HPSC (Haryana) Exam > HPSC (Haryana) Notes > HPSC Preparation: All subjects > Haryana Budget Analysis 2023-2024 Part - 2

Haryana Budget Analysis 2023-2024 Part - 2 | HPSC Preparation: All subjects - HPSC (Haryana) PDF Download

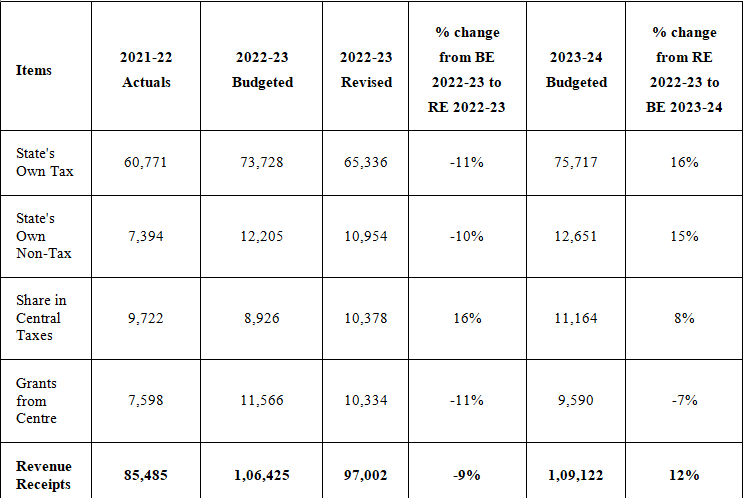

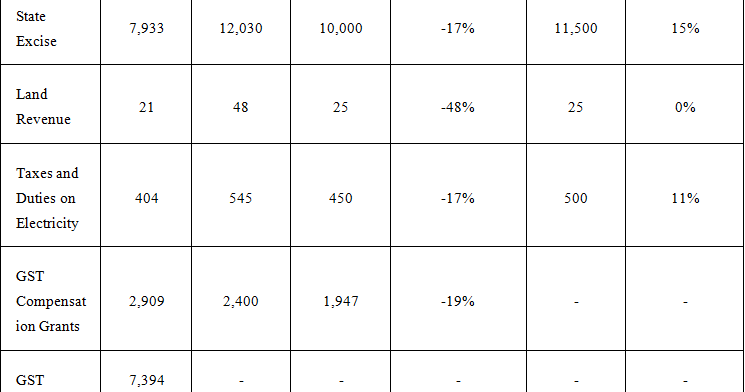

Receipts in 2023-24

The projected total revenue receipts for the fiscal year 2023-24 are anticipated to amount to Rs 1,09,122 crore, reflecting a 12% increase compared to the revised estimate for 2022-23. Within this, the state aims to generate Rs 88,368 crore (81%) through its own resources, while Rs 20,755 crore (19%) will be sourced from the central government. The central funds will comprise the state's share in central taxes, constituting 10% of revenue receipts, and grants from the central government, making up 9% of revenue receipts.

Devolution: The state's share in central taxes for 2023-24 is forecasted to be Rs 11,164 crore, marking an 8% rise from the revised estimate of Rs 10,378 crore in 2022-23. The revised estimates for 2022-23 surpass the initial budget estimates by 16%.

Grants from the centre in 2023-24 are estimated at Rs 9,590 crore, indicating a 7% decline from the revised estimates for 2022-23 (Rs 10,334 crore). In the previous fiscal year, grants from the centre were 11% lower than the budget estimate.

State’s own revenue: Haryana's total own tax revenue is projected to reach Rs 75,717 crore in 2023-24, showing a 16% increase from the revised estimate of 2022-23. The own tax revenue as a percentage of Gross State Domestic Product (GSDP) is estimated to be 6.7% in 2023-24. The state initially projected a 7.4% own tax revenue to GSDP ratio for 2022-23, which has been revised down to 6.6%. Haryana's own non-tax revenue is expected to rise by 15% in 2023-24 compared to the revised estimate of 2022-23.

