Economy: December 2021 Current Affairs | Indian Economy for State PSC Exams - BPSC (Bihar) PDF Download

1. Pepsico Controversy Over PPV&FR Act: Explained

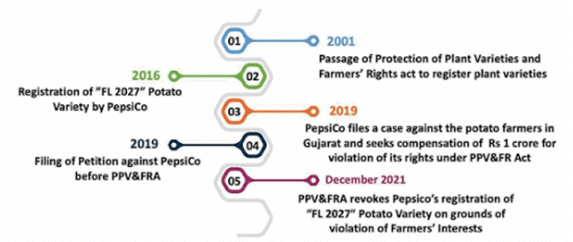

Earlier, in 2019, the PepsiCo filed a case against the potato farmers in Gujarat for allegedly growing its registered potato variety "FL 2027" which is used to make ‘Lays’ chips. The Company sought a compensation of Rs 1 crore from the farmers for the violation of its rights under the Protection of Plant Varieties and Farmers' Rights Act,2001. (PPVFR Act,2001). This case was considered to be quite unprecedented since it involved the Rights of the companies Vs. Rights of the Farmers. Further, it was for the first time that a company tried to sue a group of farmers for the violation of intellectual property rights. In a landmark decision, the Protection of Plant Varieties and Farmers' rights Authority (PPV&FRA) has now decided to revoke registration. However, due to growing backlash, the PepsiCo finally agreed to revoke PepsiCo registration of FL 2027 variety on the grounds that it was not in larger interest of the farmers

Background to Adoption to PPV&FR Act, 2001

- Trade related aspects of Intellectual property Rights (TRIPS 1995) agreement under WTO, provides for protection of intellectual property in the form of patents, copyrights etc. to promote innovation.

- On similar lines, there is a need to promote the invention of new seeds which can lead to better and high yielding plant varieties. However, the agriculture in the poor and developing countries is dominated by poor farmers and hence patenting of seeds by the companies may go against the interests of such farmers.

- In this regard, TRIPS agreement provides for a flexibility mechanism to the countries wherein a new plant variety can be protected either by issuing patents or an effective "sui generis" system or a combination of the two. The "sui generis" system means that the country may adopt its own law to meet its special needs.

- Further, TRIPS agreement provides that Union for protection of Plant Varieties (UPOV) may be used as the basis for "sui generis" system i.e., provisions of the UPOV may be incorporated in their domestic laws to protect plant varieties.

- So, the choice before India was to either enact a domestic law or issue patents for the protection of plant varieties. Further, India also had the option of becoming the member of UPOV and incorporate the provisions of the UPOV in its domestic law.

- India decided to enact domestic law in the form of PPVFR Act, 2001 without becoming a member of UPOV. This was done to protect the interest of the farmers since UPOV denies the farmers the freedom to re-use farm saved seeds and to exchange them with their neighbours. Meaning of Protection of Plant varieties: Intellectual property right that the breeder (Individual, farmer, community of farmers, institution, or a government) enjoys over the plant variety. It means no one can sell, export, import or produce the seed or propagating materials of such protected plant variety without the breeder’s permission.

Objectives of PPV&FR Act, 2001

- Grant intellectual property rights to plant breeders to stimulate R&D in new varieties of plant varieties.

- Protect the interests of the farmers and recognize their contribution in conserving, improving and making available plant genetic resources for the development of new plant varieties. Difference between Patent Act and PPV&FR Act: Both acts deal with the IPR of the inventor. The Patent Act of India does not provide for patent protection of a plant variety. The PPVFRA not only protects a plant variety, it also protects the rights of plant breeders and farmers on plant varieties. The protection of a plant variety is granted in the form of registration (and not in form of Patent).

What Kind of Varieties Can Be Registered Under The PPV&FR Act?

A variety is eligible for registration under the Act if it essentially fulfils the criteria of Distinctiveness, Uniformity and Stability (DUS). Types of varieties:

- New Variety: Developed by breeders.

- Extant Variety: Plant variety already in existence for not more than 15 years

- Farmers' Variety: Existing variety developed by a farmer or a community from the existing traditional variety

- Essentially Derived Variety: Variety derived for a targeted trait that is missing in an existing registered variety or a crossed product (hybrid) of two such initial registered varieties. Developed through genetic engineering, tissue culture etc. Note: Registration of plant varieties is provided by Protection of Plant Varieties and Farmers' rights Authority, which is a statutory body under the act.

