Depreciation - (Part - 2) | Accountancy Class 11 - Commerce PDF Download

Page No 14.49:

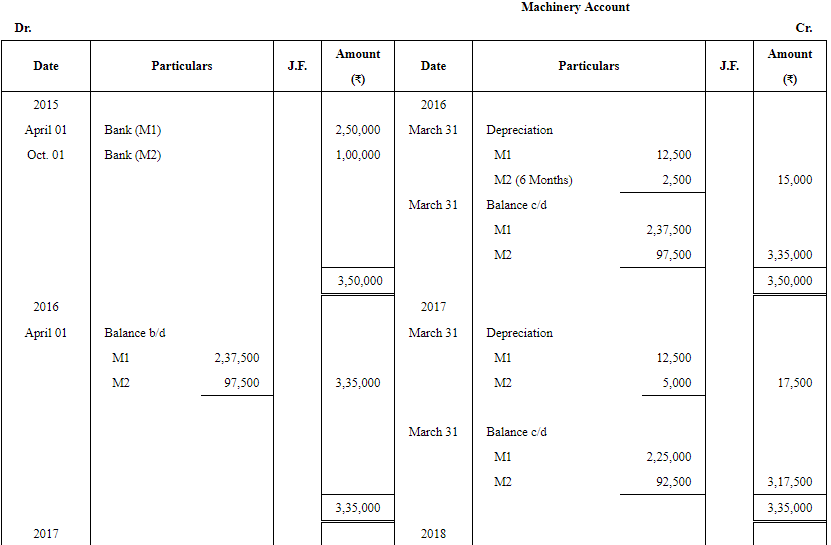

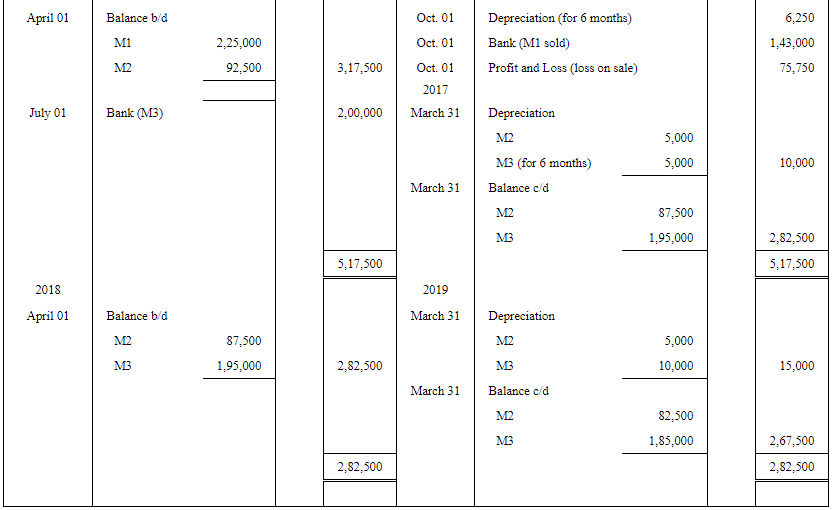

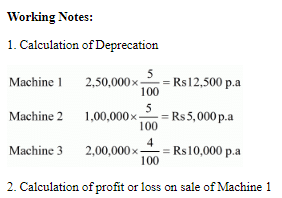

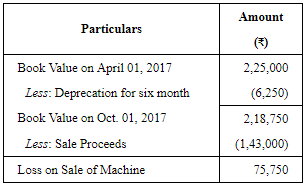

Question 6: On 1st April, 2015, A Ltd. purchased a machine for ₹ 2,40,000 and spent ₹ 10,000 on its erection. On 1st October, 2015 an additional machinery costing ₹ 1,00,000 was purchased. On 1st October, 2017, the machine purchased on 1st April, 2015 was sold for ₹ 1,43,000 and on the same date, a new machine was purchased at cost of ₹ 2,00,000.

Show the Machinery Account for the first four financial years after charging Depreciation at 5% p.a. by the Straight Line Method.

