Financial Statements of Sole Proprietorship - (Part - 3) | Accountancy Class 11 - Commerce PDF Download

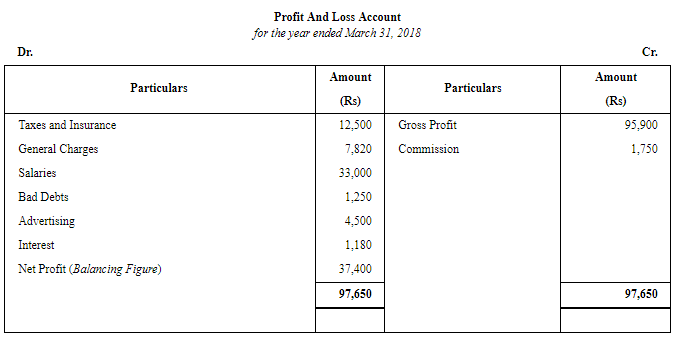

Page No 18.66:

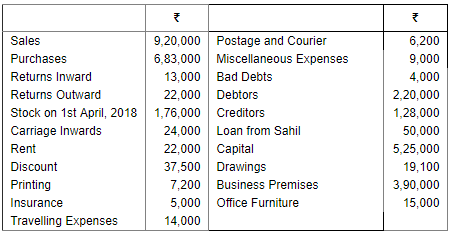

Question 19: The following are the balances as on 31st March, 2019 extracted from the books of Dass:

The stock on 31st March, 2019 was valued at ₹ 2,40,000.

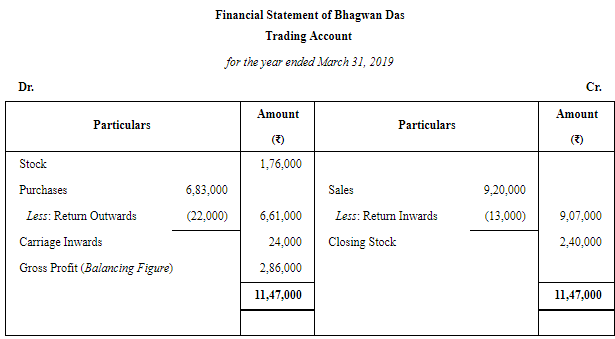

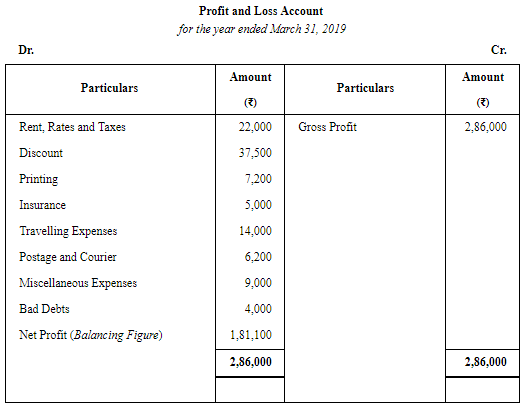

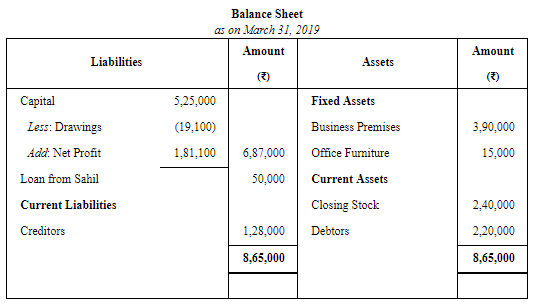

You are required to prepare Trading Account, Profit and Loss Account and Balance Sheet as at 31st March, 2019.