- Around 3500 plant varieties have been registered under this act so far. RIGHTS UNDER THE ACT 1. Breeders’ Rights: Breeders have exclusive rights to produce, sell, market, distribute, import or export the protected variety. 2. Researchers’ Rights: Researcher can use any of the registered variety for conducting experiment or research. 3. Farmers' Rights:

- Right to register traditional varieties or farmers’ varieties. Once a variety is registered, farmers obtain exclusive right to produce and market it. This right recognises the role of farmers as plant breeders and innovators.

- Right to reward and recognition: Farmers are eligible for recognition and rewards for the conservation of Plant Genetic Resources of land races and wild relatives of economic plants. This right recognizes the role of farmers in preserving and developing agro-diversity.

- Right to benefit-sharing: Farming or tribal communities that contributed to the development of a new crop variety are entitled to an equitable sharing of the benefits earned from it.

- Right to compensation for losses: This right guarantees compensation to farmers who are victims of exaggerated claims regarding the performance of newly registered varieties. The right serves to prevent unfair marketing practices by breeders and seed sellers.

- Right to protection against accusations of infringement: A farmer cannot be prosecuted on charges of infringement of another’s rights if the farmer affirms ignorance of the legal provision. This provision protects people of low legal literacy from harassment, particularly by seed companies.

Exceptions to PPV & FR Act

- A farmer can save, use, sow, re-sow, exchange, share or sell his farm produce including seed of a variety protected under the PPV&FR Act, 2001. However, the farmer is not allowed to sell branded seed of a variety protected under the PPV&FR Act, 2001.

- Researchers can use registered plant varieties without the consent of the breeder for conducting R&D.

Duration of Protection of A Registered Plant Variety

The duration of protection of registered varieties is different for different types of crops which are as below:

- Trees and vines - 18 years.

- For other crops and extant varieties - 15 years

Recent Pepsico-Gujarat Farmers Controversy

- PepsiCo India registered hybrid potato variety FL 2027 in 2016 under PPV&FR Act. PepsiCo marketed this variety under the trademark FC-5 and presently, it is used to make the popular "Lays" potato chips in India.

- The potato variety is grown by approximately 12,000 farmers who are a part of the company’s collaborative farming program, wherein the company sells seeds to farmers and has an exclusive contract to buy back their produce. The company found out that some of the farmers in Gujarat, who were not part of its collaborative farming program, were also growing and selling potatoes of this variety. On the account of this, the company decided to file a case against the farmers for the infringement of its rights and accordingly, sought a compensation of around Rs 1 crore.

- PepsiCo's Arguments: The company argued that some of the big farmers are misusing its registered FC-5 variety wherein the farmers are growing and selling this variety to regional potato chips manufacturers, which is in turn adversely affecting the market share of its popular "Lays" potato chips

- Farmers' Argument: The PPV&FR act enables farmers to “save, use, sow, re-sow, exchange, share or sell their farm produce including seed of a variety protected under this Act.” The farmers argued that they had not resorted to selling of branded seeds of the registered variety, which is prohibited under the act. Hence, accordingly, they argued that they had not violated the rights of the breeder (PepsiCo India) under the act.

- Contentious point of Law: FC-5 has been registered as an “Extant Variety”, which is also a “Variety of Common Knowledge”. This, in other words, implies that the said variety of potato was already available in the country before it was registered and that there was “common knowledge” about this variety in the country. It may, therefore, be assumed that PepsiCo’s variety would surely have been produced in the country before it was registered. Registration of extant varieties was allowed in the PPVFRA despite opposition from several experts, and the justification used was that farmers’ varieties can be registered under this provision. However, companies like PepsiCo got the opportunity to register older varieties under "Extant" category and hence can sue the farmers for the violation of their rights.

- 2019: PepsiCo filed a case against the potato farmers in Gujarat and sought a compensation of around Rs 1 crore from the farmers. However, it withdrew the cases later.

- 2021: The Protection of Plant Varieties and Farmers' rights Authority (PPV&FRA) authority has decided to revoke PepsiCo's registration of FL 2027 variety on the grounds that it was not in larger interest of the farmers.

- WAY FORWARD The PPV&FR Act, 2002 is unambiguous on upholding farmers' rights wherein the farmers are allowed to sow, re-sow and even sell the registered varieties, provided they are not branded varieties. Hence, this judgement sets a precedent for all MNCs to not only uphold, but also more importantly, not to transgress the legally granted farmers’ rights and freedoms in India.

