Economic Development: February 2022 Current Affairs | Indian Economy for State PSC Exams - BPSC (Bihar) PDF Download

1. MGNREGA:

Context: As per the latest economic survey:

- Demand for work under MGNREGA scheme has dropped from the peak of the first lockdown, but is still higher than pre-COVID levels.

- The highest demand for work under the scheme was seen in States which are usually the destination of migrant workers, rather than source States.

What's the issue?

- Advocates for rural workers have argued that the drop in demand is due to funding constraints, and urged a significant increase in allocations for the scheme in Union budget.

- The Centre had infused ₹40,000 crore worth of additional funding early in the first lockdown.

- However, additional funding was not available until late in the year when many States had already run out of money, forcing an artificial suppression in demand on the ground.

About MGNREGA: The scheme was introduced in 2005 as a social measure that guarantees “the right to work”.

- The key tenet of this social measure and labour law is that the local government will have to legally provide at least 100 days of wage employment in rural India to enhance their quality of life.

Key objectives:

- Generation of paid rural employment of not less than 100 days for each worker who volunteers for unskilled labour.

- Proactively ensuring social inclusion by strengthening the livelihood base of rural poor.

- Creation of durable assets in rural areas such as wells, ponds, roads and canals.

- Reduce urban migration from rural areas.

- Create rural infrastructure by using untapped rural labour.

Sustainable Development Goal

Sustainable Development Goal

The following are the eligibility criteria for receiving the benefits under MGNREGA scheme:

- Must be Citizen of India to seek MGNREGA benefits.

- Job seeker has completed 18 years of age at the time of application.

- The applicant must be part of a local household (i.e. application must be made with local Gram Panchayat).

- Applicants must volunteer for unskilled labour.

Implementation of the scheme:

- Within 15 days of submitting the application or from the day work is demanded, wage employment will be provided to the applicant.

- Right to get unemployment allowance in case employment is not provided within fifteen days of submitting the application or from the date when work is sought.

- Social Audit of MGNREGA works is mandatory, which lends to accountability and transparency.

- The Gram Sabha is the principal forum for wage seekers to raise their voices and make demands.

- It is the Gram Sabha and the Gram Panchayat which approves the shelf of works under MGNREGA and fix their priority.

2. Highlights of the Union Budget 2022

Finance minister Nirmala Sitharaman on February 1 presented a budget worth Rs 39.45 lakh crore with massive push to infrastructure spending.

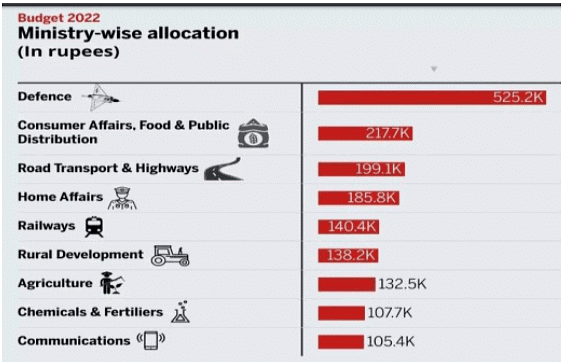

Ministry wise Allocation

Ministry wise Allocation

Note: Know about budget, what it means, related constitutional provisions and presentation stages here.

Now, highlights of the 2022 budget: Total spending and Focus:

- To enhance job creation and boost economic activity.

- Total government spending will be 4.6 per cent more than the current year and additional support of Rs 1 lakh crore to states has been announced.

- The total expenditure in 2022-23 is estimated at Rs 39.45 lakh crore, while the total receipts other than borrowings are estimated at Rs 22.84 lakh crore.

- The outlay for capital expenditure is once again being stepped up sharply by 35.4 per cent from Rs 5.54 lakh crore in the current year to Rs 7.50 lakh crore in 2022-23.

Few observations about the State of the economy:

- The government projects India's economy to grow by 9.2 per cent in the current fiscal year.

- India's gross domestic product (GDP) in dollar terms has already crossed $3 trillion.

- Fiscal deficit is projected to be higher at 6.9 per cent this fiscal as against 6.8 per cent estimated earlier. The fiscal deficit of the government for 2022-23 is estimated to be Rs 16,61,196 crore.