ANSWER:

Page No 14.49:

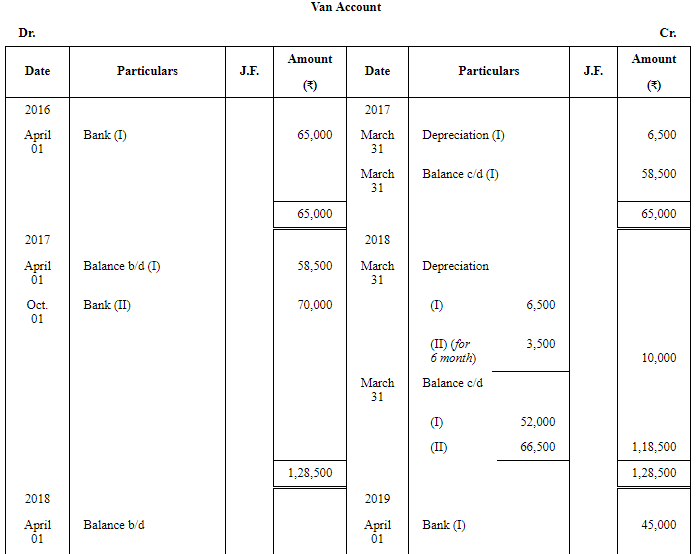

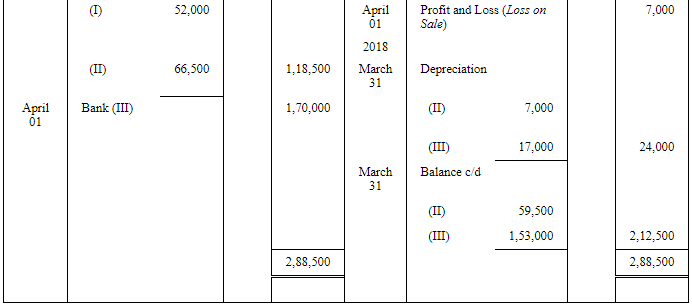

Question 7: A Van was purchased on 1st April, 2016 for ₹ 60,000 and ₹ 5,000 was spent on its repair and registration. On 1st October, 2017 another van was purchased for ₹ 70,000. On 1st April, 2018, the first van purchased on 1st

April, 2016 was sold for ₹ 45,000 and a new van costing ₹ 1,70,000 was

purchased on the same date. Show the Van Account from 2016-17 to 2018-19 on the basis of Straight Line Method, if the rate of Depreciation charged is 10% p.a. Assume that books are closed on 31st March every year.

ANSWER:

Working Notes

Working Notes

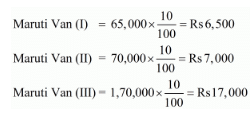

1. Calculation of Annual Depreciation

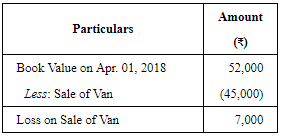

2. Calculation of profit or loss on sale of Van (I)

Page No 14.49:

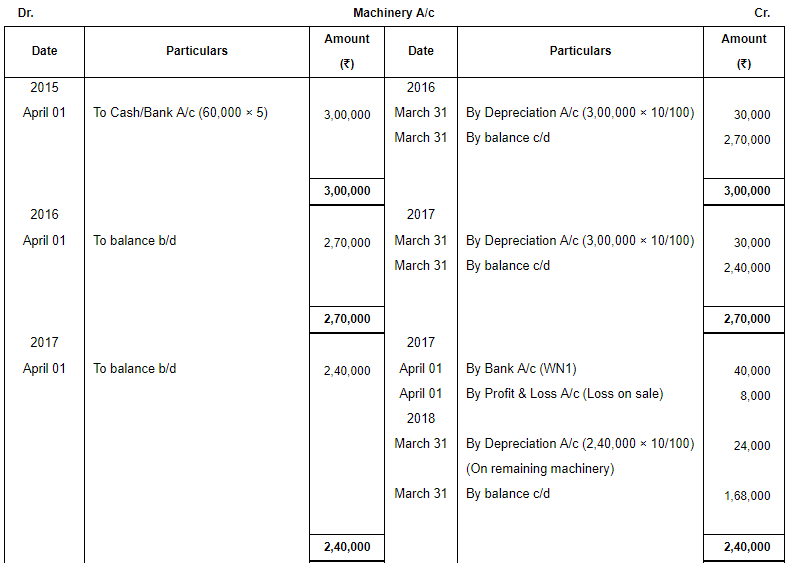

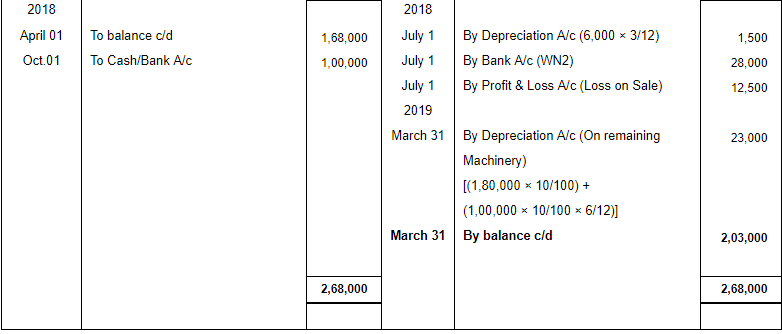

Question 8: On 1st April, 2015, Star Ltd. purchased 5 machines for ₹ 60,000 each. On 1st April, 2017, one of the machine was sold at a loss of ₹ 8,000. On 1st July, 2018, second machine was sold at a loss of ₹ 12,500. A new machine was purchased for ₹ 1,00,000 on 1st October, 2018.

