|

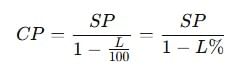

Cost price (CP) is the amount paid to acquire a product or service. |

Card: 2 / 28 |

|

Profit is calculated using the formula: |

Card: 4 / 28 |

|

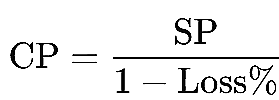

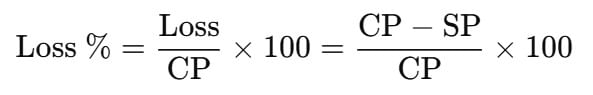

Loss percentage is calculated using the formula: |

Card: 6 / 28 |

|

If a person sells a watch for ₹240 and incurs a loss of 20%, what is the cost price of the watch? |

Card: 7 / 28 |

|

If the selling price is ₹240 and this represents 80% of the cost price, = 240 / 0.80 = 300 |

Card: 8 / 28 |

|

Calculate the selling price if an item is bought for ₹300 and a profit of 15% is desired. |

Card: 9 / 28 |

|

Selling Price is calculated as: SP = CP + Profit. |

Card: 10 / 28 |

|

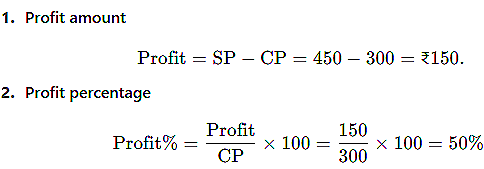

Profit is the financial gain achieved when the revenue from sales exceeds the total costs incurred in producing and selling a product or service. It is calculated using the formula: |

Card: 12 / 28 |

|

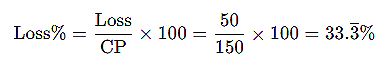

If an item is purchased for ₹150 and sold for ₹100, What is the loss and the loss percentage? |

Card: 13 / 28 |

Unlock all Flashcards with EduRev Infinity Plan Starting from @ ₹99 only

|

|

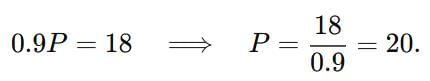

A book is sold for ₹18 after a discount of 10%. What was the original price of the book? |

Card: 15 / 28 |

|

Let the original price be x. The selling price after a 10% discount is x - 0.10x = 0.90x. |

Card: 16 / 28 |

|

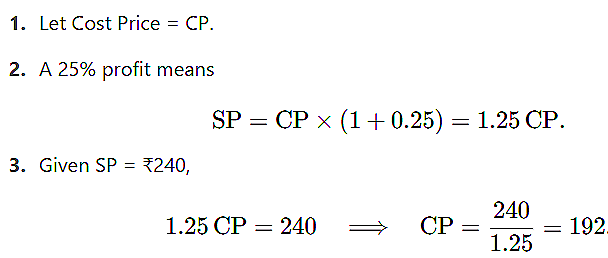

If a seller experiences a profit of 25% on an item sold for ₹240, what was the cost price? |

Card: 17 / 28 |

|

If a retailer buys a product for ₹400 and wants to achieve a profit of 30%, what should be the selling price? |

Card: 19 / 28 |

|

First calculate the profit: Profit = 30% of Cost Price = 0.30 x ₹400 = ₹120. |

Card: 20 / 28 |

|

A store offers a discount of 15% on a pair of shoes originally priced at ₹80. What is the selling price after the discount? |

Card: 21 / 28 |

|

The discount is calculated as 15% of ₹80, which is ₹12. |

Card: 22 / 28 |

|

The break-even point is the point at which total revenue equals total costs, resulting in neither profit nor loss. |

Card: 24 / 28 |

|

If a company sells a product for ₹500 and incurs a 20% loss, what is the cost price of the product? |

Card: 25 / 28 |

|

If the selling price is ₹500 and this represents 80% of the cost price (since a 20% loss means the selling price is 80% of the cost), |

Card: 26 / 28 |

|

Calculate the profit percentage if a product is bought for ₹300 and sold for ₹450. |

Card: 27 / 28 |

If a product with a CP of 200 is sold for 150,

If a product with a CP of 200 is sold for 150,