Cost of Capital | Crash Course for UGC NET Commerce PDF Download

Cost of Capital: An Overview

Cost of capital refers to the minimum return required to justify a capital investment, such as constructing a new facility. It serves as a benchmark to determine if a proposed project is financially viable.

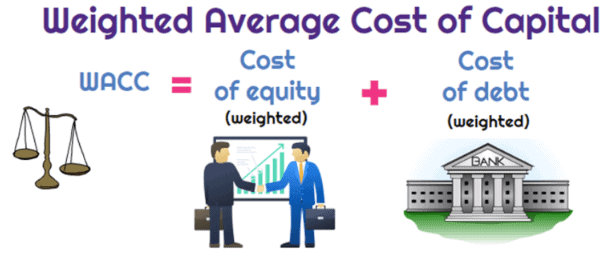

Companies typically use a mix of debt and equity to fund their growth. The overall cost of capital for such firms is calculated as a weighted average of all capital sources, commonly known as the weighted average cost of capital (WACC).

Key Points

- The cost of capital represents the return a company must achieve to justify the expense of a capital project, such as acquiring new machinery or building infrastructure.

- It includes both equity and debt costs, weighted according to the company's capital structure. This weighted calculation is referred to as the WACC.

- For new investments, companies should ensure the projected returns exceed the cost of capital. If not, the project may fail to deliver adequate returns to investors.

Understanding the Cost of Capital

The cost of capital is essential in setting a project's hurdle rate—the minimum return a project must generate to cover its costs and ensure profitability. Companies must assess how much revenue a project needs to produce to not only cover its initial investment but also generate ongoing profits.

A company can evaluate the cost of capital using two approaches: the levered cost of capital (which includes debt) or the unlevered cost of capital (which excludes debt).

From an investor's perspective, the cost of capital represents the expected return from investing in a company's stock or other assets. This expectation is often based on various scenarios, including both best- and worst-case outcomes.

Investors may also assess the volatility (beta) of a company's financial performance to determine if the potential returns justify the associated risks.

Weighted Average Cost of Capital (WACC)

A firm's cost of capital is typically determined using the weighted average cost of capital (WACC) formula, which accounts for both debt and equity costs. Each component of the firm's capital is weighted according to its proportion in the overall capital structure, resulting in a blended rate. The formula considers all forms of debt and equity listed on the company's balance sheet, including common stock, preferred stock, bonds, and other types of debt.

Cost of Debt

When determining the best financing strategy—whether to use debt, equity, or a combination of both—the cost of capital plays a crucial role.

Early-stage companies, which often lack substantial assets to use as collateral, typically rely on equity financing as their primary source of funding. These less-established firms, with limited operating histories, generally face higher capital costs compared to older companies with proven track records.

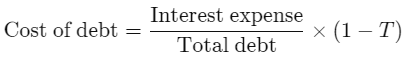

The cost of debt is merely the interest rate paid by the company on its debt. However, since interest expense is tax-deductible, the debt is calculated on an after-tax basis as follows:

where:

Interest expense = Int. paid on the firm’s current debt

T = The company’s marginal tax rate

The cost of debt can also be estimated by adding a credit spread to the risk-free rate and multiplying the result by (1 - T).

Cost of Equity

Calculating the cost of equity is more complex because the return required by equity investors is less straightforward than the interest rates demanded by lenders. The cost of equity is approximated by the capital asset pricing model as follows:

CAPM(Cost of equity)= Rf +β(Rm −Rf)

where:

Rf = risk-free rate of return

Rm = market rate of return

To estimate risk, analysts use the Capital Asset Pricing Model (CAPM), which incorporates beta. For publicly traded companies, beta is derived from the company’s own stock. For private firms, beta is estimated based on the average beta of similar publicly traded companies and may be adjusted on an after-tax basis. The assumption is that the beta of a private company will eventually align with the industry average.

Cost of Debt + Cost of Equity = Overall Cost of Capital

The overall cost of capital for a firm is the weighted average of the costs of debt and equity.

For example, consider a company with a capital structure comprising 70% equity and 30% debt, where the cost of equity is 10% and the after-tax cost of debt is 7%.

The WACC would be calculated as follows:

(0.7×10%)+(0.3×7%)=9.1%

This 9.1% WACC would be used to discount future cash flows from potential projects or investments to estimate their net present value (NPV) and assess their ability to generate value.

Companies aim to achieve an optimal financing mix based on the cost of capital for different funding sources.

