Eway Bill - What is Eway Bill? E Way Bill System, Rules & Generation Process Explained | Taxation for CA Intermediate PDF Download

What is an eWay Bill?

EWay Bill Overview:

- An eWay Bill, also known as an Electronic Way bill, is required for the movement of goods and must be generated through the eWay Bill Portal. It is mandatory for GST registered individuals to obtain an e-way bill when transporting goods valued over Rs. 50,000 (based on a single invoice, bill, or delivery challan). This bill is created on ewaybillgst.gov.in.

Generation and Cancellation:

- The eWay Bill can be produced or terminated via SMS, an Android App, or through site-to-site integration using APIs, ensuring the correct GSTIN of all parties involved. It is crucial to validate the GSTIN using the GST search tool before generating the eWay Bill.

Unique Identification:

- Upon generating the eWay Bill, a distinctive Eway Bill Number (EBN) is assigned. This EBN is accessible to the supplier, recipient, and transporter of the goods, facilitating smooth operations and compliance.

When Should eWay Bill be issued?

The eWay bill is created when goods worth over Rs. 50,000 are transported in a vehicle or conveyance, whether for a supply, a return, or due to inward supply from an unregistered person. A supply can be categorized as follows:

- A supply made for payment as part of business activities.

- A supply made for payment not related to business.

- A supply made without any payment.

In simpler terms, 'supply' typically includes sales, transfers, and barter/exchange transactions. Therefore, eWay Bills are required for all these types of movements on the common portal. Additionally, certain specified goods necessitate an eWay bill even if their value is under Rs. 50,000, such as:

- Inter-State movement of goods from Principal to Job-worker or vice versa.

- Inter-State transport of handicraft goods by a GST-exempted dealer.

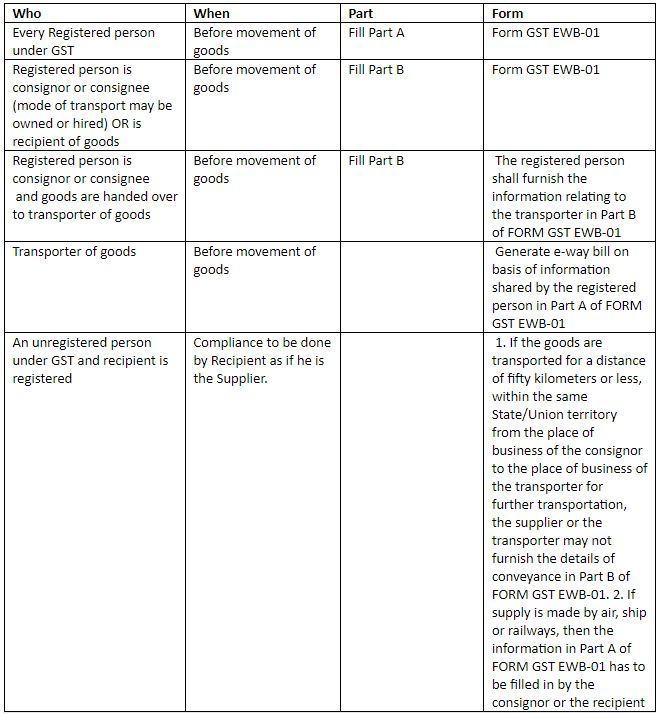

Who Should Generate an eWay Bill?

Registered Person:

- An eWay Bill must be created for goods exceeding Rs 50,000 in value to or from a registered individual.

- Even if the value is below Rs 50,000, a Registered Person or transporter can choose to generate an eWay Bill.

Unregistered Persons:

- Unregistered individuals must also produce an e-Way Bill.

- When an unregistered person supplies goods to a registered person, the receiver must ensure all compliances are met.

Transporter:

- Transporters moving goods via road, air, rail, etc., are required to create an e-Way Bill if the supplier hasn't.

The transporters need not generate the Eway bill (as Form EWB-01 or EWB-02) where all the consignments in the conveyance

- Individually(single Document**) is less than or equal to Rs 50,000 BUT

- In Aggregate (all documents** put together) exceeds Rs 50,000

**Document means Tax Invoice/Delivery challan/Bill of supply

Unregistered Transporters will be issued Transporter ID on enrolling on the e-way bill portal after which Eway bills can be generated.

