Depreciation - (Part - 4) - Commerce PDF Download

Page No 14.51:

Question 16: Following balances appear in the books of X Ltd. as on 1st April, 2018:

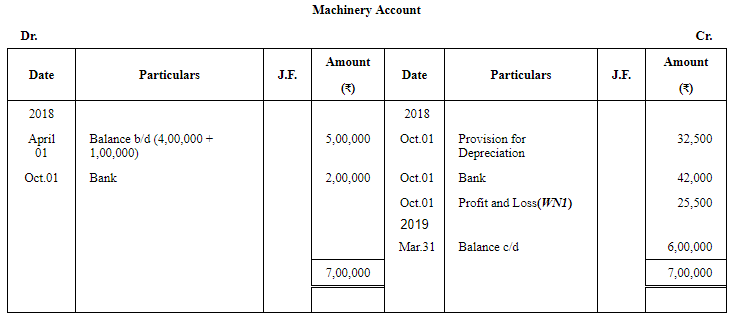

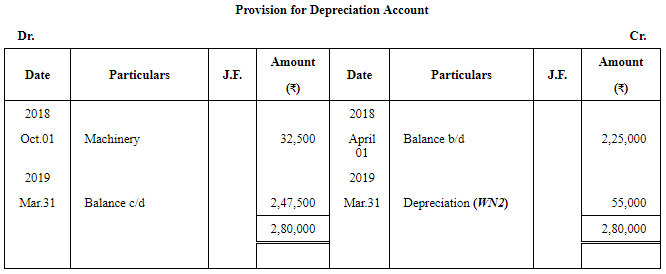

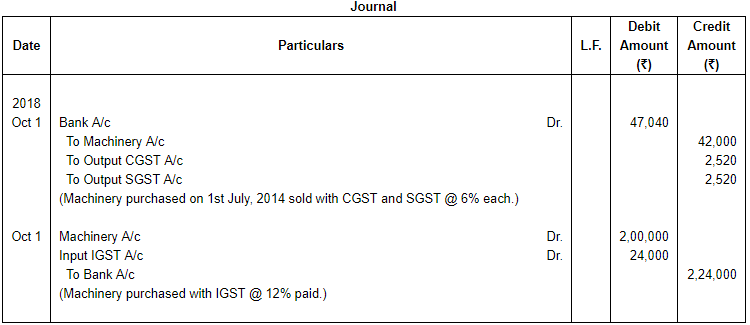

The machinery is depreciated @ 10% p.a. on the Fixed Instalment Method. The accounting year being April-March. On 1st October, 2018, a machinery which was purchased on 1st July, 2015 for ₹ 1,00,000 was sold for ₹ 42,000 plus CGST and SGST @ 6% each and on the same date a new machine was purchased for ₹ 2,00,000 paying IGST @ 12%. Prepare Machinery Account and Provision for Depreciation Account for the year ended 31st March, 2019.

ANSWER:

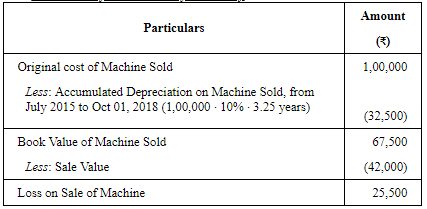

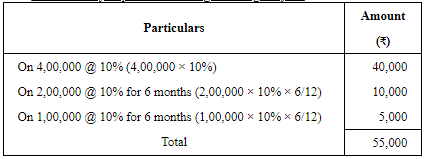

Working Notes:

1 Calculation of Loss on Sale of Machinery

2 Calculation of Depreciation Charged during the year

3. Journal entries for sale and purchase with GST

Page No 14.52:

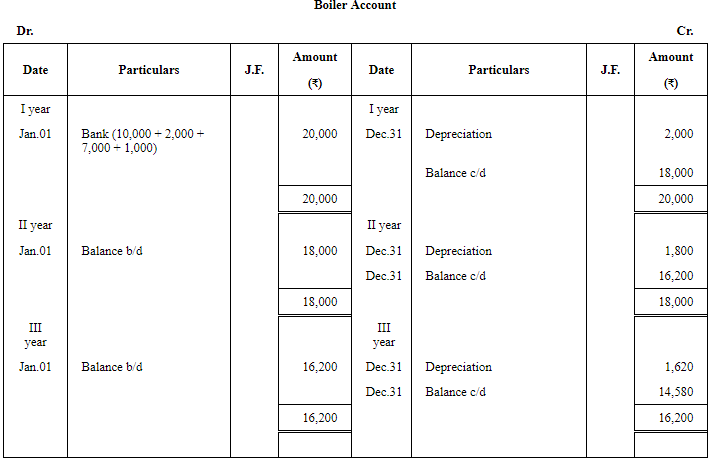

Question 17: A boiler was purchased from abroad for ₹ 10,000. Shipping and forwarding charges ₹ 2,000, Import duty ₹ 7,000 and expenses of installation amounted to ₹ 1,000.

Calculate the Depreciation for the first three years (separately for each year) @ 10% p.a. on Diminishing Balance Method.

ANSWER:

Page No 14.52:

Question 18:

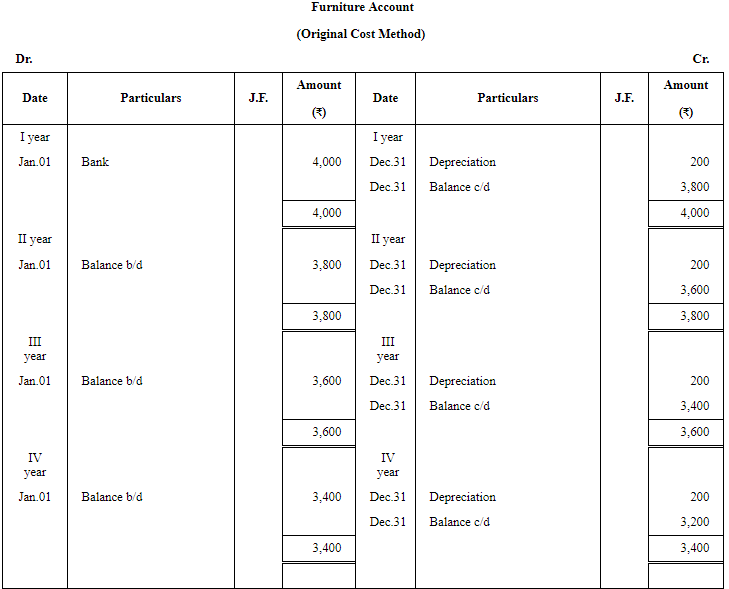

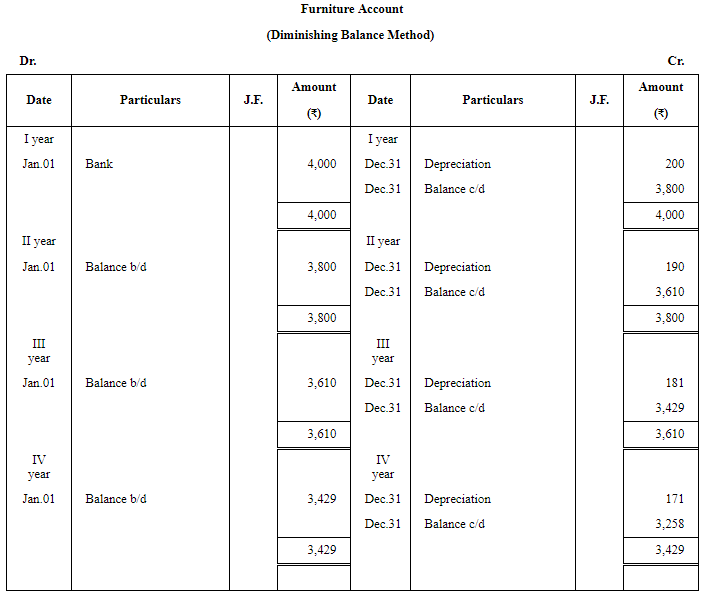

The original cost of furniture amounted to ₹ 4,000 and it is decided to write off 5% on the original cost as Depreciation at the end of each year. Show the Ledger Account as it will appear during the first four years. Show also how the same account will appear if it was decided to write off 5% p.a. on the diminishing balance of the asset each year.

ANSWER:

Page No 14.52:

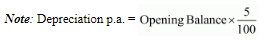

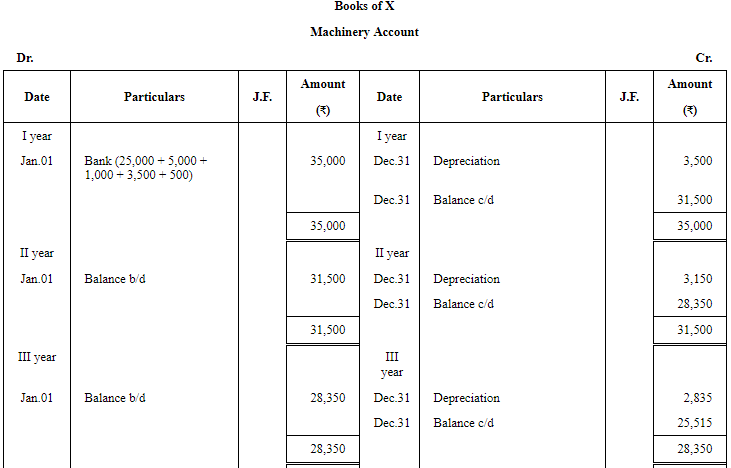

Question 19: Babu purchased on 1st April, 2017, a machine for ₹ 6,000. On 1st October, 2017, he also purchased another machine for ₹ 5,000. On 1st October, 2018, he sold the machine purchased on 1st April, 2017 for ₹ 4,000.

It was decided that Depreciation @ 10% p.a. was to be written off every year under Diminishing Balance Method.

Assuming the accounts were closed on 31st March every year, show the Machinery Account for the years ended 31st March, 2018 and 2019.

ANSWER:

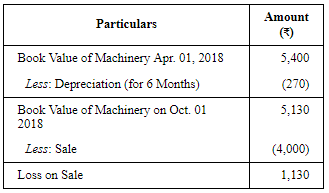

Working Note

Working Note

(1) Calculation of profit or loss on sale of machine:

Page No 14.52:

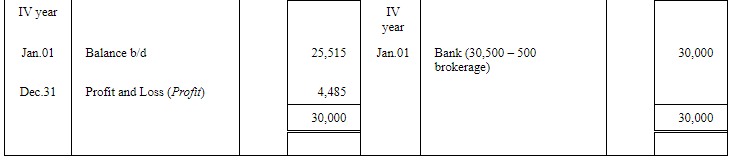

Question 20: X bought a machine for ₹ 25,000 on which he spent ₹ 5,000 for carriage and freight. ₹ 1,000 for brokerage of the middleman, ₹ 3,500 for installation and ₹ 500 for an iron pad. The machine is depreciated @ 10% p.a. on Written Down Value basis. After three years, the machine was sold to Y for ₹ 30,500 and ₹ 500 was paid as commission to the broker through whom the sale was effected. Find out the profit and loss on sale of machine.

ANSWER:

FAQs on Depreciation - (Part - 4) - Commerce

| 1. What is depreciation in commerce? |  |

| 2. How is depreciation calculated? |  |

| 3. What is the purpose of depreciation? |  |

| 4. How does depreciation affect taxes? |  |

| 5. Can depreciation be reversed? |  |