Economic Development: January 2022 Current Affairs | Indian Economy for State PSC Exams - BPSC (Bihar) PDF Download

Inland Waterways Opportunities, Challenges and Strategies

India has approximately 14,500 km of navigable waterways which comprise of rivers, canals, backwaters, creeks, etc. Navigable waterways are a fuel-efficient, environment friendly and cost-effective mode of transport. Despite the inherent advantages, the share of Inland waterway transport (IWT) in India is currently estimated to be only around 2% in comparison to 35% in Bangladesh and 20% in Germany.

Benefits of Inland Waterways

- Reduce Logistics Cost: According to World Bank, the cost of transporting one tonne freight over 1 km by waterway is Rs 1.19 compared with Rs 2.28 and Rs 1.41 by road and rail, respectively. The inland waterways can reduce the logistics cost (12-14% of GDP) and bring it on par with the global standards (8- 10% of GDP).

- Lower Investment: Development cost of inland waterway is only 5-10% in comparison to road and railways.

- Greater Fuel Efficiency: One litre of fuel moves 24 tonne - km on road, 95 tonne-km on rail and 215 tonne-km on IWT.

- Low Maintenance Cost: 30% lower than the railways and 60% lower than road.

- Environment friendly:

• Fifty percent lower carbon dioxide emissions in comparison to Roads.

• Negligible land requirement.

• Safe mode for hazardous cargo. - Streamline Infrastructure:

• Reduces pressure on Roads and Railways.

• Provide for carriage of vehicles in the form of roll-onroll-off mode.

• Easy integration of the IWT with the sea transport.

• Safe and less risky in comparison to other modes. - Socio-economic development: IWT provides benefits in terms of trade and access to markets, enhance local community’s economic engagement, promote ecotourism and boost employment opportunities. Example, Arth Ganga has potential to promote sustainable development with a focus on economic activities along river Ganga.

Initiatives for Boosting Inland Waterways

- Inland Waterways Authority of India (IWAI): Statutory authority created under the Inland Waterways Authority of India (IWAI) Act, 1985 for regulation and development of Inland Waterways.

- National Inland Navigation Institute (NINI): Setup by IWAI to develop human resources for Inland Water Transport sector

- National Waterways Act, 2016: Under this act, Parliament has declared 111 National Waterways which cover a total length of 20300 Kms and spread across 24 States.

- Sagarmala Program: Promote port-led development through 14,500 km of potentially navigable waterways

- Jal Marg Vikas Project (JMVP): Capacity augmentation of navigation on National Waterway-1with the technical and financial assistance of the World Bank.

- Arth Ganga for holistic and sustainable development of National Waterways-1 for freight, passenger movement and recreation purpose.

- Central Road and Infrastructure Fund (CRIF): Set up under the CRIF Act, 2000 and administered by Finance Ministry. The money for this fund is raised through the cess on petrol and high-speed diesel. The fund can be used for various social and physical infrastructure projects, including inland water transport.

- Inland Vessels Act, 2021: Replace separate rules framed by states with a uniform regulatory framework for inland vessel navigation. It calls for maintaining centralised record of data on inland vessels, which will include all information about registration of vessels, vessel crew and certificates issued.

- Promoting private participation in terminal operations and maintenance.

- International Cooperation such as Kaladan Multimodal Transit Transport Project, Treaty of Transit between India and Nepal, agreement between India and Bangladesh for use Chaogram and Mongla Ports for transit movement of Indian Goods.

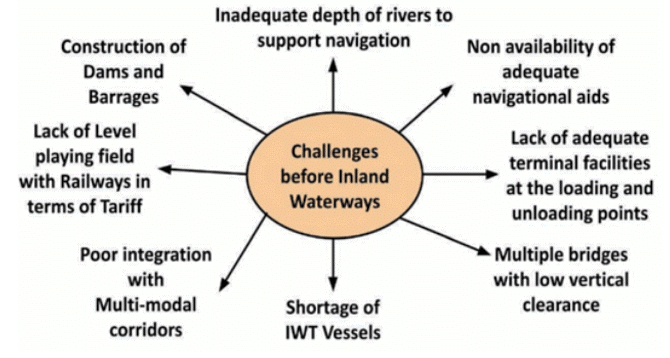

Constraints and Strategies

India has increased the modal share of cargo from 0.5% to 2% and has witnessed 20% year-on-year growth in cargo volumes over the last 5 years. However, the share of IWT has remained quite lower at 2% in comparison to 35% in Bangladesh and 20% in Germany.