2. RBI's Report on Functioning of ARCS

According to RBI's financial stability report, the gross NPAs of the Banks is set to increase to 9.8% by end of March 2022. Higher NPAs of the Banks can further accelerate growth of credit in the economy and can potentially undermine the financial stability. Recently, the Government has established ARC-AMC Model ('Bad Bank") to solve the NPA mess. Apart from that, India has also introduced Asset Reconstruction Companies (ARCs) under the SARFAESI Act, 2002. However, the private ARCs have not been successful in India. In this regard, recently, a committee appointed by the RBI has highlighted constraints and challenges faced by ARCs and has accordingly given its set of recommendations.

Evolution of The Asset Resolution Mechanism with Special

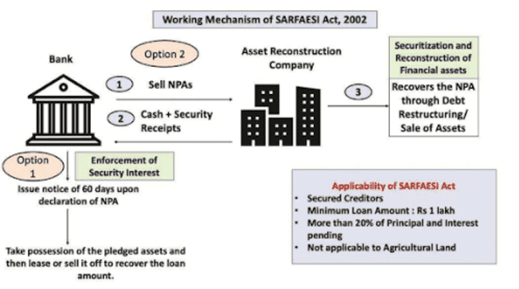

REFERENCE TO ARCs Debt Recovery Tribunals (DRTs): Recovery of Debts due to Banks and Financial Institutions (RDDBFI) Act,1993 provides for Debt Recovery Tribunals (DRTs) to deal with recovery of bad loans of more than Rs 20 lakhs. The DRTs were also authorised to form Lok Adalat. Initially, the DRTs were successful with recovery rates increasing to 81% in 2008-09. However, in 2019-20, recovery rates reduced to just 4% in 2019-20 due to inadequate infrastructure, delays etc. Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act (SARFAESI Act), 2002:

- If a borrower defaults on a loan, the Banks can give a notice period of 60 days to the borrower to repay the loans. If the borrower fails to repay within 60 days, the Banks can take the following actions:

- Take possession of the pledged assets and then lease or sell it off to recover the loan amount.

- Take over the management of the business of the borrower.

- Appoint a person to manage the assets.

- Provides for Asset Reconstruction Companies (ARCs) to be registered and regulated by the RBI.

- Provides for issuance of Security Receipts (SRs) by the ARCs.

Insolvency and Bankruptcy Code, 2016: Provide for time-bound resolution of NPAs through DRTs (for Individuals) and National Company Law Tribunals (For companies)

Difference Between Sarfaesi Act And IBC, 2016

- SARFAESI- Applicable only for secured financial creditors; IBC- Applicable for both secured and unsecured financial creditors.

- Unlike IBC, SARFAESI is not applicable to Operational Creditors.

- Minimum threshold for invoking IBC: Individuals (Rs 1000); Companies (Rs 1 crore); Minimum threshold for SARFAESI: Rs 1 lakh. PERFORMANCE ANALYSIS OF THE ARCs The ARC industry began with the establishment of the Asset Reconstruction Company India Limited (ARCIL) in 2003. Presently, there are around 28 ARCs, registered and regulated by RBI. Some of these ARCs are ARCIL, Suraksha Asset Reconstruction, Indiabulls asset reconstruction, ASREC Ltd., IndiaRF etc. As on March 31, 2021, the ARCs had cumulatively taken over NPAs worth Rs 5 lakh crores.

- Poor Recovery rates compared to IBC: The recovery rates of ARCs were significantly higher in the initial years of their inception. However, in recent years, it has dropped to just 26% in 2019-20. This is significantly lower than recovery rates under IBC (45%).

- Low Percentage of NPAs with ARCs (26%) in comparison to DRTs (33%) and IBC (31%). Remaining 10% NPAs are under Lok Adalats. Since the introduction of IBC, the Banks have started preferring IBC over the DRTs due to time-bound resolution and higher recovery rates.

- Low Capital Base of ARCs: Majority of ownership of ARCs lie in the hands of Banks and Financial Institutions. Even though, the Government has allowed 100% FDI through automatic route, ARCs have failed to attract foreign capital.

- Higher Borrowings: The ARCs tend to rely heavily on borrowings from Banks for their funds. The poor financial position of ARCs could have negative domino effect on Banking sector.

- Nature of Resolution: The ARCs have relied more on recovery of NPAs through selling-off assets and less on revival of business. ARCs have rarely used change or takeover of management of business of the borrowers or conversion of borrowers’ debt into equity as measures for reconstruction.

- Conflict of Interest: Considering that banks are not just the major shareholders of and lenders to ARCs but also sellers of NPAs to ARCs, there could be circuitous movement of funds between banks and these institutions.

Recommendations

- Sale of NPAs at an early stage: Delays in sale of NPAs to ARCs not only leads to erosion in the asset value, but also reduces the probability of reviving genuine companies. Hence, at the start of every year, Banks must compile and share the list of NPAs to be sold to ARCs. This would increase predictability in the amount and quality of stressed assets flowing into ARC sector and improve the lenders’ recovery on these NPAs.

