Disposal of Company Profits - Final Accounts, Advanced Corporate Accounting | Advanced Corporate Accounting - B Com PDF Download

Disposal of Profits

The main goals of a company are to maximise the wealth of its stockholders. Cash created from a successful business operation is typically paid to shareholders in the form of dividends. However, a corporation may opt not to pay a dividend to its shareholders if it would be better to use the profits to increase the firm's value.

It simply means that a corporation can distribute profits in one of two ways: through dividends or by shifting profits to reserve funds/retained earnings.

After accounting for bad and doubtful debts, asset depreciation, and other items that bankers often account for, the corporation may pay a dividend from its net annual profits.

In the process of making dividend decision a company generally consider following factors:

- Transaction cost

- Personal taxation

- Dividend clientele

- Dividend payout ratio

- Dividend cover

- Liquidity

- Divisible profits

- Rate of expansion

- Rate of return

- Stability of earnings

- Stability of dividend

- Legal provisions

- Degree of control and

- Cost of financing

Considering these factors a company can take the decisions regarding dividend. A dividend is generally considered to be a cash payment issued to the holders of company stock. However, there are several types of dividends, some of which do not involve the payment of cash to shareholders.

Some of these are:

- Stock dividend

- Property dividend

- Scrip dividend

- Liquidating dividend

A firm, on the other hand, may opt to hoard its profits. This is especially true for businesses whose sales and earnings are cyclical. An aviation manufacturer, for example, might invest a significant amount of money in building or modernising a plant over the course of a year. It's possible it'll lose money that year. Profits may increase in a few years, when the factory is producing and selling a large number of planes, and the firm will want to store that money to purchase the next factory.

Similarly, a company that intends to expand significantly may reinvest its profits to increase the company's value in the near future. This is frequently seen in technology equities, where acquiring more customers or raising the value of each customer would ideally result in more revenue and profits in the future.

It is also possible for a firm to buy other businesses. This is analogous to putting money into a business. This can be seen in very large corporations, when buying an existing but smaller company is less expensive and easier than starting a new line of business.

Added to these, a company may prefer to retain earning within the company due to the following reasons:

- Financial security of the company

- Expansion activities

- Sources of finance for planned future investment

- Want to maintain/increase working capital

- It is more tax efficient

- To fund pension or remuneration

- Regulatory requirements

- Build up reserves due to concern about future cash flow.

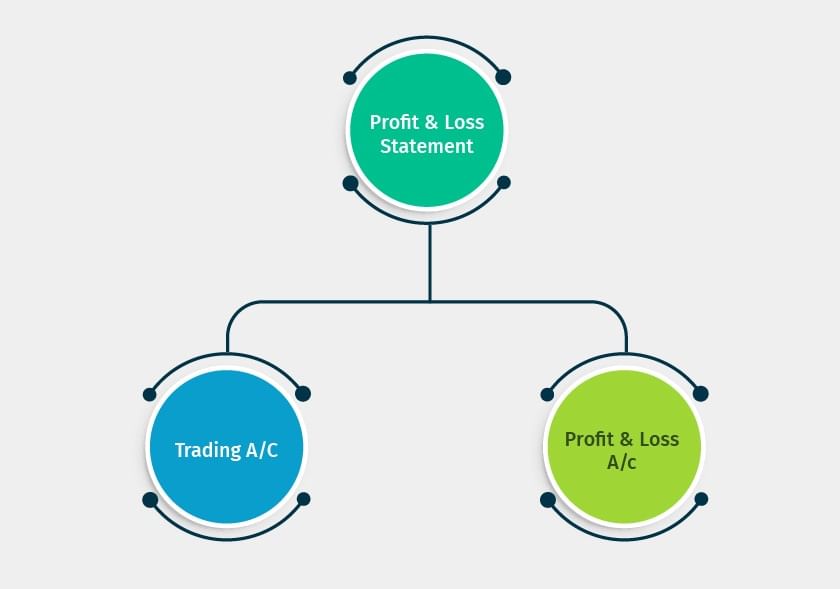

Instruction for Preparing of Profit & Loss Account and balance sheet of a company

- Where compliance with the requirements of the Act including Accounting Standards as applicable to the companies require any change in treatment or disclosure including addition, amendment, substitution or deletion in the head or sub-head or any changes, inter se , in the financial statements or statements forming part thereof, the same shall be made and the requirements of this Schedule shall stand modified accordingly.

- The disclosure requirements specified in this Schedule are in addition to and not in substitution of the disclosure requirements specified in the Accounting Standards prescribed under the Companies Act, 2013. Additional disclosures specified in the Accounting Standards shall be made in the notes to accounts or by way of additional statement unless required to be disclosed on the face of the Financial Statements. Similarly, all other disclosures as required by the Companies Act shall be made in the notes to accounts in addition to the requirements set out in this Schedule.

- (i) Notes to accounts shall contain information in addition to that presented in the Financial Statements and shall provide where required

(a) narrative descriptions or disaggregations of items recognised in those statements; and

(b) information about items that do not qualify for recognition in those statements.

(ii) Each item on the face of the Balance Sheet and Statement of Profit and Loss shall be cross-referenced to any related information in the notes to accounts. In preparing the Financial Statements including the notes to accounts, a balance shall be maintained between providing excessive detail that may not assist users of financial statements and not providing important information as a result of too much aggregation. - (i) Depending upon the turnover of the company, the figures appearing in the Financial Statements may be rounded off as given below:—

- Turnover Rounding off

(a) less than one hundred crore rupees To the nearest hundreds, thousands, lakhs or millions, or decimals thereof.

(b) one hundred crore rupees or more To the nearest lakhs, millions or crores, or decimals thereof.

(ii) Once a unit of measurement is used, it shall be used uniformly in the Financial Statements. - Except in the case of the first Financial Statements laid before the Company (after its incorporation) the corresponding amounts (comparatives) for the immediately preceding reporting period for all items shown in the Financial Statements including notes shall also be given.

- For the purpose of this Schedule, the terms used herein shall be as per the applicable Accounting Standards.

|

89 videos|82 docs|20 tests

|

FAQs on Disposal of Company Profits - Final Accounts, Advanced Corporate Accounting - Advanced Corporate Accounting - B Com

| 1. What is meant by disposal of profits in final accounts? |  |

| 2. What are the different methods of disposal of profits? |  |

| 3. Why is the disposal of profits important for companies? |  |

| 4. How are profits allocated towards reserves in final accounts? |  |

| 5. What is the difference between interim dividends and final dividends? |  |