Business Services Chapter Notes | Business Studies (BST) Class 11 - Commerce PDF Download

Introduction

The chapter Business Services gives you a brief introduction to the characteristics of business services, the difference between services and goods, the classification of types of business services, the concept of e-banking, the identification and classification of types of insurance policies, and the description of different types of warehouses.

Definition

Auxiliaries to trade are also known as business services. The service sector includes commercial firms engaged in banking, communication, transport, insurance, and warehousing. Business cannot be even imagined in the absence of these services. All these services collectively constitute the Service Sector.

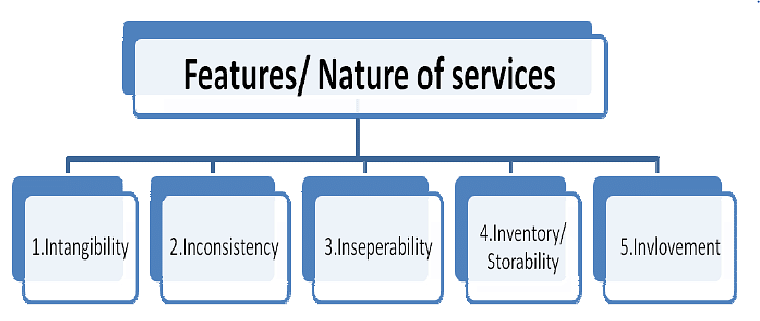

Nature/Features/characteristics of Services:

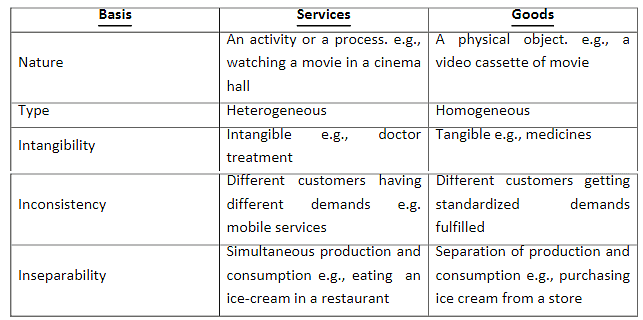

- Intangibility: A service is intangible and cannot be physically perceived or observed. It is something that is encountered or received by the buyer or recipient. Additionally, it is not possible to assess the quality of service prior to its utilization.

- Inconsistency: Achieving perfect standardization in services is not feasible. Even when the service provider remains constant, the quality of the service can vary over time.

- Inseparability: A distinguishing feature of services is the inseparability of the service itself from the service provider. In contrast to goods or products, services cannot be detached from their providers, and there is no storage phase between their creation and consumption.

- Storage: Services are distinct from goods or products in that the production and consumption of services are not inseparable. This is primarily due to the fact that services, being intangible in nature, cannot be stored or inventoried. As a result, there is no possibility of accumulating a stockpile of services.

- Involvement: Involvement is a key feature of services that refers to the active participation and engagement of both the service provider and the customer during the service delivery process. It encompasses the interactions, communication, and cooperation between the two parties involved.

Difference between Services and Goods:

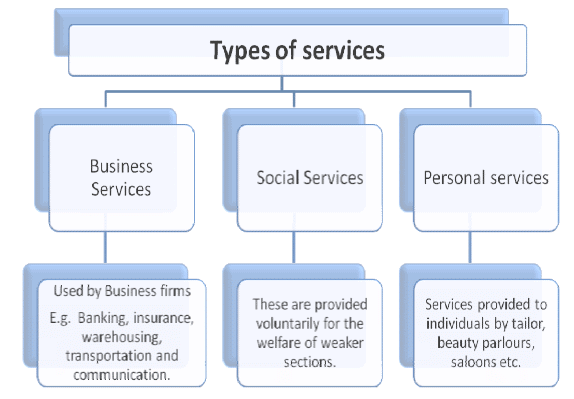

Types of Services

- Business Services: Services used by business enterprises in conducting the activities of the business. Examples: Banking, insurance, warehousing, communication services, etc.