- Soaring inflation levels continue to be a cause of concern for the economy.

- Foreign exchange reserves stood at $634.287 billion on January 21, providing a cover equivalent to 13 months of imports projected for 2021-22.

What's in the budget for infrastructure development?

- PM GatiShakti National Master Plan will encompass the seven engines for economic transformation, seamless multimodal connectivity and logistics efficiency.

- The seven engines include roads, railways, airports, ports, mass transport, waterways, and logistics infrastructure. All seven engines will pull forward the economy in unison.

- 400 new Vande Bharat trains will be introduced and the Railways will also develop new products for small farmers and MSMEs.

- Integration of postal and railways network facilitating parcel movement was announced.

- Master plan has been formulated for highways, targets to complete 25,000 km national highways in 2022- 23.

- Sovereign Green Bonds to be issued for mobilizing resources for green infrastructure.

- Data Centres and Energy Storage Systems to be given infrastructure status.

Agriculture and food processing:

- Budget allocation for the ministry of agriculture and farmers' welfare: Rs 1,32,513 crore for 2022-23 fiscal.

- 'Kisan Drones' to be promoted for crop assessment, digitisation of land records and spraying of insecticides.

- A fund with blended capital raised under the co-investment model through Nabard will be set up to finance startups and rural enterprises working in agri-space.

- Zero-budget natural farming: The agriculture universities in the country will be encouraged to include these areas in their syllabus.

Education:

- A Digital University would be established to provide access to students across the country for world-class quality universal education.

- One class one TV channel programme to be expanded to 200 TV channels.

- Virtual labs and skilling e-labs will be established to promote critical thinking skills and simulated learning environment.

- The Digital Ecosystem for Skilling and Livelihood - the DESH-Stack e-portal would be launched.

Healthcare

The health sector has been allocated Rs 86,200.65 crore in the Union Budget.

- A National Tele Mental Health Programme will be launched to improve access to quality mental health counselling and care services.

- An open platform for National Digital Health Ecosystem will also be rolled out.

- For the National Health Mission, the budget allocation increased from Rs 36,576 crore in 2021-22 to Rs 37,000 crore in 2022-23.

Tax proposals

- Taxpayers have been allowed a one-time window to correct omissions in income tax returns (ITR). They can file the updated returns within 2 years from the assessment year.

- 30 per cent tax on income from transfer of virtual digital assets has been proposed.

- One per cent tax deducted at source (TDS) on transfer of virtual assets above a threshold, gifts would be taxed.

- Government will soon roll out digital rupee based on blockchain technology.

Boost for MSMEs

- A Raising and Accelerating MSME Performance (RAMP) programme will be rolled out with a Rs 6,000 crore outlay spread over 5 years for MSMEs.

- The Emergency Credit Line Guarantee Scheme (ECLGS) that provided much needed additional credit to over 1.3 crore MSMEs will be extended till March 2023 with its guarantee cover expanded by Rs 50,000 crore to Rs 5 lakh crore.

Prime Minister's Development Initiative for North-East (PM-DevINE)

- New scheme PM-DevINE launched to fund infrastructure and social development projects in the North-East.

- An initial allocation of Rs. 1,500 crore made to enable livelihood activities for youth and women under the scheme.

3. SWAMITVA scheme

Context: The government has said that it plans to prepare digital maps of all its 6,00,000 villages and pan-India 3D maps will be prepared for 100 cities under SVAMITVA scheme.

- So far drone surveys have covered close to 1,00,000 villages and maps of 77,527 villages had been handed over to states.

- Property cards had been distributed to around 27,000 villages.

Overview and key features of the SVAMITVA (Survey of Villages and Mapping with Improvised Technology in Village Areas) Yojana’: Launched on Panchayati Raj Diwas (April 24th, 2020). Last year, it was extended to all states. Earlier, it was launched only for 9 states. - The scheme seeks to map residential land ownership in the rural sector using modern technology like the use of drones.

- The scheme aims to revolutionize property record maintenance in India.

- The scheme is piloted by the Panchayati Raj ministry.

- Under the scheme, residential land in villages will be measured using drones to create a non-disputable record.

