Classification of Budget | Cost Accounting - B Com PDF Download

Introduction

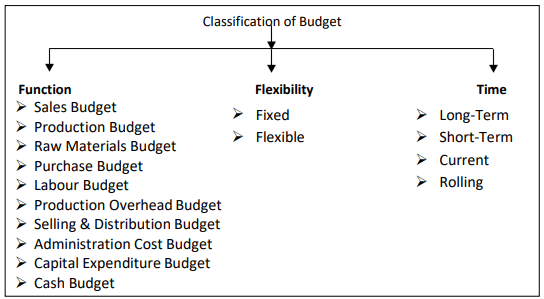

The degree of budgeting involvement differs among firms. Smaller companies might have a sales forecast, a production budget, or a cash budget. In contrast, larger firms typically develop a comprehensive master budget. Budgets can be categorized in various ways based on different perspectives. The following are key bases for classification:

Functional Classification

Sales Budget

The sales budget provides an approximation of the overall sales, expressed either in financial or quantitative terms. It typically serves as the primary foundation upon which all other budgets are built. In practical terms, the quantitative budget is usually created first and is subsequently translated into economic terms. When developing the Sales Budget, the Quantitative Budget commonly initiates the budgetary control process, as sales frequently emerge as the primary factor in budget considerations.

The factor to be consider in forecasting sales are as follows:

- Study of past sales to determine trends in the market.

- Estimates made by salesman various markets of company products.

- Changes of business policy and method.

- Government policy, controls, rules and Guidelines etc.

- Potential market and availability of material and supply

Production Budget

The production budget is formulated based on the anticipated production for the budgeted period. Typically, the production budget is derived from the sales budget. During the budget preparation phase, the production manager takes into account physical resources such as plant capacity, power, factory space, materials, and available labor for the given period. The production budget outlines the production plan aimed at achieving the sales target and may be articulated in terms of quantities, monetary values, or a combination of both. The calculation for production is often expressed as follows: Units to be produced = Desired closing stock of finished goods + Budgeted sales – Beginning stock of finished goods.

Production Cost Budget

This budget outlines the projected production expenses. The production budget illustrates the production capacity, expressed in cost terms in the production cost budget. The cost of production is detailed, encompassing material cost, labor cost, and factory overhead. Therefore, the production cost budget is reliant on the Production Budget, Material Cost Budget, Labour Cost Budget, and Factory Overhead.

Raw‐Material Budget

Direct Materials budget is prepared with an intention to determine standard material cost per unit and consequently it involves quantities to be used and the rate per unit. This budget shows the estimated quantity of all the raw materials and components needed for production demanded by the production budget. Raw material serves the following purposes:

- It supports the purchasing department in scheduling the purchases.

- Requirement of raw‐materials is decided on the basis of production budget.

- It provides data for raw material control.

- Helps in deciding terms and conditions of purchase like credit purchase, cash purchase, payment period etc.

It should be noted that raw material budget generally deals with only the direct materials whereas indirect materials and supplies are included in the overhead cost budget.

Purchase Budget

Devising a strategic plan for acquisitions represents a critical domain for cost reduction in numerous businesses. This includes both direct and indirect materials and services. The purchasing budget can be articulated in either quantity or monetary terms.

- It designates cash requirement in respect of purchase to be made during budget period; and

- It is facilitates the purchasing department to plan its operations in time in respect of purchases so that long term forward contract may be organized.

Labour Budget

Human resources constitute a highly costly element in the operation of a business. Similar to other production factors, management should proactively determine the personnel needs for different roles within the enterprise. This budget can be categorized into a labor requirement budget and a labor recruitment budget. The staffing needs across various job categories, such as unskilled, semi-skilled, and supervisory roles, are determined collaboratively with input from department heads. The recruitment of labor is carried out considering the specific job requirements, qualifications, required skill level, experience, and the corresponding pay rate.

Production Overhead Budget

The manufacturing overhead budget encompasses direct material, direct labor, and indirect costs. The production overhead budget provides an estimate of all production overhead expenses, including fixed, variable, and semi-variable costs, anticipated during the budgeted period. The reality that overheads include many different types of expenses creates considerable problems in:

- Fixed overheads i.e., that which is to remain stable irrespective of vary in the volume of output,

- Apportion of manufacturing overheads to products manufactured, semi variable cost i.e., those which are partly variable and partly fixed.