- Social Services: These are provided voluntarily to fulfill social goals. Example: Providing education and health facilities to the employees and their family members.

- Personal Services: Services which are experienced differently by different customers. e.g. tourism, restaurants etc.

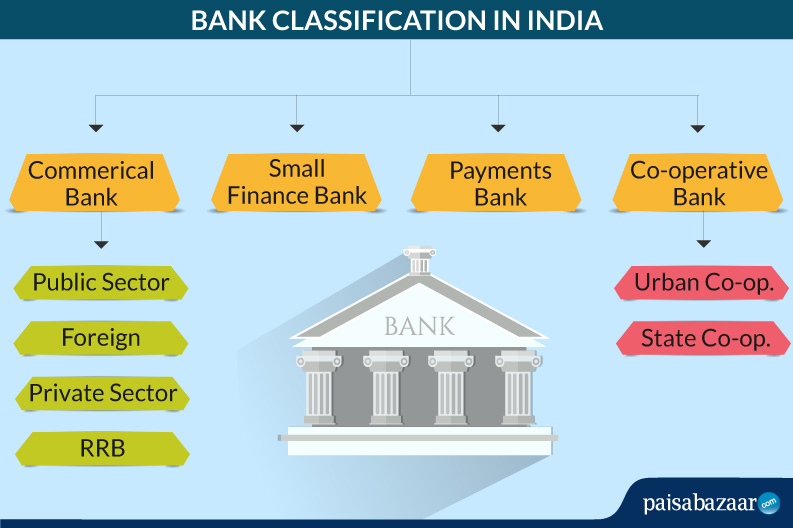

Bank

A bank is an institution that accepts deposits, and withdrawals by cheque and makes loans and advances for the purpose of earning profits.

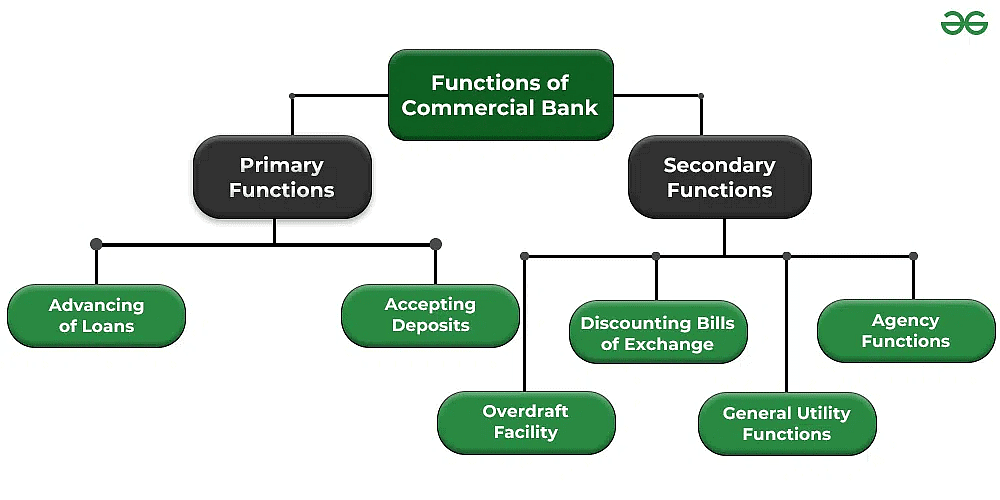

Functions of Commercial Bank

Primary Functions

1. Accepting Deposits: Commercial banks primarily engage in the core function of accepting deposits. They provide various types of bank accounts to accommodate the diverse requirements and preferences of their customers. The following are the different categories of bank accounts offered by banks.

