Government Budget and the Economy Chapter Notes | Economics Class 12 - Commerce PDF Download

Meaning of Government Budget

A statement that is prepared annually, showing estimated expenditure and receipts of the government over the fiscal or financial year is termed as GOVERNMENT BUDGET.

A financial year or fiscal year runs from April 1 to March 31.

Redistribution of Resources

The first and foremost objective of the government budget is the redistribution of resources in the Indian economy with a motive to achieve both “Economic and Social welfare” in the economy.

By providing tax concessions or subsidies government encourages investment in the economy.

By providing public utility services like water supply, health facilities etc. Govt creates social welfare in the economy.

Reducing Disparities in Income and Wealth

Governments impose tax on the rich and spends more on the welfare of the poor as to reduce disparities in the Income and wealth of the economy.

- Growth and Development of the Economy

The government make provisions in the govt budget to spend on technology, health, and Infrastructure and it will develop the economy and will increase the real GDP of the nation which leads to growth in the Economy. - Regional Equality

Govt encourages the setting up of production units in economically backward regions by providing tax holidays and other benefits so that regional equality can be achieved. - Operation of the public sector

The budget is prepared with the objective of making various provisions for the management and operation of the public sector. Financial assistance is also provided as this sector will create social welfare in the economy.

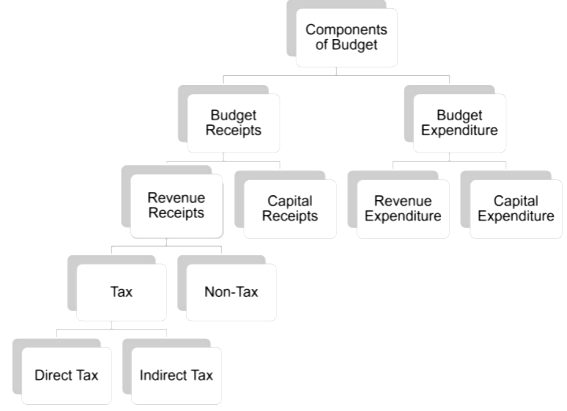

Components of Government Budget – Economy

Meaning and Types of Budget Receipt

Budget Receipt – It is the estimated receipts of the government from all the sources during a given financial year.

Types of Budget Receipt

- Revenue Receipt

- Capital Receipt

Revenue Receipt

The receipts which neither create liability nor reduce assets of the government are termed as REVENUE RECEIPT. They are regular and recurring in nature.

For Example:- Tax income

Sources of Tax Revenue

- Tax revenue

- Non Tax revenue

Tax Revenue:- It includes the receipts from the taxes and other duties which are imposed by the government.

It is a compulsory payment to the government. The revenue received from the taxes is used by the government for the welfare of the general public.

Tax can be categorized as

- Direct tax

- Indirect tax

Direct tax– When the liability and burden to pay the tax falls on the same person, the tax is called Direct Tax.

For eg. Income tax, Corporation tax etc.

Indirect tax– When the liability and burden to pay tax falls on different persons, the tax is called Indirect tax.

For eg. GST, Custom Duties.

Non-Tax Revenue - Non-tax revenue is the income earned by the Govt from all sources other than taxes.

Sources of Non-Tax Revenue

- Profits and Dividends: The public sector is a source of profits for the govt. It also receives dividends by investing in other companies.

- Fines and Penalties: The Govt imposes fines and penalties on people for maintaining or following the laws of the country. The objective of the imposition of fines and penalties is not to generate revenue but to maintain law & order in the Nation.

- Fees: The fee is paid is paid in return for the services provided by the government. For eg. Registration fees and education fees.

- License Fee: A license fee is charged by the government for granting permission.

- Gifts and Grants: The government also receives gifts & grants from the foreign govt and institutions but these sources are not a fixed source of revenue as it is usually received at the time of crisis.

