Framework for Preparation and Presentation of Financial Statements: Notes | Accounting for CA Intermediate (Old Scheme) PDF Download

Chapter Overview

- The framework sets out the concepts underlying the preparation and presentation of general purpose financial statements prepared by enterprises for wide range of users. The Accounting Standards Board (ASB) of the Institute of Chartered Accountants of India (ICAI) issued a framework for the Preparation and Presentation of Financial Statements in July 2000. This Framework is relevant in context of Companies (Accounting Standards) Rules, 2006, Companies (Accounting Standards) Amendments Rules, 2016, notified by the Central Government and Accounting Standards issued by the ICAI.

- This framework provides the fundamental basis for development of new standards as also for review of existing standards. This framework also explains components of financial statements, users of financial statements, qualitative characteristics of financial statements and elements of financial statements. The framework also explains concepts of capital, capital maintenance and determination of profit.

Introduction:

The development of accounting standards or any other accounting guidelines need a foundation of underlying principles. (ASB) of ICAI issued a framework in July, 2000 which provides the fundamental basis for development of new standards as also for review of existing standards. The principal areas covered by the framework are as follows:

- Components of financial statements;

- Objectives of financial statements;

- Assumptions underlying financial statements;

- Qualitative characteristics of financial statements;

- Elements of financial statements;

- Criteria for recognition of elements in financial statements;

- Principles for measurement of financial elements;

- Concepts of Capital and Capital Maintenance.

Purpose Of The Framework :

The framework sets out the concepts underlying the preparation and presentation of general-purpose financial statements prepared by enterprises for external users. The main purpose of the framework is to assist:

- Enterprises in preparation of their financial statements in compliance with Accounting Standards and in dealing with the topics not yet covered by any Accounting Standard,

- ASB in its task of development and review of Accounting Standards,

- ASB in promoting harmonisation of regulations, Accounting Standards and procedures relating to the preparation and presentation of financial statements by providing a basis for reducing the number of alternative accounting treatments permitted by Accounting Standards,

- Auditors in forming an opinion as to whether financial statements conform to the Accounting Standards,

- Users in interpretation of financial statements,

- those who are interested in the work of ASB with information about its approach to the formulation of Accounting Standards.

Status And Scope Of The Framework:

- The framework applies to general-purpose financial statements (hereafter referred to as ‘financial statements’ usually prepared annually for external users, by all commercial, industrial and business enterprises, whether in public or private sector. The special purpose financial reports, for example computations prepared for tax purposes are outside the scope of the framework. Nevertheless, the framework may be applied in preparation of such reports, to the extent not inconsistent with their requirements.

- Nothing in the framework overrides any specific Accounting Standard. In case of conflict between an Accounting Standard and the framework, the requirements of the Accounting Standard will prevail over those of the framework.

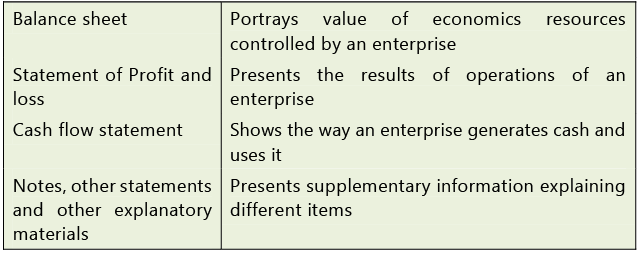

Components Of Financial Statements:

- A complete set of financial statements normally consists of a Balance Sheet, a Statement of Profit and Loss and a Cash Flow Statement together with notes, other statements and explanatory materials that form an integral part of the financial statements.

- All components of the financial statements are interrelated because they reflect different aspects of same transactions or other events. Although each statement provides information that is different from each other, none in isolation is likely to serve any single purpose nor can anyone provide all information needed by a user.

The major information contents of different components of financial statements are explained as below:

- Balance Sheet portrays value of economic resources controlled by an enterprise. It also provides information about liquidity and solvency of an enterprise which is useful in predicting the ability of the enterprise to meet its financial commitments as they fall due.

- Statement of Profit and Loss presents the result of operations of an enterprise for an accounting period, i.e., it depicts the performance of an enterprise, in particular its profitability.

- Cash Flow Statement shows the way an enterprise has generated cash and the way they have been used in an accounting period and helps in evaluating the investing, financing and operating activities during the reporting period.

- Notes and other statements present supplementary information explaining different items of financial statements. For example, they may contain additional information that is relevant to the needs of users about the items in the balance sheet and statement of profit and loss. They include various other disclosures such as disclosure of accounting policies, segment reporting, related party disclosures, earnings per share, etc.

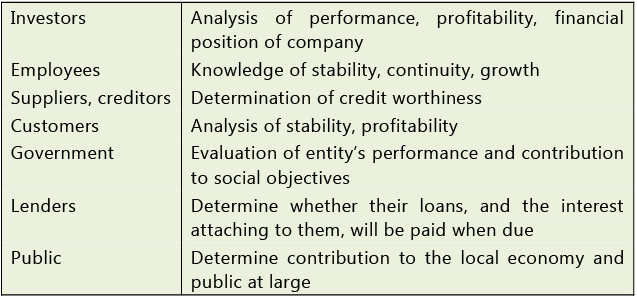

Objectives And Users Of Financial Statements:

- The objective of financial statements is to provide information about the financial position, performance and cash flows of an enterprise that is useful to a wide range of users in making economic decisions.

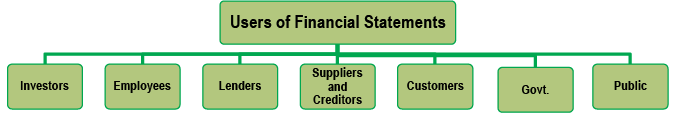

- The framework identifies seven broad groups of users of financial statements.

- All users of financial statements expect the statements to provide useful information needed to make economic decisions. The financial statements provide information to suit the common needs of most users. However, they cannot and do not intend to provide all information that may be needed, e.g. they do not provide non-financial data even if they may be relevant for making decisions.

The aforesaid users use financial statements in order to satisfy some of their information needs. These needs may include the following:

- Investors - The providers of risk capital are concerned with the risk inherent in, and return provided by, their investments. They are also interested in information which enables them to assess the ability of the enterprise to pay dividends.

- Employees - Employees and their representative groups are interested in information about the stability and profitability of their employers. They are also interested in information which enables them to assess the ability of the enterprise to provide remuneration, retirement benefits and employment opportunities.

- Lenders - Lenders are interested in information which enables them to determine whether their loans, and the interest attaching to them, will be paid when due.