Debt financing is generally more tax-efficient than equity financing because interest expenses are tax-deductible, whereas dividends on common shares are paid with after-tax dollars. However, excessive debt can lead to dangerously high leverage, increasing the company's risk of default and requiring higher interest rates to compensate for this risk.

Cost of Capital vs. Discount Rate

The terms "cost of capital" and "discount rate" are often used interchangeably due to their similarities. The cost of capital is typically calculated by a company's finance department and serves as a basis for setting a discount rate (or hurdle rate) that investments must exceed to be considered worthwhile.

However, management should critically assess the internally generated cost of capital figures, as overly conservative estimates might discourage potentially beneficial investments.

The cost of capital can vary depending on the nature of the project. For instance, a highly innovative and risky project should have a higher cost of capital than a project focused on updating essential equipment or software with proven performance.

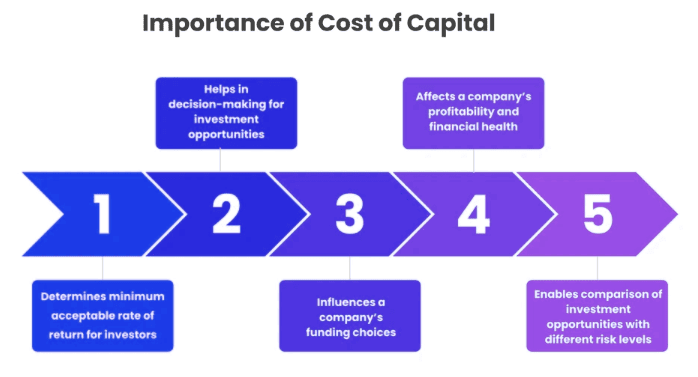

Importance of Cost of Capital

The cost of capital is a crucial metric for businesses and financial analysts when assessing whether funds are being invested wisely. If an investment's return exceeds the cost of capital, it will contribute positively to the company's balance sheet. Conversely, if the returns are equal to or less than the cost of capital, it indicates that the investment may not be a wise use of resources.

The cost of capital also impacts a company's valuation. A company with a high cost of capital is expected to generate lower long-term returns, which may lead investors to assign less value to its equity.

Cost of Capital by Industry

Different industries have varying average costs of capital. For example, according to data from New York University's Stern School of Business, the homebuilding industry has a relatively high cost of capital at 9.28%, while the retail grocery industry has a much lower cost of capital at 5.31%.

Industries with the highest costs of capital include software internet companies, paper/forest companies, building supply retailers, and semiconductor companies, all of which typically require substantial capital investment.

On the other hand, industries with lower capital costs include rubber and tire companies, power companies, real estate developers, and financial services companies (excluding banks and insurance). These industries may require less equipment or benefit from steady cash flows.

Why Is Cost of Capital Important?

Most businesses aim to grow and expand, and they often have multiple options, such as expanding a factory, acquiring a competitor, or building a new, larger facility. Before deciding on any of these options, a company will determine the cost of capital for each potential project. This helps estimate how long it will take for the project to repay its costs and how much it will generate in future returns. Although these projections are estimates, following a reasonable methodology is essential for choosing the best option.

What Is the Difference Between the Cost of Capital and the Discount Rate?

While the terms are often used interchangeably, there is a distinction. In business, the cost of capital is typically calculated by the accounting department as a straightforward measure of the breakeven point for a project. Management then uses this calculation to determine the discount rate, or hurdle rate, which is the rate that the project must meet or exceed to repay its costs and provide adequate returns to shareholders.

How Do You Calculate the Weighted Average Cost of Capital?

The weighted average cost of capital (WACC) represents the average cost of a company's capital, weighted according to the type of capital and its proportion on the company's balance sheet. It is calculated by multiplying the cost of each type of capital by its percentage share on the balance sheet and then summing these values.

The Bottom Line

The cost of capital measures the expense a business incurs to finance its operations, whether through borrowing from creditors or raising funds from investors via equity financing. It is crucial for evaluating whether capital is being deployed effectively in generating expected returns.

|

157 videos|236 docs|166 tests

|

FAQs on Cost of Capital - Crash Course for UGC NET Commerce

| 1. What is the Weighted Average Cost of Capital (WACC)? |  |

| 2. Why is Cost of Capital important for businesses? |  |

| 3. How do you calculate the Weighted Average Cost of Capital (WACC)? |  |

| 4. What is the difference between Cost of Capital and Discount Rate? |  |

| 5. How does the Cost of Capital vary by industry? |  |