Elements of Cost & Cost Sheet | Cost Accounting - B Com PDF Download

What are the Elements of Cost?

Understanding the elements of cost is crucial for comprehending the total expenses involved in producing goods or providing services. These costs are generally divided into three main categories: Material Costs, Labor Costs, and Overhead Costs.

Material Costs include expenses for raw materials or supplies necessary for production. Labor Costs cover expenditures for the workforce, including wages, salaries, and other benefits. Overhead Costs encompass indirect expenses such as utilities, rent, and maintenance, which, while not directly tied to production, are essential for operational processes.

A thorough understanding of these cost elements is vital for accurate costing, budgeting, and financial analysis, all of which are key for effective decision-making. Additionally, a detailed breakdown of these costs facilitates better cost control, more strategic pricing, and ensures the financial sustainability of the organization.

Material Cost

Material costs are a vital component of overall costs, encompassing the expenditures on all materials necessary for production. These costs are divided into Direct and Indirect Materials, based on their traceability and significance in the production process.

Direct Material

- Direct materials are raw materials that can be directly traced to the production process and represent a significant portion of the total cost. These materials are essential and identifiable components of the finished product.

Example: In manufacturing wooden furniture, timber, nails, and glue are direct materials. The cost of these materials is directly attributed to the finished table.

Indirect Material

- Indirect materials are used in the production process but cannot be directly traced to the final product. While they are essential for production, they do not become part of the finished product.

Example: Indirect materials include cleaning supplies, lubricants for machines, or small quantities of glue or nails used to maintain equipment in the furniture manufacturing facility. Their costs are spread over multiple output units or across various production departments.

Labor

Labor cost is a crucial element of cost accounting, covering the expenses related to the workforce involved in the production process. It is divided into Direct Labor and Indirect Labor, depending on the extent to which these costs can be traced to the final product.

Direct Labor

- Direct labor refers to the workers directly involved in producing goods or providing services. The costs associated with direct labor can be specifically traced to particular products or services.

Example: In an automobile assembly line, the workers assembling the cars are considered direct labour. Their wages are direct costs associated with the production of each vehicle.

Indirect Labor

- Indirect labor involves personnel who support the production process but are not directly engaged in producing goods or services. The costs associated with indirect labor are distributed across multiple output units or production departments.

Example: The salaries of maintenance staff, supervisors, and quality control inspectors in the automobile assembly plant are indirect labour costs. These costs are necessary for production but are not attributed to a specific vehicle.

Overhead Cost

Overhead cost is a vital component of cost accounting, including all expenses not directly linked to the production of goods or the delivery of services. It is further divided into direct and indirect overheads, depending on their traceability and allocation to specific cost centers or products.

Direct Overheads

- Direct overheads are overhead costs that can be specifically assigned to a particular cost center or product. These costs are closely linked to specific departments or products, allowing for accurate allocation.

Example: In a furniture manufacturing facility, the electricity cost of running machinery can be a direct overhead attributed to the production department.

Indirect Overheads

- Indirect overheads are costs that cannot be directly linked to a specific cost center or product. These expenses are distributed across multiple departments or products, necessitating a method for apportionment.

Example: The salary of the administrative staff, general factory maintenance costs, or the rent of the entire manufacturing facility are examples of indirect overheads. These costs are necessary for overall operations but cannot be directly allocated to a particular product or department.

Role of Cost Elements in Cost Accounting

The role of cost elements in cost accounting is vital as they form the basis for accurate and effective cost analysis and control. Here are key points about their role:

- Cost Identification and Classification: Cost elements help identify and classify various types of costs incurred by a business. This categorization is essential for accurate cost analysis.

- Cost Allocation and Apportionment: They assist in the allocation and apportionment of costs to different departments, products, or services, which is crucial for determining profitability and managing costs.

- Budgeting and Forecasting: Understanding cost elements enables organizations to prepare budgets and forecasts more accurately, facilitating better future planning.