- Bring ARCs under IBC: Under IBC, Banks are required to invite applications from different entities for the resolution of NPAs. However, the current regulatory and legal framework does not allow ARCs to act as Resolution Applicants (RA) under IBC i.e., they cannot apply for resolution of Bad loans under IBC. This is in spite of the fact that ARCs can use tools such as change in/takeover of management, debt to equity conversion, etc. Hence, regulations should have to be changed to enable ARCs as Resolution Applicants under IBC.

- Enhanced Financing Options: The RBI must permit ARCs to raise finances from all regulated entities such as FPIs, Alternate Investment Funds (AIFs), NBFCs as well as retail investors.

- Liquidity and Trading of Security Receipts (SRs): Presently, only the Qualified Institutional Buyers (QIBs) such as Banks, Pension fund, Insurance and Mutual fund companies are allowed to invest in Security receipts (SRs) issued by the ARCs. To broaden the investor base of SRs, the list of eligible qualified buyers may be further expanded to include High-net worth individuals (HNIs), corporates, NBFCs/HFCs etc.

Corporates As Banks

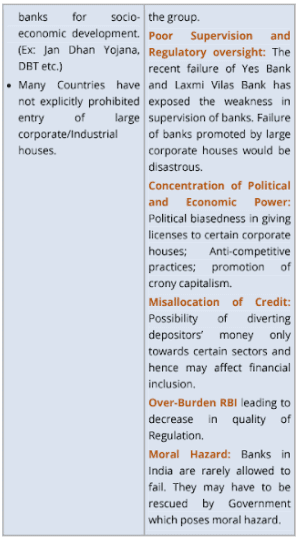

- Earlier, in November 2020, the IWG had submitted 33 recommendations to the RBI with respect to ownership structure of Banks. One of the most contentious recommendations submitted by this committee is to allow large corporate/Industrial houses to be the promoters of the Indian Banks.

- In November 2021, the RBI stated that it has accepted around 21 recommendations of IWG. However, it has decided to put on hold the recommendation to grant Banking licences to Corporates.

Evolution in Banking Policy

- Phase of Nationalisation (1969-1991): India's public sector banks (PSBs) were initially set up as Private Banks and later Nationalised in two waves in 1969 and 1980.

- Entry of New Private Banks (NPBs) post 1991 Reforms: Based upon the recommendations of Narasimhan committee, the RBI issued policy guidelines to facilitate the entry of new private Banks (NPBs) on a large scale. Subsequently, it led to the entry of large-sized private Banks such as HDFC, ICICI, Axis Bank etc.

- Guidelines for Licensing of Universal Banks in the Private Sector: The minimum initial paid-up capital for setting up new private Bank was set at Rs 500 crores. Resident individuals and professionals having 10 years of experience in banking and finance were also eligible to promote universal banks. However, Large corporate/industrial houses were not allowed to set up Banks but were permitted to invest in the banks up to 10 per cent.

- Consolidation of Public Sector Banks (PSBs): Based upon the recommendations of Narasimhan Committee (1991) and P.J. Nayak Committee (2014), the Government has focussed on consolidation/merger of PSBs. After a series of mergers, currently there are 12 public sector banks, including the SBI.

- Present Phase: Shift towards greater role of Private Sector in Banking industry as evident in the new public sector enterprise policy.

Present Status of Banking Sector Underdeveloped Banking Sector

- Total balance sheet of banks in India constitutes less than 70% of the GDP, which is lower in comparison to China (170%), Japan (110%) etc.

- Low credit-GDP ratio in India

- Banking sector has remained dwarf in comparison to size of Indian economy (Eco Survey 2019-20). India's largest Bank, SBI is placed at 55th position globally. Government's monopoly in Banking sector: Public sector Banks (PSBs) account for almost 70% of the market share in the Banking sector. However, PSBs account for 80% of the overall NPAs of the Banking sector. Higher efficiency of Private Sector Banks: According to the Economic Survey 2019-20, every rupee of the taxpayers' money which is invested in PSBs fetches a market value of 71 paise. On the other hand, every rupee invested in NPs fetches a market value of Rs 3.70 i.e., more than five times as much value as that of a rupee invested in PSBs.

Should Corporate/ Industrial Houses Be Allowed to Set Up Banks?

A large corporate/industrial/business house is defined as a group having total assets of Rs 5000 crore or more wherein the non-financial business of the group accounts for more than 40 per cent in terms of total assets or gross income.