Cases when eWay bill is Not Required

In the following situations, generating an e-Way Bill is not mandatory:

- The method of transportation is a non-motor vehicle.

- Items transported from Customs port, airport, air cargo complex, or land customs station to Inland Container Depot (ICD) or Container Freight Station (CFS) for Customs clearance.

- Goods transported under Customs supervision or sealed by customs.

- Goods transported under a Customs Bond from ICD to Customs port or between custom stations.

- Transit cargo transported to or from Nepal or Bhutan.

- Movement of goods due to defense formation under the Ministry of Defense as either the consignor or consignee.

- Empty cargo containers in transit.

- Consignor transporting goods between the place of business and a weighbridge for weighment within a 20 km distance, accompanied by a Delivery challan.

- Goods transported by rail where the Consignor is the Central Government, State Governments, or a local authority.

- Goods specified as exempt from E-Way bill requirements in the respective State/Union territory GST Rules.

- Transport of specific goods, including those exempt from the E-Way bill requirements as per various regulations.

Note: Part B of the e-Way Bill is unnecessary when the distance between the consigner or consignee and the transporter is under 50 km, and the transport occurs within the same state.

State-wise e-Way Bill Rules and Limits

Inter-State movement of goods has experienced a significant increase in the generation of e-way bills since its enforcement began on April 1, 2018. The implementation of the e-way bill system on a state-wise basis has garnered positive feedback, with all States and Union Territories participating in the generation of e-way bills for intra-State/UT goods transportation.

Several States have granted exemptions to their residents by waiving the requirement for e-way bill generation in cases where the value of goods falls below a specified threshold amount or for certain designated items. For example, Tamil Nadu exempts its residents from generating an e-way bill if the value of goods is less than Rs. One Lakh. For more information on such exemptions in other States/UTs, you can refer to our page on state-wise e-way bill rules and threshold limits or visit the respective commercial tax websites of each State/UT.

Main Points:

- Introduction of e-way bill system for Inter-State goods movement

- Participation of all States and Union Territories in e-way bill generation

- Exemptions granted by some States based on monetary limits or specific goods

- Example of Tamil Nadu exempting e-way bill generation for goods below Rs. One Lakh

- Information sources for further details on exemptions in different regions

How to Generate an e-Way Bill on the Portal

E-Way Bill and the e-way bill number can be generated on the e-Way Bill Portal. All you need is a Portal login.

SMS e-way bill generation on mobile

You can create e-way bills through SMS using a registered mobile phone. To start, activate the SMS e-way bill generation feature. Register the mobile phone you intend to use for SMS-based e-way bill generation. Then, send specific SMS codes to a designated mobile number managed by the e-way bill portal/GSTN to create, manage, and cancel e-way bills effortlessly.

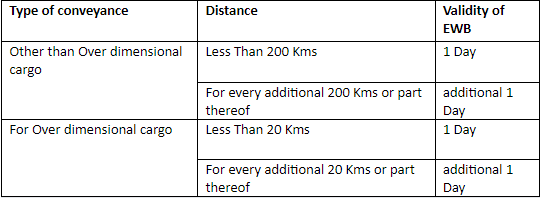

Validity of eWay Bill

An e-way bill remains valid for specific durations based on the distance the goods travel. The validity period is calculated from the e-way bill's generation timestamp.

The validity of an e-way bill can be extended. The individual who generated the e-way bill must extend its validity either eight hours before expiry or within eight hours after expiry.

Documents or Details required to generate eWay Bill

- Invoice/Bill of Supply/Challan related to the consignment of goods

- Transport by road - Transporter ID or Vehicle number

- Transport by rail, air, or ship - Transporter ID, Transport document number, and date on the document

|

38 videos|118 docs|12 tests

|

FAQs on Eway Bill - What is Eway Bill? E Way Bill System, Rules & Generation Process Explained - Taxation for CA Intermediate

| 1. What is an eWay Bill? |  |

| 2. When Should eWay Bill be issued? |  |

| 3. Who Should Generate an eWay Bill? |  |

| 4. Conditions for not generating Eway bill by transporters: |  |

| 5. What are some recent updates on the e-way bill system? |  |