Cost Accounting Records, Ledgers and Cost Statements | Cost Accounting - B Com PDF Download

| Table of contents |

|

| Cost Statement |

|

| Cost Accumulation |

|

| Cost Sheet Formats & Preparation |

|

| Important Components of Cost Sheet |

|

Cost Statement

In the earlier sections, we've covered fundamental cost concepts and the various components involved. The steps for determining the cost of a product or service were outlined, and we delved into the detailed treatment of different cost aspects. It's evident that the term "cost" holds broad implications and lacks significance in isolation. Understanding costs is crucial for effective control, and the initial step in this control process is measuring costs. Measurement is essential because control is not feasible without it. The measurement of costs varies across industries.

Initially, costs need to be measured concerning specific cost centers and then on a broader scale with respect to the overall cost unit. The approach to determining the cost of a product or service may take diverse paths, but the underlying logic remains consistent: gather all pertinent costs involved in transforming raw materials into the final product and accumulate the total costs.

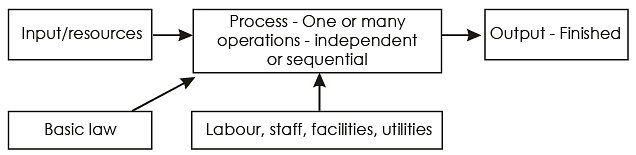

To simplify, the production or provision of any product or service necessitates resources known as inputs. These inputs undergo a conversion process, resulting in the production of either a product or a service. The utilization of resources incurs costs. When determining the total cost of resources, all costs associated with the resources used (directly or indirectly) in the process are collected. This involves establishing the connection between the resource and the final product or service.

The process of accumulating costs will differ according to the nature of business and the activities carried out. The common way to accumulate costs is to prepare cost sheets.

Cost Accumulation

The logic of Cost Accumulation is to track costs in the same sequence as the resources get used. See the following flow of activities:

(a) Raw material & other material are purchased and stored

(b) The material is used up in process of conversion

(c) People or machines work upon the material while in the process

(d) The process results into some products that are finished

The entire cost chain, concluding with the production of the final product, requires comprehensive data collection. Cost accumulation is based on source documents utilized for cost booking. Depending on the nature of the business, a specific cost unit is identified for which costs need to be gathered. Business organization is departmentalized to align with the production process. For instance, in a fruit processing industry, costs are accumulated according to distinct processes such as cutting, pulp formation, blending, purifying, and final packing. As materials physically move from one process to the next, costs are also transferred from one stage to the subsequent one.

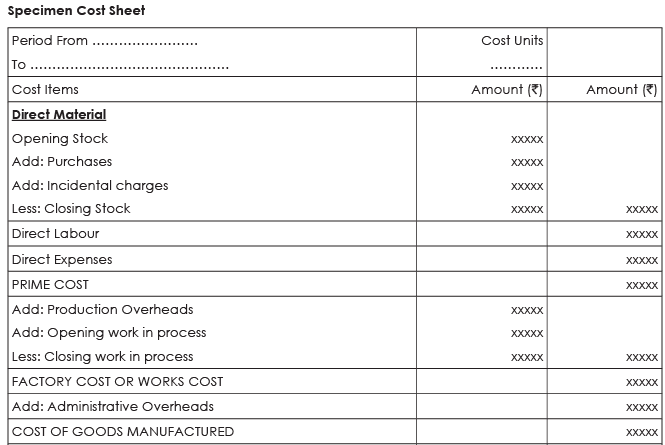

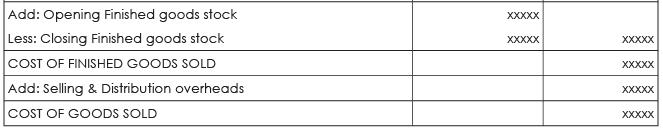

Combining all direct cost elements results in the Prime Cost. Subsequently, production overheads are added to form Factory Cost or Works Cost. Administration overheads are further incorporated into the Factory Cost to yield the Cost of Production. Once the product is prepared for sale, selling and distribution overheads are included to determine the Cost of Sales or Cost of Goods Sold. Subtracting this from the Sales revenue provides the profit or loss.

Process of accumulation of cost comprises of:

- Identification of costs to the cost centers or departments.

- Apportionment of service costs to production costs.

- Absorption of costs into cost units.

Cost Collection

Cost Collection involves the registration of costs under a specific Cost Account code, either within a designated cost center or directly under a particular cost unit. This process utilizes source documents to document the costs that have been or will be incurred. These source documents are appropriately authorized and assigned unique numbers, serving as the principal point of entry. Additionally, there may be other documents and reports, including allocation sheets, labor utilization reports, analyses of idle time and overtime, scrap reports, etc., which aid in identifying costs. Let's explore the method of collecting costs.