Way Forward

We need to be extra-cautious in issuing licenses to corporate houses as the problems may outweigh the benefits. The issue of licences to the corporate houses should be preceded by number of reforms:

- Strengthen Banking Regulation Act, 1949: The Federal Reserve Act in USA prohibits financial transactions of Banks with their affiliates. Hence, amendments to Banking Regulation Act, 1949 should be done to prevent Inter-connected lending.

- Consolidated Supervision: The RBI must be empowered to carry out the consolidated supervision of the Banks and their non-Banking entities to avoid any conflict of Interest.

- Strengthen Supervisory Cadre: The RBI has set up Specialised Supervisory and Regulatory Cadre (SSRC) in November 2019 to strengthen and consolidate the supervision functions, which were scattered across different departments. The SSRC needs to be strengthened and given proper training.

- Reforms in PSBs: The failure of Yes Bank and Laxmi Vilas Bank (LVB) has highlighted that it is not the ownership structure, but quality of corporate governance which determines the efficiency of banks. Hence, the Government must also give due amount of emphasis on governance reforms in the PSBs as highlighted by P.J. Nayak Committee.

4. Proposal For Digital Banks in India

NITI Aayog has recently released a concept paper highlighting the need for Digital Banks in India. The digital Banks will help us leverage ICT to improve the creditcreation and financial inclusion. PRESENT STATUS Presently, only those entities which are licensed by the RBI can undertake banking related operations. As of now, the RBI does not allow Banks to be 100% digital. Hence, even though Banks can provide banking services by leveraging technology (such as Imobile of ICICI), the Banks must have physical branches.

About Digital Banks Proposed by Niti Aayog

- To be licensed under Banking Regulation Act, 1949.

- Provide banking services- Acceptance of Deposits, giving loans, provide insurance etc. without the need to have physical branches.

- No physical branches.

- Leverage technology to provide banking service.

- Also called ‘Challenger Banks’- Newly created Banks which compete with longer established Banks through use of Digital Technology. Global Examples: Challenger Banks such as Starling Bank, Monese Banks in UK.

Models of Digital Banks

- (Front-End Only) Neo-banks: These neo-banks partner with existing Banks to offer Banking services such as deposits and loans. These neo-Banks do not have funds of their own, but they collaborate with traditional banks to offer various banking related services. Ex: RazorPayX, InstantPay, Open, Niyo etc.

- (Licensed) Digital banks: These entities are fully functional banks, regulated by the banking regulator and issue deposits and make loans on their own balance sheet. Presently, RBI does not allow such fully digital Banks to operate in India. NITI Aayog has argued in favour of such banks in India.

- (Autonomous) unit of traditional banks: These entities are essentially neo-banking operations of traditional banks that function autonomously and compete with stand-alone neobanks. In. SBI Yono, 811 of Kotak Mahindra, DigiBank of DBS etc.

Need For Fully Licensed Digital Banks in India

Under-developed Banking sector: As highlighted by Economic Survey 2019-20, Indian Banking sector has remained dwarf in comparison to the size of our economy. Take for instance, India's largest Bank i.e., SBI is ranked at 55th position globally. The growth of large sized economies such as USA, China etc. has been supported by large-sized global banks. Poor status of Public Sector Banks: PSBs account for 80% of the overall NPAs of the Banking sector. The digital banks would infuse competition and improve the performance of PSBs. Constraints faced by traditional banks:

- High Operational costs due to the need to maintain physical branches.

- Limited focus on innovation, particularly on delivering banking services by leveraging technology.

- Low risk appetite in giving loans to MSMEs leading to credit gap of around Rs 25 lakh crores. Higher Efficiency: Unlike normal banks, Digital Banks need not maintain physical branches, which in turn enables them to reduce their operational costs and provide loans at cheaper rates of interest. Improve financial inclusion: India has made rapid strides in financial inclusion by leveraging digital technology such as JAM Trinity, UPI etc.

- Digital Banks can leverage technology to provide banking services in rural and unbanked areas leading to further fillip to financial inclusion. Empirical Evidence: Digital Banks like Starling Bank (UK) & MyBank (China) has emerged as challenger banks and have been able to compete with bigger banks leading to positive disruption in banking sector.