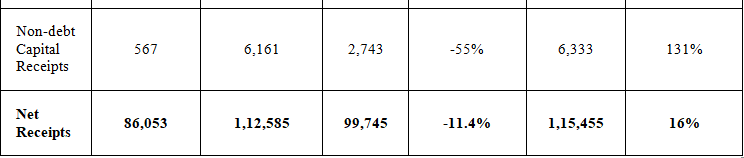

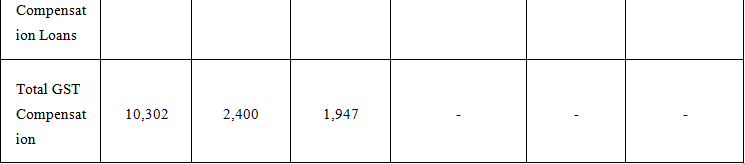

Table 5: Break-up of the state government’s receipts (in Rs crore)

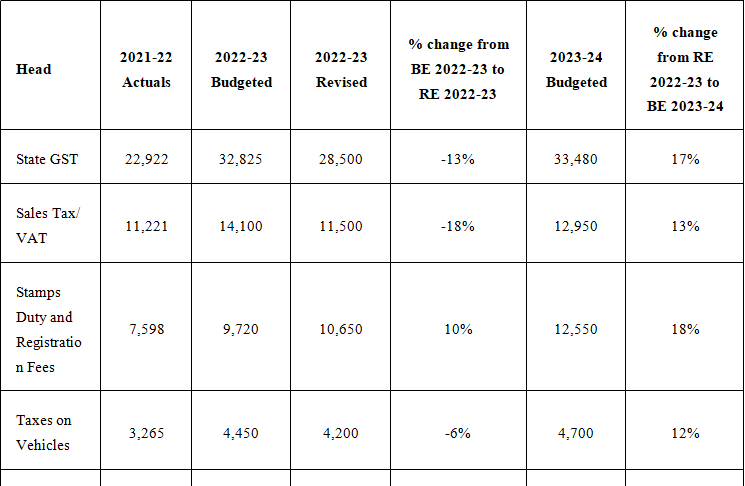

In the fiscal year 2023-24, State GST is projected to constitute the predominant portion of the state's own tax revenue, commanding a 44% share. Anticipated to experience a substantial 17% growth compared to the revised estimates of the previous fiscal year (2022-23), State GST revenue is poised to demonstrate a notable upswing. Contrarily, for the ongoing fiscal year (2022-23), the anticipated receipts in this category are projected to be 13% below the initially budgeted figures.

Likewise, revenue derived from sales tax/VAT is forecasted to witness a 13% increase in the fiscal year 2023-24 when compared to the revised estimates of the preceding fiscal year. Conversely, in the current fiscal year (2022-23), the projected receipts under this category are expected to fall short by 18% compared to the initial budgetary estimates.

Table 6: Major Sources of the State's Own-Tax Revenue (in Rs crore)

Deficits, Debt, and FRBM Targets for 2023-24 in Haryana

The Haryana Fiscal Responsibility and Budget Management Act of 2005 establishes annual targets to progressively decrease the state government's outstanding liabilities, revenue deficit, and fiscal deficit.

Revenue Deficit:

The Finance Commissions (FCs) have consistently recommended the elimination of revenue deficit for states. Various states' Fiscal Responsibility and Budget Management Acts also mandate the eradication of revenue deficit. Between 2015-16 and 2019-20, eight states, including Andhra Pradesh, Haryana, Kerala, Punjab, and Rajasthan, maintained a revenue deficit. The 15th FC proposed grants to eliminate revenue deficit for 17 states during the 2021-26 period. Although the 15th FC initially recommended a revenue deficit grant of Rs 132 crore only for Haryana in 2021-22, the state's 2022-23 budget estimates accounted for Rs 659 crore in revenue deficit grants.

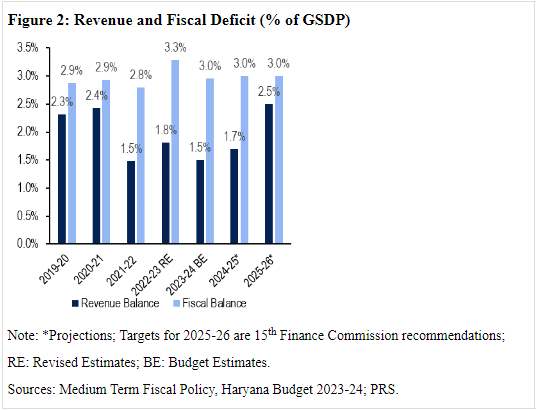

Definition: Revenue deficit is the difference between revenue expenditure and revenue receipts, indicating that the government needs to borrow to fund expenses that do not enhance its assets or reduce its liabilities. The projected revenue deficit for 2023-24 is Rs 16,949 crore (1.5% of GSDP), whereas in 2022-23, it is estimated to be Rs 18,005 crore (1.8% of GSDP), marking an 85% increase over the budget estimate of Rs 9,774 crore.

