Financial Statements - I Chapter Notes | Accountancy Class 11 - Commerce PDF Download

Stakeholders and their Information Requirements

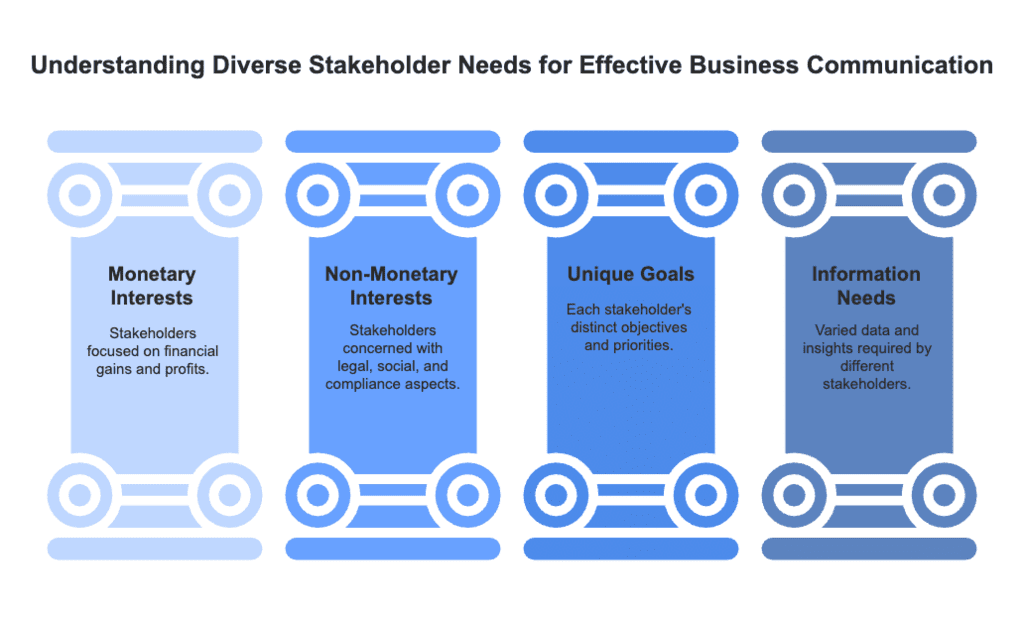

- The main goal of business is to share important information with different stakeholders so they can make smart choices.

- A stakeholder is anyone who is involved with a business, whether directly or indirectly.

- They can have either monetary interests, such as making profits, or non-monetary interests, like ensuring legal compliance or promoting social welfare.

- For instance, owners and lenders have a monetary interest, while the government, consumers, and researchers have non-monetary interests.

- Each stakeholder has unique goals and therefore different information needs from the business.

Types of Stakeholder Interests

Stakeholder interests can be:

- Active or Passive: Active stakeholders actively participate in business activities, while passive stakeholders have an interest but do not engage directly.

- Direct or Indirect: Direct stakeholders have a clear, immediate interest in the business, while indirect stakeholders are affected by the business’s activities but not directly involved.

Examples of Stakeholders

- Financial Interest: The owner of the business and lenders are mainly concerned about profits, returns, and financial stability.

- Non-Financial Interest: The government may be interested in tax compliance, consumers may care about product quality, and researchers may focus on business practices for studies.

Users and Their Classification

Stakeholders are also called users, and they can be classified into two categories:

- Internal Users: People within the business, like managers and employees, who need detailed information to make decisions.

- External Users: People outside the business, such as investors, government agencies, and consumers, who require information for various purposes like investment decisions, regulatory compliance, or product evaluations.

Since users join the business for different reasons, their information needs vary significantly. Understanding these needs is essential for effectively analyzing and communicating accounting information.

Accounting Process (up to Trial balance) :

- The process of recording transactions involves several key steps.

- First, only transactions that can be measured in monetary terms are recorded.

- This recording follows the double-entry system, where each transaction has two aspects: debit and credit.

- Repeated transactions of similar nature are documented in subsidiary books, also known as special journals, instead of the general journal.

- For instance, credit sales are recorded in a sales book, while credit purchases are noted in a purchases book.

- Other subsidiary books include the return inwards book and return outwards book, with cash and bank transactions recorded in a cash book.

- Transactions not captured in these specialized books are entered into a residual journal called the journal proper.

- Following this, the entries from these books are posted to the corresponding accounts in the ledger.

- The accounts are then balanced and compiled into a statement known as the trial balance.

- If the total debit and credit balances match, the accounts are deemed free from arithmetic errors.

- The trial balance serves as the foundation for preparing financial statements, including the trading and profit and loss account as well as the balance sheet.

Distinction between Capital and Revenue

- The difference between capital and revenue items is crucial in accounting.

- Revenue items are included in the trading and profit and loss accounts.

- Capital items are used to prepare the balance sheet.

What is Expenditure?

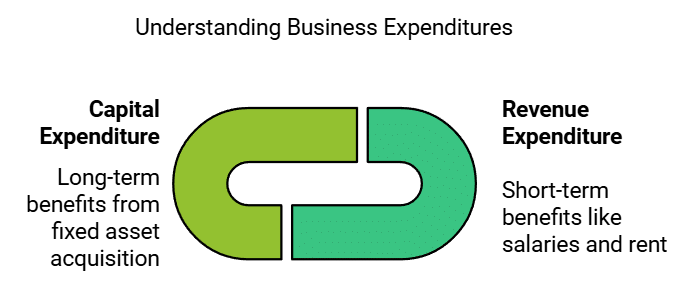

- Expenditure means any payment made for reasons other than paying off existing debts.

- Businesses make expenditures with the hope of receiving benefits in return.

- The benefits from these expenditures can last for one accounting year or even longer.

- If the benefits last for up to one accounting year, it is known as revenue expenditure.

- Examples of revenue expenditure include payments for salaries and rent.

- For example, salary payments made in the current period do not provide any benefit in the next period.

- If the benefits continue beyond one accounting period, it is referred to as capital expenditure.

- Purchasing furniture for business use is an example of capital expenditure.

- Capital expenditures usually involve acquiring or enhancing fixed assets.

Key Differences Between Capital and Revenue Expenditure

- Capital expenditure boosts a business's ability to earn money, while revenue expenditure is spent to keep that ability intact.

- Capital expenditure involves purchasing fixed assets, like buildings and machines, whereas revenue expenditure covers day-to-day costs.

- Revenue expenditure usually occurs often, while capital expenditure happens less frequently.

- Capital expenditure benefits the business over several accounting years.

- Capital expenditure (which depreciates) appears on the balance sheet, while revenue expenditure (adjusted for outstanding and prepaid amounts) goes into the trading and profit and loss account.

- Sometimes, it is challenging to determine whether an expense is revenue or capital.

- Deferred revenue expenditure refers to costs expected to benefit the business across multiple accounting periods.

Challenges in Classifying Expenditure

- It can be challenging to decide whether certain expenses should be labelled as revenue or capital.

- Advertising expenses are typically considered revenue expenditures, but they may offer benefits that last for several years.

- When advertising expenses provide advantages over more than one year, they are referred to as deferred revenue expenditures.

Understanding Expenditure and Expenses

- Expenditure is a general term that covers all kinds of expenses.

- Expenditure means any money that a business spends.