Prepare Machinery Account for 4 years, assuming accounts are closed on 31st March each year and depreciation is charged @ 10% per annum as per Straight Line Method.

ANSWER:

Page No 14.49:

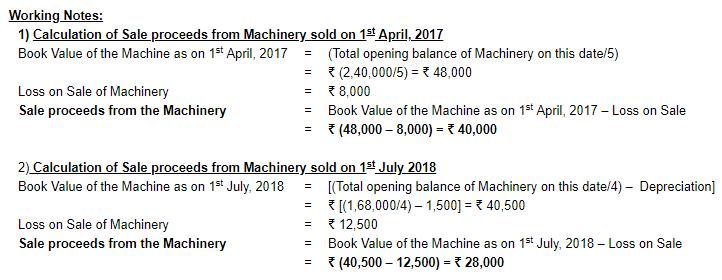

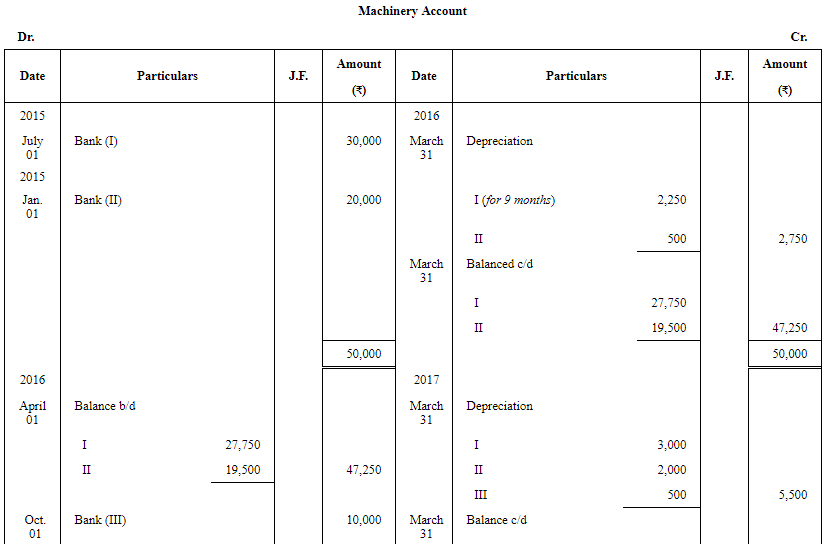

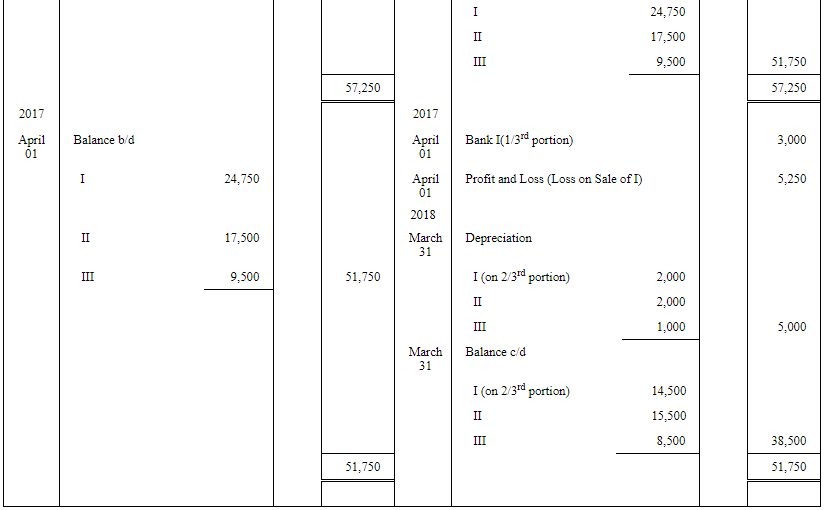

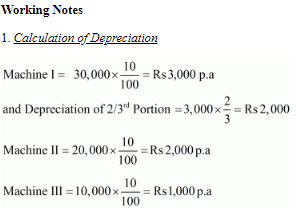

Question 9: A company whose accounting year is a financial year, purchased on 1st July, 2015 machinery costing ₹ 30,000.

It purchased further machinery on 1st January, 2016 costing ₹ 20,000 and on 1st October, 2016 costing ₹ 10,000.

On 1st April, 2017, one-third of the machinery installed on 1st July, 2015 became obsolete and was sold for ₹ 3,000.