Fiscal Deficit:

Fiscal deficit represents the excess of total expenditure over total receipts, and the government covers this gap through borrowings, leading to an increase in total liabilities. Haryana's fiscal deficit for 2023-24 is estimated to be 3.0% of GSDP (Rs 33,274 crore). In 2022-23, the fiscal deficit is anticipated to be 3.3% of GSDP, exceeding the budget estimate by about 0.3 percentage points.

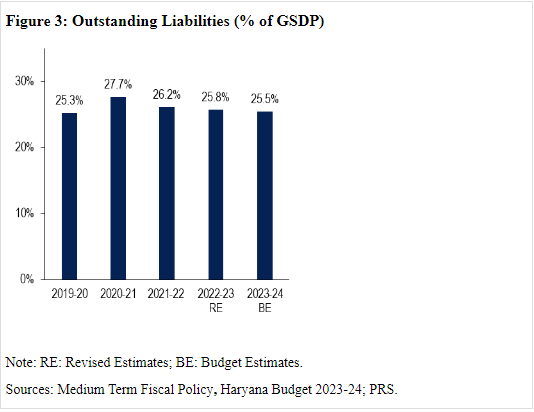

Outstanding Liabilities:

Outstanding liabilities encompass the total borrowings at the end of a financial year, including any liabilities on the public account. In 2023-24, outstanding liabilities are projected to be 25.5% of GSDP.

Outstanding government guarantees: States' outstanding liabilities exclude certain contingent liabilities that may need to be honored in specific cases. State governments, including Haryana, provide guarantees for the borrowings of State Public Sector Enterprises (SPSEs) from financial institutions. As of the conclusion of the 2021-22 fiscal year, Haryana's outstanding government guarantees totaled Rs 24,343 crore.

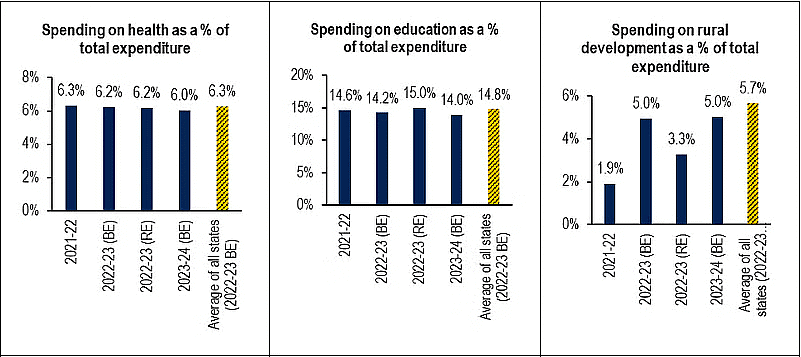

Annexure 1: Comparison of states' expenditure on key sectors

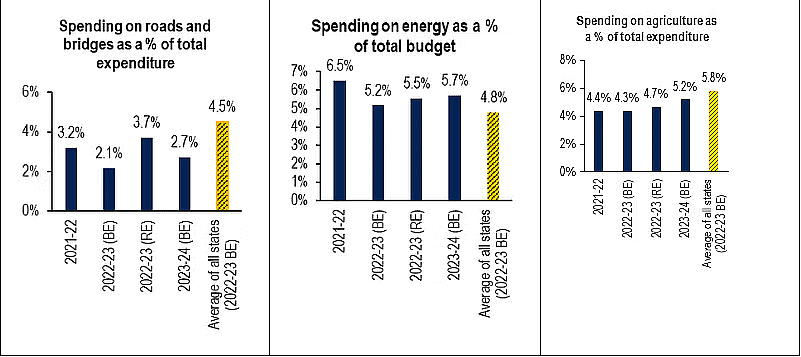

The following graphs illustrate Haryana's expenditure in the 2023-24 fiscal year on six key sectors as a percentage of its total expenditure across all sectors. The sector averages represent the average expenditure by 31 states (including Haryana) based on their budget estimates for 2022-23. [1]

Health: In 2023-24, Haryana has allocated 6% of its expenditure to health, slightly below the average allocation for education by states in 2022-23 (6.3%).

Education: Haryana has allocated 14% of its total expenditure to education, falling short of the average allocation for education by states (14.8%).