Capital Receipt

The receipts that either create liability or reduce the assets of the government are termed CAPITAL receipts. They are non-recurring in nature.

For Example:-

Sources of Capital Receipt

- Borrowings: This includes funds raised by the govt through loans from the public, Reserve Bank of India etc. It is a capital receipt for the govt as it creates liability for the Govt as the funds raised need to be repaid by the Govt in future.

- Recovery of loan: Repayment of loan by the state and union territory to the govt falls under this category. Recovery of a loan is a capital receipt as it reduces the financial asset of the Govt.

- Other Receipts: This includes capital receipts from Disinvestment and Small Savings.

Budget Expenditure – Government Budget and the Economy

Budget expenditure is the estimated expenditure to be incurred by the Govt during a given financial year.

Types of Budget Expenditure

- Revenue expenditure

- Capital Expenditure

Revenue Expenditure: Revenue expenditure refers to the expenditure which neither creates assets nor reduces the liability of the government.

For eg. Expenditure on administration, Payment of salary etc.

Capital Expenditure: Capital expenditure refers to the expenditure which either creates assets or reduces the liability of the govt.

For eg. Repayment of loans, and construction of dams.

Measures of Government Deficit

Budget Deficit can be defined as the situation when the estimated revenues are less than the estimated expenditure.

Types of Deficit

There are mainly three types of deficit in the budget:

Revenue Deficit

The revenue deficit is the excess of the government’s revenue expenditure over revenue receipts.

FORMULA – Revenue Deficit= Revenue Expenditure – Revenue Receipts

Revenue Deficit represents that the government’s own earnings are insufficient to meet the day-to-day operations of its various departments.

Implications

- It shows that the Govt is using savings to meet the govt expenditure.

- It also signifies that govt has to meet its deficit from capital receipts. This will reduce the assets of the Govt or will increase the liability of the govt.

- The use of capital receipts will create a situation of inflation in the Economy.

- It implies a repayment burden in future.

Measures to Reduce Revenue Deficit

- Govt should take the same major steps to reduce its expenditure.

- Govt should try to increase their source of revenue receipts and should take some serious steps to control tax evasion.

Fiscal Deficit

Fiscal Deficit refers to the excess of total expenditure over total receipts excluding borrowings during a given fiscal year.

Formula – Fiscal Deficit = Total expenditure – Total receipts excluding borrowings

The extent of the fiscal deficit is an indication of how far the government is spending beyond its means.

Implications

- It indicates the total borrowing requirements of the Govt. The borrowing will not just increase the loan repayment amount(Principal amount) but will also increase the obligation to pay interest.

- Interest payment will increase the revenue expenditure which will lead to a revenue deficit.

- To meet the deficit the RBI will print new currency which will increase the money supply and create inflationary pressure in the economy.

- Because of borrowings financial burden will increase and this will hamper the growth and development process in the economy.

Measures to Reduce Fiscal Deficit

- By borrowing from external or internal sources fiscal deficit can be reduced.

- RBI will issue new currency and will lend it to the Govt against securities to meet the fiscal deficit. This process is called ‘DEFICIT FINANCING’

Primary Deficit

Primary deficit refers to the difference between fiscal deficit and interest payment.

Formula – Primary Deficit = Fiscal Deficit – Interest Payment

It indicates how much government borrowing is going to meet expenses other than interest payments.

Implications

It reflects the extent to which current govt policy is adding to future burdens originating from past policy. If the primary deficit is zero then it shows that the fiscal deficit is equal to interest payment.

|

64 videos|275 docs|52 tests

|

FAQs on Government Budget and the Economy Chapter Notes - Economics Class 12 - Commerce

| 1. What is a government budget and why is it important for the economy? |  |

| 2. What are the main components of a government budget? |  |

| 3. How does a government budget impact public services? |  |

| 4. What is a budget deficit and what are its consequences? |  |

| 5. How do government budgets influence economic policies? |  |

|

Explore Courses for Commerce exam

|

|