ANSWER:

Page No 18.66:

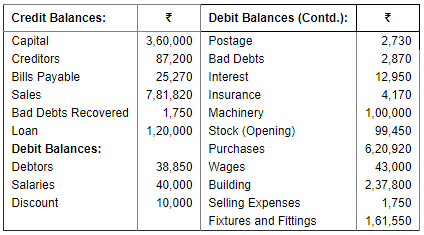

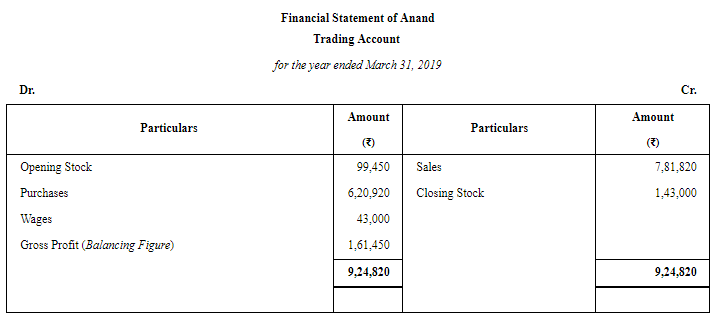

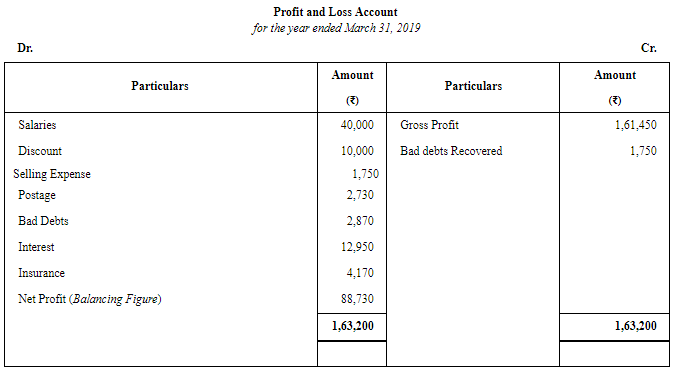

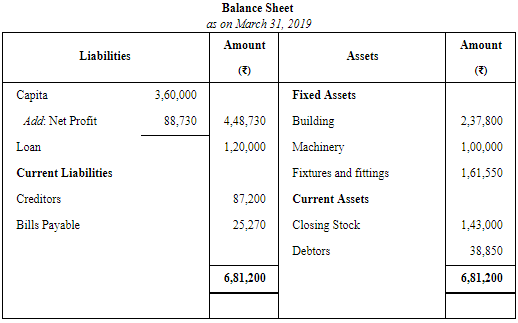

Question 20: From the following balances of Anand, prepare Trading Account, Profit and Loss Account, and Balance Sheet as at 31st March, 2019:

Value of goods on hand (31st March, 2019) was ₹ 1,43,000.

ANSWER:

Page No 18.67:

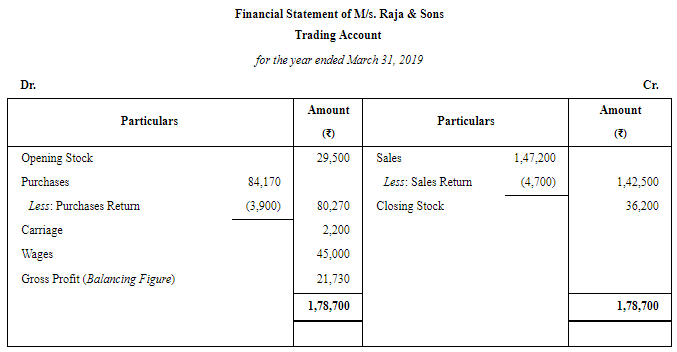

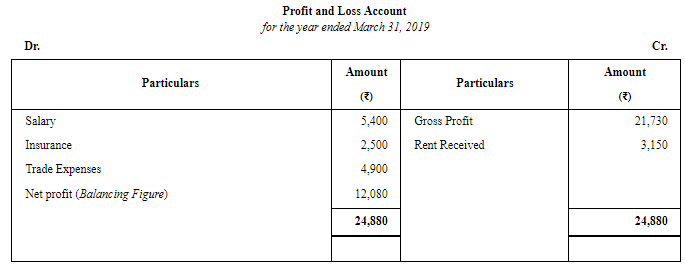

Question 21: From the following balances, prepare Final Accounts of M/s Raja & Sons for the year ended 31st March, 2019:

Salary ₹ 5,400; Insurance ₹ 2,500; Cash ₹ 400; Purchases ₹ 84,170; Rent Received ₹ 3,150; Drawings ₹ 2,100; Bills Payable ₹ 3,900; Debtors ₹ 38,080; Stock (1st April, 2018) ₹ 29,500; Bank Overdraft ₹ 9,700; Carriage ₹ 2,200; Creditors ₹ 4,200; Trade Expenses ₹ 4,900; Sales Return ₹ 4,700; Machinery ₹ 12,000; Wages ₹ 45,000; Sales ₹ 1,47,200; Purchases Return ₹ 3,900; Capital ₹ 58,900; Closing Stock (31st March, 2019) ₹ 36,200.