5. Revised PCA Framework

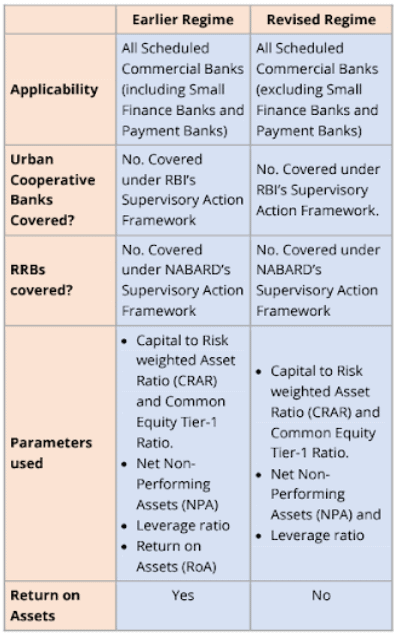

Recently, the RBI has come out with the revised Prompt Corrective Action (PCA) framework. The provisions of the revised PCA Framework will be effective from January 1, 2022.

Details About Revised PCA Framework

Introduced by RBI in 2002 as a structured early intervention mechanism along the lines of the US Federal Deposit Insurance Corporation’s PCA framework. Subsequently, the RBI reviewed the framework in line with international best practices in 2017. The 2017 framework has further been revised. Rationale: Tool used by the RBI to monitor the financial health of the Banks and take corrective action in the early stages. Indicators used:

- Capital to Risk weighted Assets Ratio (CRAR) and Common Equity Tier-1 Ratio.

- Net Non-Performing Assets (NPA) and

- Leverage ratio When does it get triggered: When the above 3 Indicators breach the threshold target. (Example: If Net NPA Is greater than or equal to 6%) Applicability:

- Covers all the scheduled Commercial Banks except Payment Bank, Small Finance Banks and RRBs.

- Does not cover Cooperative Banks. Cooperative Banks are covered under RBI's Supervisory Action Framework (SAF) which is similar to PCA.

What Happens If a Bank is Placed Under PCA Framework?

- RBI can take certain mandatory and discretionary actions which can include

- Halting branch expansion

- Stopping dividend payment

- Undertake special audit, restructuring operations and activation of recovery plan. Discretionary Provision Bank to be taken out of PCA framework if there are no breaches in the parameters for 4 continuous quarters.

- Banks’ promoters can be asked to bring in new management.

- RBI can also supersede the bank’s board. Banks under PCA (as on Nov 2021): In Sep 2021, RBI removed Indian Overseas Bank and UCO Bank from the purview of PCA framework. As on Nov 2021, only Central Bank is under PCA framework.

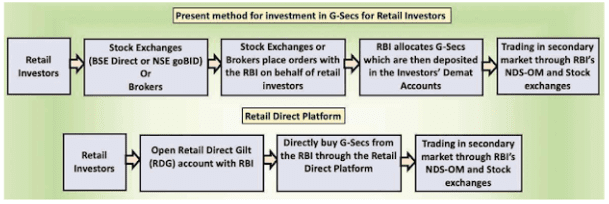

6. RbI’s Retail Direct Scheme

The RBI has recently launched the "Retail Direct Scheme" as a one-stop solution to facilitate investment in Government Securities by individual investors. Earlier, the retail investors had to buy G-Secs indirectly through Banks, Stock exchanges etc. But now, retail investors can purchase G-Secs in the primary market directly from the RBI through the Retail direct platform.

What are Government Securities (G-Secs)?

Financial instruments issued by the Central or state Government to borrow money. Types:

- Treasury Bills: Issued only by the Central Government with 3 different maturity periods- 91 days, 182 days and 364 days. Zero Coupon securities with no interest. Issued at discount and redeemed at face value.

- Government bonds or dated securities: Issued by the Central Government with long term maturity period of more than 1 year.

- State Development Loans (SDLs): Issued by the State Government with long term maturity period of more than 1 year. Note: G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

How are The G-Secs Issued?

- The G-Secs are issued through auctions conducted by RBI. Auctions are conducted on an electronic platform called the E-Kuber, the Core Banking Solution (CBS) platform of RBI. Scheduled Banks, Primary Dealers, Insurance companies etc.

- who maintain accounts with RBI, are members of this electronic platform. All members of E-Kuber can place their bids in the auction through this electronic platform.

Participation of Retail Investors in G-Secs Market

- Presently, the Retail Investors cannot purchase G-secs in the primary market directly from the RBI. They can purchase G-Secs through aggregators/ Facilitators such as Banks, Primary dealers, Stock exchanges etc. For example, Retail investors can purchase G-Secs through the BSE Direct, NSE's goBID, stockbrokers etc.

- The retail investors can also participate in the trading of G-Secs in the secondary market through the RBI's Negotiated dealing system-Order matching (NDS-OM) and stock exchanges.

Details About Retail Direct Platform

- Platform to enable retail investors to buy G-Secs directly from RBI. Individual Retail investors can open Gilt Securities Account – “Retail Direct Gilt (RDG)” Account with the RBI.

