Liberalization, Privatisation and Globalisation Chapter Notes | Economics Class 12 - Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Background |

|

| What is Liberalisation? |

|

| Privatization |

|

| What is Globalisation? |

|

| Indian Economy During Reforms: An Assessment |

|

Introduction

- After independence, India adopted a mixed economy, combining capitalism and socialism.

- Some believe that regulations later hindered growth, while others see progress in savings, industrial development, and food security.

- In 1991, India faced a severe economic crisis due to external debt, with foreign reserves too low for even two weeks of imports, worsening with rising prices.

- This led the government to introduce new policies that reshaped India’s economic strategy.

- This chapter explores the 1991 crisis, government measures in response, and their impact on the economy.

Background

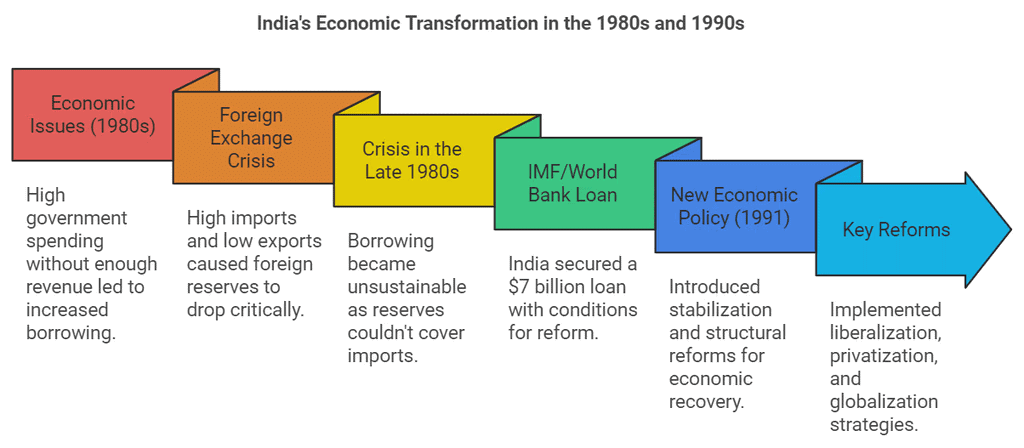

- The financial crisis in India can be traced back to the mismanagement of the economy in the 1980s.

- The government relied on taxation and profits from public sector enterprises to fund its policies and administration.

- When expenditure exceeded income, the government borrowed from banks, people within the country, and international financial institutions.

- Imports, such as petroleum, were paid for in dollars, which were earned from exports.

- Despite low revenues, the government had to spend heavily on development policies to address issues like unemployment, poverty, and population growth.

- Excessive spending on areas like the social sector and defence without immediate returns strained resources.

- Foreign exchange borrowed from other countries and international financial institutions was often used for consumption needs.

- In the late 1980s, government expenditure outpaced revenue significantly, making borrowing unsustainable.

- Prices of essential goods rose sharply, and imports grew faster than exports.

- Foreign exchange reserves fell to critically low levels, inadequate to finance imports for more than two weeks.

- India struggled to pay interest to international lenders, and there was a lack of willing lenders.

- To manage the crisis, India sought assistance from the International Bank for Reconstruction and Development or the World Bank and the International Monetary Fund (IMF), receiving a $7 billion loan.

- In exchange for the loan, India agreed to liberalize its economy, reduce government intervention, and remove trade restrictions.

- This led to the announcement of the New Economic Policy (NEP), focusing on creating a more competitive environment and removing barriers to business growth.

- The NEP included stabilization measures to address balance of payments and inflation issues, and structural reforms to enhance economic efficiency and international competitiveness.

- The reforms were categorized into liberalization, privatization, and globalization.

What is Liberalisation?

Liberalisation was introduced to eliminate restrictive rules and laws that hindered economic growth and development. While some measures were taken in the 1980s, such as in industrial licensing and foreign investment, the comprehensive reforms of 1991 marked a significant shift.