- Control of production overheads.

- Variable overheads refer to costs that are expected to fluctuate with the level of output. The production overhead budget involves creating overhead budgets for each division of the factory, as it is preferable to have estimates of manufacturing overheads prepared by those responsible for incurring them. Costs for service departments are projected and assigned to the production departments based on the proportion of services received by each department.

Selling and Distribution Cost Budget

The Selling and Distribution Cost budget estimates the expenses associated with selling, advertising, and delivering goods to customers throughout the budget period. This budget is closely linked to the sales budget, as sales forecasts significantly impact the projections of these expenses. However, in preparing the selling and distribution budget, all other relevant information should also be taken into account. The sales manager is responsible for the selling and distribution cost budget and typically collaborates with managers from sub-divisions within the sales department in its preparation. The development of this budget is grounded in an analysis of market conditions, management decisions regarding advertising policies, research programs, and various other influencing factors. Some companies choose to create a separate advertising budget, particularly when expenditures on advertisements are substantial.

Administration Cost Budget

This budget encompasses administrative expenses related to non-manufacturing business activities, such as director's fees, managing directors' salaries, office lighting, heating, and air conditioning. The majority of these expenses are fixed, making them relatively predictable. However, there are semi-variable expenses influenced by anticipated cost fluctuations that need to be considered. Typically, this budget is formulated in the form of a fixed budget.

Capital‐ Expenditure Budget

This budget represents the spending on all fixed assets throughout the budget period, typically covering a more extended timeframe than other functional budgets. It encompasses expenses related to items such as new buildings, land, machinery, and intangible assets like patents. The preparation of this budget is overseen by the accountant with support from the plant engineer and other functional managers.

At the time of preparation of the budget some important information should be observed:

- Overfilling on the production facilities of certain departments as revealed by the plant utilization budget.

- Long‐term business policy with regard to technical developments.

- Potential demand for certain products.

Cash Budget

The cash budget outlines the anticipated cash inflows and outflows of the business over a specific period. It is considered one of the most crucial and typically one of the final budgets to be prepared. The cash budget provides a detailed forecast of cash receipts from all sources and cash payments for various purposes, resulting in the projected cash balance throughout the budget period. It serves as a mechanism to control and coordinate the financial aspects of the business, ensuring solvency and serving as the foundation for forecasting and financing needed to address any cash deficiencies. The cash budget plays a pivotal role in the financial management of a business enterprise by aiding management in determining future liquidity requirements, forecasting these needs, and maintaining control over cash.

Function of Cash Budget

- It makes sure that enough cash is available when it is required.

- It designates cash excesses and shortages so that steps may be taken in time to invest any excess cash or to borrow funds to meet any shortages.

- It shows whether capital expenditure could be financed internally.

- It provides funds for standard growth.

- It provides a sound basis to manage cash position.

Advantages of Cash Budget

Cash Flow Management: The management can strategically plan cash usage in alignment with variations in receipts and payments. By scheduling payments when sufficient cash is available, the business can operate with the minimum required working capital.

Capital Investment Allocation: This provides dual benefits, enabling the internal financing of capital expenditure projects and offering insights into the cash availability for capital investments.

Excess Funds Provision: The cash budget reveals the presence of excess cash, allowing management to decide on investing surplus funds for short-term or long-term purposes based on business requirements.

Pay-out Policy Consideration: The budgetary system aids management in formulating future pay-out policies, such as dividends. If the cash budget indicates an unfavorable liquidity position, management may opt to reduce the dividend rate, maintain the dividend amount, or skip dividends for the year.

Funds Acquisition Planning: It provides top-level management with insights into acquiring funds for specific durations and identifies potential sources to explore.

Optimal Cash Utilization: Business decision-makers can make informed choices regarding the most profitable use of liquidity, especially during bulk purchase payments, leveraging the benefits of discounts.

Limitation of Cash Budget

Complex Projections: The business environment is inherently uncertain, making it challenging to achieve nearly perfect estimates of cash receipts and payments, especially for extended durations. While short-term predictions, spanning three to four months, are feasible, longer-term forecasts are more intricate.