- Which G-Secs can be bought? T-Bills, Dated Secs, SDLs and Sovereign Gold Bonds.

- Who can open RDG Account? Retail investors having Bank account, PAN Card etc. fulfilling KYC norms. NonResident investors are also eligible.

- Limits on Investment: RBI has imposed minimum and maximum investment limits for the retail investors. For example, minimum investment in the GSecs should be Rs 10,000.

Benefits For Different Stakeholders

- Retail Investors: Risk-free Investment; Held in DEMAT form; Can be sold easily in secondary market to meet immediate cash requirements; can be used as collateral to borrow loans etc.

- Government: Make it easier for the Government to mobilize household deposits for undertaking long term investment.

- Economy: Deepens the G-Secs Market Higher Investment rates Promote Economic Growth. WAY FORWARD Going forward, the Government must run awareness campaigns to educate the people on the benefits of the scheme. The Government must also attract retail investors through income tax deductions for these instruments.

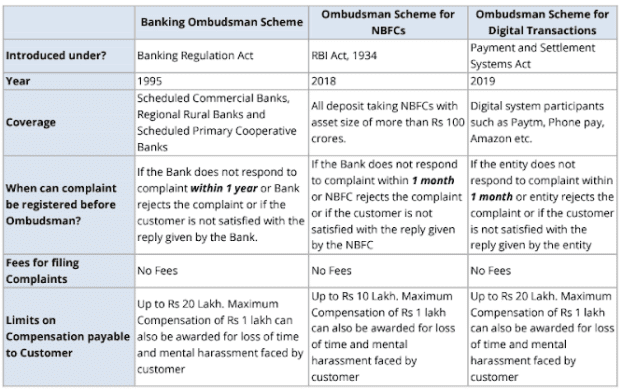

7. RBI’s Integrated Ombudsman Scheme

The protection of consumers in the financial sector such as Banks, NBFCs has gained policy priority in recent years. Accordingly, the RBI has decided to merge three Ombudsman schemes (i) Banking Ombudsman Scheme (ii) Ombudsman Scheme for Non-Banking Financial Companies and (iii) Ombudsman Scheme for Digital Transactions into a single scheme. The merger of these schemes is intended to make the process of redressal of grievances easier for the consumers across different verticals.

Salient Features of The Integrated Ombudsman Scheme

Need: The three ombudsman schemes mentioned above had different grounds of complaints, leading to uneven redressal across customers of different entities. Further, they also provided for different compensation amounts resulting in unequal treatment of aggrieved customers. Coverage:

- Commercial Banks, Regional Rural Banks, Scheduled Primary (Urban) Co-operative Banks and Non-Scheduled Primary (Urban) Co-operative Banks with deposits size of Rupees 50 crore and above.

- Non-Banking Financial Companies (excluding Housing Finance Companies) which (a) are authorised to accept deposits; or (b) have customer interface, with an assets size of Rupees 100 crore.

- Payment system operators such as Paytm, PhonePe, TReDS platform etc. Grounds on which complaints can be filed: Deficiency in services provided by above entities which may or may not result in financial loss or damage to customers. Mode for registering complaints: RBI to establish the Centralised Receipt and Processing Centre.

- Complaints can also be filed online on separate portal. Institutional Framework to handle complaints: RBI to appoint Ombudsman and Deputy Ombudsman with a tenure of 3 years. Limits on compensation payable to Customer: The Ombudsman shall have the power to provide a compensation of up to Rs 20 lakhs.

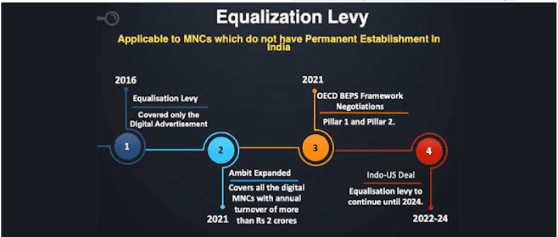

8. Indo-Us Deal on Equalisation Levy

Recently, India and US have reached a settlement on the issue of imposition of Equalization levy by India. The agreement is said to end trade hostilities between the two countries and improve their economic relationship.

Background

- Rationale: The digital MNCs such as Amazon, Facebook, Google etc. pay taxes in the countries in which they are registered and not in the countries in which they operate and make huge profits. For example, even though, these companies make huge profits in India, they do not pay tax.