- Expenses are specific parts of expenditure that are consumed within the current year.

- Revenue expenditure is considered an expense for the current year and is listed in the profit and loss account.

- For instance, salaries paid to employees are counted as expenses for that particular year.

- Capital expenditures are costs that are spread over several years, such as furniture costing ₹50,000 that is used for 5 years.

- This amount will be recorded as an expense of ₹10,000 each year, which is referred to as depreciation.

- Deferred revenue expenditures are treated similarly to capital expenditures and are written off during their benefit period.

Receipts

- Receipts are considered differently from expenditures. Expenditures represent cash outflows, while receipts signify cash inflows.

- If a receipt involves a promise to return money, it is called a capital receipt. These receipts relate to the owner’s equity and liabilities.

- Examples of capital receipts include additional funds from the owner and loans from banks.

- When selling fixed assets, such as old machinery, this also counts as a capital receipt.

- In contrast, if a receipt does not require returning the money or is not from selling a fixed asset, it is referred to as a revenue receipt.

- Revenue receipts include sales made by the business and interest received on investments.

- Capital expenditure enhances the earning potential of the business, while revenue expenditure is spent to maintain that potential.

- At times, it can be challenging to categorise expenditures as revenue or capital.

Importance of Distinction between Capital and Revenue

- The difference between capital and revenue affects how the trading and profit and loss account and balance sheet are prepared.

- All revenue items must be recorded in the trading and profit and loss account, while capital items belong in the balance sheet.

- If items are misclassified, it can lead to incorrect profit or loss figures.

- For instance, if revenue of ₹10,00,000 is reported with expenses of ₹8,00,000, profit appears to be ₹2,00,000.

- If a revenue item of ₹20,000 for repairs is mistakenly recorded as capital, expenses are actually ₹8,20,000, reducing profit to ₹1,80,000.

- This misclassification can lead to overstated profits.

- Conversely, if capital expenditure is wrongly recorded as revenue, it can lead to understated profits and asset values.

- Therefore, accurately identifying and categorizing items in accounts is essential for clear financial reporting.

- This accuracy is also important for tax purposes, as capital and revenue profits are taxed differently.

Financial Statements

- It is important to recognize that different users have various needs for information.

- Instead of creating specific details for each user, the company prepares a collection of financial statements that generally meet the information needs of users.

- The main goals of creating financial statements are:

1. To provide a true and fair view of the business's financial performance.

2. To provide a true and fair view of the business's financial position. - To achieve these goals, the company typically prepares the following financial statements:

1. Trading and Profit and Loss Account

2. Balance Sheet - The Trading and Profit and Loss Account, also called the Income Statement, displays the financial performance in terms of profit made or loss incurred by the business.

- The Balance Sheet shows the financial position by listing assets, liabilities, and capital.

- These statements are prepared based on the trial balance and any additional information that may be available.

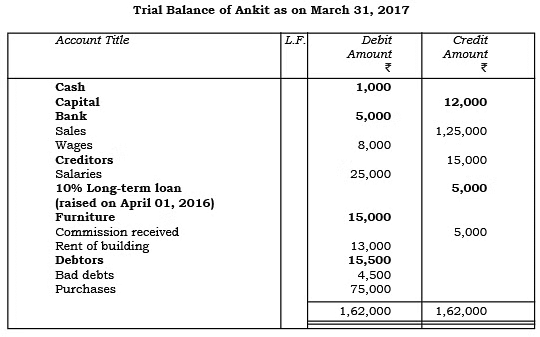

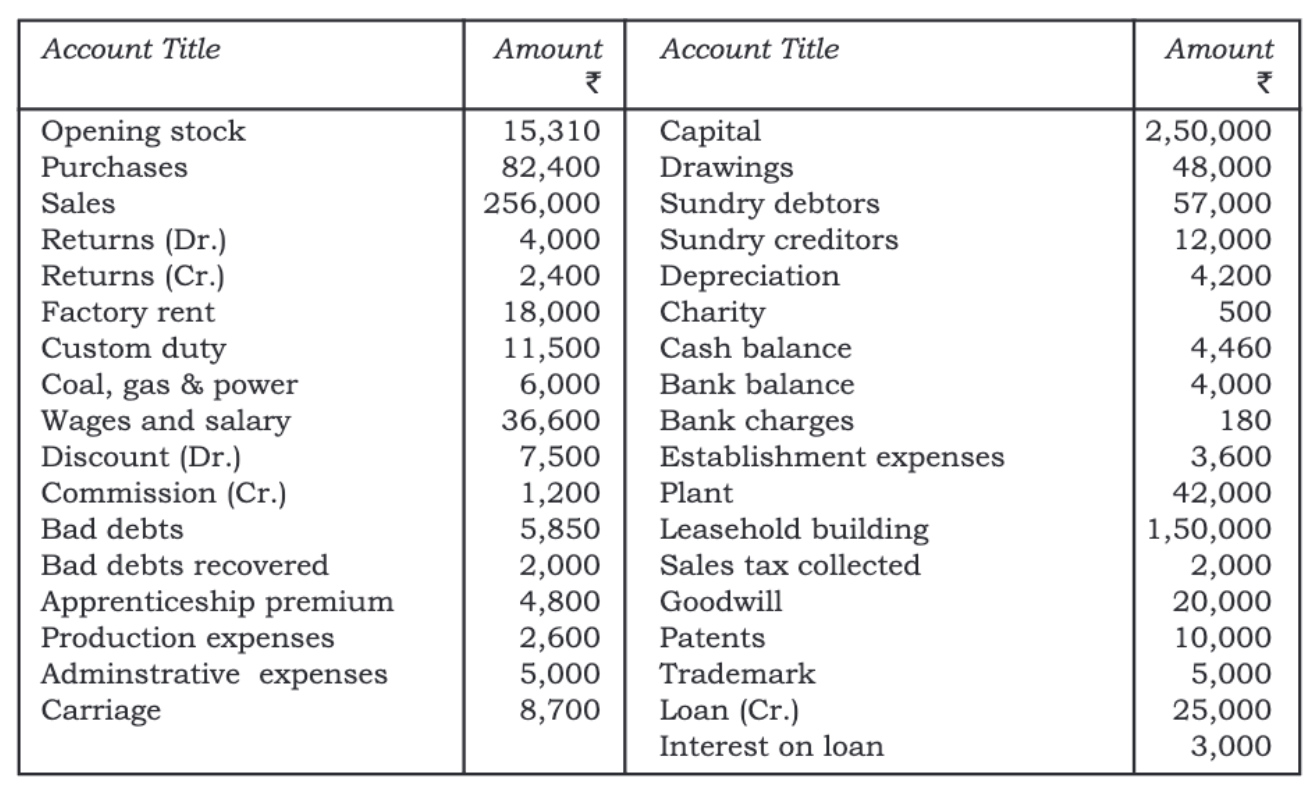

Example: Observe the following trial balance of Ankit and signify correctly the various elements of accounts and you will notice that the debit balances represent either assets or expenses/ losses and the credit balance represents either equity/liabilities or revenue/gains. [This trial balance of Ankit will be used throughout the chapter to understand the process of preparation of financial statements]

- The balance sheet and profit and loss account are now called position statement and statement of profit and loss in the company’s financial statements.