A. Fixed Deposit Account: A Fixed Deposit account refers to the act of depositing money in an account for a predetermined duration. Once the specified period elapses, the account holder can withdraw the deposited funds from the bank. Generally, this account offers the highest interest rates compared to other types of accounts. The duration of the deposit directly influences the interest rate, with longer periods typically yielding higher rates of interest.

B. Current Deposit Account: Businessmen commonly open Current Deposit Accounts, which allow the account holder to deposit and withdraw money at their convenience. These accounts are often referred to as demand deposits because the deposited amount can be repaid upon request. Withdrawals from current accounts are typically made through the use of cheques. Unlike other types of accounts, current accounts do not earn interest. Instead, banks levy charges for the services provided to the account holder.

C. Saving Deposit Account: The primary objective of a savings account is to gather the savings of the general public. Individuals can initiate this account by depositing a modest amount of money. They have the flexibility to withdraw funds and make additional deposits as desired. Account holders also receive interest on their deposits. However, the interest rate on savings accounts is typically lower compared to that of fixed deposit accounts.

D. Recurring Deposit Account: The aim of recurring deposit is to encourage regular savings by the people. A depositor can deposit a fixed amount, say Rs. 100 every month for a fixed period. The amount together with interest is repaid on maturity. The interest rate on this account is higher than that on saving deposits.

2. Lending Money with the help of money collected through various types of deposits, commercial banks lend finance to businessman, farmers, and others. The main ways of lending money are as follows:

A. Term Loans: Banks extend loans to their customers for a specified duration to facilitate the purchase of assets such as machinery, trucks, scooters, houses, and more. The borrowers then repay these loans in regular installments, which can be on a monthly, quarterly, semi-annual, or annual basis.

B. Bank Overdraft: Customers who hold current accounts with a bank can request permission to withdraw an amount exceeding the balance available in their account. This additional withdrawn amount is known as an overdraft. This facility is typically granted to reliable customers for a short duration. It may be secured by assets or based on the personal security of the customer. Interest is levied on the actual overdrawn amount by the customer.

C. Cash Credit: In this arrangement, the bank provides a cash loan up to a predetermined limit based on current assets and other securities. The bank establishes an account in the borrower's name and permits them to withdraw the loaned funds as needed, within the approved limit. Interest is applied to the actual amount withdrawn by the borrower.

D. Discounting of Bill of Exchange: In this process, a bank lends money to its customers by taking a bill of exchange as security, even before the bill's maturity if the customer requires it. The bank imposes a discount fee based on the remaining period of the bill as a charge for providing this service.

Secondary Functions

The secondary functions of commercial banks are as under:

(1) Agent Functions

As an agent of its customers a commercial bank provides the following services:

(I) Collecting bills of exchange, promissory notes and cheques.

(II) Collecting dividends, interest etc.

(III) Buying and selling shares, debentures and other securities.

(IV) Payment of interest, insurance premium etc.

(V) Transferring funds from one branch to another and from one place to another.

(VI) Acting as an agent of representative while dealing with other banks and financial institutions. A Commercial banks performs the above functions on behalf of and as per the instructions of its customers.

(2) General Utility Functions:

Commercial banks also perform the following miscellaneous functions:

(I) Providing lockers for safe custody of jewellery and other valuables of customers.

(II) Giving references about the financial position of customers

(III) Providing information to a customer about the credit worthiness of other customers.

(IV) Supplying various types of trade information useful to customer.

(V) Issuing letter of credit, pay orders, bank draft, credit cards and travelers cheques to customers.

(VI) Underwriting issues of shares and debentures.

(VII) Providing foreign exchange to importers and travellers going abroad.

Bank Draft

It is a financial instrument with the help of which money can be remitted from one place to another. Anyone can obtain a bank draft after depositing the amount in the bank. The bank issues a draft for the amount in its own branch at other places or other banks (only in case of tie up with those banks) on those places. The payee can present the draft on the drawee bank at his place and collect the money. Bank charges some commission for issuing a bank draft.

