Financial Statements Of Sole Proprietorship - (Part - 1) | Accountancy Class 11 - Commerce PDF Download

Page No 18.62:

Question 1: State whether the following expenses are capital or revenue in nature:

(i) Expenses on whitewashing and painting of a building purchased to make it ready for use.

(ii) ₹ 10,000 spent on constructing platform for a new machine.

(iii) Repair expenses of ₹ 25,000 incurred for whitewashing of factory building.

(iv) Insurance premium paid as renewal premium.

(v) Purchased a new car.

ANSWER:

(1) Capital Expenditure: Paid to make an asset ready to use

(2) Capital Expenditure: Paid to make an asset ready to us

(3) Revenue Expenditure: Made for the maintenance of asset

(4) Revenue Expenditure: Part of normal operating cost

(5) Capital Expenditure: Used in business for a number of years

Page No 18.62:

Question 2: State with reasons whether the following are Capital or Revenue Expenses:

(i) Excise duty paid on purchase of new machine.

(ii) Wages paid to install a machine.

(iii) Repairs carried out on existing car.

(iv) Office block of building repainted for ₹ 50,000.

(v) Paid telephone bill ₹ 2,500.

ANSWER:

(1) Capital Expenditure: Paid for the acquisition of new asset

(2) Capital Expenditure: Paid to make the asset ready to use

(3) Revenue Expenditure: Paid for the running and maintenance of car

(4) Revenue Expenditure: Paid for the maintenance of Building

(5) Revenue Expenditure: Part of normal operating cost

Page No 18.62:

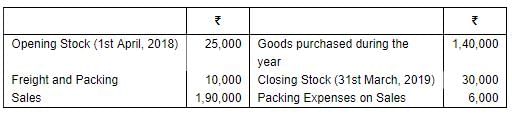

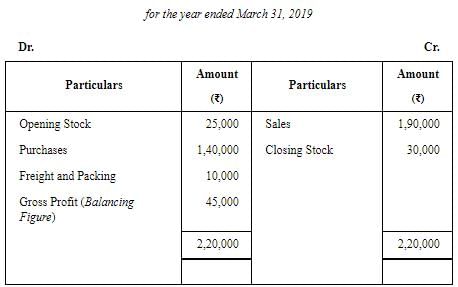

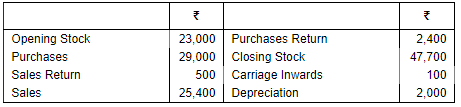

Question 3: From the following information, determine Gross Profit for the year ended 31st March, 2019:

ANSWER:

Gross Profit

= Sales + Closing Stock – (Opening Stock + Freight and Packing + Goods Purchased)

=1,90,000 + 30,000 – (25,000 + 10,000 + 1,40,000)

=2,20,000 – 1,75,000 = ₹45,000

Alternatively,

Note: Packing Expenses (Rs 6,000) on Sales is an Indirect Expense, therefore it is not considered to compute the amount of Gross Profit

Page No 18.62:

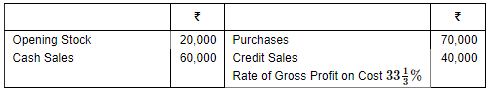

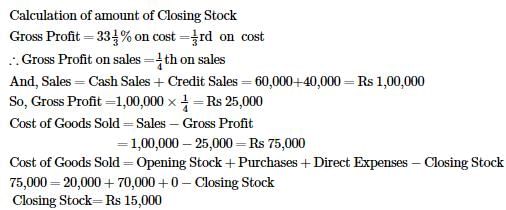

Question 4: Calculate Closing Stock from the following details:

ANSWER:

Page No 18.62:

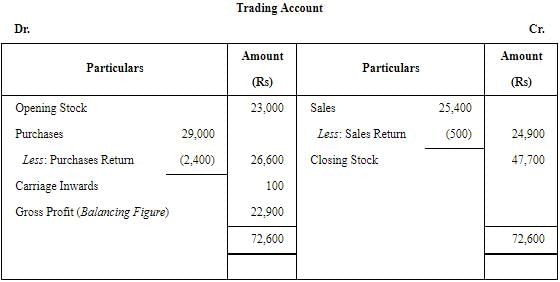

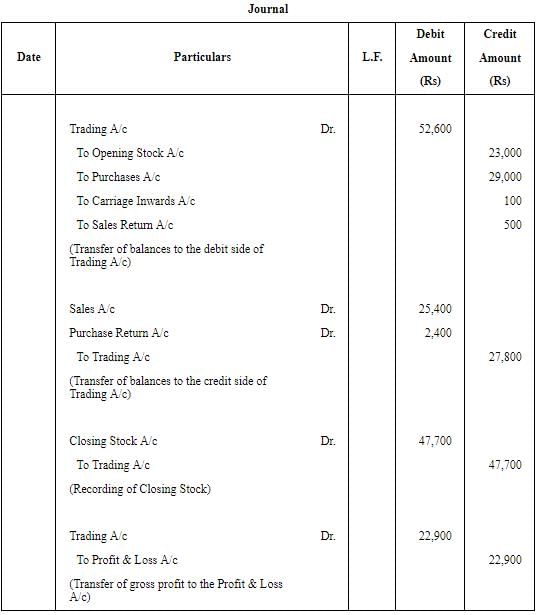

Question 5: Prepare Trading Account from the transactions givne below:

Also pass the Journal entries.

ANSWER:

Note: Depreciation is an Indirect Expense, therefore it is not shown in the Trading Account.

|

64 videos|153 docs|35 tests

|

FAQs on Financial Statements Of Sole Proprietorship - (Part - 1) - Accountancy Class 11 - Commerce

| 1. What are financial statements of a sole proprietorship? |  |

| 2. Why are financial statements important for a sole proprietorship? |  |

| 3. How often should financial statements be prepared for a sole proprietorship? |  |

| 4. What information is included in an income statement for a sole proprietorship? |  |

| 5. How can a sole proprietorship use financial statements to evaluate its performance? |  |

|

Explore Courses for Commerce exam

|

|