- Since Chapters 8 and 9 deal with the preparation of financial statements of sole proprietorship firm, the terms balance sheet and profit and loss account are retained.

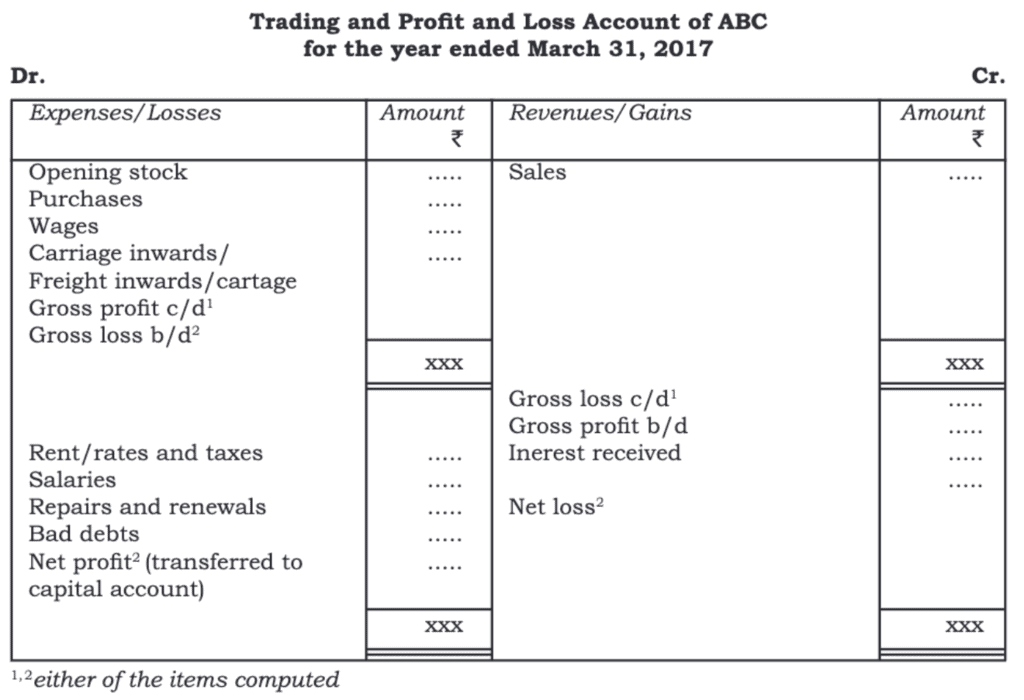

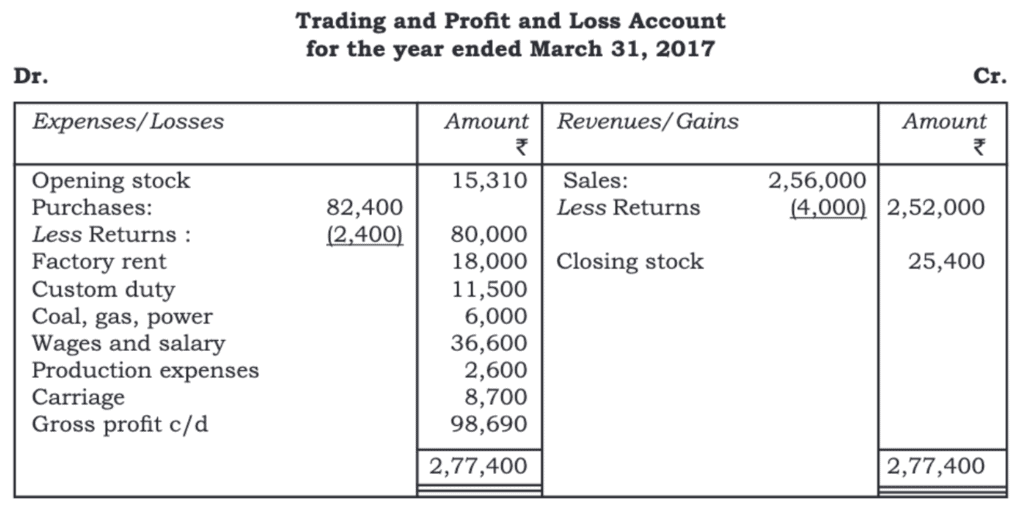

Trading and Profit and Loss Account

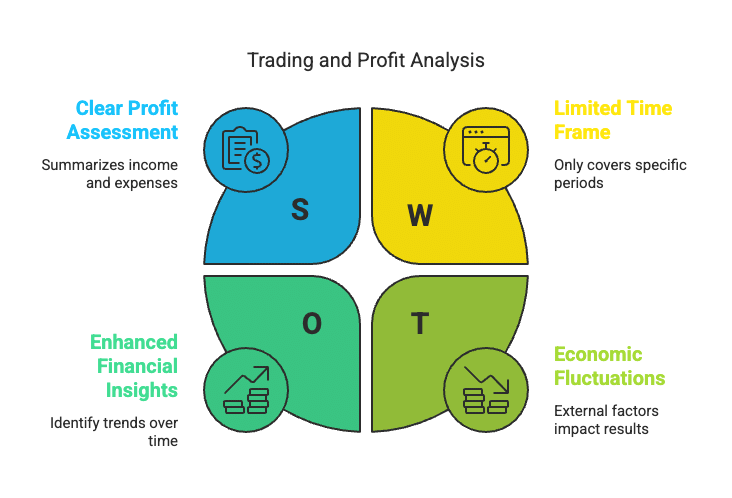

- Purpose: The Trading and Profit and Loss account is made to determine the profit or loss a business experiences over a certain time frame. It shows a summary of the income and expenses of the business to find out if there is a profit or a loss.

- Calculation of Profit: Profit is figured out by taking the total expenses away from the total income. If the expenses are greater than the income, this means there is a loss.

- Performance Summary: This account gives an overview of how the business performed during an accounting period by using the revenue and expense amounts from the trial balance.

- Structure: The Trading and Profit and Loss account has two main sides: Debit and Credit.

1. The debit side includes expenses and losses.

2. The credit side includes revenues and gains.

Relevant Items in Trading and Profit and Loss Account

Items on the Debit Side:

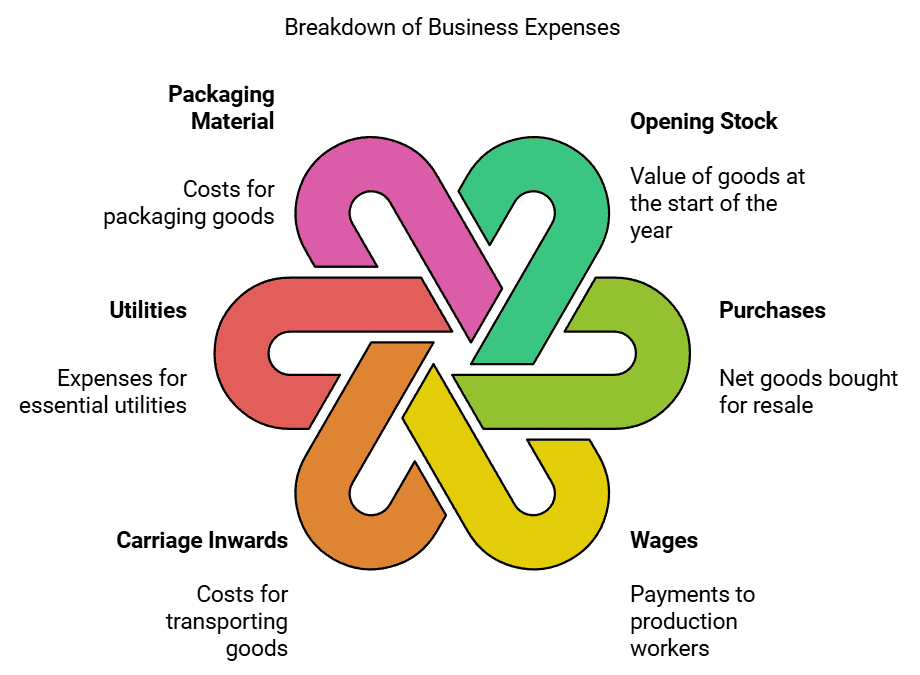

- Opening Stock: This is the value of goods available at the start of the accounting year, carried over from the previous year.