- Suppliers and other trade creditors - Suppliers and other creditors are interested in information which enables them to determine whether amounts owing to them will be paid when due. Trade creditors are likely to be interested in an enterprise over a shorter period than lenders unless they are dependent upon the continuance of the enterprise as a major customer.

- Customers - Customers have an interest in information about the continuance of an enterprise, especially when they have a long term involvement with, or are dependent on, the enterprise for their goods and services.

- Governments and their agencies - Governments and their agencies are interested in the allocation of resources and, therefore, the activities of enterprises. They also require information in order to regulate the activities of enterprises and determine taxation policies, and to serve as the basis for determination of national income and similar statistics.

- Public - Enterprises affect members of the public in a variety of ways. For example, enterprises may make a substantial contribution to the local economy in many ways including the number of people they employ and their patronage of local suppliers. Financial statements may assist the public by providing information about the trends and recent developments in the prosperity of the enterprise and the range of its activities.

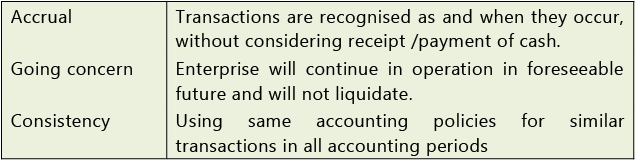

Fundamental Accounting Assumptions:

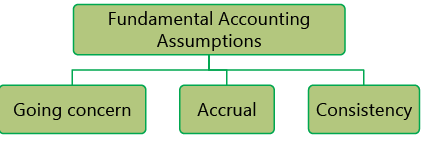

- As per the framework, there are three fundamental accounting assumptions:

- These are assumptions, i.e., the users of financial statements believe that the same has been considered while preparing the financial statements. That is why, as long as financial statements are prepared in accordance with these assumptions, no separate disclosure in financial statements would be necessary.

- If nothing has been written about the fundamental accounting assumption in the financial statements, then it is assumed that they have already been followed in their preparation of financial statements.

- However, if any of the above-mentioned fundamental accounting assumption is not followed then this fact should be specifically disclosed.

Let us discuss these assumptions in detail:

Going Concern:

Financial statements are normally prepared on the assumption that an enterprise will continue in operation in the foreseeable future and neither there is an intention, nor there is a need to materially curtail the scale of operations.

Financial statements prepared on going concern basis recognise among other things the need for sufficient retention of profit to replace assets consumed in operation and for making adequate provision for settlement of its liabilities. If any financial statement is prepared on a different basis, e.g. when assets of an enterprise are stated at net realisable values in its financial statements, the basis used should be disclosed.

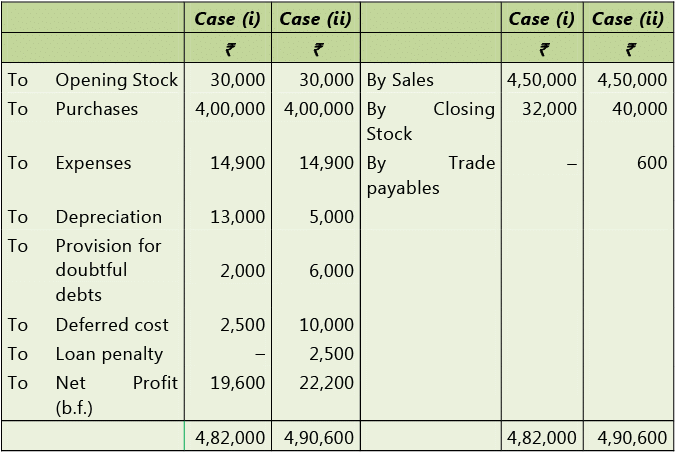

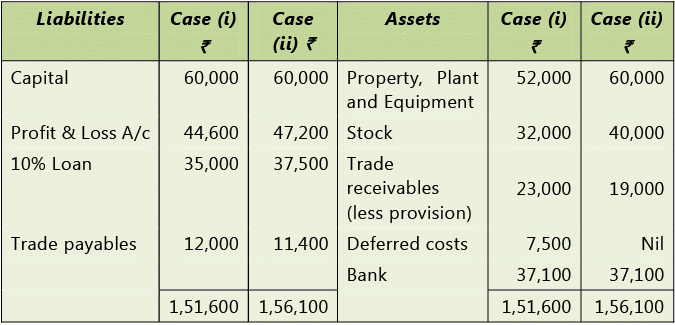

Illustration 1

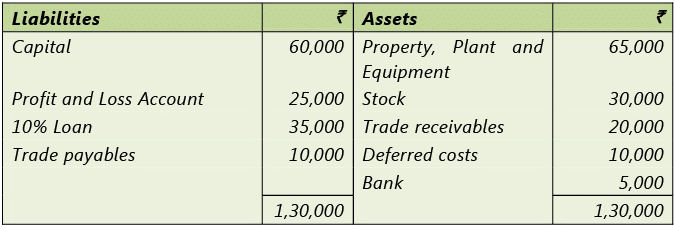

Balance sheet of a trader on 31st March, 20X1 is given below:

Additional information:

- The remaining life of Property, Plant and Equipment is 5 years. The pattern of use of the asset is even. The net realisable value of Property, Plant and Equipment on 31.03.X2 was ₹ 60,000.

- The trader’s purchases and sales in 20X1-X2 amounted to ₹ 4 lakh and ₹ 4.5 lakh respectively.

- The cost and net realisable value of stock on 31.03.X2 were ₹ 32,000 and ₹ 40,000 respectively.

- Expenses (including interest on 10% Loan of ₹ 3,500 for the year) amounted to ₹ 14,900.

- Deferred cost is amortised equally over 4 years.

- Trade receivables on 31.03.X2 is ₹ 25,000, of which ₹ 2,000 is doubtful. Collection of another ₹ 4,000 depends on successful re-installation of certain product supplied to the customer.

- Closing trade payable is ₹ 12,000, which is likely to be settled at 5% discount.

- Cash balance on 31.03.X2 is ₹ 37,100.

- There is an early repayment penalty for the loan ₹ 2,500.

You are required to prepare Profit and Loss Accounts and Balance Sheets of the trader in both cases (i) assuming going concern (ii) not assuming going concern.

Profit and Loss Account for the year ended 31st March, 20X2

Balance Sheet as at 31st March, 20X2

Accrual Basis:

According to AS 1, revenues and costs are accrued, that is, recognised as they are earned or incurred (and not as money is received or paid) and recorded in the financial statements of the periods to which they relate. Further Section 128(1) of the Companies Act, 2013 makes it mandatory for companies to maintain accounts on accrual basis only. It is not necessary to expressly state that accrual basis of accounting has been followed in preparation of a financial statement. In case, any income/ expense is recognised on cash basis, the fact should be stated.