The inland waterways are cost-effective, fuel-efficient, and safe and secure mode of transportation for goods and passenger. Going forward, Government's initiatives must be implemented efficiently to realise full potential of Inland water transport.

2. Price Support Vs Income Support: Way Forward for Agriculture?

The recent demand of farmers for the legalization of MSP has been turned down on account of being financially imprudent and hurting the long-term interests of the farmers and Indian agriculture. In this regard, different alternatives have been proposed, which mainly center around either Price Deficiency payment mechanism or Income support mechanism. Some of the economists have highlighted that the Government can compensate the farmers through direct benefits transfer if they sell agricultural produce below the MSP. This is like Price deficiency Payment system (PDPS) which is a component of PM-AASHA scheme. On the other hand, certain economists have highlighted that Price Deficiency payment mechanism has number of inherent flaws and instead adopt income support mechanism such as PM-KISAN.

In this regard, we will focus on the following on the following dimensions:

- Critical Analysis of PM-AASHA- Features, Benefits and Challenges

- Challenges with Price Deficiency Payment mechanism

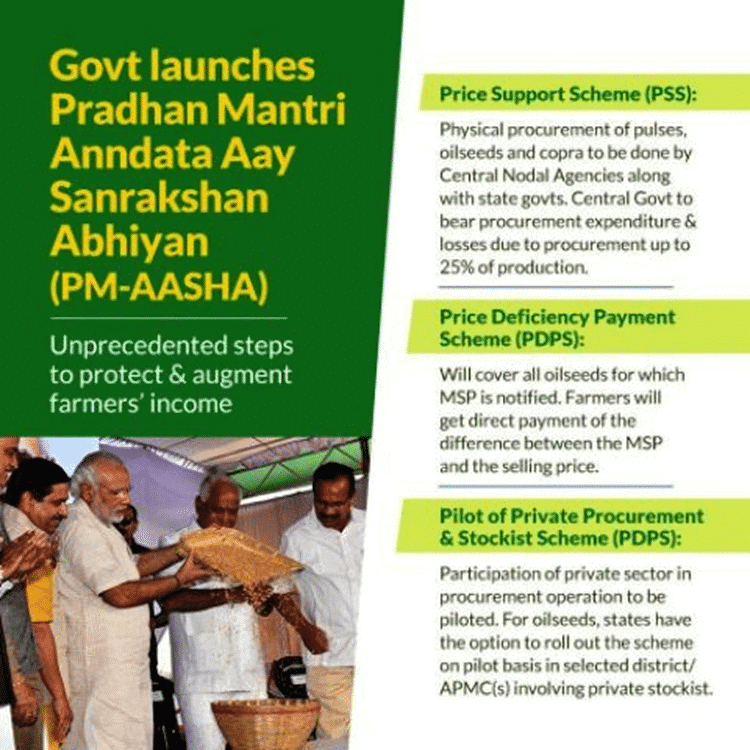

- Way forward ABOUT PM-AASHA SCHEME The PM-AASHA scheme aims to incentivize the farmers to produce oilseeds, pulses, and Copra by offering them remunerative prices on these crops.

PM-AASHA

PM-AASHA

Is It Feasible to Provide for Price Deficiency Payment System (PDPS) In Place of Legalization of MSP?

Price Deficiency Payment System (PDPS) can address some of the distortions created by the MSP regime. Some of the benefits include:

- Encourage farmers to undertake agricultural diversification towards other crops such as Oilseeds and Pulses.

- Benefit even the small and marginal farmers throughout India

- Reduce the need to undertake physical procurement and hence reduce transportation and storage costs.

- Reduce burgeoning food subsidy bill. Because of these benefits, the NITI Aayog's 3-year Action Agenda (2017-2020) argued in favour of PDPS. However, PDPS would face number of constraints and challenges: Does not address the core problem of mismatch between MSP and Market Price: Presently, the MSP is determined based upon factors of production i.e. A2 + FL approach. This approach considers various input costs such as Seeds, fertilizers, Labour etc. as well as implied cost of family labour. However, the market price of the commodities is based upon the demand and supply. Because of this, there is mismatch between MSP and Market prices.

- Issue in Price Deficiency Payment System (PDPS): As seen, such a scheme has already failed in MP on account of low registration of farmers, delays in transfer of money and unfair collusion between farmers and traders. Several economists have highlighted that such a mechanism would end up benefitting the traders more than the farmers. Financial Burden: According to a study conducted by ICRIER in 2018, implementation of PDPS at national level would need around Rs 1.6 lakh crores on an annual basis. Does not address structural problems of Indian Agriculture i.e., poor marketing infrastructure.