Rural Development: Haryana has allocated 5% of its expenditure to rural development, trailing the average allocation for rural development by states (5.7%).

Roads and Bridges: Haryana has allocated 2.7% of its total expenditure to roads and bridges, which is less than the average allocation by states (4.5%).

Energy: Haryana has allocated 5.7% of its expenditure to energy, surpassing the average allocation for energy by states (4.8%).

Agriculture: Haryana has allocated 5.2% of its expenditure to agriculture, slightly below the average allocation for agriculture by states (5.8%).

Please note that the figures for the fiscal years 2021-22, 2022-23 (Budget Estimates), 2022-23 (Revised Estimates), and 2023-24 (Budget Estimates) pertain to the state of Haryana.

Sources for this information include the Annual Financial Statement of the Haryana Budget for 2023-24, various state budgets, and PRS.

The 31 states mentioned encompass the Union Territories of Delhi, Jammu and Kashmir, and Puducherry.

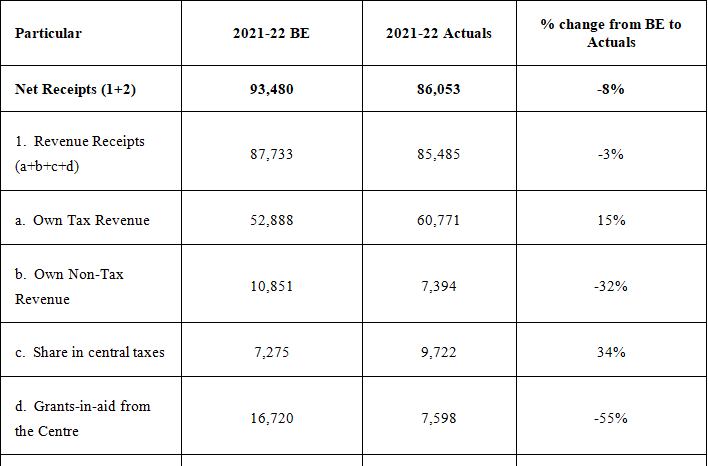

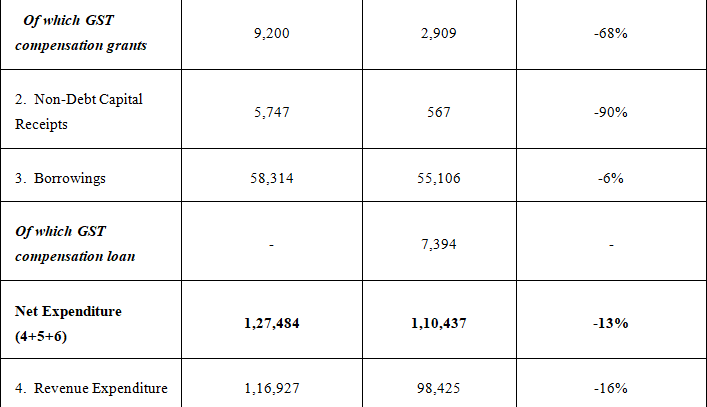

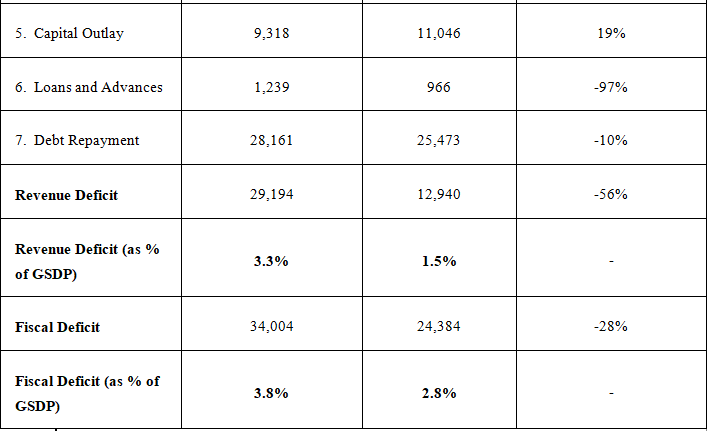

Annexure 2: A Comparison of Budget Estimates and Actuals for the Fiscal Year 2021-22

The subsequent tables provide a comparison between the actual figures for the fiscal year 2021-22 and the corresponding budget estimates for that period.

Table 7: Summary of Receipts and Expenditure (in Rs crore)

Note: BE: Budget Estimates. For calculating deficits, GST compensation loan not treated as grants.