Let’s understand the impact of both approaches of accounting by way of an example:

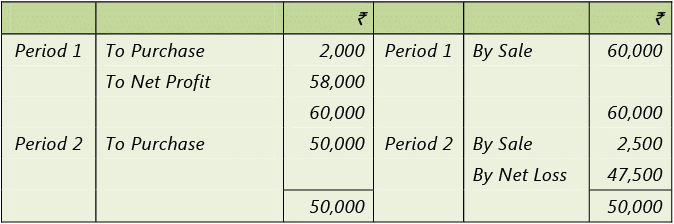

Example: (a) A trader purchased article A on credit in period 1 for ₹ 50,000.

(b) He also purchased article B in period 1 for ₹ 2,000 cash.

(c) The trader sold article A in period 1 for ₹ 60,000 in cash.

(d) He also sold article B in period 1 for ₹ 2,500 on credit.

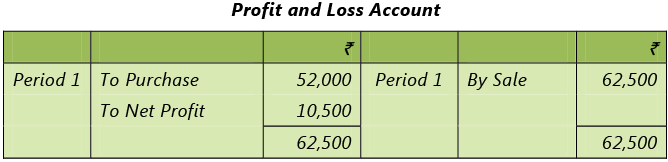

Profit and Loss Account of the trader by two basis of accounting are shown below. A look at the cash basis Profit and Loss Account will convince any reader of the irrationality of cash basis of accounting.

Cash basis of accounting

Cash purchase of article B and cash sale of article A is recognised in period 1 while purchase of article A on payment and sale of article B on receipt is recognised in period 2.

Accrual basis of accounting

Credit purchase of article A and cash purchase of article B and cash sale of article A and credit sale of article B is recognised in period 1 only.

Consistency:

It is assumed that accounting policies are consistent from one period to another. The consistency improves comparability of financial statements through time. According to Accounting Standards, an accounting policy can be changed if the change is required

(i) by a statute or

(ii) by an Accounting Standard or

(iii) for more appropriate presentation of financial statements.

Qualitative Characteristics Of Financial Statements:

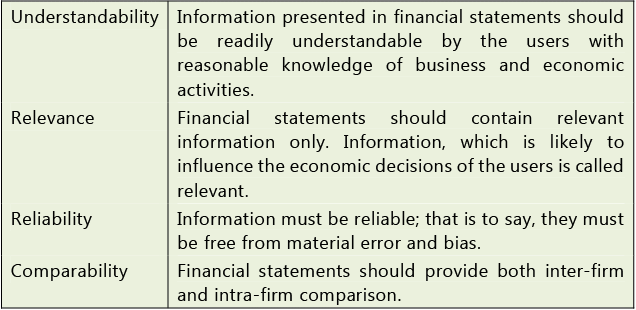

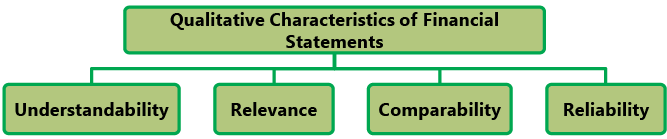

The qualitative characteristics are attributes that improve the usefulness of information provided in financial statements. The framework suggests that the financial statements should observe and maintain the following four qualitative characteristics as far as possible within limits of reasonable cost/ benefit.

These attributes can be explained as:

- Understandability: The financial statements should present information in a manner as to be readily understandable by the users with reasonable knowledge of business and economic activities and accounting.

- Relevance: It is not right to think that more information is always better.. A mass of irrelevant information creates confusion and can be even more harmful than non-disclosure.

The financial statements should contain relevant information only. Information, which is likely to influence the economic decisions by the users, is said to be relevant. Such information may help the users to evaluate past, present or future events or may help in confirming or correcting past evaluations. The relevance of a piece of information should be judged by its materiality. A piece of information is said to be material if its misstatement (i.e., omission or erroneous statement) can influence economic decisions of a user taken on the basis of the financial information. Materiality depends on the size and nature of the item or error, judged in the specific circumstances of its misstatement. Materiality provides a threshold or cut-off point rather than being a primary qualitative characteristic which the information must have if it is to be useful.

Further it is important to know the constraints also on Relevant and Reliable Information to better understand the qualitative characteristics of financial statements. Following are some of the constraints:

(a) Timeliness

If there is undue delay in the reporting of information it may lose its relevance. Management may need to balance the relative merits of timely reporting and the provision of reliable information. To provide information on a timely basis it may often be necessary to report before all aspects of a transaction or other event are known, thus impairing reliability. Conversely, if reporting is delayed until all aspects are known, the information may be highly reliable but of little use to users who have had to make decisions in the interim. In achieving a balance between relevance and reliability, the overriding consideration is how best to satisfy the information needs of users.

(b) Balance between Benefit and Cost

The balance between benefit and cost is a pervasive constraint rather than a qualitative characteristic. The benefits derived from information should exceed the cost of providing it. The evaluation of benefits and costs is, however, substantially a judgmental process. The preparers and users of financial statements should be aware of this constraint. - Reliability: To be useful, the information must be reliable; that is to say, they must be free from material error and bias. The information provided are not likely to be reliable unless:

(i) Transactions and events reported are faithfully represented.

(ii) Transactions and events are reported on the principle of 'substance over form (discussed later in AS-1)'.

(iii) The reporting of transactions and events are neutral, i.e. free from bias.

(iv) Prudence is exercised in reporting uncertain outcome of transactions or events.

(v) The information in financial statements must be complete. - Comparability: Comparison of financial statements is one of the most frequently used and most effective tools of financial analysis. The financial statements should permit both inter-firm and intra-firm comparison. One essential requirement of comparability is disclosure of financial effect of change in accounting policies. However, the need for comparability should not be confused with mere uniformity and should not be allowed to become an impediment to the introduction of improved accounting standards. It is not appropriate for an enterprise to continue accounting in the same manner for a transaction or other event if the policy adopted is not in keeping with the qualitative characteristics of relevance and reliability. It is also inappropriate for an enterprise to leave its accounting policies unchanged when more relevant and reliable alternatives exist.

True And Fair View:

Financial statements are required to show a true and fair view of the performance, financial position and cash flows of an enterprise. The framework does not deal directly with this concept of true and fair view, yet application of the principal qualitative characteristics and appropriate accounting standards normally results in financial statements portraying true and fair view of information about an enterprise.