- Purchases (Less Returns): All goods bought for resale are recorded here, including cash and credit purchases. Goods returned to suppliers are deducted, resulting in Net Purchases.

- Wages: Payments made to workers involved in the production process are included here.

- Carriage Inwards: Costs for transporting purchased goods to the business location are recorded as expenses.

- Fuel/Water/Power/Gas: These utilities are necessary for production and are considered expenses.

- Packaging Material: Costs for small containers used in products are direct expenses, while larger containers used for transport are indirect expenses.

- Salaries: Payments to administrative and warehouse staff are recorded here, including any perks provided to employees.

- Rent Paid: Expenses for office, warehouse, and factory rent, along with any related taxes, are noted here.

- Interest Paid: This includes interest on loans and bank overdrafts, treated as expenses.

- Commission Paid: Commissions paid to agents for business transactions are recorded as expenses.

- Repairs: Costs for maintenance and small replacements of equipment and furniture are included here.

- Miscellaneous Expenses: Smaller expenses that don't fit into specific categories are grouped as miscellaneous or sundry expenses.

Items on the Credit Side:

- Sales (Less Returns): The total sales amount (both cash and credit) is recorded here. Returns by customers are deducted to calculate Net Sales.

- Other Incomes: Any additional income, such as rent received, dividends, interest, discounts, or commissions, is recorded in the profit and loss account.

Closing Entries

- To prepare the trading and profit and loss account, you need to move the balances of all relevant accounts into it.

- The following accounts are closed by transferring their balances to the debit side of the trading and profit and loss account:

- Opening stock account

- Purchases account

- Wages account

- Carriage inwards account

- Direct expenses account

- This is done by recording the following entry:

Trading A/c Dr.

To Opening stock A/c

To Purchases A/c

To Wages A/c

To Carriage inwards A/c

To All other direct expenses A/c - The purchase returns or returns outwards are closed by transferring their balance to the purchase account. This is recorded as:

Purchases return A/c Dr.

To Purchases A/c - Similarly, the sales returns or returns inwards account is closed by transferring its balance to the sales account:

Sales A/c Dr.

To Sales return A/c - The sales account is closed by moving its balance to the credit side of the trading and profit and loss account:

Sales A/c Dr.

To Trading A/c - Expenses, losses, and similar items are closed with the following entries:

Profit and Loss A/c Dr.

To Expenses (individually) A/c

To Losses (individually) A/c - Items of income, gains, etc., are closed with this entry:

Incomes (individually) A/c Dr.

Gains (individually) A/c Dr.