ANSWER:

Page No 18.67:

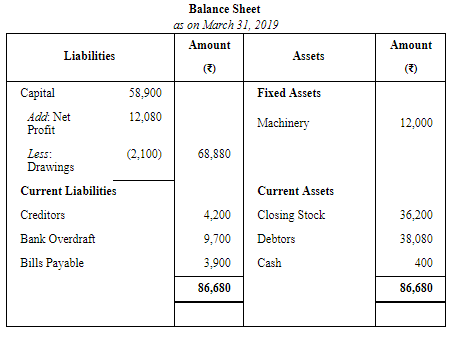

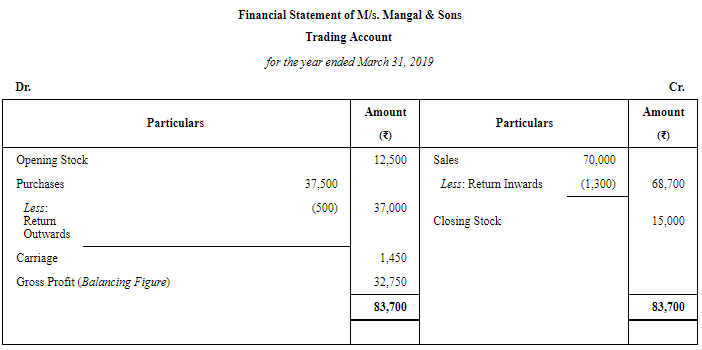

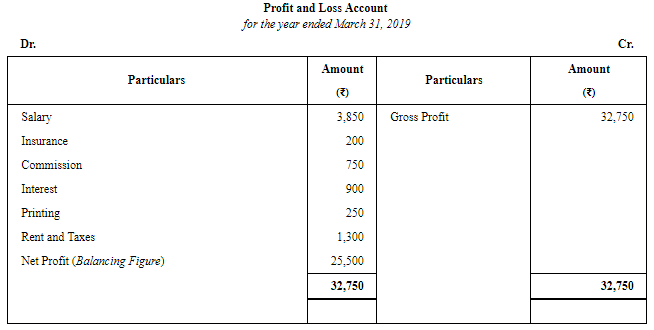

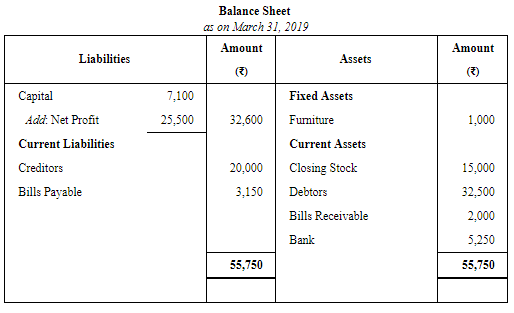

Question 22: From the following balances, prepare Final Accounts of M/s Mangal & Sons for the year ended 31st March, 2019:

Opening Stock ₹ 12,500; Bills Receivable ₹ 2,000; Sales ₹ 70,000; Purchases ₹ 37,500; Creditors ₹ 20,000; Salaries ₹ 3,850; Insurance ₹ 200; Debtors ₹ 32,500; Carriage ₹ 1,450; Commission ₹ 750; Interest ₹ 900; Printing ₹ 250; Bills Payable ₹ 3,150; Returns In ₹ 1,300; Returns Out ₹ 500; Bank ₹ 5,250; Rent and Taxes ₹ 1,300; Furniture ₹ 1,000; Capital ₹ 7,100; Stock on 31st March, 2019 ₹ 15,000.