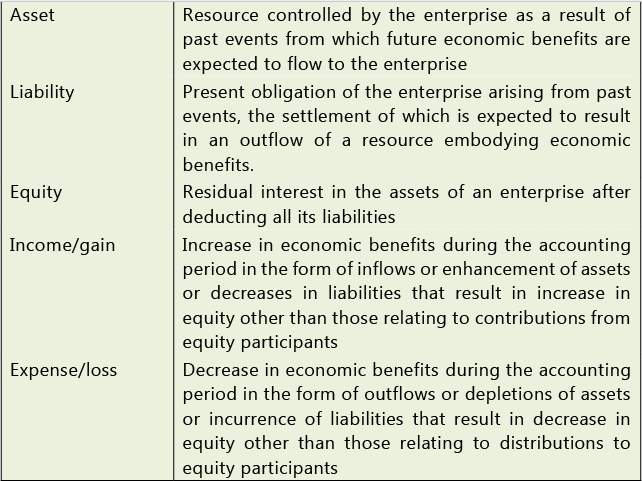

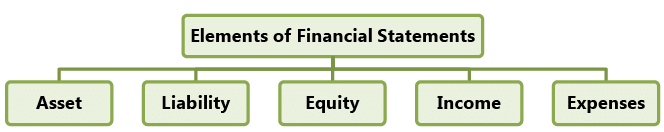

Elements Of Financial Statements:

The framework classifies items of financial statements in five broad groups depending on their economic characteristics.

Gains and losses differ from income and expenses in the sense that they may or may not arise in the ordinary course of business. Except for the way they arise, economic characteristics of gains are same as income and those of losses are same as expenses. For these reasons, gains and losses are not recognised as separate elements of financial statements.

Let us discuss each element of financial statement in detail:

- Asset: An asset is a resource controlled by the enterprise as a result of past events from which future economic benefits are expected to flow to the enterprise. The following points must be considered while recognising an asset:

(a) The resource regarded as an asset, need not have a physical substance. The resource may represent a right generating future economic benefit, e.g. patents, copyrights, trade receivables. An asset without physical substance can be either intangible asset, e.g. patents and copyrights or monetary assets, e.g. trade receivables. The monetary assets are money held and assets to be received in fixed or determinable amounts of money.

(b) An asset is a resource controlled by the enterprise. This means it is possible to recognise a resource not owned but controlled by the enterprise as an asset, i.e., legal ownership may or may not vest with the enterprise. Such is the case of financial lease, where lessee recognises the asset taken on lease, even if ownership lies with the lessor. Likewise, the lessor does not recognise the asset given on finance lease as asset in his books, because despite of ownership, he does not control the asset.

(c) A resource cannot be recognised as an asset if the control is not sufficient. For this reason specific management or technical talent of an employee cannot be recognised because of insufficient control. When the control over a resource is protected by a legal right, e.g. copyright, the resource can be recognised as an asset.

(d) To be considered as an asset, it must be probable that the resource generates future economic benefits. If the economic benefits from a resource is expected to expire within the current accounting period, it is not an asset. For example, economic benefits, i.e. profit on sale, from machinery purchased by an enterprise who deals in such kind of machinery is expected to expire within the current accounting period. Such purchase of machinery is therefore booked as an expense rather than capitalised in the machinery account. However, if the articles purchased by a dealer remain unsold at the end of accounting period, the unsold items are recognised as assets, i.e. closing stock, because the sale of the article and resultant economic benefit, i.e. profit is expected to be earned in the next accounting period.

(e) To be considered as an asset, the resource must have a cost or value that can be measured reliably.

(f) When flow of economic benefit to the enterprise beyond the current accounting period is considered improbable, the expenditure incurred is recognised as an expense rather than as an asset. - Liability: A liability is a present obligation of the enterprise arising from past events, the settlement of which is expected to result in an outflow of a resource embodying economic benefits. The following points may be noted:

(a) A liability is a present obligation1, i.e. an obligation the existence of which, based on the evidence available on the balance sheet date is considered probable. For example, an enterprise may have to pay compensation if it loses a damage suit filed against it. The damage suit is pending on the balance sheet date. The enterprise should recognise a liability for damages payable by a charge against profit if it is probable that the enterprise will lose the suit and if the amount of damages payable can be ascertained with reasonable accuracy. The enterprise should create a provision for damages payable by charge against profit, if probability of losing the suit is more than not losing it and if the amount of damages payable can be ascertained with reasonable accuracy. In other cases, the company reports the damages payable as ‘contingent liability’, which does not meet the definition of liability. Accounting standards 29 defines provision as a liability, which can be measured only by using a substantial degree of estimation.

(b) It may be noted that certain provisions, e.g. provisions for doubtful debts, depreciation and impairment losses, represent diminution in value of assets rather than obligations. These provisions are outside the scope of Accounting Standard 29 and hence should not be considered as liability.

(c) A liability is recognised only when outflow of economic resources in settlement of a present obligation can be anticipated and the value of outflow can be reliably measured. Otherwise, the liability is not recognised. For example, liability cannot arise on account of future commitment. A decision by the management of an enterprise to acquire assets in the future does not, of itself, give rise to a present obligation. An obligation normally arises only when the asset is delivered or the enterprise enters into an irrevocable agreement to acquire the asset.

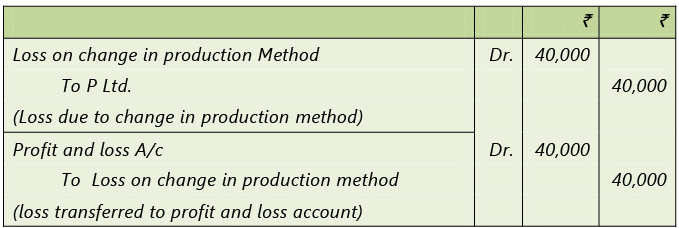

Example 2.

A Ltd. has entered into a binding agreement with P Ltd. to buy a custom-made machine for ₹ 40,000. At the end of 20X1-X2, before delivery of the machine, A Ltd. had to change its method of production. The new method will not require the machine ordered and it will be scrapped after delivery. The expected scrap value is nil.

A liability is recognised when outflow of economic resources in settlement of a present obligation can be anticipated and the value of outflow can be reliably measured. In the given case, A Ltd. should recognise a liability of ₹ 40,000 to P Ltd.