Deregulation of the Industrial Sector

Prior to 1991, the industrial sector in India was heavily regulated through licensing, restrictions on private sector participation, and controls on production and pricing.

Key Regulatory Mechanisms Included:

- Industrial Licensing: Entrepreneurs needed government permission to start, close, or determine production levels for firms.

- Sector Restrictions: Private sector involvement was restricted in many industries.

- Small-Scale Production Limits: Certain goods could only be produced by small-scale industries.

- Price and Distribution Controls: Controls were in place for the fixation and distribution of selected industrial products.

Removing Restrictions:

These reforms aimed to liberalize and deregulate the industrial sector by removing many of the aforementioned restrictions.

- Abolition of Industrial Licensing: Licensing was abolished for nearly all product categories, with exceptions for industries such as alcohol, cigarettes, hazardous chemicals, industrial explosives, electronics, aerospace, and pharmaceuticals.

- Public Sector Reservations: Only a few industries, such as atomic energy generation and certain railway transport activities, remained reserved for the public sector.

- Deregulation of Small-Scale Industries: Many goods previously restricted to small-scale industries were dereserved.

- Market-Determined Pricing: The market was allowed to determine prices in most industries, reducing government control.

Financial Sector Reforms

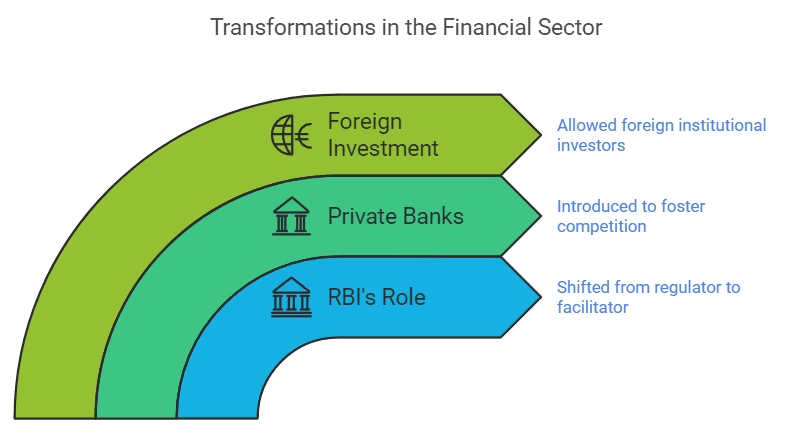

The financial sector, including institutions like banks, investment banks, stock exchanges, and the foreign exchange market, was regulated by the Reserve Bank of India (RBI).

- Objectives of Financial Sector Reforms: One major goal was to shift the RBI's role from a regulator to a facilitator, allowing the financial sector more autonomy in decision-making.

- Establishment of Private Sector Banks: Reforms led to the establishment of private sector banks, both Indian and foreign.

- Foreign Investment in Banks: The foreign investment limit in banks was raised to around 74%.

- Branch Expansion Freedom: Banks meeting certain conditions were allowed to set up new branches and rationalize existing branch networks without RBI approval.

- Foreign Institutional Investors (FIIs): Entities such as merchant bankers, mutual funds, and pension funds were permitted to invest in Indian financial markets.

Tax Reforms

- Tax reforms focus on changes in the government’s taxation and public expenditure policies, known as fiscal policy.

- There are two types of taxes: direct and indirect.

- Direct taxes are imposed on individual incomes and business profits.

- Since 1991, there has been a gradual reduction in individual income taxes to curb tax evasion.

- Moderate income tax rates are now seen as encouraging savings and voluntary income disclosure.

- The rate of corporation tax, previously very high, has also been reduced over time.

- Reforms in indirect taxes aim to establish a common national market for goods and commodities.

- The introduction of the Goods and Services Tax (GST) in 2016, following a constitutional amendment, aimed to generate additional revenue, reduce tax evasion, and create a unified national market.

- Simplification of tax procedures and substantial rate reductions have been implemented to encourage better compliance among taxpayers.