Rigidity: Lack of flexibility in implementing the cash budget can have detrimental effects. Strict adherence to cash inflow estimates may result in customer loss, and unwavering loyalty to payment schedules can lead to a decline in liquidity. Flexibility is crucial for mitigating these risks.

Cost Constraints: The application of this technique involves gathering statistical information from diverse sources, and engaging expert personnel in operations research can be costly. This expense may be impractical for small businesses, where finding and affording experts is not always feasible. In such cases, long-term predictions may prove inaccurate.

Methods

Receipt and payment: It is most popular and is universally used for preparing cash budget. The assumption of statistical data is arrived at calculated on the basis of requirements like monthly, weekly or fortnightly. On account of elasticity, this method is used in forecasting cash at different time periods and thus it helps in controlling cash distributions.

(a) Cash inflows from customers are determined based on sales forecasts, considering factors such as terms of sale and payment delays.

(b) Other sources contribute to cash receipts, including dividends, interest from trade investments, rental income, capital issuance, proceeds from the sale of investments, and disposal of fixed assets.

(c) Cash needs for material purchases, labor and salary costs, and overhead expenses are established using information from purchasing, personnel, and overhead budgets.

(d) Cash requirements for capital expenditures align with the capital expenditure budget.

(e) Additional cash requirements for various purposes, such as dividend payments, income tax obligations, fines, and penalties, are considered.

- Estimating Cash Receipts: Primary sources of cash receipts encompass sales, interest, dividends, asset and investment sales, and capital borrowings. The company estimates the time lag based on historical experiences of cash receipts from credit sales, while cash sales are easily determined.

- Estimating Cash Payments: Decisions regarding cash outflows are made by referencing various operating budgets, covering credit purchases, labor costs, interest and dividend payments, overhead charges, and capital investments.

Adjusted Profit and Loss Account: This approach relies on both cash and non-cash transactions to estimate the closing cash balance by transforming profit into cash. The underlying assumption is that earning a profit results in an equivalent amount of cash entering the business. It acknowledges that the net profit presented in the profit and loss account does not necessarily represent the actual cash inflow into the business. Furthermore, this method operates under the assumption that the business will remain static, with no depreciation or appreciation of assets and no changes in working capital, ensuring that the total cash on hand for the business equals the earned profit.

Budgeted Balance Sheet Method: The Budgeted Balance Sheet Method closely resembles the Adjusted Profit and Loss Account method, with the key distinction being the projection of a Balance Sheet instead of adjusting the Profit and Loss Account. In this approach, a Balance Sheet is formulated using projected amounts for all assets and liabilities, excluding cash, at the conclusion of the budget period. The cash balance is then determined as the balancing amount. If the assets side exceeds the liability side, it results in a bank overdraft, while if the liability side surpasses the assets side, it indicates a bank balance. This method is commonly employed by stable business entities.

Working Capital Differential Method: This method relies on the working capital estimate, commencing with the opening working capital and incorporating any adjustments made to current assets, excluding cash, and current liabilities. The final balance at the end of the budget period reflects the actual cash balance. This approach closely resembles the Balance Sheet method.

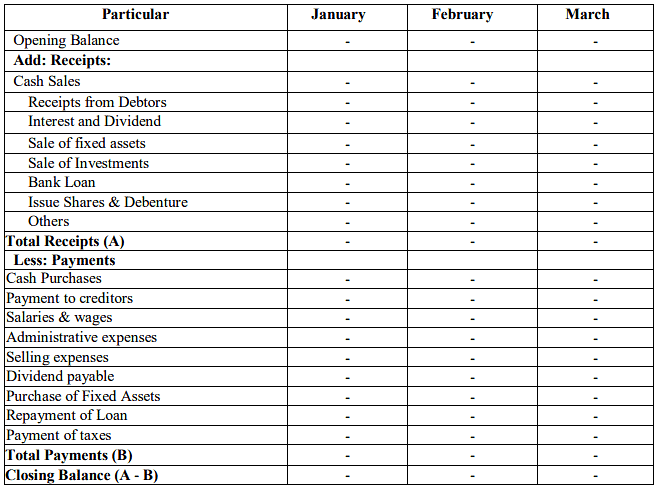

Model of Cash Budget

|

104 videos|132 docs|14 tests

|