ANSWER:

Page No 18.67:

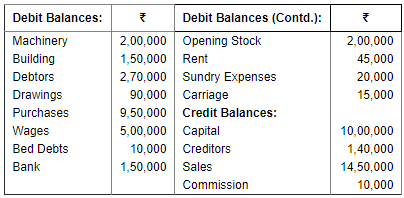

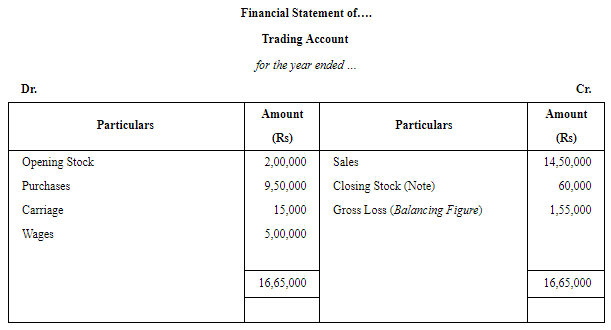

Question 23: From the following balances, prepare Trading and Profit and Loss Account and the Balance Sheet:

Closing Stock was of ₹ 70,000 but its net realisable value was estimated at ₹ 60,000.

ANSWER:

Note: Closing Stock is recorded at cost price or market price which is lower.

Page No 18.67:

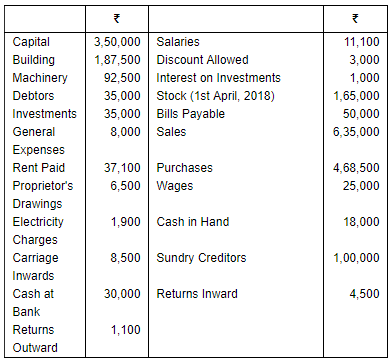

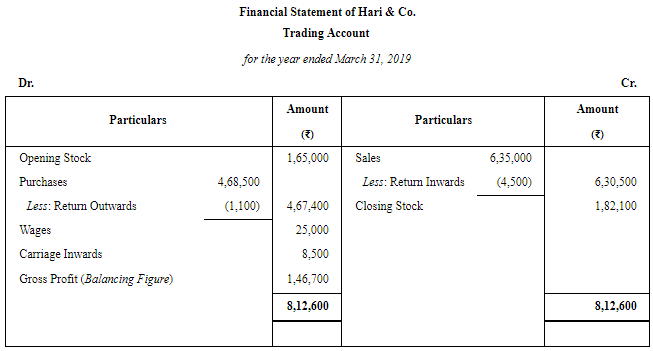

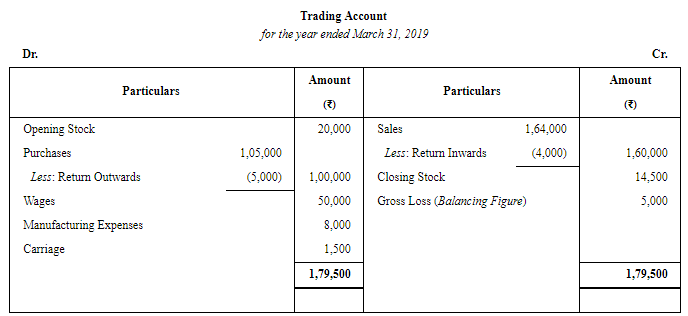

Question 24: From the following balances taken from the books of Hari & Co., prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date:

Closing Stock was valued at ₹ 1,82,100.

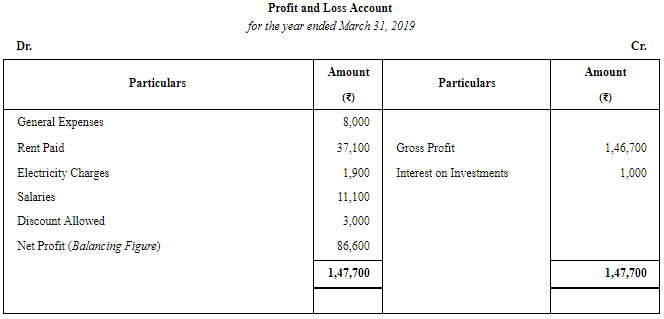

ANSWER:

Page No 18.68:

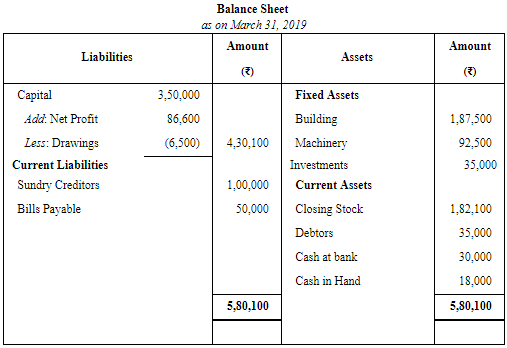

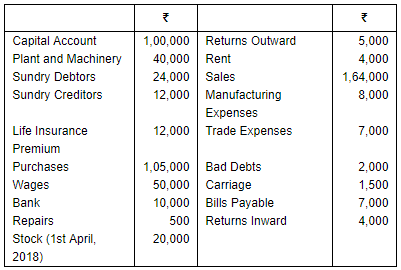

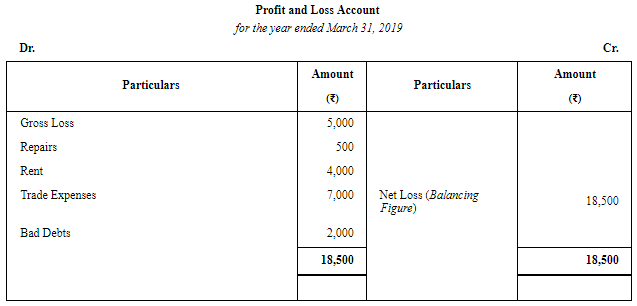

Question 25: From the following balances, as on 31st March, 2019, prepare Trading and Profit and Loss Account and Balance Sheet:

Closing Stock on 31st March, 2019 was valued at ₹ 14,500.

ANSWER:

Page No 18.68:

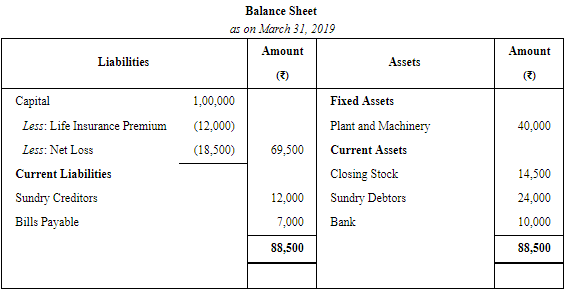

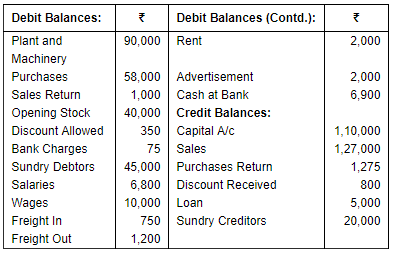

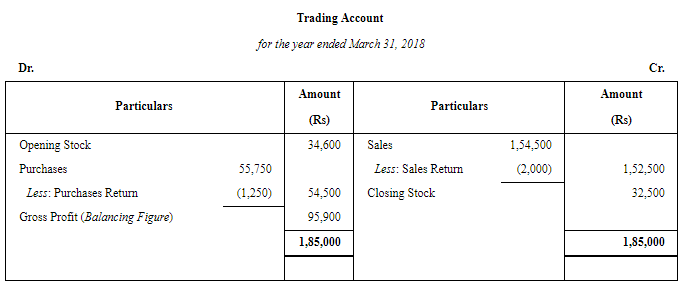

Question 26: Trial Balance of Chatter Sen on 31st March, 2019 revealed the following balances:

Stock on 31st March, 2019 was valued at ₹ 35,000.

Prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at the date.

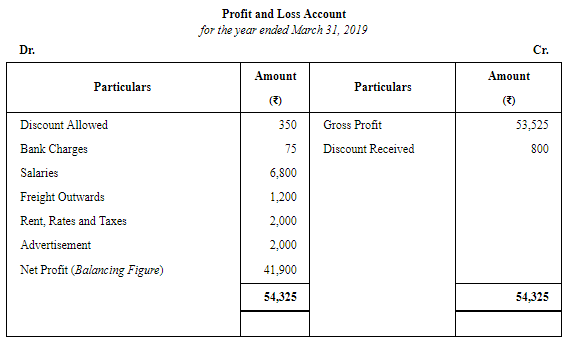

ANSWER:

Page No 18.68:

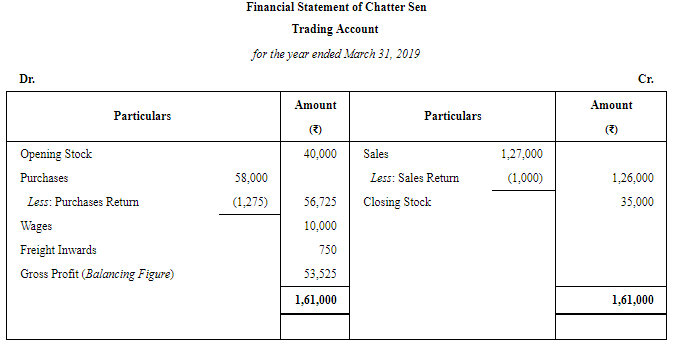

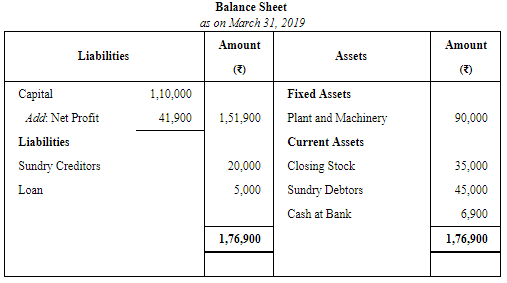

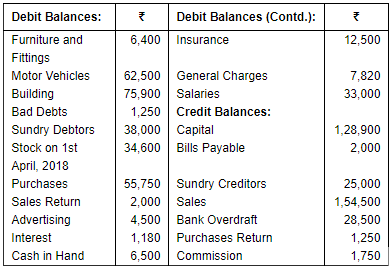

Question 27: Following Trial Balance is extracted from the books of a merchant on 31st March, 2019:

Stock in Hand on 31st March, 2019 was valued at ₹ 32,500.

From the above, prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date.

ANSWER:

Page No 18.69:

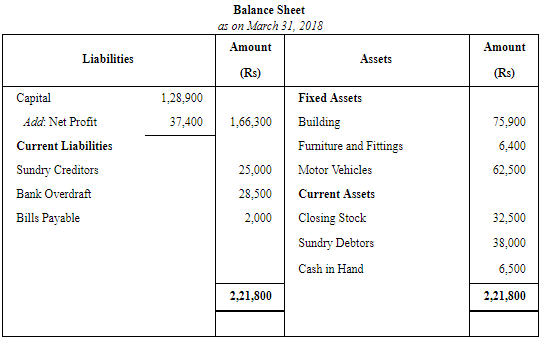

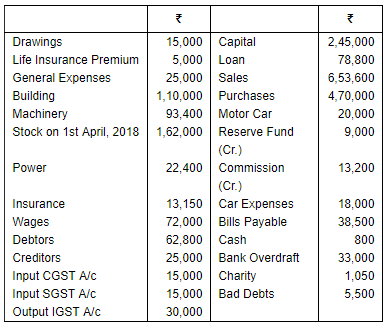

Question 28: The following balances were extracted from the books of Harish Chandra on 31st March, 2019:

Stock on 31st March, 2019 was valued at ₹ 2,35,000.

Prepare final accounts for the year ended 31st March, 2019.

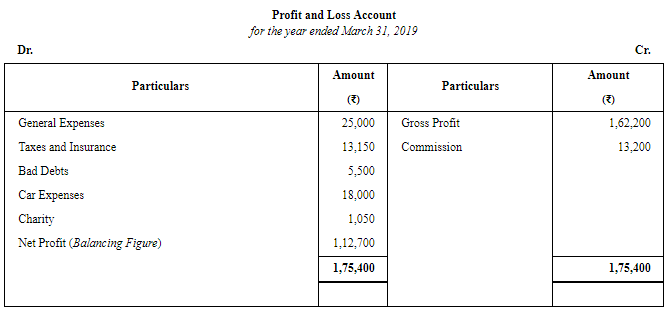

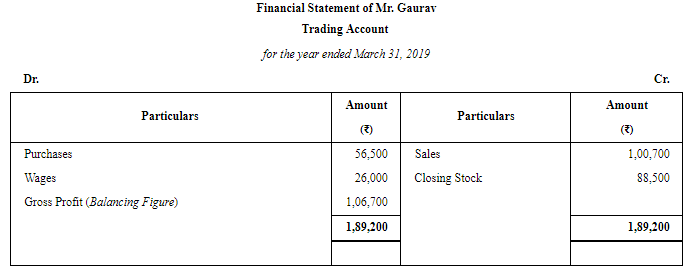

ANSWER:

Working Note:

(1) GST Set off

Output IGST-Input CGST-Input SGST= 30,000-15,000-15,000=Nil

GST Payable/Receivable=Nil

Hence, Computation of GST won't affect the Balance Sheet.