To Profit and Loss A/c

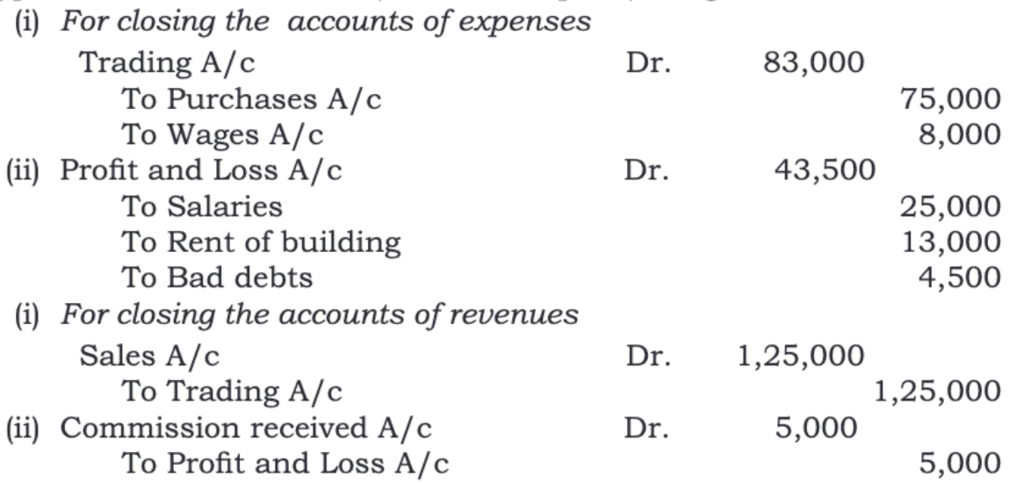

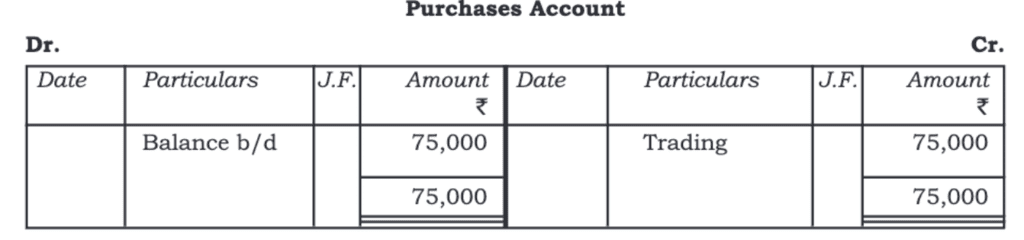

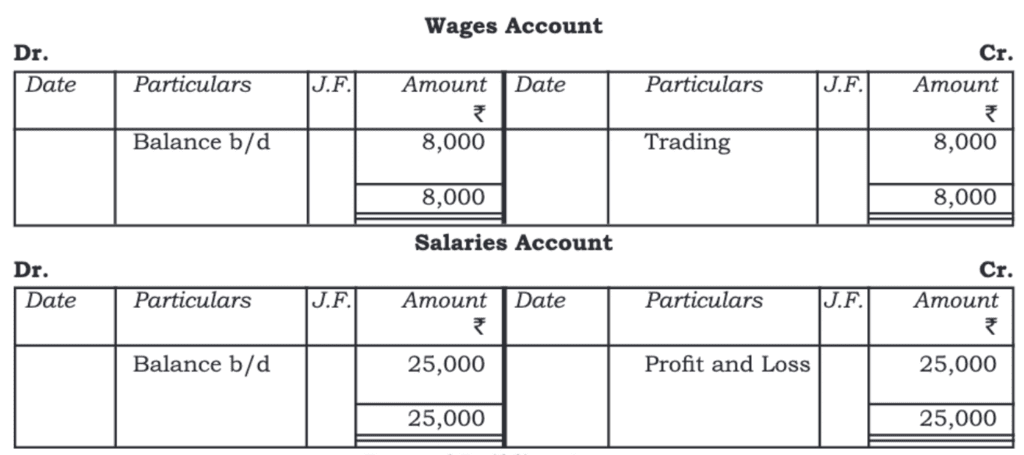

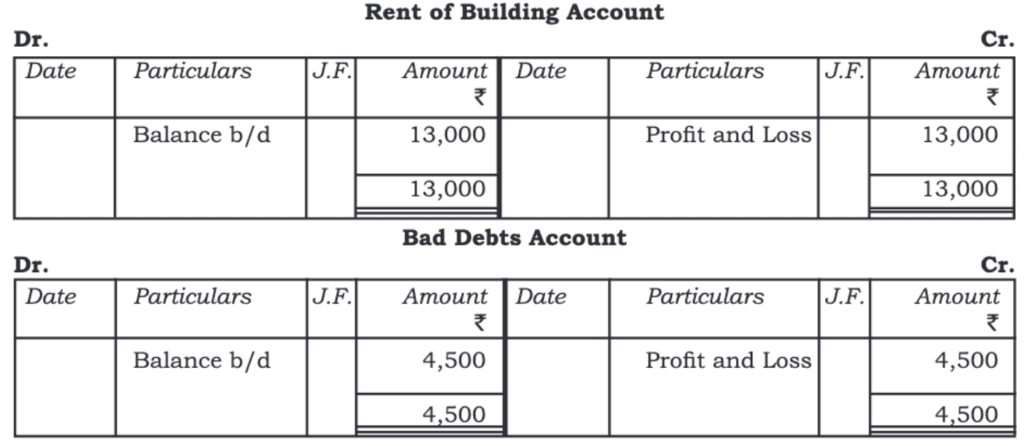

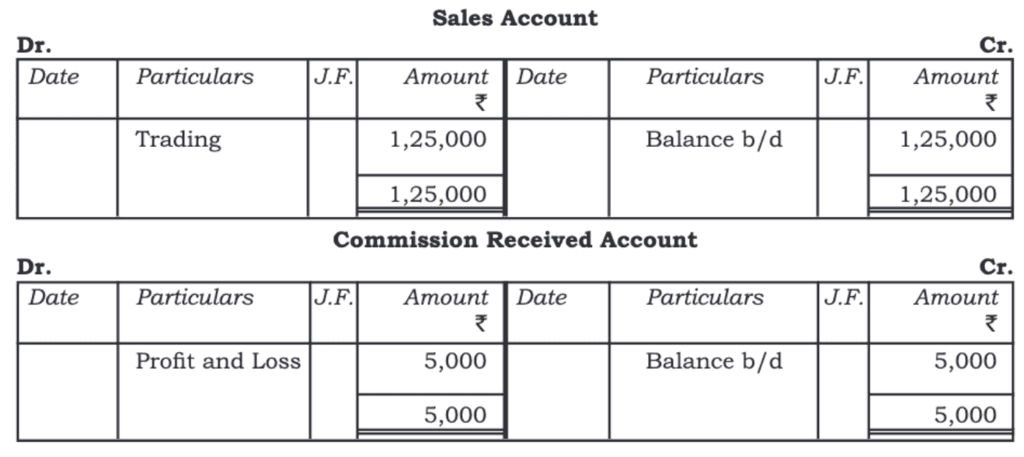

The entries needed to close the seven expense and revenue accounts shown in the trial balance (as seen in our example 1) are listed below:

The posting done in the ledger will appear as follows :

- Now, we will learn how to create the trading and profit and loss account using the trial balance.

- The format for this account is shown in Figure 8.2.

- This list does not include everything.

- In reality, there can be many more items.

- We will discuss these additional items later on.

- As we go through each one, you will see how the format changes.

Concepts of Gross Profit and Net Profit

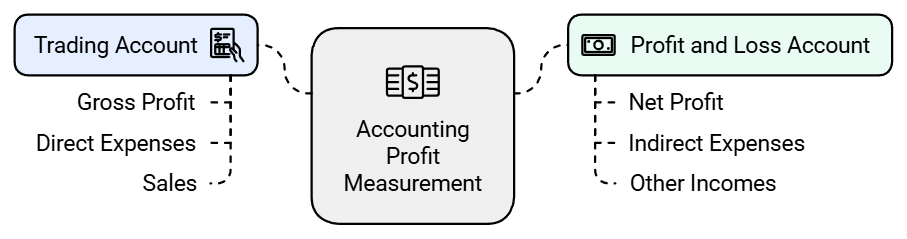

- The trading and profit and loss can be viewed as two accounts: Trading Account and Profit and Loss Account.

- The Trading Account measures the gross profit, while the Profit and Loss Account measures the net profit.

- The trading account determines the outcomes from the basic operations of a business, which include:

1. Manufacturing goods

2. Purchasing goods

3. Selling goods - It is created to check if selling goods or providing services is profitable for the business.

- Purchases are a major part of expenses in a business.

- Other expenses are categorised into:

- 1. Direct Expenses: Costs that are directly linked to manufacturing or purchasing goods, such as:

- Carriage inwards

- Freight inwards

- Wages

- Factory lighting

- Coal, water, and fuel

- Royalty on production

- 2. Indirect Expenses: Costs not directly tied to production, including:

- Salaries

- Rent of buildings

- Bad debts

- Sales are the primary source of revenue for the business.

- The difference between sales and the sum of purchases plus direct expenses is called Gross Profit.

- If purchases plus direct expenses exceed sales revenue, it results in Gross Loss.

- The formula for calculating gross profit is: Gross Profit = Sales – (Purchases + Direct Expenses)

- The gross profit or gross loss is then recorded in the profit and loss account.

- Indirect Expenses are recorded on the debit side of the profit and loss account.

- All other revenue/gains apart from sales are noted on the credit side of the profit and loss account.

- If the total on the credit side exceeds the debit side, the difference is the Net Profit for that period.

- Conversely, if the debit side totals higher than the credit side, the difference is the Net Loss.

- The formula for net profit is: Net Profit = Gross Profit + Other Incomes – Indirect Expenses

- The calculated net profit or net loss is then transferred to the capital account in the balance sheet through these entries:

- For transferring Net Profit:

- Profit and Loss A/c Dr.

- To Capital A/c

- For transferring Net Loss:

- Capital A/c Dr.