When flow of economic benefit to the enterprise beyond the current accounting period is considered improbable, the expenditure incurred is recognised as an expense rather than as an asset. In the present case, flow of future economic benefit from the machine to the enterprise is improbable. The entire amount of purchase price of the machine should be recognised as an expense. The accounting entry is suggested below:

- Equity: Equity is defined as residual interest in the assets of an enterprise after deducting all its liabilities. It is important to avoid mixing up liabilities with equity. Equity is the excess of aggregate assets of an enterprise over its aggregate liabilities. In other words, equity represents owners’ claim consisting of items like capital and reserves, which are clearly distinct from liabilities, i.e. claims of parties other than owners. The value of equity may change either through contribution from / distribution to equity participants or due to income earned /expenses incurred.

- Income: Income is increase in economic benefits during the accounting period in the form of inflows or enhancement of assets or decreases in liabilities that result in increase in equity other than those relating to contributions from equity participants. The definition of income encompasses revenue and gains. Revenue is an income that arises in the ordinary course of activities of the enterprise, e.g. sales by a trader. Gains are income, which may or may not arise in the ordinary course of activity of the enterprise, e.g. profit on disposal of Property, Plant and Equipment. Gains are showed separately in the statement of profit and loss because this knowledge is useful in assessing performance of the enterprise.

Income earned is always associated with either increase of asset or reduction of liability. This means, no income can be recognised unless the corresponding increase of asset or decrease of liability can be recognised. For example, a bank does not recognise interest earned on non-performing assets because the corresponding asset (increase in advances) cannot be recognised, as flow of economic benefit to the bank beyond current accounting period is not probable.

Thus

Balance sheet of an enterprise can be written in form of:

A – L = E.

Where:

A = Aggregate value of asset

L = Aggregate value of liabilities

E = Aggregate value of equity

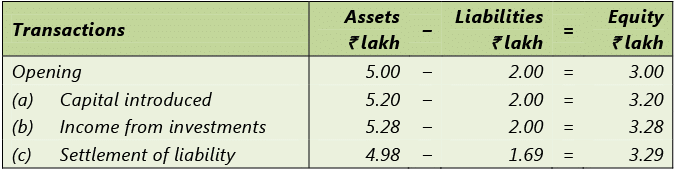

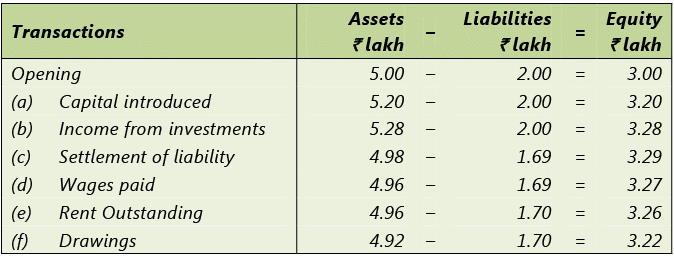

Example 3. Suppose at the beginning of an accounting period, aggregate values of assets, liabilities and equity of a trader are ₹ 5 lakh, ₹ 2 lakh and ₹ 3 lakh respectively. Also suppose that the trader had the following transactions during the accounting period.

(a) Introduced capital ₹ 20,000.

(b) Earned income from investment ₹ 8,000.

(c) A liability of ₹ 31,000 was finally settled on payment of ₹ 30,000.

Balance sheets of the trader after each transaction are shown below: The example given above explains the definition of income. The equity increased by ₹ 29,000 during the accounting period, due to (i) Capital introduction ₹ 20,000 and (ii) Income earned ₹ 9,000 (Income from investment + Discount earned). Incomes therefore result in increase in equity without introduction of capital.

The example given above explains the definition of income. The equity increased by ₹ 29,000 during the accounting period, due to (i) Capital introduction ₹ 20,000 and (ii) Income earned ₹ 9,000 (Income from investment + Discount earned). Incomes therefore result in increase in equity without introduction of capital.

Also note that income earned is accompanied by either increase of asset (Cash received as investment income) or by decrease of liability (Discount earned). - Expense: An expense is decrease in economic benefits during the accounting period in the form of outflows or depletions of assets or incurrence of liabilities that result in decrease in equity other than those relating to distributions to equity participants. The definition of expenses encompasses expenses that arise in the ordinary course of activities of the enterprise, e.g. wages paid. Losses may or may not arise in the ordinary course of activity of the enterprise, e.g. loss on disposal of Property, Plant and Equipment. Losses are separately shown in the statement of profit and loss because this knowledge is useful in assessing performance of the enterprise.

Expenses are always incurred simultaneously with either reduction of asset or increase of liability. Thus, expenses are recognised when the corresponding decrease of asset or increase of liability are recognised by application of the recognition criteria stated above. Expenses are recognised in Profit & Loss A/c by matching them with the revenue generated. However, application of matching concept should not result in recognition of an item as asset (or liability), which does not meet the definition of asset or liability as the case may be.

Where economic benefits are expected to arise over several accounting periods, expenses are recognised in the profit and loss statement on the basis of systematic and rational allocation procedures. The obvious example is that of depreciation.

An expense is recognised immediately in the profit and loss statement when it does not meet or ceases to meet the definition of asset or when no future economic benefit is expected. An expense is also recognised in the profit and loss statement when a liability is incurred without recognition of an asset, as is the case when a liability under a product warranty arises.

Example 4. Continuing with the example 3 given earlier, suppose the trader had the following further transactions during the period:

(a) Wages paid ₹ 2,000.

(b) Rent outstanding ₹ 1,000.

(c) Drawings ₹ 4,000.

Balance sheets of the trader after each transaction are shown below: The example given above explains the definition of expense. The equity decreased by ₹ 7,000 from ₹ 3.29 lakh to ₹ 3.22 lakh due to (i) Drawings ₹ 4,000 and (ii) Expenses incurred ₹ 3,000 (Wages paid + Rent). Expenses therefore result in decrease of equity without drawings. Also note that expenses incurred is accompanied by either decrease of asset (Cash paid for wages) or by increase in liability (Rent outstanding).

The example given above explains the definition of expense. The equity decreased by ₹ 7,000 from ₹ 3.29 lakh to ₹ 3.22 lakh due to (i) Drawings ₹ 4,000 and (ii) Expenses incurred ₹ 3,000 (Wages paid + Rent). Expenses therefore result in decrease of equity without drawings. Also note that expenses incurred is accompanied by either decrease of asset (Cash paid for wages) or by increase in liability (Rent outstanding).