Sources: Haryana Budget Documents of various years; PRS.

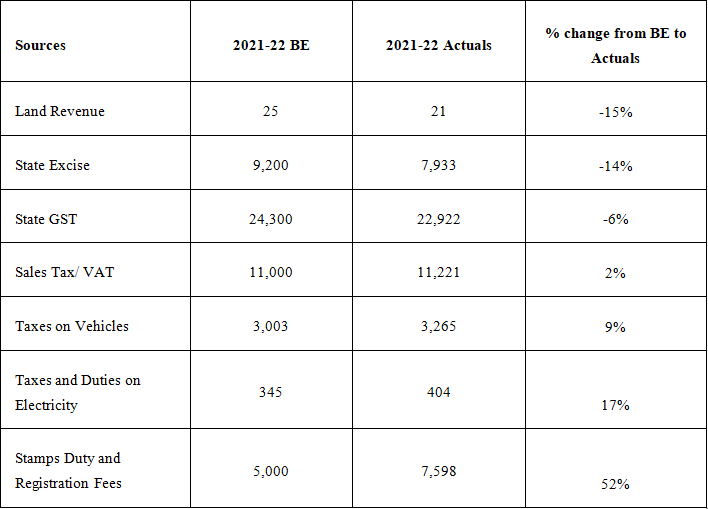

Table 8 : Key Components of State's Own Tax Revenue (in Rs crore)

Sources: Haryana Budget Documents of various years; PRS.

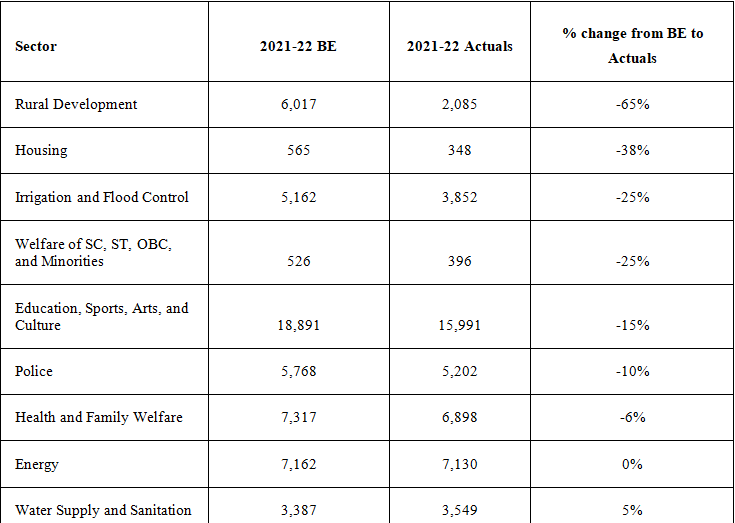

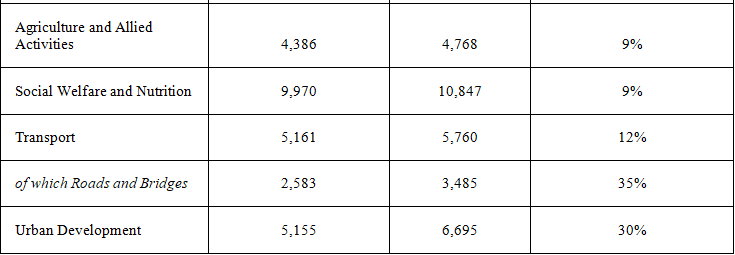

Table 9 : Allocation towards Key Sectors (in Rs crore)

Various years' budget documents from Haryana and information from PRS.

DISCLAIMER: This document is provided for informational purposes. You have the option to reproduce or distribute this report, either in part or in full, to any other individual for non-commercial purposes, with proper acknowledgment of PRS Legislative Research (“PRS”). The opinions expressed in this document solely belong to the author(s). PRS endeavors to utilize reliable and comprehensive information, but it does not assert that the contents of the report are accurate or exhaustive. PRS is an independent, not-for-profit organization. This document is crafted without consideration of the objectives or opinions of those who may receive it.

The document Haryana Budget Analysis 2023-2024 Part - 2 | HPSC Preparation: All subjects - HPSC (Haryana) is a part of the HPSC (Haryana) Course HPSC Preparation: All subjects.

All you need of HPSC (Haryana) at this link: HPSC (Haryana)

|

95 videos|318 docs|111 tests

|

Related Searches