- Pricing Decisions: Cost elements play a significant role in determining the pricing of products or services by ensuring all costs are accounted for, which is essential for achieving desired profit margins.

- Cost Control and Reduction: Identifying and analyzing cost elements helps in controlling and reducing costs by pinpointing areas where efficiencies can be improved.

- Performance Evaluation: Cost elements are crucial for evaluating the performance of different departments and identifying areas for improvement.

- Financial Reporting and Analysis: Accurate costing based on cost elements is essential for reliable financial reporting and analysis, aiding in better decision-making and ensuring compliance with accounting standards.

- Strategic Decision-making: Precise cost accounting supports informed strategic decisions regarding production, operations, and investments, contributing to the overall financial health and sustainability of the organization.

What is a cost sheet?

A cost sheet is a statement that details the various components of the total cost for a product and provides historical data for comparison. By using a cost sheet, you can determine the ideal selling price of a product.

A cost sheet can be prepared using either historical costs or estimated costs. A historical cost sheet is based on the actual costs incurred for a product, while an estimated cost sheet is created using projected costs just before production begins.

Note: The cost sheet referred to in this guide is a financial concept and is not a feature available in Zoho Books.

Importance and Objectives of a Cost Sheet

Cost sheets are vital for several essential business processes:

- Determining Cost: The primary objective of a cost sheet is to accurately calculate the cost of a product. It provides both the total cost and the cost per unit.

- Fixing Selling Price: To set the selling price of a product, a cost sheet is necessary to understand the details of its production cost.

- Cost Comparison: Cost sheets help management compare the current cost of a product with its previous per unit cost. This comparison enables management to take corrective measures if costs have increased.

- Cost Control: Cost sheets are crucial for controlling production costs in a manufacturing unit. An estimated cost sheet helps monitor labor, material, and overhead costs at each production step.

- Decision-Making: Many important management decisions are based on the cost sheet. When deciding whether to produce or purchase a component, or when quoting prices for goods in a tender, managers refer to the cost sheet.

Types of Costs in Cost Accounting

Costs in cost accounting are broadly classified into four categories: fixed costs, variable costs, operating costs, and direct costs.

- Fixed Costs: These costs remain unchanged regardless of the number of items produced. Examples include the depreciation of a building or the cost of equipment.

- Variable Costs: These costs fluctuate with the level of production. For example, a bakery spends $10 on labor and $5 on raw materials per cake, with the variable cost changing based on the number of cakes produced.

- Operating Costs: These expenses are incurred to maintain daily operations. Examples include travel expenses, telephone bills, and office supplies.

- Direct Costs: These costs can be directly linked to production. For instance, if a furniture manufacturing company takes five days to produce a couch, the direct cost includes the raw material and labor costs for those five days.

Components & elements of total cost

Components of total cost are constituted mainly of prime cost, factory cost, office cost and cost of sales. Let us take a detailed look at each of these elements:

Prime cost

This comprises direct material, direct wages, and direct expenses. It is also called basic cost, first cost, or flat cost. It can be defined as an aggregate of the price of the material consumed, the wages involved in production, and the direct expenses.

Prime cost = Direct material + Direct wages + Direct expenses

Direct material cost usually refers to the cost of raw materials used or consumed during a given period. To calculate the amount of raw material actually consumed during a given period, you add the opening stock and the amount of material purchased, and deduct the closing stock. Here is the formula for material consumed:

Material consumed = Material purchased + Opening stock of material – Closing stock of material

Factory cost

This is made up of prime cost plus factory overhead, which includes indirect wages, indirect material and indirect expenses. Factory cost is also known as works cost, production cost, or manufacturing cost.

Factory cost = Prime cost + Factory overhead

Office cost

This is also called administration cost or total cost of production. Office cost is equal to factory cost plus office and administration overhead.

Total cost or cost of sales

This is the sum of the total cost of production and the total of selling and distribution overhead.