Note: The points discussed above leads us to the following relationships:

Closing equity (CE) = Closing Assets (CA) – Closing Liabilities (CL)

Opening Equity (OE) = Opening Assets (OA) – Opening Liabilities (OL)

Capital Introduced = C

Drawings = D

Income = I

Expenses = E

CE= OE + C + (I – E) – D

Or CE = OE + C + Profit – D

Or Profit = CE – OE – C + D

Or Profit = (CA – CL) – (OA – OL) – C + D

From above, one can clearly see that profit depends on values of assets and liabilities. Since historical costs are mostly used for valuation, the reported profits are mostly based on historical cost conventions. The framework recognises other methods of valuation of assets and liabilities. The point to note is that reported figures of profit change with the changes in the valuation basis. Conceptually, this is the foundation of idea of Capital Maintenance.

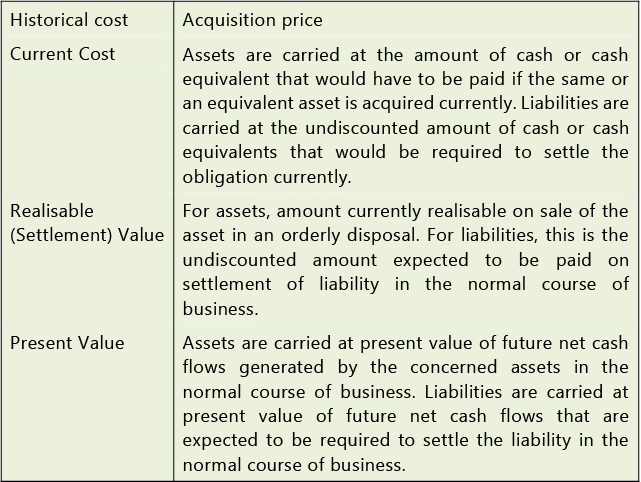

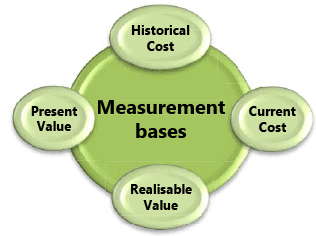

Measurement Of Elements Of Financial Statements:

Measurement is the process of determining money value at which an element can be recognised in the balance sheet or statement of profit and loss. The framework recognises four alternative measurement bases. These bases relate explicitly to the valuation of assets and liabilities. The valuation of income or expenses, i.e. profit is implied, by the value of change in assets and liabilities. In preparation of financial statements, all or any of the measurement basis can be used in varying combinations to assign money values to items, subject to the requirements under the Accounting Standards. However, it may be noted, that Accounting Standards largely uses the ‘historical cost’ for the purpose of preparation of financial statements though for some items, use of other value is permitted, e.g., inventory is recorded at historical costs on its acquisition, however, at year end, it is valued at lower of costs and net realisable value.

In preparation of financial statements, all or any of the measurement basis can be used in varying combinations to assign money values to items, subject to the requirements under the Accounting Standards. However, it may be noted, that Accounting Standards largely uses the ‘historical cost’ for the purpose of preparation of financial statements though for some items, use of other value is permitted, e.g., inventory is recorded at historical costs on its acquisition, however, at year end, it is valued at lower of costs and net realisable value.

A brief explanation of each measurement basis is as follows:

- Historical Cost: Historical cost means acquisition price. For example, the businessman paid ₹ 7,00,000 to purchase the machine, its acquisition price including installation charges is ₹ 8,00,000. The historical cost of machine would be ₹ 8,00,000.

According to this, assets are recorded at an amount of cash or cash equivalent paid or the fair value of the asset at the time of acquisition. Liabilities are recorded at the amount of proceeds received in exchange for the obligation. In certain circumstances a liability is recorded at the amount of cash or cash equivalent expected to be paid to satisfy the obligation in the normal course of business.

When Mr. X, a businessman, takes ₹ 5,00,000 loan from a bank @ 10% interest p.a., it is to be recorded at the amount of proceeds received in exchange for the obligation. Here the obligation is the repayment of loan as well as payment of interest at an agreed rate i.e. 10%. Proceeds received are ₹ 5,00,000 - it is the historical cost of the transaction. Take another case regarding payment of income tax liability. You know that every individual has to pay income tax on his income if it exceeds certain minimum limit. But the income tax liability is not settled immediately when one earns his income. The income tax authority settles it sometime later, which is technically called assessment year. Then how does he record this liability? As per historical cost basis, it is to be recorded at an amount expected to be paid to discharge the liability.

Example 5. Mr. X purchased a machine on 1st January, 20X1 at ₹ 7,00,000. As per historical cost basis, he has to record it at ₹ 7,00,000 i.e. the acquisition price. As on 1.1.20X6, Mr. X found that it would cost ₹ 25,00,000 to purchase that machine. Mr. X also took loan from a bank as on 20X1 for ₹ 5,00,000 @ 18% p.a. repayable at the end of 15th year together with interest.

As per historical cost, the liability is recorded at ₹5,00,000 at the amount of proceeds received in exchange for obligation and asset is recorded at ₹ 7,00,000. - Current Cost: Current cost gives an alternative measurement basis. Assets are carried at the amount of cash or cash equivalent that would have to be paid if the same or an equivalent asset was acquired currently. Liabilities are carried at the undiscounted amount of cash or cash equivalents that would be required to settle the obligation currently.

Example 6. A machine was acquired for $ 10,000 on deferred payment basis. The rate of exchange on the date of acquisition was ₹ 49 per $. The payments are to be made in 5 equal annual instalments together with 10% interest per year. The current market value of similar machine in India is ₹ 5 lakhs.

Current cost of the machine = Current market price = ₹ 5,00,000.

By historical cost convention, the machine would have been recorded at ₹ 4,90,000.

To settle the deferred payment on current date one must buy dollars at ₹ 49/$. The liability is therefore recognised at ₹ 4,90,000 ($ 10,000 × ₹ 49). Note that the amount of liability recognised is not the present value of future payments. This is because, in current cost convention, liabilities are recognised at undiscounted amount. - Realisable (Settlement) Value: For assets, this is the amount of cash or cash equivalents currently realisable on sale of the asset in an orderly disposal. For liabilities, this is the undiscounted amount of cash or cash equivalents expected to be paid on settlement of liability in the normal course of business.

- Present Value: Assets are carried at the present value of the future net cash inflows that the item is expected to generate in the normal course of business. Liabilities are carried at the present value of the future net cash outflows that are expected to be required to settle the liabilities in the normal course of business.

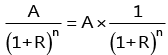

Present value (P) is an amount, one has to invest on current date to have an amount (A) after n years. If the rate of interest is R then,

A = P(1 + R)n

Or P (Present value of A after n years) =

The process of obtaining present value of future cash flow is called discounting.

