ITC Rules for Capital Goods under GST | Taxation for CA Intermediate PDF Download

| Table of contents |

|

| What are Capital Goods? |

|

| What is credit on capital goods? |

|

| What is Common Credit? |

|

| Why is common credit important? |

|

What are Capital Goods?

Section 2(19) of CGST Act states “capital goods” means goods, the value of which is capitalized in the books of account of the person claiming the input tax credit and which are used or intended to be used in the course or furtherance of business. Goods will be regarded as capital goods if the following conditions are satisfied: (a) The value of such goods is capitalized in the books of account of the person claiming input tax credit; (b) Such goods are used or intended to be used in the course or furtherance of business.

Therefore, Capital goods are tangible assets such as buildings, machinery, equipment, vehicles and tools that an organization uses to produce goods or services in order to produce consumer goods and goods for other businesses. For example, a blast furnace used in iron and steel industry is a capital asset for the steel manufacturer.

Difference between capital goods & other inputs

- Capital goods are not consumed when the final product is made. They are not consumed in a single year of production. Therefore, they cannot be entirely deducted as business expenses in the year of their purchase. Instead, they are depreciated over the course of their useful lives. The business recognizes part of the cost each year through accounting techniques as depreciation, amortization and depletion.

- Whereas, other inputs which are not the capital goods (as inputs) are consumed / utilized in the final product that is made, fabricated or manufactured. All inputs other than capital goods may be other inputs consumed, comprising of natural resources, electrical/mechanical items or any resources which are essential ingredients to obtain an output. Hence, other inputs are consumed while making the final product and are treated as business expenses as cost of production.

For example: If you are making a cake in your oven; you add ingredients eggs, water, flour, butter. These are your inputs. The cake is your final product. The oven is the capital good which helps you to make the cake.

What is credit on capital goods?

When a business purchases anything, it is required to pay GST on it. Later, the manufacturer or a trader can claim input tax credit on the G ST paid on its purchases. Similarly, when a business is purchasing any machinery for its factory, the manufacturer will pay the applicable GST rate. This GST paid can be claimed as credit in the same way as inputs. Credits for capital goods are available in full. There is no provision stipulating availment of capital goods credit in instalment or partially. Further, if the tax payer claims depreciation of the tax component in the value of capital goods (while purchasing the capital asset) under the provisions of Income Tax Act, then credit is not allowed on such tax component of capital goods.

What is Common Credit?

Businesses often use the same assets and inputs for both business & personal use. The input tax credit benefit can be availed to the extent of proportionate business use.

Example 1: Ms. Anita owns a grocery shop. She rents a 2-storey building and uses the ground floor for her shop and 1st floor of the same building as residence. The input credit of GST paid on rent will be allowed only to the extent it pertains to her business. Ms. Anita also has an attached land where she grows vegetables and sells them in her shop. The same property or common property is used for 3 separate reasons – taxable sales, exempted sales (vegetable) and personal expenses (residence).

While Ms Anita is eligible to claim input credit for GST paid by her on her business expenses, some of the expenses are used for both business and non-business purposes. The GST in rent (GST is applicable since it is let out for commercial purposes) is the common credit.

Example 2: Ms. Anita is a freelance designer and blogger. She has a personal laptop which she also uses for her freelance work. She can claim the input credit of GST paid on purchase of laptop only to the extent it pertains to her freelance business. Ms. Anita has also purchased special designing software. Since this pertains only to her business, she can claim full ITC on this.

Why is common credit important?

ITC is only available for business purposes. Many traders use the same inputs for both business & personal reasons. A taxpayer cannot claim any tax benefit of personal expenses. Again, goods exempted under GST already enjoy 0% GST. ITC cannot be claimed for inputs used in such exempted goods as it will lead to negative taxation. So, ITC on inputs for exempted goods will also be removed.

A. Capital Goods used only for Personal Use or for Exempted Sales No ITC is available for personal purchases or for capital goods used in exempted sales. This will be indicated in FORM GSTR-2 and shall not be credited to the electronic credit ledger.

Example 1: Personal Purchases Ms. Anita has purchased a fridge. Since this is not required for her business, i.e., a purely personal purchase, she will not be able to claim any ITC on the GST paid for the fridge.

Example 2: Capital Goods used for exempted sales Mr. Avinash has purchased a small flour mill in his grocery shop to grind wheat grains to flour. Since he is producing unbranded flour it is exempted from GST. As it is an exempted sale, he cannot claim any ITC on the GST paid for the mill.

B. Capital Goods used for normal sales XYZ has purchased machinery to manufacture shoes. Since, shoes are normal taxable supplies, the GST included paid while purchasing machinery will be completely available as ITC. This shall be indicated in FORM GSTR-2 and shall be credited to the electronic credit ledger.

C. Common credit for partly personal/ exempted and partly normal sales The ITC paid for the capital goods will be credited to electronic credit ledger. Useful life of such capital asset will be taken as 5 years from the date of purchase Now the total amount of input tax credited to electronic credit ledger for the whole useful life will be distributed over the useful life

The useful life will be taken as 5 years.

If you pay GST on a monthly basis then you will use the following formula

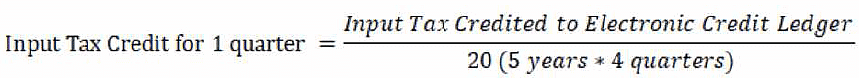

If your turnover is less than 1.5 crores, then you will pay GST on a quarterly basis. ITC will be calculated using the following formula

|

42 videos|98 docs|12 tests

|

|

Explore Courses for CA Intermediate exam

|

|