Depreciation - (Part- 5) | Accountancy Class 11 - Commerce PDF Download

Page No 14.52:

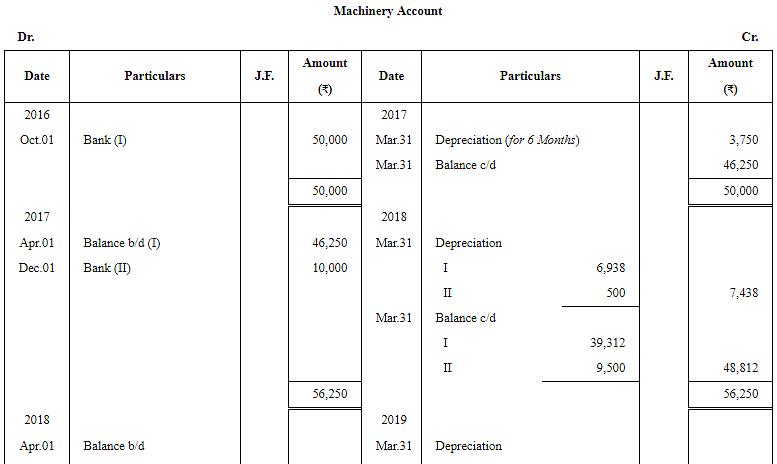

Question 21: A company purchased a machinery for ₹ 50,000 on 1st October, 2016. Another machinery costing ₹ 10,000 was purchased on 1st December, 2017. On 31st March, 2019, the machinery purchased in 2016 was sold at a loss of ₹ 5,000. The company charges depreciation @ 15% p.a. on Diminishing Balance Method. Accounts are closed on 31st March every year. Prepare the Machinery Account for 3 years.

ANSWER:

Working Note

(1) Calculation of profit or loss on sale of machine:

Page No 14.52:

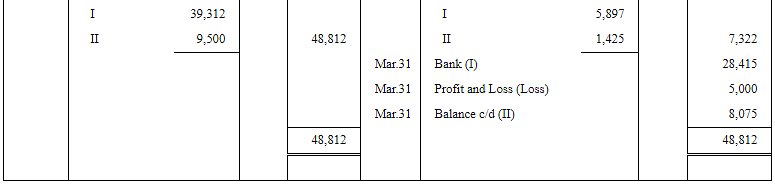

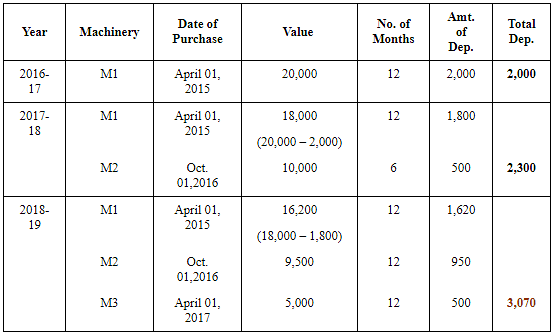

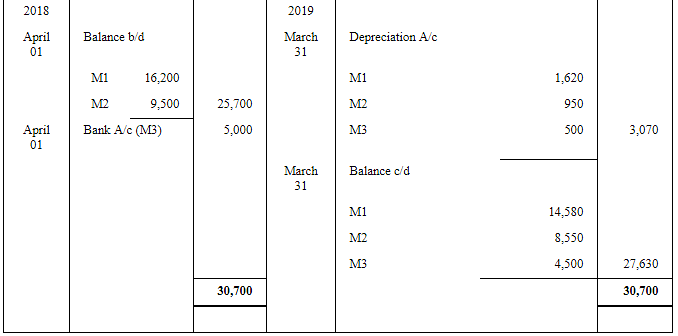

Question 22: On 1st April, 2016, a machinery was purchased for ₹ 20,000. On 1st October, 2017 another machine was purchased for ₹ 10,000 and on 1st April, 2018, one more machine was purchased for ₹ 5,000. The firm depreciates its machinery @ 10% p.a. on the Diminishing Balance Method.

What is the amount of Depreciation for the years ended 31st March, 2017, 2018 and 2019? What will be the balance in Machinery Account as on 31st March, 2019?

ANSWER:

I. Calculation of Depreciation from April 01, 2016 to March 31, 2019

Depreciation Rate: 10% p.a. on Diminishing Balance Method

II. Balance in Machinery Account as on March 31, 2019 will be Rs 27,630

Working Notes: Preparation of Machinery Account

Note: Since the question does not specify to prepare the Machinery Account, thus, it is optional to prepare this account.

Page No 14.53:

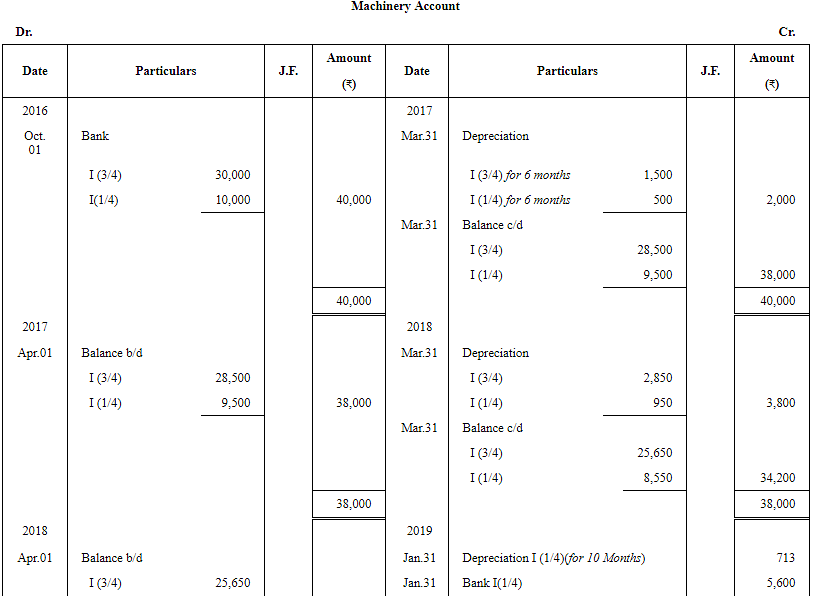

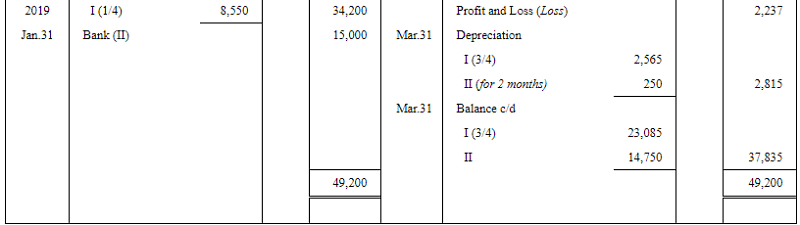

Question 23: M/s. P & Q purchased machinery for ₹ 40,000 on 1st October, 2016. Depreciation is provided @ 10% p.a. on the Diminishing Balance. On 31st January, 2019, one-fourth of the machinery was found unsuitable and disposed off for ₹ 5,600. On the same date new machinery at a cost of ₹ 15,000 was purchased. Write up the Machinery account for the years ended 31st March, 2017, 2018 and 2019. Accounts are closed on 31st March each year.

ANSWER:

Working Note

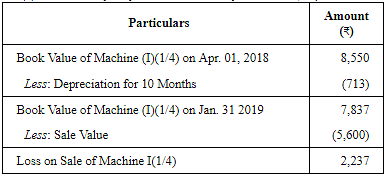

Working Note

(1)Calculation of Profit or Loss on Sale of Machine I (1/4):

Page No 14.53:

Question 24: On 1st October, 2015, Meenal Sharma bought a machine for ₹ 25,000 on which he spent ₹ 5,000 for carriage and freight; ₹ 1,000 for brokerage of the middle-man, ₹ 4,000 for installation. The machine is depreciated @ 10% p.a. on written down value basis. On 31st March, 2018 the machine was sold to Deepa for ₹ 30,500 and ₹ 500 was paid as commission to broker through whom the sales was effected. Find out the profit or loss on sale of machine if accounts are closed on 31st March, every year.

ANSWER:

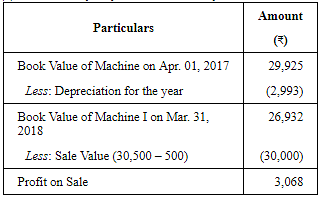

Working Note:

(1) Calculation of Profit or Loss on sale of Machine I:

Page No 14.53:

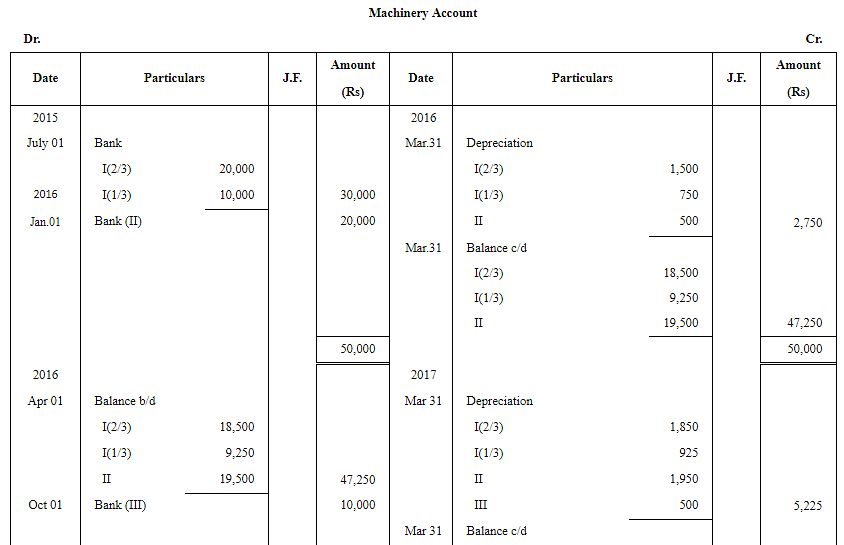

Question 25: A company purchased on 1st July, 2015 machinery costing ₹ 30,000. It further purchased machinery on 1st January, 2016 costing ₹ 20,000 and on 1st October, 2016 costing ₹ 10,000. On 1st April, 2017, one-third of the machinery installed on 1st July, 2015 became obsolete and was sold for ₹ 3,000. The company follows financial year as accounting year.

Show how the Machinery Account would appear in the books of company if depreciation is charged @ 10% p.a. on Written Down Value Method.

ANSWER:

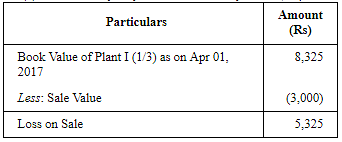

Working Note:

(1) Calculation of Profit or Loss on Sale of Plant I(1/3):

|

82 videos|167 docs|42 tests

|

FAQs on Depreciation - (Part- 5) - Accountancy Class 11 - Commerce

| 1. What is depreciation in commerce? |  |

| 2. How is depreciation calculated? |  |

| 3. What is the impact of depreciation on financial statements? |  |

| 4. Can depreciation be reversed or increased? |  |

| 5. Is depreciation a cash outflow? |  |

|

Explore Courses for Commerce exam

|

|