- Violation of WTO Agreement on Agriculture (AoA): PDPS would further violate the limit on the subsidies under Agreement on Agriculture (AoA) and it can be challenged by other countries. India's quest for Permanent solution on public stockholding could be in jeopardy.

Way Forward

Indian agriculture needs income support rather than price support. Price support to the farmers in the form of MSP ends up distorting the market. Hence, the Government should focus on providing higher income support to the farmers in the form of PM-KISAN Scheme. The higher income support would help us reduce the input costs in agriculture, enhance productivity and hence double farmers' income.

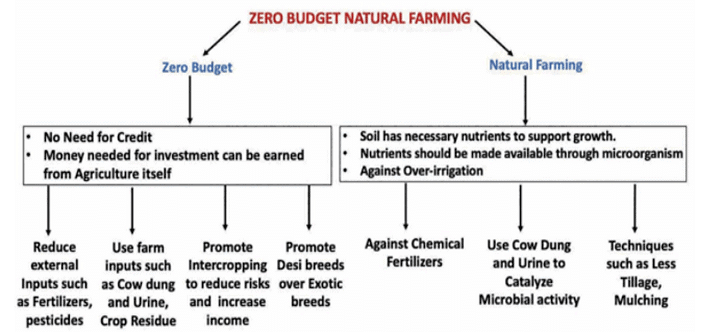

3. Zero Budget Natural Farming (ZBNF): A Game Changer for Doubling Farmers’ Income?

Soil has all the necessary nutrients which could be made available through the intermediation of microorganisms; Against chemical fertilizers; low cost, low level of inputs and limited reliance on externally purchased inputs.

Four Pillars of ZBNF

- Jivamrita/jeevamrutha: Fermented microbial culture prepared using cow dung and urine to provides nutrients to the soil, acts as a catalytic agent to promote the activity of microorganisms in the soil.

- Bijamrita/beejamrutha: Protection of the young roots from various diseases through cow dung and urine.

- Acchadana: Mulching: Less Tilling; Covering soil surface with Crop residue

- Whapasa (Moisture): It challenges the basic notion that plants need more amount of water and instead focuses on conservation of soil moisture and promoting less irrigation.

- Other important pillars are- Intercropping, Rainwater harvesting, Revival of the soils through earthworms etc.

Government's Initiatives to Promote ZBNF

Under the RKVY-RAFTAAR and Paramparagat Krishi Vikas Yojana, States have been allowed to use certain percentage of funds to promote the ZBNF.

Benefits of Zero Budget Natural Farming

- Reduce the input costs responsible for present agrarian distress.

- Reduce the dependence of the farmers on the credit responsible for the debt trap.

- Enhancement in the soil fertility.

- Optimum utilization of water and reduce water consumption (85%)

- Promote diversification of the agriculture- towards other crops and towards livestock rearing. This can also lead to reduction in the risks and enhance nonfarm income.

- Enhance the farmers’ income in the long term.

Challenges and Concerns

A group of agricultural experts from the National Academy of agricultural sciences (NAAS) have questioned ZBNF on multiple grounds.

- Low Awareness among Farmers: ZBNF is knowledge intensive and hence requires training.

- Lack of Empirical Evidence: Lack of independent and scientific studies to validate the claim that the yields through the ZBNF are much higher.

- Based on Unscientific Premise

- Against High yielding Seed Varieties (B) Assumes that the soils have all the necessary ingredients and

- Cow dung and Urine can provide necessary nutrients.

- One-Size fits all approach: In some regions of the country, the soils are either acidic or saline and, in some regions, the fertility of the soil has reduced due to heavy metal pollution.

- Previous Experiences: Farmers in Sikkim switching back to Conventional Farming as the yield in the initial years is lower; Recent Experience of Sri Lanka of promoting Organic Farming which led to Food crisis. According to experts, replacing all farming with ZBNF could decrease crop production by 50% and thus severely affect both food security as well as income of farmers. Hence, the Government must adopt evidence-based approach and must not hastily promote ZBNF without multi-agroclimatic location studies, and scientific validation of long-term impact and viability of ZBNF.