Page No 18.69:

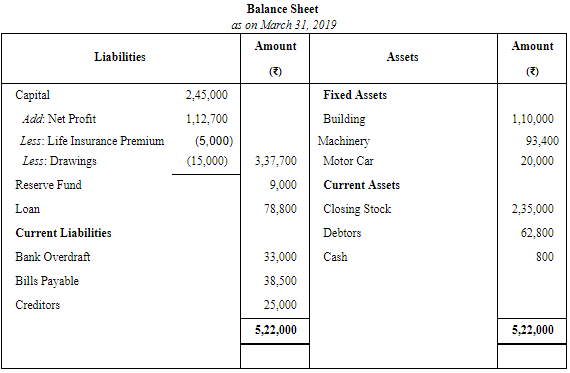

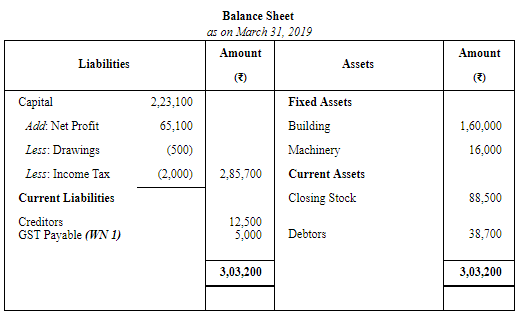

Question 29: From the following Trial Balance and additional information of Mr. Gaurav, a proprietor, prepare Trading and Profit and Loss Account for the year ended 31st March, 2019 and Balance Sheet as at that date:

Closing Stock at cost ₹ 1,00,000 but its market value is ₹ 88,500.

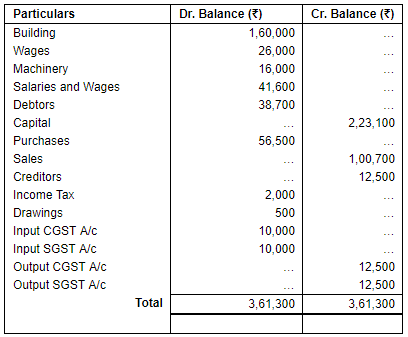

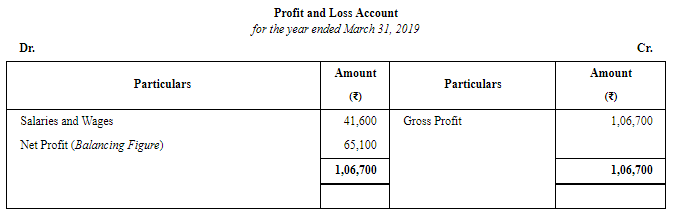

ANSWER:

Working Notes:

(1) GST Set off

First: Output CGST-Input CGST= 12,500-10,000=2,500

Second: Output SGST-Input SGST= 12,500-10,000=2,500

GST Payable=Output CGST+Output SGST=2,500+2,500=5,000

(2) Closing Stock has been taken at its Market Price (i.e. Rs 88,500) and not on its Cost. This is because, as per the Principle of Conservatism, Closing Stock is taken at Cost or Market Price whichever is less.

|

64 videos|152 docs|35 tests

|

FAQs on Financial Statements of Sole Proprietorship - (Part - 3) - Accountancy Class 11 - Commerce

| 1. What are the financial statements of a sole proprietorship? |  |

| 2. How does an income statement of a sole proprietorship differ from a balance sheet? |  |

| 3. What information does a statement of cash flows provide for a sole proprietorship? |  |

| 4. How can financial statements of a sole proprietorship be used for decision making? |  |

| 5. How often should financial statements be prepared for a sole proprietorship? |  |

|

Explore Courses for Commerce exam

|

|