Total cost = Cost of goods sold + Selling and distribution overhead

In the production process, some units of a product are scheduled to be finished at the end of a period. Such incomplete units are called work-in-progress. In such situations, while calculating the factory cost of a product unit, it is necessary to make adjustment for opening and closing stock to arrive at net factory cost of the product. Generally, the cost of these unfinished units include direct material, direct expenses, and factory overheads.

Besides this, the adjustments for inventories need to be made in the following manner

- Direct material consumed = Opening stock of direct material + Purchases of direct material – Closing stock of direct

- Works cost = Gross works cost + Opening work in progress – Closing work in progress

- Cost of production of goods sold = Cost of production + Opening stock of finished goods – closing stock of finished goods

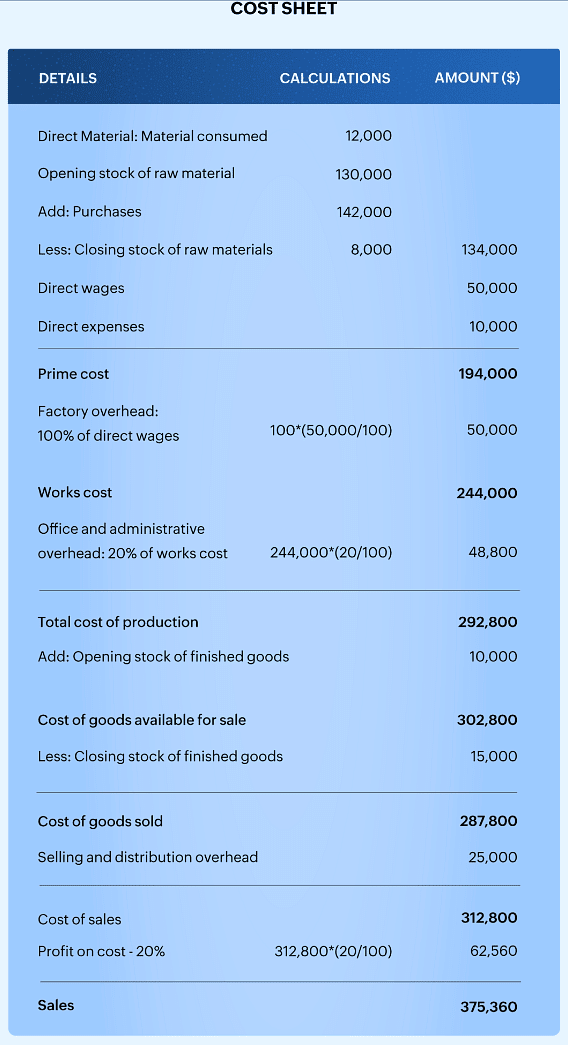

Cost Sheet Example

The various components of cost explained in the previous section can be represented in the form of a statement. A cost sheet statement consists of prime cost, factory cost, cost involved in the production of goods sold, and total cost. Let us look at an example, in which you have to prepare a cost sheet for a furniture company for the financial year ending March 31, 2019. Now take a look at the following information which is available to you to prepare a cost sheet statement.

Direct material consumed – $12,000

Opening stock of raw materials – $130,000

Closing stock of raw materials – $8,000

Direct wages – $50,000

Direct expenses – $10,000

Factory overhead is 100% of direct wages

Office and administration overhead is 20% of works

Selling and distribution overhead – $25,000

Cost of opening stock for finished goods – $10,000

Cost of closing stock for finished goods – $15,000

Profit on cost is 20%

|

106 videos|173 docs|18 tests

|

FAQs on Elements of Cost & Cost Sheet - Cost Accounting - B Com

| 1. What are the different elements of cost in cost accounting? |  |

| 2. How do cost elements play a role in cost accounting? |  |

| 3. What is the significance of preparing a cost sheet in cost accounting? |  |

| 4. How can cost sheet analysis help in identifying cost-saving opportunities? |  |

| 5. How can understanding the elements of cost benefit businesses in improving profitability? |  |

|

Explore Courses for B Com exam

|

|