Dividend Decision: Theories and Policies | Crash Course for UGC NET Commerce PDF Download

| Table of contents |

|

| Dividend Decision Theories |

|

| Theories of Relevance and Irrelevance of Dividend Decision- in Detail |

|

| Dividend Decision Theories and Policies |

|

| Importance of Dividend Policies |

|

Dividend Decision Theories

When it comes to dividend decision theories, it's akin to a family dividing a freshly baked pie, ensuring everyone gets a fair share, much like how companies decide on distributing profits to shareholders.

- Residual Theory of Dividends: Picture this - you've baked a pie, and you've invited some friends over. You want to make sure everyone gets a slice, but you also want to save some for later. This theory is similar. Companies first cover all their expenses and set aside money for future plans, and then distribute the remaining money (the "residual") as dividends. It's like saving some pie for tomorrow.

- Dividend Relevance Theory: Imagine that every time you baked a pie, you made sure to give a slice to your neighbor. Over time, your neighbor starts expecting that slice. The Dividend Relevance Theory suggests that shareholders have similar expectations. When a company consistently pays dividends, shareholders see the company as reliable, like a trustworthy pie-baker who always shares.

- Dividend Irrelevance Theory: Suppose you give a friend the option of having a slice of pie now or the whole pie later. Your friend might not care when they get the pie, as long as they eventually get it. The Dividend Irrelevance Theory, proposed by clever economists Modigliani and Miller, says the same thing about dividends. It doesn't matter whether a company pays dividends now or reinvests the profits for future growth, as long as shareholders get their returns in the end.

- Bird-in-the-Hand Theory: Have you heard the saying, "A bird in the hand is worth two in the bush?" This theory applies that idea to dividends. Shareholders often prefer the certainty of getting dividends now rather than the possibility of higher returns in the future. It's like choosing to enjoy a slice of pie today instead of waiting for a bigger pie that might or might not come later.

Theories of Relevance and Irrelevance of Dividend Decision- in Detail

Theories of Relevance

The theories of relevance emphasize the significance of how profits are distributed, particularly through dividend payments, within a company.

- Dividend Relevance Theory: This theory can be likened to promising friends a portion of the profits from a lemonade stand each day. By consistently sharing profits, similar to paying dividends regularly, trust and satisfaction among shareholders increase. Companies that maintain a steady dividend payment are perceived as stable and reliable, thereby attracting more investments.

- Bird-in-the-Hand Theory: Imagine offering friends a choice between receiving a portion of today's profits or waiting for a larger share in the future. Most would opt for immediate gains as it's a guaranteed benefit. Similarly, this theory suggests that shareholders prefer current dividends over potential future returns, emphasizing the value of present income.

Theories of Irrelevance

In contrast, theories of irrelevance argue that the method of profit distribution holds little significance as long as the business remains profitable.

Dividend Policy Irrelevance Theory: This concept posits that the dividend policy of a company has no impact on its valuation. Investors are indifferent between receiving dividends or reinvesting profits into the business, assuming the investment opportunities are equivalent.

Dividend Decision Theories and Policies

Imagine a company as a big fruit tree. At the end of the season (or year), the tree has some fruit (profits). Now, the tree's caretaker (the company) has to decide how many fruits to give away to the people who own parts of the tree (shareholders) and how many to keep to grow the tree even bigger.

Dividend Theories

- Does it even matter? (Dividend Irrelevance Theory): Modigliani and Miller propose that whether a company distributes profits as dividends now or reinvests to grow for future dividends, the total return to shareholders remains the same over time.

- It totally matters! (Dividend Relevance Theory): Some argue that consistent dividend payouts build trust among investors, making the company seem reliable and attracting more ownership interest.

- A fruit now is better than two fruits later (Bird-in-the-Hand Theory): This theory suggests that investors prefer immediate dividends over potential future gains, as they value certainty and current income.

- Leftovers (Residual Theory of Dividends): Companies following this approach distribute dividends from what remains after essential business expenses, investments, and growth initiatives have been addressed.

Dividend Policies (How companies decide to share or keep the fruits)

- Regular Sharing (Regular Dividend Policy): Imagine a tree that consistently provides the same amount of fruit regardless of the season. It's reliable and predictable, which is appreciated by many people.

- Percentage Play (Stable Dividend Policy): In this scenario, the tree promises to give, for instance, half of its fruits. During abundant seasons, shareholders receive more, and during lean times, they receive less. However, they always receive their agreed-upon share.

- Whenever I Feel Like It (Irregular Dividend Policy): This type of tree might bear fruit sporadically, with no set pattern. It all depends on the tree's mood and the prevailing circumstances.

- Saving for Growth (No Dividend Policy): Envision a young tree that saves all its fruit to foster growth and strength. Similarly, companies in their early stages often reinvest all profits to expand and solidify their position in the market.

Importance of Dividend Policies

How a company distributes its profits is crucial for maintaining the company's health, keeping shareholders content, and planning for the future. Balancing these elements is akin to a juggling act, and these theories and policies aid companies in determining the most suitable approach.

Conclusion

When it comes to sharing profits (or dividends), there's no one-size-fits-all approach for companies. It's a bit like a family deciding how to spend their money - some might save for a big vacation, while others might buy something nice every month. Just like that, some companies share their profits regularly, while others might keep them for growing the business or only share when there's extra. There are different theories about what's best, but it really depends on the company's situation, what its shareholders prefer, and what the company wants for its future. It's all about finding the right balance between keeping the business healthy, keeping the shareholders happy, and planning for what's coming up next. It's a tough decision, but a crucial one, and these dividend theories and policies are tools that can help companies make it.

|

237 videos|236 docs|166 tests

|

FAQs on Dividend Decision: Theories and Policies - Crash Course for UGC NET Commerce

| 1. What is the Dividend Irrelevance Theory? |  |

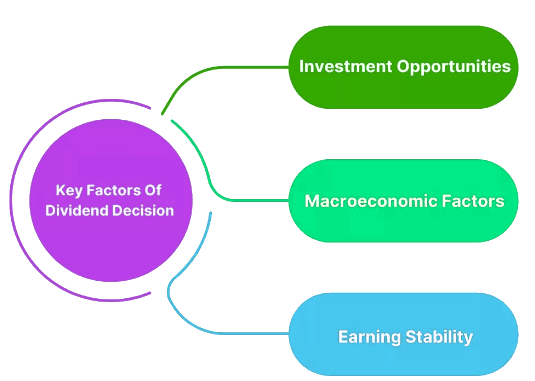

| 2. What are some factors that influence dividend decisions according to the article? |  |

| 3. What are some common dividend policies followed by companies? |  |

| 4. How does the Dividend Irrelevance Theory impact a company's decision-making process? |  |

| 5. How can companies determine the most appropriate dividend policy for their specific situation? |  |