- Global Efforts: More than 130 countries (including India) have come under the OECD BEPS framework to put an end to tax avoidance strategies of such digital MNCs. The deal focusses on 2 Pillars - Pillar 1 (Allocation of profits of Digital MNCs among countries) and Pillar 2 (Global Minimum Corporate Tax). The deal is most likely to come into force from 2024 onwards. (Covered in detail in October Focus 2021)

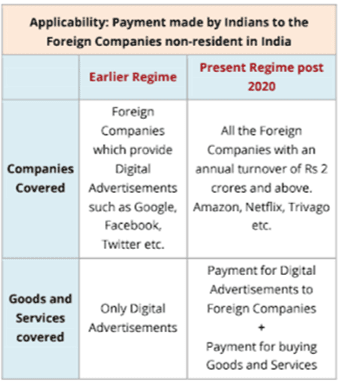

- India's Efforts: Government has introduced Equalization levy through the Union Budget 2016. Initially, the tax was applicable only on digital advertisements. Later, the Union Budget 2021-22 expanded the ambit of Equalization levy to cover all the digital MNCs.

Details About Equalization Levy

To clear confusion related to the expansion in scope of Equalisation Levy, the Finance Act, 2021 has provided the following clarifications:

- Earlier, the Equalisation levy was applicable only for placing Digital Advertisements. Now, it has been expanded to cover all the Goods and Services which are sold through the online platforms such as Amazon, Netflix, Trivago etc.

- Earlier equalisation levy was applicable only on B2B transactions. But now, the new equalisation levy would be applicable on every transaction undertaken by non-resident e-commerce companies which includes both B2B as well as B2C transactions.

- The tax would be applicable on the total payment (and not commission) received by the e-commerce companies on selling goods and services sold through their online platforms.

Deal Between India and USA

- US Demands: The US government was against the unilateral imposition of Equalisation Levy by India since it affected the interests of US companies. Hence, the US Government wanted India to do away with the Equalisation levy until global deal under OECD comes into being, which is likely to be in 2024.

- India's concerns: India was against doing away with the Equalisation levy since it would have led to loss of revenue.

Broad Contours of The Deal

- Benefits for India: India would continue to impose Equalisation levy until 2024 when the OECD deal comes into being.

- Benefits for USA:

- India would have to do away with Equalisation Levy once OECD deal comes into being.

- The Indian Government would refund the excess tax amount collected through Equalisation levy between April 1, 2022 to March 31, 2024. For example, Let's say, a particular US based MNC has paid Rs 20 crores in the form of Equalisation levy between April 1, 2022 to March 31, 2024. However, its tax obligation under OECD framework may be only around Rs 15 crores. In such a case, Indian Government would refund excess Rs 5 crores.

9. New Wage Rate Index

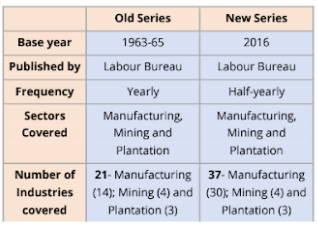

The Union Labour Ministry has recently released the new series of Wage Rate Index with the base year of 2016. The new series is based on the recommendations of International Labour Organisation (ILO). DETAILS ABOUT NEW WAGE RATE INDEX (WRI)

- Purpose: Economic indicator which measures relative changes in the wage level in selected industries. It can be considered similar to Index of Industrial Production (IIP) which tracks changes in the volume of Industrial production.

- Enhanced Coverage: The new series seeks to cover 700 occupations and makes the index more representative, expanding the number of industries, sample size and the weightage of industries. While the previous series covered 21 industries, the new one covers 37, including 30 from the manufacturing sector and three each from the mining and plantation sectors.

- Modifications: Under the manufacturing sector, 16 industries such as synthetic textiles, publishing, footwear, petroleum, drugs and medicines, have been added.

- Under plantation sector, Tea, Coffee and Rubber have been retained, with enhanced coverage.

- Under mining sector, oil mining industry has been introduced in the basket in place of mica mines industry Benefits of new series: Provide valuable insights to determine minimum wages and national floor wage policy. Highlights of new series: The overall Wage Rate Index for all the 37 industries combined stood at 119.7 in 2020. The highest Wage Rate Index in 2020 was reported for Plantation Sector followed by Manufacturing Sector and Mining Sector.

|

150 videos|425 docs|144 tests

|

FAQs on Economy: December 2021 Current Affairs - Indian Economy for State PSC Exams - BPSC (Bihar)

| 1. What is the controversy surrounding the PPV&FR Act and Pepsico? |  |

| 2. What is the proposal for digital banks in India? |  |

| 3. What are the key features of the revised PCA framework? |  |

| 4. How does RBI's Retail Direct Scheme work? |  |

| 5. What is the Indo-US deal on equalisation levy? |  |