Foreign Exchange Reforms

- In 1991, as part of external sector reforms, the foreign exchange market underwent significant changes.

- The Indian rupee was devalued against foreign currencies to address the balance of payments crisis.

- This devaluation increased the inflow of foreign exchange and marked the beginning of moving away from government control over rupee valuation.

- Since then, exchange rates are primarily determined by market forces based on the supply and demand for foreign exchange.

Trade and Investment Policy Reforms

- Trade and investment policy reforms were introduced to enhance the international competitiveness of Indian industrial production and attract foreign investments and technology.

- The previous regime involved strict quantitative restrictions on imports and high tariffs to protect domestic industries. However, this approach hindered efficiency and competitiveness, leading to slow growth in the manufacturing sector.

- Trade policy reforms aimed at dismantling quantitative restrictions on imports and exports, reducing tariff rates, and eliminating licensing procedures for imports.

- Import licensing was abolished except for hazardous and environmentally sensitive industries. By April 2001, quantitative restrictions on imports of manufactured consumer goods and agricultural products were fully removed, and export duties were eliminated to boost the competitiveness of Indian goods in international markets.

Privatization

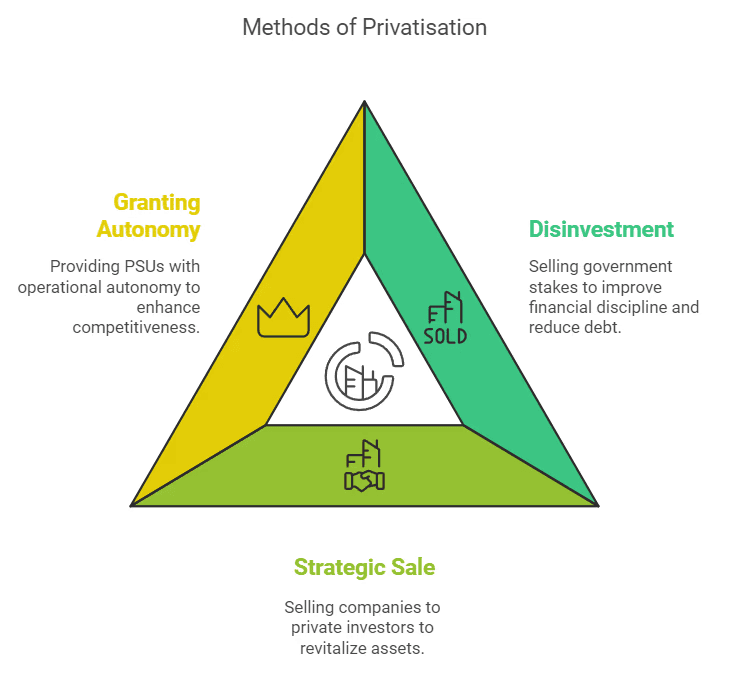

- Privatization involves transferring the ownership or management of a government-owned enterprise to the private sector.

- Government companies can be converted into private entities through:

1. Withdrawal of government ownership and management.

2. Outright sale of public sector companies. - Disinvestment refers to selling part of the equity of public sector enterprises (PSEs) to the public.

- The government aims to improve financial discipline and facilitate modernization through disinvestment.

- Privatization is expected to enhance performance by utilizing private capital and managerial expertise.

- The government anticipates that privatization could boost the inflow of Foreign Direct Investment(FDI).

- To improve the efficiency of Public Sector Undertakings(PSUs), the government has granted them greater autonomy in managerial decisions.

- Some PSUs have been given special status as maharatnas, navratnas, and miniratnas to enhance their operational flexibility.

What is Globalisation?