- Property card for every property in the village will be prepared by states using accurate measurements delivered by drone-mapping. These cards will be given to property owners and will be recognised by the land revenue records department.

Benefits of the scheme:

- The delivery of property rights through an official document will enable villagers to access bank finance using their property as collateral.

- The property records for a village will also be maintained at the Panchayat level, allowing for the collection of associated taxes from the owners. The money generated from these local taxes will be used to build rural infrastructure and facilities.

- Freeing the residential properties including land of title disputes and the creation of an official record is likely to result in appreciation in the market value of the properties.

- The accurate property records can be used for facilitating tax collection, new building and structure plan, issuing of permits and for thwarting attempts at property grabbing. Need for and significance of the scheme: The need for this Yojana was felt since several villagers in the rural areas don’t have papers proving ownership of their land. In most states, survey and measurement of the populated areas in the villages has not been done for the purpose of attestation/verification of properties. The new scheme is likely to become a tool for empowerment and entitlement, reducing social strife on account of discord over properties.

4. Farm loan waiver

Context: The Congress manifesto for the UP polls promises waiver of farm loans within 10 days of coming to power and a subquota for the most backward classes (MBCs) within the other backward classes (OBC) quota to ensure maximum benefits, if voted to office Uttar Pradesh.

Background: To help the farm sector, state governments have time and again announced loan waiver schemes. Back in 2008-09, the then UPA government at the Centre had announced a loan waiver scheme for the entire country. States like Madhya Pradesh, Chhattisgarh and others have announced similar schemes in the recent past.

Drawbacks of loan waivers:

- Firstly, it covers only a tiny fraction of farmers. The loan waiver as a concept excludes most of the farm households in dire need of relief and includes some who do not deserve such relief on economic grounds.

- Second, it provides only a partial relief to the indebted farmers as about half of the institutional borrowing of a cultivator is for non-farm purposes.

- Third, in many cases, one household has multiple loans either from different sources or in the name of different family members, which entitles it to multiple loan waiving.

- Fourth, loan waiving excludes agricultural labourers who are even weaker than cultivators in bearing the consequences of economic distress.

- Fifth, it severely erodes the credit culture, with dire long-run consequences to the banking business.

- Sixth, the scheme is prone to serious exclusion and inclusion errors, as evidenced by the Comptroller and Auditor General’s (CAG) findings in the Agricultural Debt Waiver and Debt Relief Scheme, 2008.

- Lastly, schemes have serious implications for other developmental expenditure, having a much larger multiplier effect on the economy.

What needs to be done?

Proper identification: For providing immediate relief to the needy farmers, a more inclusive alternative approach is to identify the vulnerable farmers based on certain criteria and give an equal amount as financial relief to the vulnerable and distressed families.

Enhance non- farm income: The sustainable solution to indebtedness and agrarian distress is to raise income from agricultural activities and enhance access to non-farm sources of income. The low scale of farms necessitates that some cultivators move from agriculture to non-farm jobs. Improved technology, expansion of irrigation coverage, and crop diversification towards high-value crops are appropriate measures for raising productivity and farmers’ income. All these require more public funding and support.

Observations made by RBI: As per RBI, loan waivers not only inhibit investment in the farm sector but put pressure on the fiscal of states which undertake farm loan waiver.

In every state election during the last five years, loan waiver promise made by one political party or other. Also, loan waivers, as the RBI has repeatedly argued, vitiate the credit culture, and stress the budgets of the waiving state or central government.

Way ahead

The magic wand of a waiver can offer temporary relief, but long-term solutions are needed to solve farmer woes. There are many dimensions of the present agrarian crisis in India. The search for a solution therefore needs to be comprehensive by taking into consideration all the factors that contribute to the crisis. Furthermore, both short- and long-term measures are required to address the numerous problems associated with the agrarian crisis.

5. World Food Programme

Context: India signed an agreement with the United Nation’s World Food Programme (WFP) for the distribution of 50,000 MT of wheat that it has committed to sending Afghanistan as part of a humanitarian assistance.

- According to the MoU, the wheat will be taken through Pakistan to the Afghan border crossing and handed over to WFP officials in Kandahar beginning February 22.