- To Profit and Loss A/c

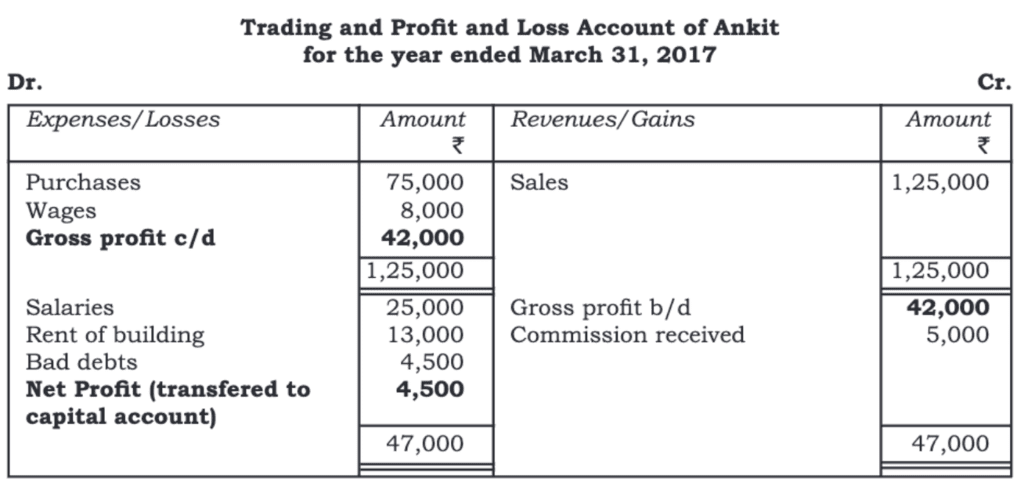

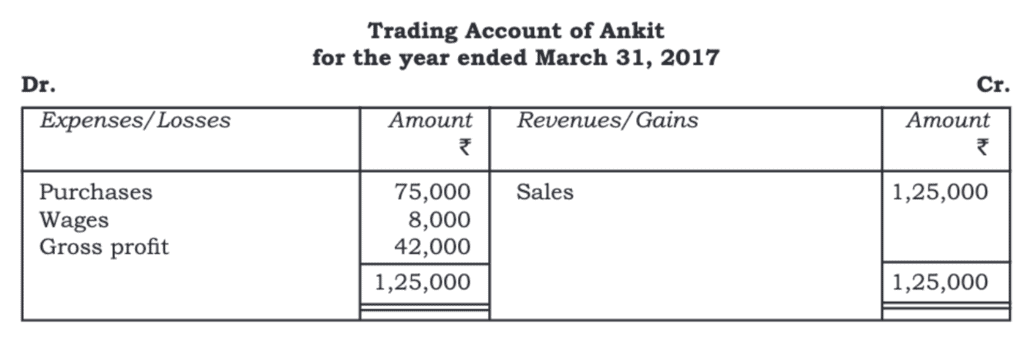

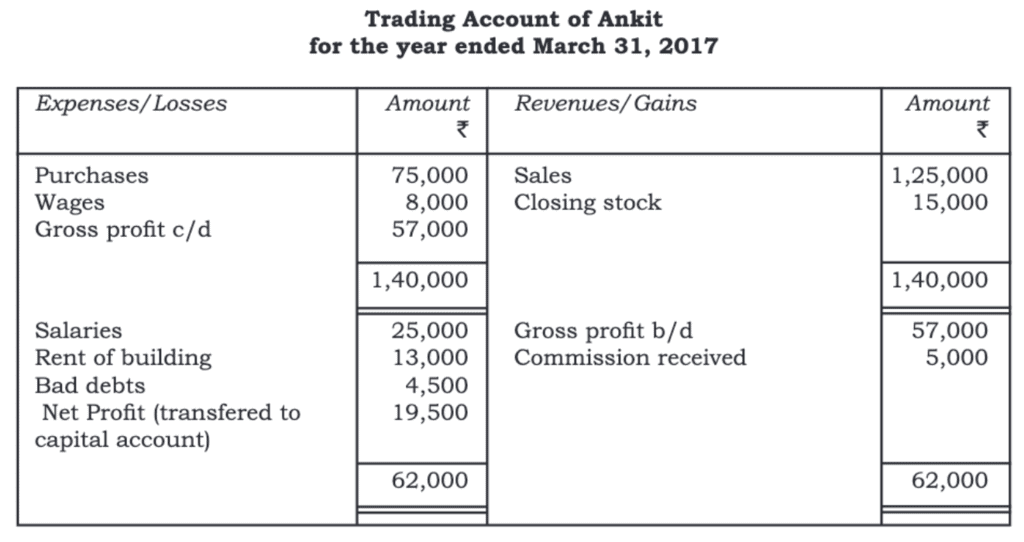

- We are updating the trading and profit and loss account to display the gross profit and net profit of Ankit for the year that ended on March 31, 2017.

- The revised trading and profit and loss account will be presented in the format shown below:

- Gross profit is the amount that shows how well the business is doing in its main activities, which is calculated as $42,000.

- This gross profit is moved from the trading account to the profit and loss account.

- In addition to the gross profit, the business has also earned $5,000 from commissions received.

- The business has incurred expenses totalling $42,500, which includes:

- $25,000 for salaries

- $13,000 for rent

- $4,500 for bad debts

- As a result, the net profit is calculated to be $4,500.

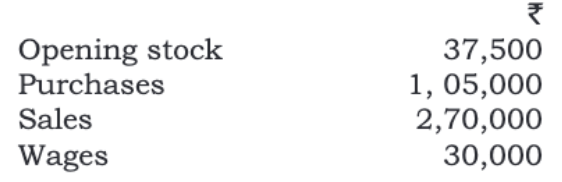

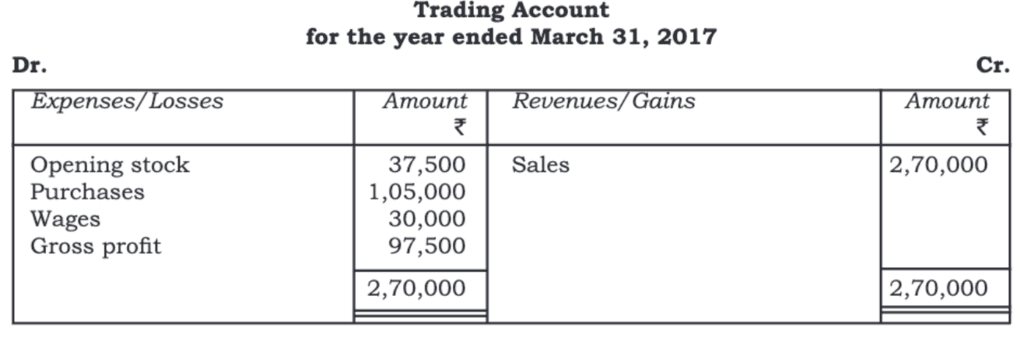

Example 1: Prepare a trading account from the following particulars for the year ended March 31, 2017

Solution:

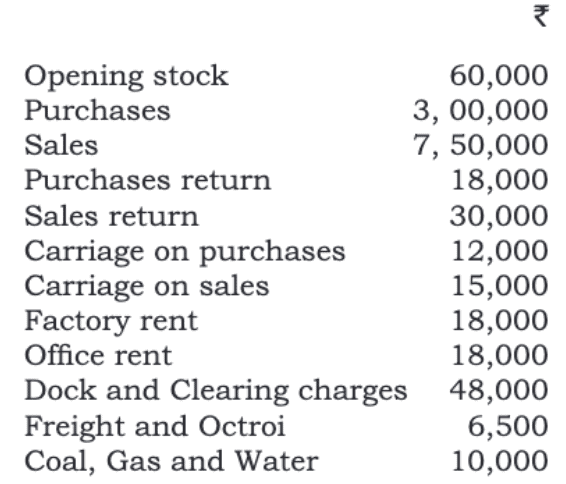

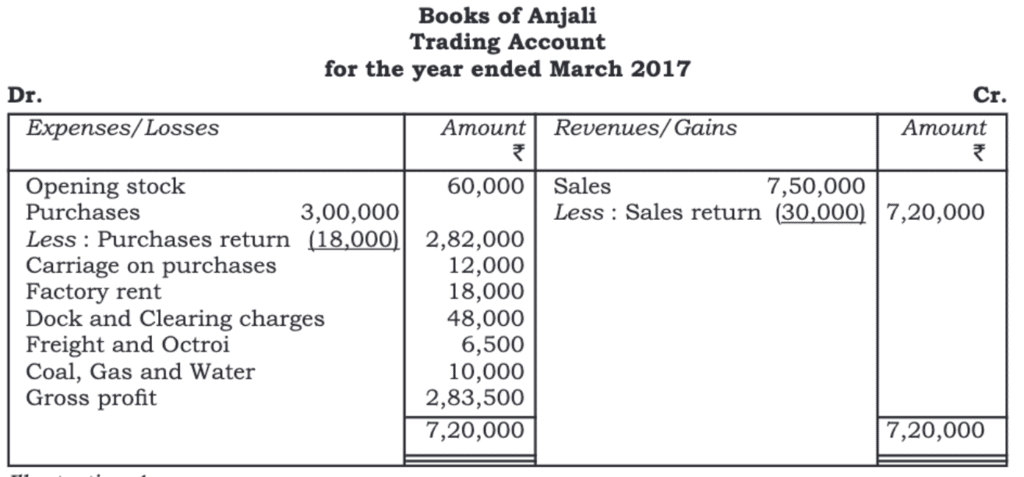

Example 2: Prepare a trading account of M/s Anjali from the following information related to March 31, 2017.

Solution:

Cost of Goods Sold and Closing Stock – Trading Account Revisited

Have a look at the following account:

- Without Opening or Closing Stock: When there is no opening or closing stock, the Cost of Goods Sold (COGS) is calculated by simply adding Purchases and Direct Expenses.

- Example Calculation: In the given example, Purchases amount to ₹75,000 and Direct Expenses (wages) amount to ₹8,000. Therefore, COGS is: COGS = Purchases + Direct Expenses = ₹75,000 + ₹8,000 = ₹83,000

- With Closing Stock: If there is unsold stock at the end of the accounting period, COGS is adjusted. For instance, if out of the purchased goods worth ₹75,000, only ₹60,000 worth were sold, there would be a closing stock of ₹15,000.

- Adjusted COGS Calculation: In this case, COGS would be calculated as: COGS = Purchases + Direct Expenses – Closing Stock

- Impact on Gross Profit: The presence of closing stock affects gross profit. In the example, gross profit changes from ₹42,000 (in the table above) to ₹57,000 (in the table below) with the inclusion of closing stock.

- Closing stock usually does not appear in the trial balance. Instead, it is recorded in the books through a specific journal entry.

- The journal entry for closing stock is as follows:

- Closing Stock A/c Dr.To Trading A/c

- This entry creates a new asset account for closing stock, valued at ₹15,000, which is then transferred to the balance sheet.

- Closing stock recorded this year will become opening stock for the next year and will be sold during that year.

- Typically, businesses have both opening stock and closing stock each year. The cost of goods sold (COGS) is calculated using the following formula:

- Cost of Goods Sold = Opening Stock + Purchases + Direct Expenses - Closing Stock

Operating Profit (EBIT)

Operating profit is the money a business earns from its regular activities.

- It is the difference between operating revenue and operating expenses.

- When calculating operating profit, we do not consider financial income and expenses.

- Therefore, operating profit is also known as earnings before interest and tax (EBIT).

- Abnormal items, like losses from events such as a fire, are excluded from this calculation.

- The formula for calculating operating profit is:

Operating profit = Net Profit - Non-Operating Expenses + Non-Operating Incomes - In the example from Ankit's trial balance, there is a line item for 10% interest on a long-term loan taken on April 1, 2017.

- The total interest amounts to ₹500 (calculated as ₹5,000 × 10/100).

- This interest has been recorded on the debit side of the trading and profit and loss account.

Showing the treatment of interest on profitThe operating profit will be :

Showing the treatment of interest on profitThe operating profit will be :

Operating profit = Net profit + Non-operating expenses – Non-operating incomes

Operating profit = ₹ 19,000+ 500 – nil = ₹ 19,500

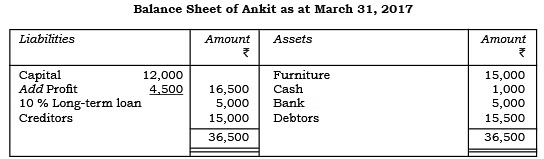

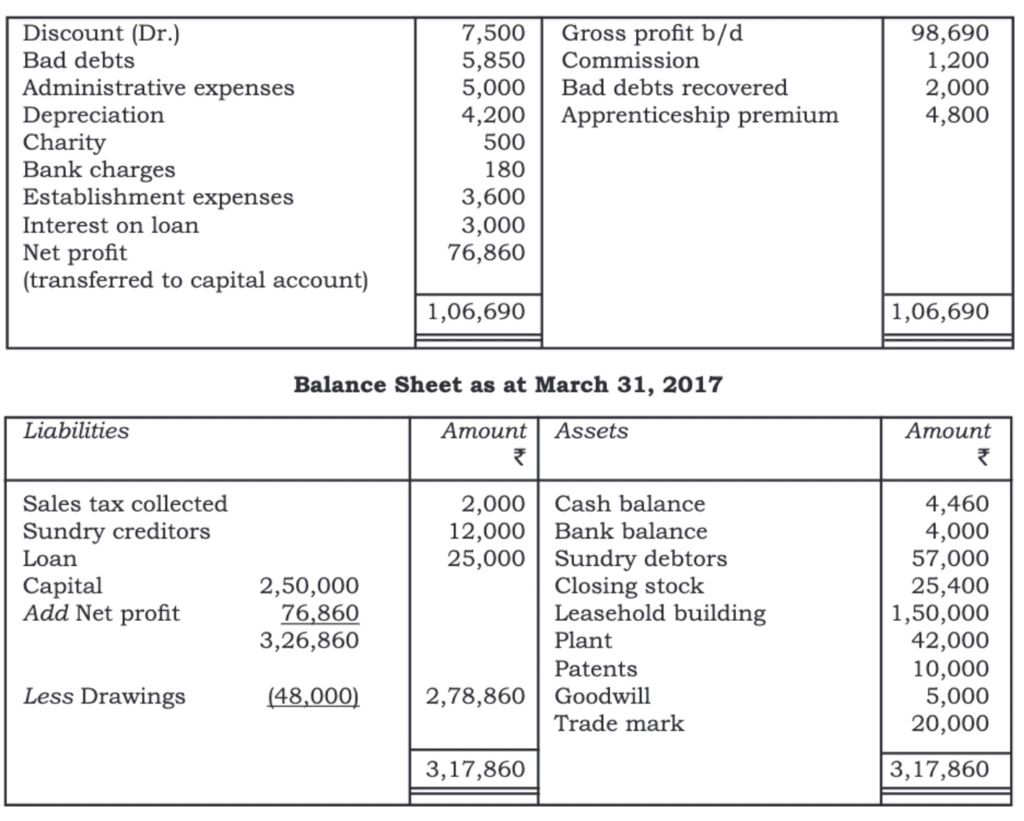

Balance Sheet

The balance sheet is a financial statement that shows the financial position of a business by summarizing its assets and liabilities at a specific date.