The rate of interest used for discounting is called the discounting rate. The expression [1/(1+R)n], called discounting factor which depends on values of R and n.

Let us take a numerical example assuming interest 10%, A = ₹ 11,000 and n = 1 year 11,000 = 10,000(1 + 0.1)1

Or Present value of ₹ 11,000 after 1 year =

Or Present value of ₹ 11,000 after 1 year = 11,000 × 0.909 = ₹ 10,000

Note that a receipt of ₹ 10,000 (present value) now is equivalent of a receipt of ₹ 11,000 (future cash inflow) after 1 year, because if one gets ₹ 10,000 now he can invest to collect ₹ 11,000 after 1 year. Likewise, a payment of ₹ 10,000 (present value) now is equivalent of paying of ₹ 11,000 (future cash outflow) after 1 year.

Thus if an asset generates ₹ 11,000 after 1 year, it is actually contributing ₹ 10,000 at the current date if the rate of earning required is 10%. In other words, the value of the asset is ₹ 10, 000. which is the present value of net future cash inflow it generates.

If an asset generates ₹ 11,000 after 1 year, and ₹ 12,100 after two years, it is actually contributing ₹ 20,000 (approx.) at the current date if the rate of earning required is 10% (₹ 11,000 × 0.909 + ₹ 12,100 × 0.826). In other words the value of the asset is ₹ 20,000(approx.), i.e. the present value of net future cash inflow it generates.

Under present value convention, assets are carried at present value of future net cash flows generated by the concerned assets in the normal course of business. Liabilities under this convention are carried at present value of future net cash flows that are expected to be required to settle the liability in the normal course of business.Illustration 2

Carrying amount of a machine is ₹ 40,000 (Historical cost less depreciation). The machine is expected to generate ₹ 10,000 net cash inflow. The net realisable value (or net selling price) of the machine on current date is ₹ 35,000. The enterprise’s required earning rate is 10% per year.

The enterprise can either use the machine to earn ₹ 10,000 for 5 years. This is equivalent of receiving present value of ₹ 10,000 for 5 years at discounting rate 10% on current date. The value realised by use of the asset is called value in use. The value in use is the value of asset by present value convention.

Value in use = ₹ 10,000 (0.909 + 0.826 + 0.751 + 0.683 + 0.621) = ₹ 37,900

Net selling price = ₹ 35,000

The present value of the asset is ₹ 37,900, which is called its recoverable value. It is obviously not appropriate to carry any asset at a value higher than its recoverable value. Thus the asset is currently overstated by ₹ 2,100 (₹ 40,000 – ₹ 37,900).

Capital Miantenance:

Capital refers to net assets of a business. Since a business uses its assets for its operations, a fall in net assets will usually mean a fall in its activity level. It is therefore important for any business to maintain its net assets in such a way, as to ensure continued operations at least at the same level year after year. In other words, dividends should not exceed profit after appropriate provisions for replacement of assets consumed in operations. For this reason, the Companies Act does not permit distribution of dividend without providing for depreciation on Property, Plant and Equipment. Unfortunately, this may not be enough in case of rising prices. The point is explained below:

We have already observed: P = (CA – CL) – (OA – OL) – C + D

Where: Profit = P

Opening Assets = OA and Opening Liabilities = OL

Closing Assets = CA and Closing Liabilities = CL

Introduction of capital = C and Drawings / Dividends = D

Retained Profit = P – D = (CA – CL) – (OA – OL) – C

A business should ensure that Retained Profit (RP) is not negative, i.e. closing equity should not be less than capital to be maintained, which is sum of opening equity and capital introduced.

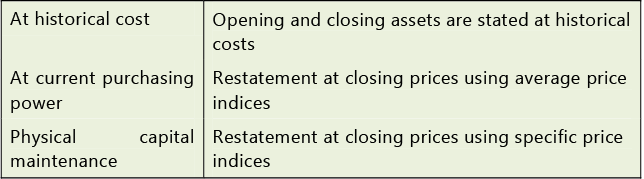

It should be clear from above that the value of retained profit depends on the valuation of assets and liabilities. In order to check maintenance of capital, i.e. whether or not retained profit is negative, we can use any of following three bases:

- Financial capital maintenance at historical cost: Under this convention, opening and closing assets are stated at respective historical costs to ascertain opening and closing equity. If retained profit is greater than or equals to zero, the capital is said to be maintained at historical costs. This means the business will have enough funds to replace its assets at historical costs. This is quite right as long as prices do not rise.

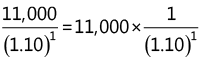

Illustration 3

A trader commenced business on 01/01/20X1 with ₹ 12,000 represented by 6,000 units of a certain product at ₹ 2 per unit. During the year 20X1 he sold these units at ₹ 3 per unit and had withdrawn ₹ 6,000. Thus:

Opening Equity = ₹ 12,000 represented by 6,000 units at ₹ 2 per unit.

Closing Equity = ₹ 12,000 (₹ 18,000 – ₹ 6,000) represented entirely by cash.

Retained Profit = ₹ 12,000 – ₹ 12,000 = Nil

The trader can start year 20X2 by purchasing 6,000 units at ₹ 2 per unit once again for selling them at ₹ 3 per unit. The whole process can repeat endlessly if there is no change in purchase price of the product.

- Financial capital maintenance at current purchasing power: Under this convention, opening and closing equity at historical costs are restated at closing prices using average price indices. (For example, suppose opening equity at historical cost is ₹ 3,00,000 and opening price index is 100. The opening equity at closing prices is ₹ 3,60,000 if closing price index is 120). A positive retained profit by this method means the business has enough funds to replace its assets at average closing price. This may not serve the purpose because prices of all assets do not change at average rate in real situations. For example, price of a machine can increase by 30% while the average increase is 20%.

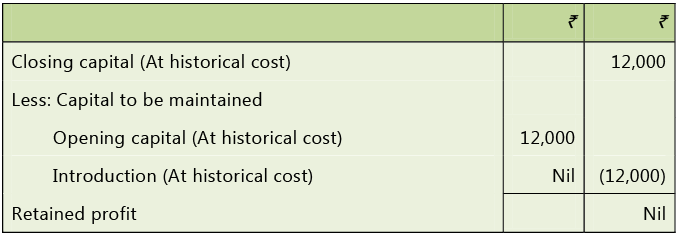

Illustration 4

In the previous illustration (Illustration 3), suppose that the average price indices at the beginning and at the end of year are 100 and 120 respectively.

Opening Equity = ₹ 12,000 represented by 6,000 units at ₹ 2 per unit.