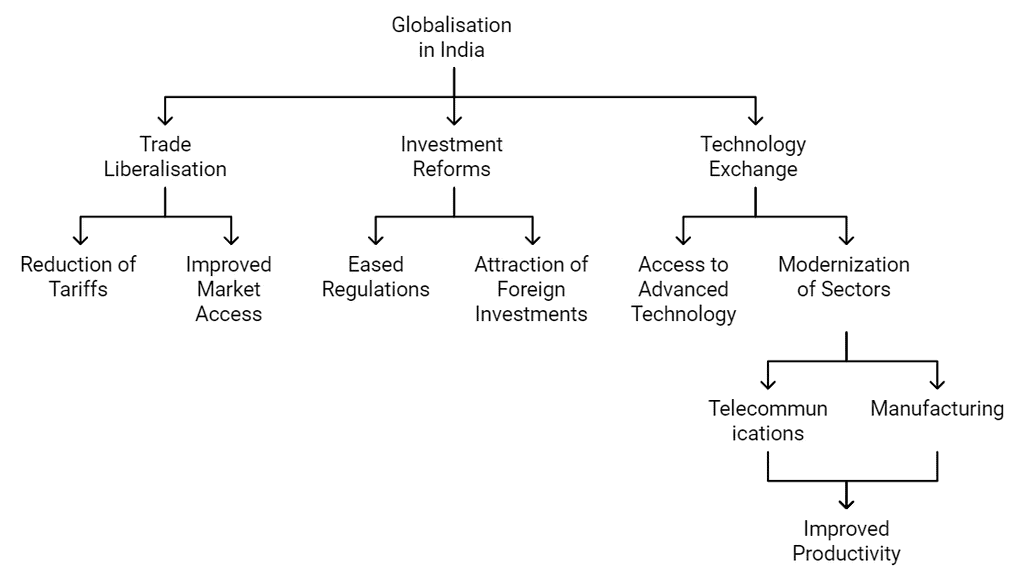

- Globalisation is the process of integrating a country's economy with the global economy. It involves creating networks and activities that cross economic, social, and geographical boundaries. This leads to greater interdependence and integration among countries.

Outsourcing

- One of the key outcomes of globalisation is outsourcing. This is when a company hires services from external sources, often from other countries, instead of providing them internally. Services such as legal advice, computer support, advertising, and security are commonly outsourced.

- Outsourcing has increased due to advancements in communication technology, particularly Information Technology (IT). Many services like call centres, record keeping, banking, and even teaching are outsourced from developed countries to places like India where services can be provided at a lower cost with a high level of skill.

- Modern telecommunication, including the Internet, allows for real-time transmission of text, voice, and visual data across continents and national borders. This has made India a popular destination for global outsourcing due to its low wage rates and availability of skilled manpower.

- Globalisation aims to link countries in such a way that events in one part of the world can impact others, effectively creating a borderless world.

World Trade Organization (WTO)

- Founded in 1995 as the successor to the General Agreement on Trade and Tariffs (GATT).

- GATT was established in 1948 with 23 countries to administer multilateral trade agreements and provide equal trading opportunities.

- WTO aims to create a rule-based trading system where nations cannot impose arbitrary trade restrictions.

- It also seeks to expand the production and trade of services, ensure optimal use of world resources, and protect the environment.

- WTO agreements cover trade in goods and services, facilitating international trade by removing tariff and non-tariff barriers and enhancing market access for member countries.

- India, as a key WTO member, actively participates in shaping fair global trade rules and advocating for developing countries' interests.

- India has fulfilled its WTO commitments by liberalizing trade, removing quantitative restrictions on imports, and reducing tariff rates.

Criticism of India’s Membership in the WTO:

- Limited Trade Benefits: Some scholars argue that India’s membership in the WTO is of limited benefit, as a large portion of international trade happens primarily among developed nations.

- Unfair Agricultural Subsidy Policies: Developed countries frequently file complaints regarding agricultural subsidies in other nations, despite providing substantial subsidies within their own countries.

- Market Access Imbalance: Developing countries, including India, feel disadvantaged as they are pressured to open their markets to developed countries but face restrictions in accessing the markets of those same developed nations.

Indian Economy During Reforms: An Assessment

The economic reforms in India have now been in place for over three decades. Let's review the Indian economy's performance during this period.