Banker’s cheque or Pay Order

It is almost like a bank draft. It refers to that bank draft which is payable within the town. In other words banks issue pay order for local purpose and issue bank draft for outstation transactions.

|

Download the notes

Chapter Notes - Business Services

|

Download as PDF |

E-BANKING

E-banking means banking transactions carried out with the help of computer systems (i.e., banking over the internet).

- Electronic Fund Transfer (EFT): Under this system, a bank transfers wages and salaries directly from the company’s account to the accounts of employees of the company.

- Automatic Teller Machine (ATM): It refers to an electronic terminal that allows people with plastic card to perform simple banking transactions like withdrawal of cash 24x7 without any help of human teller.

- Debit Card: It refers to a plastic card that allows the bank to take money from the customer’s account and transfer it to a seller’s account.

- Credit Card: It refers to a plastic card that allows the customer to buy now and payback the loaned amount to bank at a future date.

- Online Banking: Under this system, when the customer gives instruction to his computer, the bank computer transfers money from/ to customer’s account to biller’s account.

Insurance

It is a contract where by in exchange of fixed consideration one party promises to pay a fixed amount either at happening of an event or at the expiry of certain period.

Functions of Insurance

The functions of insurance can be listed as follows:

- They provide certainty to the insured.

- They ensure the protection of the family.

- They are risk-sharing policies.

- They prevent the damages that can come from loss.

- It provides capital.

- It’s known for improving efficiency.

- It helps in boosting the economy.

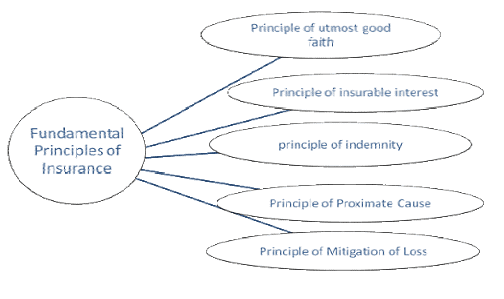

Fundamental Principles of insurance:

- Principle of utmost faith: It means that no material or important facts should be concealed by both the parties of insurance contract.

- Principle of Insurable Interest: There must be some pecuniary interest in the subject matter of the insurance contract.

- Principle of Indemnity: It means that the insured can get only the compensation against actual loss and he cannot make a profit out of the insurance.

- Principle of proximate cause: It refers to the direct cause and not the remote cause.

- Principle of mitigation of loss: It states that it is the duty of the insured to take reasonable steps to minimize the loss/damage to the insured property.

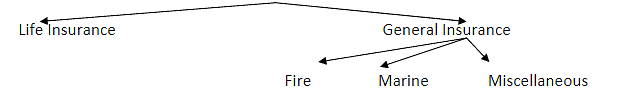

Types of Insurance

Life Insurance: It is a contract under which the insurer, in consideration of a premium, undertakes to pay a fixed sum of money on the death of the insured or on the expiry of a specified period of time, which ever is earlier.

Fire insurance: It is a contract whereby the insurer undertakes to make good any loss/damage caused by fire during a specified period.

Marine Insurance: A marine insurance is an agreement where by the insurer undertakes to indemnify the insured loss against perils of the sea.

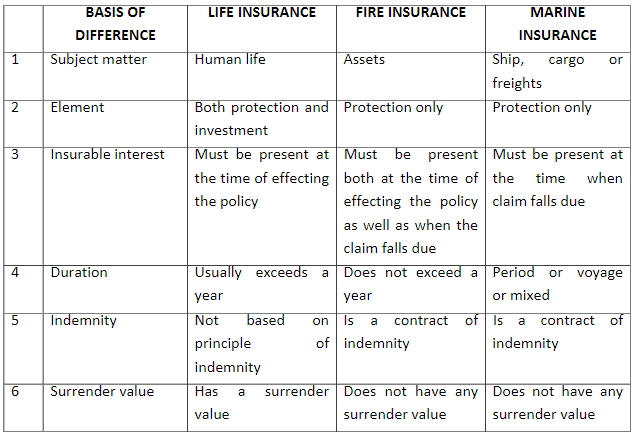

Difference between Life, Fire and Marine Insurance:

Types of Life Insurance Policies (Insurance Products)

Communication services:

These are helpful to business for establishing links with outside world. The main service is postal and telecommunication.