- Assets are recorded with debit balances, while liabilities, including capital, are shown with credit balances.

- This statement is created at the end of the accounting period after completing the trading and profit and loss accounts.

- The name balance sheet comes from its role in listing the balances of ledger accounts that are not part of the trading and profit and loss account and will be carried into the next year.

- To carry forward these balances, an opening entry is made in the journal at the beginning of the next year.

- When making a balance sheet, all accounts related to assets, liabilities, and capital are included.

- The accounts for capital and liabilities are shown on the left side, known as Liabilities.

- Assets and other debit balances are displayed on the right side, referred to as Assets.

- There is no fixed format for balance sheets in sole proprietorships and partnerships.

- However, for companies, the format and order of listing assets and liabilities must follow the rules outlined in Schedule III of the Companies Act 2013.

Format of Balance Sheet

Format of Balance Sheet

For example:

- You will observe that the trial balance of Ankit depicts 14 accounts, out of which 7 accounts have been transferred to the trading and profit and loss accounts.

- These are the accounts of revenues and expenses.

- The analysis shows that the business has incurred total expenses of ₹ 1,25,500 and revenues generated are ₹ 1,30,000 making a profit of ₹ 4,500.

- The remaining seven items in the trial balance reflect the capital, assets and liabilities.

- We are reproducing the trial balance to show how the accounts of assets and liabilities of Ankit would be presented in the balance sheet.

Showing the accounts of assets and liabilities in the trial balance of Ankit

Showing the accounts of assets and liabilities in the trial balance of Ankit

Showing the balance sheet of Ankit

Showing the balance sheet of Ankit

Relevant Items in the Balance Sheet

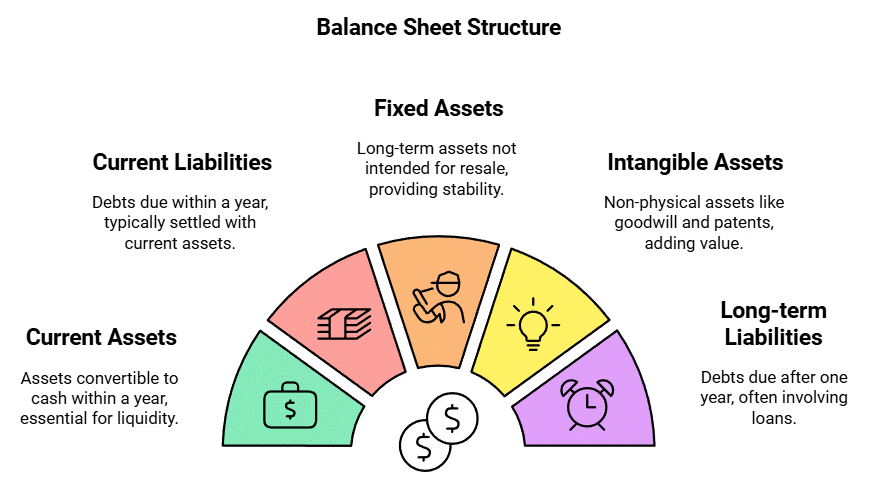

1. Current Assets

These are assets that are either cash or can be turned into cash within a year.

Examples include:

- Cash in hand or bank

- Bills receivable

- Stock of raw materials

- Semi-finished goods

- Finished goods

- Sundry debtors

- Short-term investments

- Prepaid expenses

2. Current Liabilities

These are debts that are expected to be paid within a year, typically using current assets.

Examples include:

- Bank Overdraft

- Bills payable

- Sundry creditors

- Short-term loans

- Outstanding expenses

3. Fixed Assets

These are long-term assets held by the business that are not meant for resale.

Examples include:

- Land

- Building

- Plant and machinery

- Furniture and fixtures

Sometimes referred to as Fixed Block or Block Capital.

4. Intangible Assets

These are assets that cannot be seen or touched. Examples include:

- Goodwill

- Patents

- Trademarks

5. Investments

This represents the money put into government securities, company shares, etc. They are listed at their cost price. If the market price of these investments is lower than the cost on the date of the balance sheet, a note may be added to explain this.

6. Long-term Liabilities

These are all debts that are not classified as current liabilities. They are usually due after one year. Important items include:

- Long-term loans from banks

- Loans from other financial institutions

- Capital: This is the difference between assets and liabilities owed to outsiders. It reflects the amount originally invested by the owner(s), plus profits and interest on capital, minus losses, drawings, and interest on drawings.

- Drawings: This refers to the money taken out by the owner, which reduces the capital account balance. The drawings account is closed by transferring its balance to the capital account, and it is shown as a deduction from capital in the balance sheet.

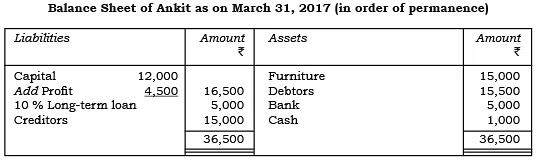

Marshalling and Grouping of Assets and Liabilities

- A key focus in accounting is the preparation and presentation of financial statements.

- The information in these statements should be useful for decision-making by users.

- It is important that items listed on the balance sheet are organized and shown in a specific order.

- Marshalling of Assets and Liabilities: In a balance sheet, assets and liabilities are arranged based on either liquidity or permanence.

- The process of organizing assets and liabilities in a specific order is referred to as Marshalling.

- For permanence, the most enduring asset or liability is placed at the top of the balance sheet.

- Following that, assets are arranged in a way that reflects their decreasing level of permanence.

In the balance sheet of Ankit, you will find that furniture is the most permanent of all the assets. Out of debtors, banks and cash, debtors will take maximum time to convert back into cash. Bank is less liquid than cash. Cash is the most liquid of all the assets. Similarly, on the liabilities side, the capital, being the most important source of finance will tend to remain in the business for a longer period than the long-term loan. Creditors being a liquid liability will be discharged in the near future.

In the case of liquidity, the order is reversed. The information presented in this manner would enable the user to have a good idea about the life of the various accounts. The assets account of the relatively permanent nature would continue in the business for a longer time whereas the less permanent or more liquid accounts will change their forms in the near future and are likely to become cash or cash equivalent.

The balance sheet of Ankit in the order of liquidity is:

- The items listed on the balance sheet can be organized into groups.

- Grouping means collecting similar items under one heading.

- For example, the balances of cash, bank accounts, and debtors can be combined and shown under the title 'current assets'.

- Similarly, the total values of fixed assets and long-term investments can be grouped together and labelled as 'non-current assets'.

Example: From the following balances prepare trading and profit and loss account and balance sheet for the year ended March 31, 2017.

The value of the closing stock on March 31, 2017 was 25,400.

Solution:

|

61 videos|154 docs|35 tests

|

FAQs on Financial Statements - I Chapter Notes - Accountancy Class 11 - Commerce

| 1. What are the key stakeholders in a sole proprietorship and what information do they typically require? |  |

| 2. How do you differentiate between capital and revenue in financial statements? |  |

| 3. What is the purpose of a Trading and Profit and Loss Account? |  |

| 4. What is Operating Profit (EBIT) and why is it important? |  |

| 5. How does the Balance Sheet reflect the financial position of a sole proprietorship? |  |