- The wheat will eventually be divided into five batches of 10,000 MT, to be distributed across the country on approximately 200 trucks that are run by WFP.

What is UN WFP?

The World Food Programme (WFP) is the food assistance branch of the United Nations and the world’s largest humanitarian organization addressing hunger and promoting food security. Born in 1961, the WFP strives to eradicate hunger and malnutrition, with the ultimate goal in mind of eliminating the need for food aid itself. It is a member of the United Nations Development Group and part of its Executive Committee.

- WFP food aid is also directed to fight micronutrient deficiencies, reduce child mortality, improve maternal health, and combat disease, including HIV and AIDS.

- What is “World Hunger Map”? Alibaba Cloud, the cloud computing arm of Alibaba is working with WFP to develop digital “World Hunger Map”.

- The map will help to monitor global hunger and operations to end scourge by 2030 which is one of UN’s key Sustainable Development goals.

- It also aims to boost efficiency of interventions and shorten emergency response times

6. Pradhan Mantri Fasal Bima Yojana:

Context: The Pradhan Mantri Fasal Bima Yojana (PMFBY) has successfully entered its seventh year of implementation with the upcoming Kharif 2022 season, completing six years of its implementation since its announcement on 18 February 2016.

Meri Policy Mere Hath to be launched:

- As part of the celebrations, the Govt. has launched a doorstep distribution drive to deliver crop insurance policies to the farmers ‘Meri Policy Mere Hath’ in all implementing States.

- The campaign aims to ensure all farmers are well aware and equipped with all information on their policies, land records, the process of claim and grievance redressal under PMFBY.

Performance of PMFBY:

- Till date, the scheme has insured over 30 crore farmer applications (5.5 crore farmer applications on year-on-year basis).

- Over the period of 5 years, more than 8.3 crore farmer applications have benefited from the scheme.

- Moreover, Rs.95,000 crores claims have been paid as against Rs. 20,000 crore farmers share.

About Pradhan Mantri Fasal Bima Yojana:

- It is in line with the One Nation – One Scheme theme- It replaced National Agricultural Insurance Scheme (NAIS) and Modified National Agricultural Insurance Scheme (MNAIS).

- Launched in 2016.

- Coverage: All food & oilseed crops and annual commercial/horticultural crops for which past yield data is available.

- Premium: The prescribed premium is 2% to be paid by farmers for all Kharif crops and 1.5% for all rabi crops. In the case of annual commercial and horticultural crops, the premium is 5%.

Objectives:

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crops as a result of natural calamities, pests & diseases.

- To stabilise the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure flow of credit to the agriculture sector. Coverage: The Scheme covers all Food & Oilseeds crops and Annual Commercial/Horticultural Crops for which past yield data is available and for which requisite number of Crop Cutting Experiments (CCEs) are being conducted under General Crop Estimation Survey (GCES).

PMFBY to PMFBY 2.0 (overhauled PMFBY):

- Completely Voluntary: It has been decided to make enrolment 100% voluntary for all farmers from 2020 Kharif.

- Limit to Central Subsidy: The Cabinet has decided to cap the Centre’s premium subsidy under these schemes for premium rates up to 30% for unirrigated areas/crops and 25% for irrigated areas/crops.

- More Flexibility to States: The government has given the flexibility to states/UTs to implement PMFBY and given them the option to select any number of additional risk covers/features like prevented sowing, localised calamity, mid-season adversity, and post-harvest losses.

- Penalising the Pendency: In the revamped PMFBY, a provision has been incorporated wherein if states don’t release their share before March 31 for the Kharif season and September 30 for rabi, they would not be allowed to participate in the scheme in subsequent seasons.

- Investing in ICE Activities: Insurance companies have to now spend 0.5% of the total premium collected on information, education and communication (IEC) activities.

|

136 videos|423 docs|144 tests

|

FAQs on Economic Development: February 2022 Current Affairs - Indian Economy for State PSC Exams - BPSC (Bihar)

| 1. What is economic development? |  |

| 2. What are the key indicators of economic development? |  |

| 3. How does economic development impact a country's population? |  |

| 4. What are the main drivers of economic development? |  |

| 5. What are the challenges faced in achieving economic development? |  |