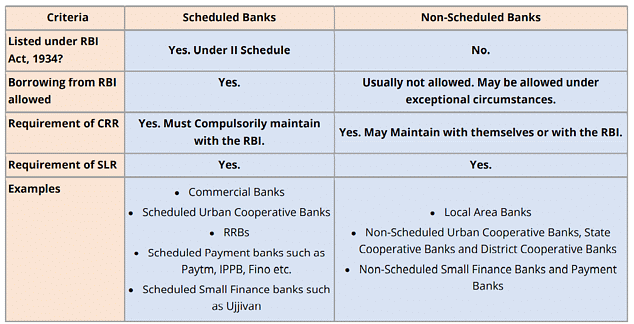

4. Scheduled Bank Status for Paytm

The RBI has recently decided to give status of Scheduled Bank to Paytm payment bank. With the Scheduled Bank status, Paytm payment bank would be allowed to directly borrow money from the RBI.

Definition of Scheduled Bank

Definition of the Scheduled Bank has been provided under the RBI Act, 1934. According to RBI act, a scheduled Bank is one which is:

- Included in the second schedule of the RBI Act.

- Has a paid-up capital of not less than 5 lakhs.

- Satisfies that its affairs are not being conducted in a manner which is detrimental to the interests of the depositors. It includes different categories such as Scheduled commercial Banks, Public Sector Banks, Cooperative Banks, Regional Rural Banks etc. Note: The RBI usually comes out with detailed policy guidelines for the issuance of Banking Licenses.

- For example, the RBI has stipulated the minimum capital requirement of Rs 500 crores for the issuance of new banking licenses. Further, to be eligible to get a Banking license, an entity should have successful track record of running its business for at least 10 years. These requirements are in addition to the requirements mentioned in the RBI Act, 1934. Based upon fulfilment of these requirements, in 2016, the RBI had given approval for 2 new Banks- IDFC and Bandhan Bank.

5. Scale Based Regulation of NBFCs

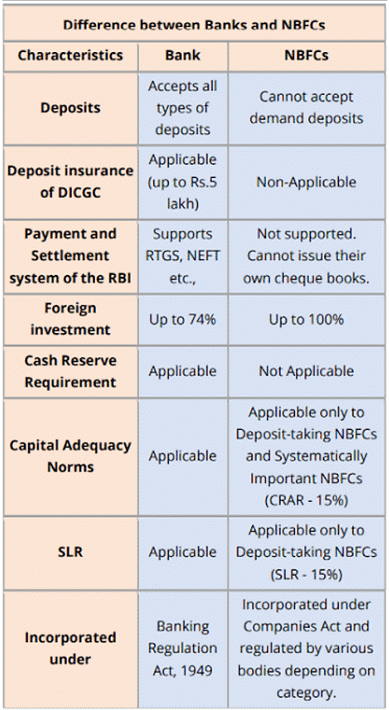

The NBFC sector plays a key role in supplementing credit creation along with the Banks. Over the years, the NBFC sector has undergone considerable evolution in terms of size, complexity, and interconnectedness within the financial sector. Recent crisis such as IL&FS and DHL have highlighted the need to strengthen the regulatory framework for NBFCs. In this regard, the RBI has recently unveiled Scale based Regulation (SBR) for the NBFCs.

Types of NBFCs Based on Asset-Liability Structures

Deposit-taking NBFCs (NBFCs-D) and non-deposit taking NBFCs (NBFCs ND). Based on Systemic Importance: Among non-deposit taking NBFCs, those with asset size of Rs 500 crore or more are classified as non-deposit taking systemically important NBFCs (NBFCs-ND-SI). Based on Activities: NBFCs regulated by RBI

- Investment and Credit Company (ICC): Lending and Investment.

- NBFC-Infrastructure Finance Company (NBFC-IFC): Provision of infrastructure loans.

- NBFC-Systemically Important Core Investment Company (CIC-ND-SI): Investment in equity shares, preference shares, debt or loans in group companies.

- NBFC-Infrastructure Debt Fund (NBFC-IDF): Facilitation of flow of long-term debt into infrastructure projects.

- NBFC-Micro Finance Institution (NBFC-MFI): Credit to economically disadvantaged groups.

- NBFC-Factor: extending loans against the security interest of the receivables at a discount

- NBFC-Non-Operative Financial Holding Company (NBFC-NOFHC): Facilitation of promoters/ promoter groups in setting up new banks.

- Mortgage Guarantee Company (MGC): Undertaking of mortgage guarantee business.

- NBFC-Account Aggregator (NBFC-AA): Collecting and providing information about a customer’s financial assets in a consolidated, organised and retrievable manner to the customer.