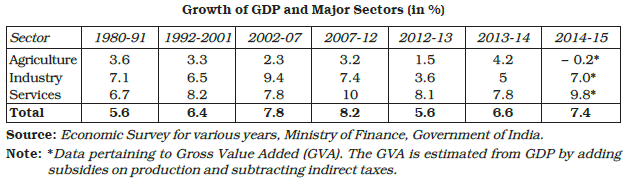

GDP Growth

- Economic growth, measured by GDP, accelerated post-1991, rising from 5.6% during 1980-91 to 8.2% in 2007-12.

- Growth was primarily driven by the service sector, while agriculture slowed and industry showed fluctuating growth.

- From 2012-15, growth rates across sectors saw a decline.

- Agriculture peaked in 2013-14, then dropped, while the service sector maintained high growth, reaching 9.8% in 2014-15.

- Industry declined in 2012-13 but returned to positive growth thereafter.

Foreign Investment and Exchange Reserves

- Economic reforms have boosted foreign direct investment (FDI) and foreign exchange reserves significantly.

- Foreign investment grew from $100 million in 1990-91 to $30 billion in 2017-18.

- Foreign exchange reserves rose from $6 billion in 1990-91 to $413 billion in 2018-19, making India one of the top holders globally.

Exports and Challenges

- Since 1991, India has become a strong exporter of auto parts, pharmaceuticals, engineering goods, IT software, and textiles.

- Inflation has remained relatively controlled.

- However, the reform process has faced criticism for insufficiently addressing key issues in employment, agriculture, industry, infrastructure, and fiscal management.

Growth and Employment

- Despite increased GDP growth, reforms have not generated sufficient employment opportunities.