Transportation:

It refers to the physical movement of goods from one place to another.

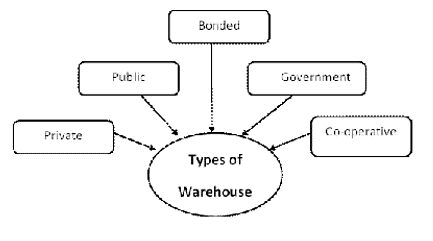

Warehousing: It refers to that activity under which goods are kept safely and systematically at a particular place.

Warehouse : It refers to the specially built building where the raw materials and finished goods are kept safely till their owner does need them.

Types of Warehouses:

Postal Services

This service is required by every business to send and receive letters, market reports, parcel, money order etc.on regular. All these services are provided by the post and telegraph offices scattered throughout the country. The postal department performs the following services.

1. Financial Services: They provide postal banking facilities to the general public and mobilize their savings through the following saving schemes like public provident fund (PPF), KisanVikasPatra, National Saving Certificate, Recurring Deposit Scheme and Money Order facility.

2. Mail Services: The mail services offered by post offices includes transmission of messages through postcards, Inland letters, envelops etc. The various mail services all:

- UPC (under postal certificate): When ordinary letters are posted the post office does not issue any receipt. However, if sender wants to have proof then a certificate can be obtained from the post office on payment of prescribed fee. This paper now serves as a evidence of posting the letters.

- Registered Post: Sometimes we want to ensure that our mail is definitely delivered to the addressee otherwise it should come back to us. In such situations the post office offers registered post facility which serves as a proof that mail has been posed.

- Parcel: Transmission of articles from one place to another in the form of parcels is known as parcel post. Postal charges vary according to the weight of the parcels.

Allied Postal Services

1. Greetings Post: Greetings can be sent through post offices to people at different places.

2. Media Post: Cooperates can advertise their brands through post cards, envelops etc.

3. Speed Post: It allows speedy transmission of articles (within 24 hours) to people in specified cities.

4. e-bill post: The post offices collect payment of bills on behalf of BSNL and other organizations.

5. Courier Services: Letters, documents, parcels etc. can be sent through the courier service. It being a private service the employees work with more responsibility.

Telecom Services

Today’s global business world, the dream of doing business across the world, will remain a dream only in the absence of telecom services. The various types of telecom services are

1. Cellular mobile services: cordless mobile communication device including voice and non-voice messages, data services and PCO services.

2. Radio Paging Services means of transmitting information to persons even when they are mobile.

3. Fixed Line Services includes voice and non-voice messages and data services to establish linkage for long distance traffic.

4. Cable services Linkages and switched services within a licensed area of operation to operate media services which are essentially oneway entertainment related services.

5. VSAT Service (Very small Aperture Terminal) is a Satellite based communication service. It offers government and business agencies a highly flexible and reliable communication solution in both urban and rural areas.

6. DTH Services (Direct to Home) a Satellite based media services provided by cellular companies with the help of small dish antenna and a setup box.

|

37 videos|143 docs|38 tests

|

FAQs on Business Services Chapter Notes - Business Studies (BST) Class 11 - Commerce

| 1. What are the key features that differentiate services from goods? |  |

| 2. What are some common types of services provided by commercial banks? |  |

| 3. What are the primary functions of a commercial bank? |  |

| 4. What is a bank draft and how does it differ from a regular cheque? |  |

| 5. What is a banker’s cheque or pay order and when is it used? |  |