- NBFC–Peer to Peer Lending Platform (NBFC-P2P): online platform to bring lenders and borrowers together to help mobilise funds.

- Housing Finance Companies (HFC): Financing for housing (Earlier, the Housing Finance Companies (HFCs) were regulated by NHB) Note: In 2018-19, three categories of NBFCs namely, asset finance companies (AFCs), loan companies (LCs) and investment companies (ICs) were merged into a new category called investment and credit companies (ICCs). In 2019-20, the p Other Categories of NBFCs

- Venture Capital Fund/Merchant Banking companies/Stock broking companies are registered with SEBI.

- The Insurance Companies are regulated by IRDA

- Chit Fund Companies are regulated by the respective State Governments

- Nidhi Companies are regulated by Ministry of Corporate Affairs, Government of India

Need for Effective Regulation of NBFCs

- Increased lending by NBFCs: The share of credit given by NBFCs increased from 8.5 % (2012-13) to 11.5 % (2019-20). However, bank credit as a proportion of GDP declined from 52% to 50% during the same period. Interconnectedness: NBFCs mobilise more than 50% of funds by borrowing from Banks.

- This interconnectedness between Banks and NBFCs has systemic implications. Failure of large NBFCs such as IL&FS could have adverse implications on the financial health of the Banks. Recent failure of large NBFCs such as IL&FS, Dewan Housing Finance etc. has also highlighted the need for strengthening supervisory tools for NBFCs.

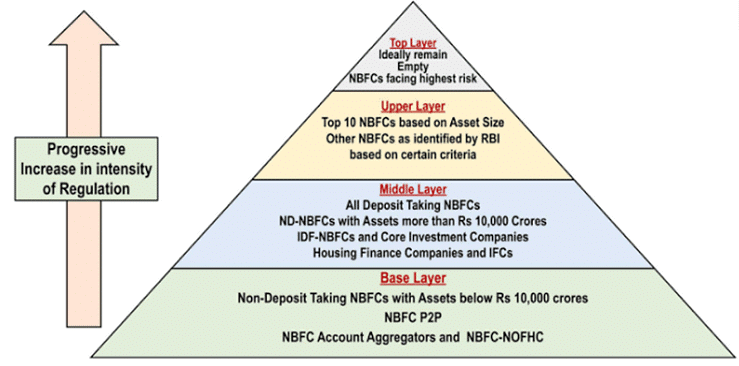

Rbi's Scale Based Regulation (SBR) of NBFCs

- Regulatory structure for NBFCs shall comprise of four layers based on their size, activity, and perceived riskiness. NBFCs in the lowest layer shall be known as NBFC - Base Layer (NBFC-BL).

- NBFCs in middle layer and upper layer shall be known as NBFC - Middle Layer (NBFC-ML) and NBFC - Upper Layer (NBFC-UL) respectively. The Top Layer is ideally expected to be empty and will be known as NBFC - Top Layer (NBFC-TL).

Key Regulatory Changes Under the SBR Framework

- Applicability: Any regulatory stipulation applicable to a lower layer under the new NBFC categorisation will automatically apply to a higher layer, unless otherwise notified by the RBI. Increase in Net owned Fund (NOF) requirement: The RBI has increased the minimum net owned fund (NOF) requirement for NBFC-ICC from Rs 2 crores to Rs 10 crores. For NBFC-MFI and NBFC-Factor, the NOF requirement has been increased from Rs 5 crores to Rs 10 crores.

- Changes to NPA classification norms: Presently, all NBFCs other than NBFC-MFIs classify loans as NPA if it is due for more than 180 days. The RBI has prescribed a uniform overdue period of more than 90 days for classification of loans as NPA for all categories of NBFCs. Hence, going forward, the NPA classification requirements for banks and NBFCs would be aligned. Overall, the RBI has looked to plug the loopholes in the regulation of NBFCs and ensure that they are well funded, efficiently managed, and insulated against various risks. The SBR Framework will bring about much needed accountability in the NBFC sector.

|

136 videos|423 docs|144 tests

|

FAQs on Economic Development: January 2022 Current Affairs - Indian Economy for State PSC Exams - BPSC (Bihar)

| 1. What are the opportunities and challenges associated with inland waterways? |  |

| 2. What is the difference between price support and income support in agriculture? |  |

| 3. How does Zero Budget Natural Farming contribute to doubling farmers' income? |  |

| 4. What is the significance of granting scheduled bank status to Paytm? |  |

| 5. What is scale-based regulation for NBFCs and how does it impact economic development? |  |