Opening equity at closing price = (₹ 12,000 / 100) x 120 = ₹ 14,400 (6,000 x ₹ 2.40)

Closing Equity at closing price = ₹ 12,000 (₹ 18,000 – ₹ 6,000) represented entirely by cash.

Retained Profit = ₹ 12,000 – ₹ 14,400 = (–) ₹ 2,400

The negative retained profit indicates that the trader has failed to maintain his capital. The available fund of ₹ 12,000 is not sufficient to buy 6,000 units again at increased price ₹ 2.40 per unit. In fact, he should have restricted his drawings to ₹ 3,600 (₹ 6,000 – ₹ 2,400).

Had the trader withdrawn ₹ 3,600 instead of ₹ 6,000, he would have left with ₹ 14,400, the fund required to buy 6,000 units at ₹ 2.40 per unit.

- Physical capital maintenance at current costs: Under this convention, the historical costs of opening and closing assets are restated at closing prices using specific price indices applicable to each asset. The liabilities are also restated at a value of economic resources to be sacrificed to settle the obligation at current date, i.e. closing date. The opening and closing equity at closing current costs are obtained as an excess of aggregate of current cost values of assets over aggregate of current cost values of liabilities. A positive retained profit by this method ensures retention of funds for replacement of each asset at respective closing prices.

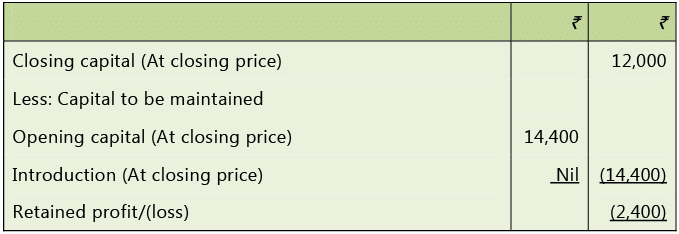

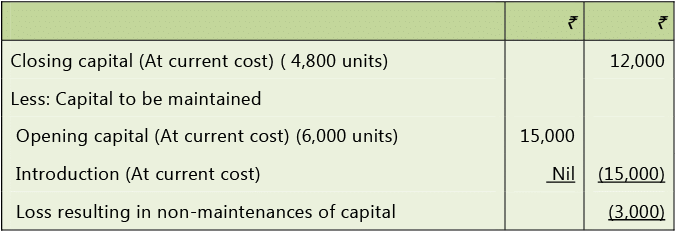

Illustration 5

A trader commenced business on 01/01/20X1 with ₹ 12,000 represented by 6,000 units of a certain product at ₹ 2 per unit. During the year 20X1 he sold these units at ₹ 3 per unit and had withdrawn ₹ 6,000. Let us assume that the price of the product at the end of year is ₹ 2.50 per unit. In other words, the specific price index applicable to the product is 125.

Current cost of opening stock = (₹ 12,000 / 100) x 125 = 6,000 x ₹ 2.50 = ₹ 15,000

Current cost of closing cash = ₹ 12,000 (₹ 18,000 – ₹ 6,000)

Opening equity at closing current costs = ₹ 15,000

Closing equity at closing current costs = ₹ 12,000

Retained Profit = ₹ 12,000 – ₹ 15,000 = (-) ₹ 3,000

The negative retained profit indicates that the trader has failed to maintain his capital. The available fund of ₹ 12,000 is not sufficient to buy 6,000 units again at increased price of ₹ 2.50 per unit. The drawings should have been restricted to ₹ 3,000 (₹ 6,000 – ₹ 3,000). Had the trader withdrawn ₹ 3,000 instead of ₹ 6,000, he would have left with ₹ 15,000, the fund required to buy 6,000 units at ₹ 2.50 per unit.

You are required to compute the Capital maintenance under all three bases i.e. (i) Historical costs, (ii) Current purchasing power and (iii) Physical capital maintenance.

Financial Capital Maintenance at historical costs

Financial Capital Maintenance at current purchasing power

Physical Capital Maintenance

Summary:

- Components of Financial Statements

- Users of Financial Statements

- Fundamental Accounting Assumptions

- Qualitative Characteristics of Financial Statements

- Elements of Financial Statements

- Measurement of Elements in Financial Statements

- Financial Capital Maintenance

What you've learned?

- Understand the meaning and significance of Framework for the Preparation and Presentation of Financial Statements;

- Learn objectives of Financial Statements

- Understand qualitative characteristics of Financial Statements;

- Comprehend recognition and measurement of elements of Financial Statements;

- Know concepts of capital, capital maintenance and determination of profit.

|

25 videos|34 docs

|

FAQs on Framework for Preparation and Presentation of Financial Statements: Notes - Accounting for CA Intermediate (Old Scheme)

| 1. What is the purpose of the framework for preparation and presentation of financial statements? |  |

| 2. What is the status and scope of the framework for preparation and presentation of financial statements? |  |

| 3. What are the components of financial statements? |  |

| 4. Who are the objectives and users of financial statements? |  |

| 5. What are the qualitative characteristics of financial statements? |  |

|

Explore Courses for CA Intermediate exam

|

|

Accrual basis of accounting

Accrual basis of accounting

The example given above explains the definition of income. The equity increased by ₹ 29,000 during the accounting period, due to (i) Capital introduction ₹ 20,000 and (ii) Income earned ₹ 9,000 (Income from investment + Discount earned). Incomes therefore result in increase in equity without introduction of capital.

The example given above explains the definition of income. The equity increased by ₹ 29,000 during the accounting period, due to (i) Capital introduction ₹ 20,000 and (ii) Income earned ₹ 9,000 (Income from investment + Discount earned). Incomes therefore result in increase in equity without introduction of capital. The example given above explains the definition of expense. The equity decreased by ₹ 7,000 from ₹ 3.29 lakh to ₹ 3.22 lakh due to (i) Drawings ₹ 4,000 and (ii) Expenses incurred ₹ 3,000 (Wages paid + Rent). Expenses therefore result in decrease of equity without drawings. Also note that expenses incurred is accompanied by either decrease of asset (Cash paid for wages) or by increase in liability (Rent outstanding).

The example given above explains the definition of expense. The equity decreased by ₹ 7,000 from ₹ 3.29 lakh to ₹ 3.22 lakh due to (i) Drawings ₹ 4,000 and (ii) Expenses incurred ₹ 3,000 (Wages paid + Rent). Expenses therefore result in decrease of equity without drawings. Also note that expenses incurred is accompanied by either decrease of asset (Cash paid for wages) or by increase in liability (Rent outstanding).