Material costs

The identification of costs with a cost unit is facilitated through the 'stores issue summary.' For job costing scenarios, a job-wise summary is prepared based on 'material issue notes.' In the case of contracts, a summary is created on a contract-by-contract basis. In instances where material is procured and directly used on the contract site instead of being stored, the 'purchase invoice' serves as the foundation for capturing direct material costs. In process industries, materials are issued to various processes, and costs input to a process may be determined by the cost of materials processed in the preceding phase. A process-wise summary of material issues is maintained, and the cost of material that does not become part of the final product is apportioned to the output of that process. Indirect material costs are gathered based on consumable issues, scrap reports, standard parts lists, etc., with consideration for accounting for material losses. Normal material losses are allocated to the produced units, while abnormal losses are excluded from the computation of the cost of good units and directly reflected in the Profit and Loss Account.

Labour Cost

The primary basis for collecting labour costs is the salaries and wages summary prepared after the monthly payroll run. This summary provides a department-wise breakdown, allowing the Direct Labour Cost of the production department to be separately identified, while costs for other indirect departments are available to be charged as overheads. In contracting businesses, the cost of labour used on various sites is determined based on the wages sheet maintained for each contract site. Idle time reports and overtime reports are utilized for booking the costs of idle time and overtime. When laborers are shared among different jobs, contracts, or processes, an estimate of the time spent on each is made, and costs are allocated accordingly.

Expenses

Expenses are collected through accounting entries in the cash book or journal proper. Direct expenses specific to a job, contract, or process are collected based on vouchers. Indirect expenses are collected and then apportioned in a summarized form using apportionment sheets.

Collection of Budgeted costs

The determination of costs for the chosen cost unit may involve either actual costs or budgeted costs. Actual costs, as detailed above, are gathered based on relevant documents. In contrast, budgeted costs are computed using the standard bill of material and predetermined overhead rates. A bill of material is prepared for each product (including sub-assemblies) to estimate budgeted direct material costs. This includes a quantitative estimate, and a budgeted material price is considered for valuing the material cost. Estimated labor hours are costed using estimated Labour Hour Rates, and predetermined overheads are computed, taking into account the selected base for absorption. This process allows for the estimation of total costs with a comprehensive composition.

Cost Accountant & Cost Data collection

The Cost Accountant plays a crucial role in ensuring the effectiveness of the cost data collection process. For managerial decision-making, accurate cost analysis and reporting are essential, and these outcomes heavily rely on the integrity of the data collection procedures. To guarantee a robust data collection process, a strong Costing System is imperative. The Cost Accountant may conduct periodic assessments and internal audits to evaluate and enhance the system, utilizing expertise to establish precise cost estimates that contribute to informed decision-making.

The collected cost data should be presented in a suitable format to enhance its informativeness and significance. It is evident that the report should align with the intended purpose. While a complete cost sheet may not always be necessary, providing the production manager with the cost of production alone may suffice. The cost report should present this figure distinctly, breaking it down into its various components. Additionally, sales and marketing costs can be detailed for each distribution channel, customer, region, etc., alongside a product-wise breakdown.

It is crucial that the collected cost data is structured to provide relevant information to those accountable for costs. A comprehensive cost sheet should present figures for each cost element, distinguishing between direct and indirect costs and categorizing them by functions such as production, administration, and selling & distribution. The format of the Cost Sheet should logically derive from its intended use. In addition to displaying the total deducted cost, it should highlight other costs, enabling comparisons with budgets, analysis of variances, and facilitating cost control measures to enhance profitability.

Cost Sheet Formats & Preparation

The cost concept itself being subjective, there is no standard format in which the collected costs can be presented. It has to suit the type of business, need of the details, and management’s requirement of control over costs. Yet a simple way to show the Total Cost of any cost unit is shown below:

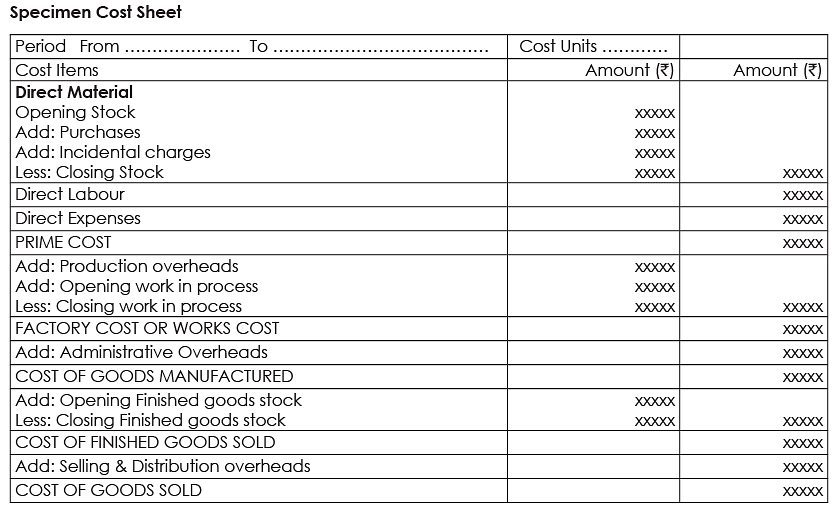

You can observe the logical way in which the cost flow has been shown in the above chart. The focus in this specimen is on elements and functions split further into direct and indirect costs with respect to the cost units. Although the formats could be different, the contents of a cost sheet must be understood and interpreted correctly so that one can analyse it for control and decision making. For example if it has to be prepared for a process industry, the format would reflect the portion up to factory cost for each process separately. Then the administration costs will be added together. The cost per unit will be computed for every process separately. The stock for processes subsequent to process one will mean stocks transferred from earlier processes and stocks transferred to the next processes. The objective here is to compute the cost per process. The cost sheet format here could be:

The presentation of the workflow will extend up to the factory cost, contingent upon the number of processes involved. Following that, administration, selling, and distribution overheads are incorporated, similar to what is depicted in the initial format. Certain companies employing multiple processes might opt to create distinct cost sheets for each process. This process-specific breakdown allows for enhanced control over process costs and losses by the respective process managers when such detailed information is readily accessible.

Important Components of Cost Sheet

- The cost sheet pertains to a specific job, contract, batch, production, or service to be undertaken. If the job spans multiple accounting periods, it is advisable to incorporate separate columns to detail figures for each period, with the job or batch reference indicated in the header.

- When cost estimates are available, a dedicated column should be included for estimated costs, allowing for a direct comparison with actual costs. This modification enhances the user-friendliness and meaningfulness of cost sheets.

- In certain scenarios, materials may not constitute a significant portion of the total cost and may be treated as an overhead item. In such instances, the Prime Cost will predominantly comprise labor and other expenses.

- Proper understanding of the treatment of raw material stocks is crucial. Since costs are to be linked to the units produced, accurate computation of material consumption, completion of semi-finished goods from earlier periods, and the sale of finished goods is necessary.

Raw Material Consumed: Opening Stock + Purchases – Closing Stock

One has to go into the depth of this arithmetical formula. Where do we get the figure of purchases from? It is from the suppliers invoices for purchase of stockable material. It also should include all charges incidental to purchase of goods like carriage, insurance, customs duty etc. which is directly associated with the incoming material.

As we know that the stocks are always valued at cost or market price whichever is less. This norm has to be applied to the rates of all the items of material in stock, and then the total valuation of stock is done. The stock ledger records all receipts and issues of the quantity and rate of material items. The valuation of material issues has to be properly done based on correctly chosen method of issue pricing. This summary figure as per the issue column should exactly match with the raw material consumed figure as included in the cost sheet.

The normal losses on account of material shortages must be included in the cost of raw material consumed. Care should be taken to remove the abnormal losses there from.

- The handling of work in process is a critical aspect. Upon closer examination of the format, it becomes apparent that the adjustment of WIP stocks occurs specifically after the inclusion of Factory Overheads. Why is this adjustment necessary, and why at this stage? It's important to recognize that a Cost Sheet is compiled for a specific time period for a given cost unit. If a job is carried forward from the previous period at the beginning of the current period, there may be some partially completed work that is being continued. Simultaneously, there might be partially finished production at the end of the current period. These stocks must be adjusted to reflect the cost consumed during the current period. Additionally, work in process is typically valued at Factory Cost, excluding Administration Overheads, as the production of goods is not yet fully complete. Administration costs are incorporated at the stage of finished production. Therefore, the adjustment of WIP stocks should be done before adding Administration Overheads.

- Similarly, adjustments for the opening and closing stocks of finished goods need to be performed, and this should occur after the cost of production stage.

- Having separate columns for total costs and per unit costs placed side by side can provide a quick overview of the per unit figures. This arrangement proves highly beneficial for operational-level management in gaining swift insights.

|

106 videos|173 docs|18 tests

|

|

Explore Courses for B Com exam

|

|