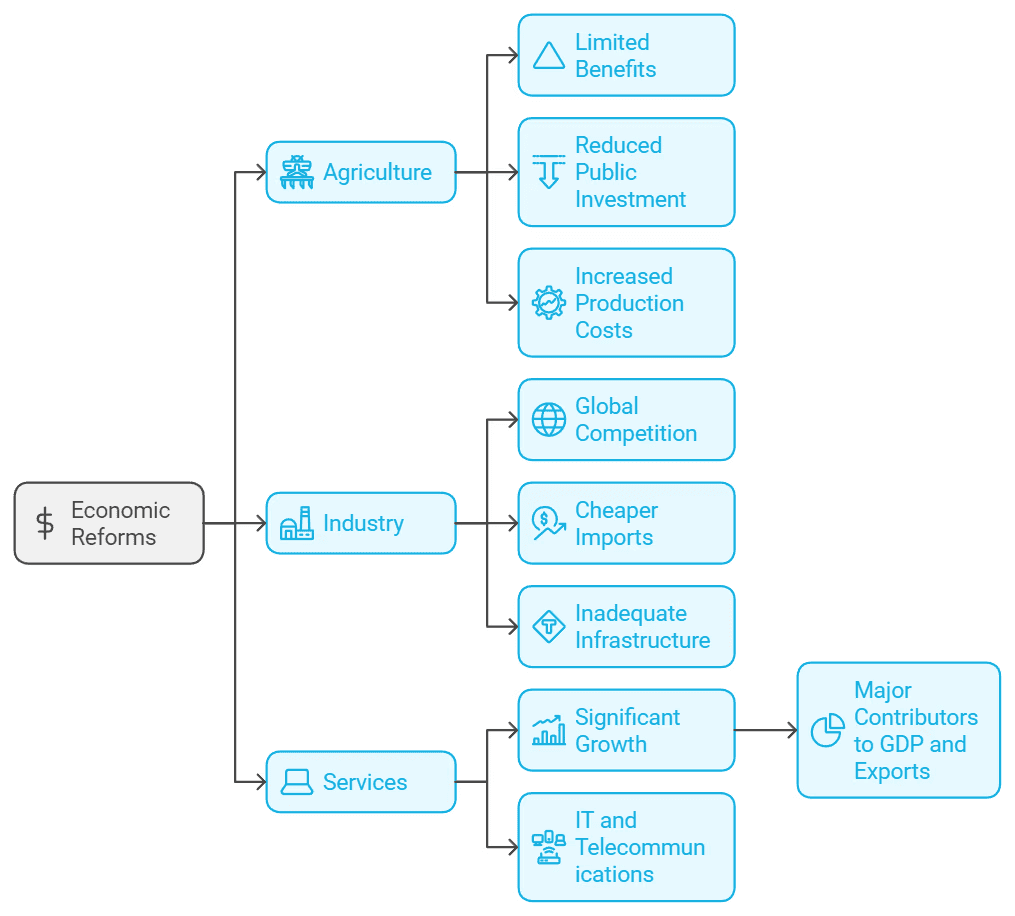

Reforms in Agriculture

- Growth in agriculture has decelerated.

- Public Investment in agriculture, especially in infrastructure, has fallen.

- Partial removal of fertiliser subsidies increased production costs, impacting small and marginal farmers.

- Policy Changes such as reduction in import duties, low minimum support price, and lifting of quantitative restrictions on agricultural imports increased international competition for Indian farmers.

- Export-oriented policies shifted production focus from the domestic market to the export market, affecting food grain prices.

Reforms in Industry

- Industrial growth has slowed down due to decreasing demand for industrial products. This decline is attributed to factors such as cheaper imports and inadequate investment in infrastructure.

- In a globalized world, developing countries are forced to open their economies to a greater flow of goods and capital from developed countries, making local industries vulnerable to imported products.

- Cheaper imports have replaced the demand for domestic goods, causing domestic manufacturers to face intense competition from foreign products.

- The lack of adequate investment in infrastructure facilities, including power supply, has further hampered industrial growth.

- Globalization is often seen as facilitating the free movement of goods and services from foreign countries, which negatively impacts local industries and employment opportunities in developing nations.

- Moreover, despite being a developing country, India faces high non-tariff barriers that limit its access to developed countries' markets. For instance, while India has removed quota restrictions on textiles and clothing exports, the USA still imposes quota restrictions on imports of textiles from India and China.

Disinvestment

- The government sets annual targets for disinvestment of Public Sector Enterprises (PSEs). For example, in 1991-92, the target was to mobilize Rs 2500 crore through disinvestment, and the government exceeded this by mobilizing ₹ 3,040 crore.

- In 2017-18, the disinvestment target was about ₹ 1,00,000 crore, and the achievement was approximately ₹ 1,00,057 crore.

- Critics argue that the assets of PSEs have been undervalued and sold to the private sector, resulting in a significant loss to the government and the outright sale of public assets.

- Furthermore, the proceeds from disinvestment are often used to cover government revenue shortfalls rather than being reinvested in the development of PSEs or building social infrastructure.

- This raises the question of whether selling a part of government companies' properties is the most effective way to enhance their efficiency.

Reforms and Fiscal Policies

- Economic reforms have limited the growth of public spending, particularly in social sectors.

- Tax cuts during the reform period, intended to increase revenue and reduce tax evasion, have not led to an increase in tax revenue for the government.

- Reform policies, such as tariff reductions, have limited the government's ability to raise revenue through customs duties.

- To attract foreign investment, tax incentives are offered to foreign investors, which further reduces the potential for tax revenue.

- This situation has a negative impact on developmental and welfare expenditures.

Conclusion

- Globalization through liberalization and privatization has had both positive and negative impacts on India and other countries.

- Some scholars view globalization as an opportunity for greater access to global markets, advanced technology, and the potential for large industries in developing countries to become significant players internationally.

|

64 videos|308 docs|51 tests

|

FAQs on Liberalization, Privatisation and Globalisation Chapter Notes - Economics Class 12 - Commerce

| 1. What is the significance of liberalization in the Indian economy? |  |

| 2. How did privatization impact state-owned enterprises in India? |  |

| 3. What are the key features of globalization in the context of the Indian economy? |  |

| 4. What assessment can be made about the Indian economy during the reforms period? |  |

| 5. How do liberalization, privatization, and globalization interconnect in the context of India's economic policy? |  |