Show how Machinery Account would appear in the books of the company. It being given that machinery was depreciated by Fixed Instalment Method at 10% p.a. What would be the value of Machinery Account on 1st April, 2018?

ANSWER:

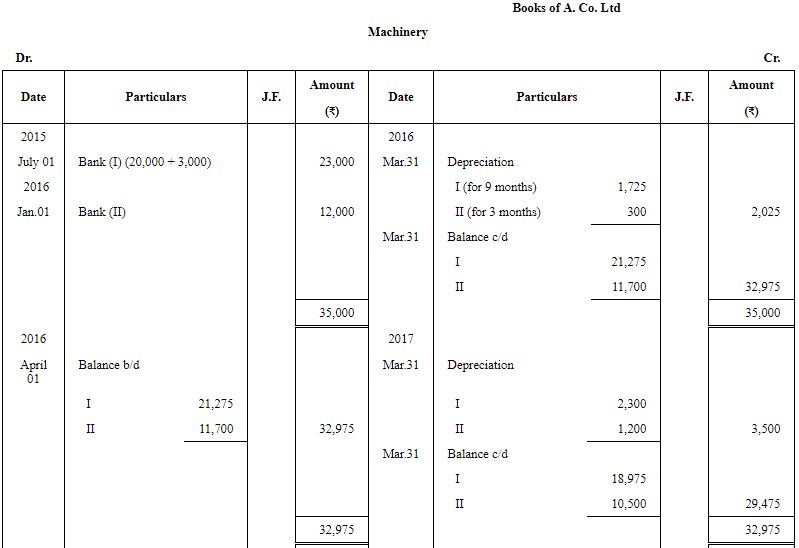

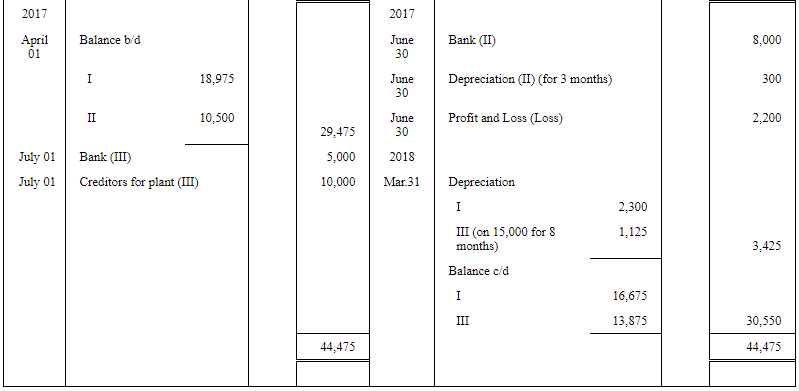

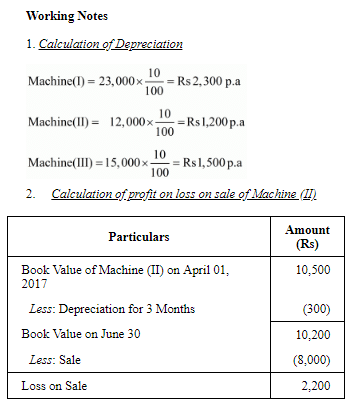

Page No 14.50:

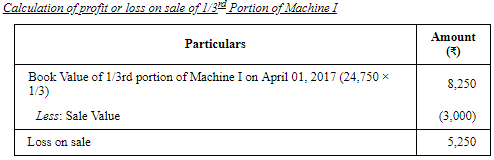

Question 10: On 1st July, 2015, A Co. Ltd. purchases second-hand machinery for ₹ 20,000 and spends ₹ 3,000 on reconditioning and installing it. On 1st January, 2016, the firm purchases new machinery worth ₹ 12,000. On 30th June, 2017, the machinery purchased on 1st January, 2016, was sold for ₹ 8,000 and on 1st July, 2017, a fresh plant was installed.

Payments for this plant was to be made as follows:

Payments in 2018 and 2019 include interest of ₹ 1,000 and ₹ 500 respectively.

The company writes off 10% p.a. on the original cost. The accounts are closed every year on 31st March. Show the Machinery Account for the year ended 31st March, 2018.

ANSWER:

|

64 videos|152 docs|35 tests

|

FAQs on Depreciation - (Part - 2) - Accountancy Class 11 - Commerce

| 1. What is depreciation in commerce? |  |

| 2. How is depreciation calculated? |  |

| 3. What is the significance of depreciation in financial statements? |  |

| 4. Can depreciation be reversed or adjusted in future periods? |  |

| 5. How does depreciation impact taxes? |  |

|

Explore Courses for Commerce exam

|

|