary documents:- Promoters file the following documents:-

(i) Memorandum of Association.

(ii) Articles of Association.

(iii) Statement of Authorized Capital.

(iv) Consent of proposed director.

(v) Agreement with the proposed managing director.

(vi) Statutory declaration.

3. Payment of fees:- Along with the filing of the above documents, registration fees have to be deposited which depends on the amount of the authorized capital.

4. Registration:- The Registrar verifies all the documents submitted. If he is satisfied then he enters the name of the company in his Register.

5. Certificate of Incorporation:- After entering the name of the company in the register. The Registrar issues a Certificate of Incorporation. This is called the birth certificate of the company.

III. Capital Subscription:- A public company can raise funds from the public by issuing shares and Debentures. For this it has to issue a prospectus and undergo various other formalities:-

Steps required for raising funds from the public:

1. SEBI Approval: SEBI regulates the capital market of India. A public company is required to take approval from SEBI.

2. Filing of Prospectus:- Prospectus means any document that invites offers from the public to purchase shares and Debenture of the company.

3. Appointment of bankers, brokers, and underwriters: The banker of the company receives the application money. Brokers encourage the public to apply for the shares. Underwriters are the person who undertakes to buy the shares if these are not subscribed by the public. They receive an underwriting commission.

4. Minimum subscription:- According to the SEBI guidelines, the minimum subscription is 90% of the issue amount. If minimum subscription is not received then the allotment cannot be made and the application money must be returned to the applicants within 30 days.

5. Application to Stock Exchange:- A public company must list their shares in the stock exchange therefore the promoters apply in a stock exchange to list company shares.

6. Allotment of Shares: Allotment of shares means acceptance of share applied. Allotment letters are issued to the shareholders. The name and address of the shareholders are submitted to the Registrar.

Commencement of Business

To commence business a public company has to obtain a certificate of commencement of Business. For this, the following documents have to be filled with the registrar of companies.

1. A declaration that 90% of the issued amount has been subscribed.

2. A declaration that all directors have paid in cash in respect of the allotment of shares made to them.

3. A statutory declaration that the above requirements have been completed and must be signed by the director of the company.

Important Questions

1 MARK QUESTIONS:-

1. Write the name of a form of business organisation found only in India.

2. Write the name of a form of business organisation found only in India.

3. Name two types of business in which sole proprietorship is very suitable.

4. Name the person who manages a Joint Hindu Family business.

5. Write the names of systems that govern membership in the Joint Hindu Family Business.

6. Enumerate the two conditions necessary for the formation of a Joint Hindu Family business.

7. What is the minimum no. of persons required to form a cooperative society?

8. Explain the meaning of unlimited liability.

9. Name the type of Co. which must have a minimum paid-up capital of 5 lacs.

10 . What is meant by minimum subscription?

3 MARKS QUESTIONS:-

11. What is the role of Karta in a Joint Hindu Family business?

12. Name the types of companies that two people can start.

13. What is meant by Partner by estoppel?

14. What is a Secret Partner?

15. Write a short note on producers co-operative society.

16. Explain a cooperative organisation in a democratic setup.

17. Explain the concept of mutual agency in partnership with a suitable example.

4/5 MARKS QUESTIONS :

18. Is registration of partnership compulsory? What are the consequences of non-registration?

19. Explain any four limitations of a Joint Stock Company.

20. Differentiate between Private Co. & Public Co.

6 MARKS QUESTIONS :

21. Mr. Amit Kumar is interested in the flotation of a company. Briefly discuss the steps he should take.

22. Discuss the reasons for the superiority of Joint Stock Co. over sole proprietorship and partnership.

23. Explain the factors which affect the choice of form of business organisation.

24. Which form of business is suitable for the following types of business and why?

(a) Beauty Parlour

(b) Coaching Centre for Science Students

|

37 videos|142 docs|38 tests

|

FAQs on Short Notes & Important Questions - Forms of Business Organisation - Business Studies (BST) Class 11 - Commerce

| 1. What are the main types of business organizations? |  |

| 2. What are the advantages of a sole proprietorship? |  |

| 3. How does a partnership differ from a corporation? |  |

| 4. What are the key benefits of forming a limited liability company (LLC)? |  |

| 5. What factors should be considered when choosing a business organization type? |  |

|

Explore Courses for Commerce exam

|

|