Year 11 Exam > Year 11 Notes > Accounting for GCSE/IGCSE > Impact of Errors on Profit & Financial Position

Impact of Errors on Profit & Financial Position | Accounting for GCSE/IGCSE - Year 11 PDF Download

| Table of contents |

|

| Impact of Errors on Profit |

|

| How do errors affect the gross profit? |

|

| Which accounts affect profit for the year? |

|

| Impact of Errors on a Statement of Financial Position |

|

Impact of Errors on Profit

Which accounts affect gross profit?

- Understanding how an account's balance impacts gross profit is crucial:

- An account might contribute to increasing gross profit.

- Conversely, it could lead to a decrease in gross profit.

- Some accounts may have no impact on gross profit.

- Keep in mind these essential formulas:

- Gross profit = net revenue - cost of sales

- Net revenue = sales - sales returns

- Cost of sales = opening inventory + net purchases - closing inventory

- Net purchases = purchases + carriage inwards - purchases returns - goods for own use

- Any factor that raises net revenue will consequently boost gross profit.

- Conversely, anything that escalates the cost of sales will inevitably reduce gross profit.

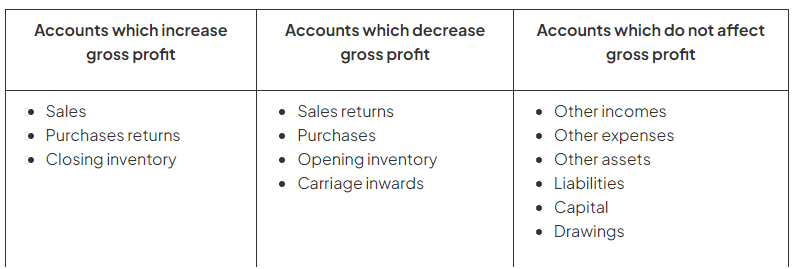

- This concept can be succinctly summarized in the following table:

How do errors affect the gross profit?

- Certain errors can lead to either an overstatement or understatement of gross profit.

- Gross profit will be inflated if:

- An account that typically boosts gross profit has been recorded with an exaggerated balance.

- Alternatively, an account that normally reduces gross profit has been recorded with an insufficient balance.

- Conversely, gross profit will be underestimated if:

- An account that typically enhances gross profit has been recorded with a deficient balance.

- Conversely, an account that usually diminishes gross profit has been recorded with an excessive balance.

- Evaluate the collective impact of all errors on gross profit:

- Some errors might offset each other's effects, resulting in no net impact on gross profit.

How do corrections of errors affect the gross profit?

- You may be tasked with rectifying errors and determining the adjusted gross profit.

- Analyze which debit and credit entries are necessary to rectify the errors.

- For accounts impacting gross profit:

- Debit entries will reduce gross profit.

- Credit entries will augment gross profit.

- Keep in mind that certain accounts have no bearing on gross profit.

Question for Impact of Errors on Profit & Financial PositionTry yourself: How do errors affect gross profit?View Solution

Which accounts affect profit for the year?

- Understanding whether an account balance influences the profit for the year is crucial, and similar methods used for assessing gross profit can be applied.

- Recall the formula: Profit for the year = gross profit + other incomes - other expenses

- Factors that elevate gross profit or other incomes will consequently raise the profit for the year.

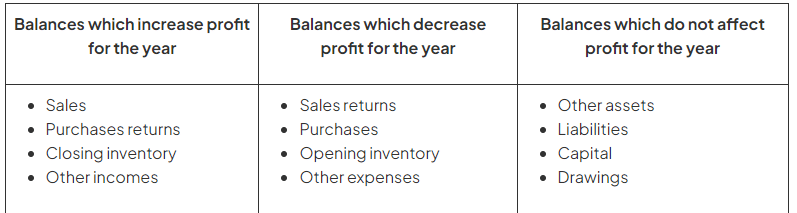

- This concept can be succinctly summarized in the following table:

- If an account impacts the profit for the year:

- Debit entries lead to a decrease in profit.

- Credit entries result in an increase in profit.

Impact of Errors on a Statement of Financial Position

How do errors affect the statement of financial position?

- Some errors can impact the reported values of:

- Assets

- Liabilities

- Capital

- The capital account becomes overstated if:

- Profit for the year is exaggerated.

- Drawings account is inaccurately recorded.

- Conversely, the capital account becomes understated if:

- Profit for the year is underestimated.

- Drawings account is incorrectly overstated.

- Certain errors may neutralize each other's effects, thus leaving the statement of financial position unaffected.

- For instance, if a $100 payment from a trade receivable is omitted from the ledger accounts:

- Trade receivables would be overstated by $100.

- The bank would be understated by $100.

- However, the total value of assets remains unaffected by this error.

- For instance, if a $100 payment from a trade receivable is omitted from the ledger accounts:

How does the correction of errors affect capital?

- Capital rises under the following circumstances:

- An increase in the profit for the year.

- A decrease in the balance of the drawings account.

- Determining the corrected balance for capital closely resembles determining the corrected profit for the year, but it's essential to pay attention to transactions involving drawings.

The document Impact of Errors on Profit & Financial Position | Accounting for GCSE/IGCSE - Year 11 is a part of the Year 11 Course Accounting for GCSE/IGCSE.

All you need of Year 11 at this link: Year 11

|

22 videos|29 docs|12 tests

|

FAQs on Impact of Errors on Profit & Financial Position - Accounting for GCSE/IGCSE - Year 11

| 1. How do errors affect the gross profit? |  |

Ans. Errors can impact gross profit by misstating revenue or expenses. For example, if revenue is understated or expenses are overstated, it can lead to a lower gross profit figure than what should actually be reported.

| 2. Which accounts affect profit for the year? |  |

Ans. Accounts such as revenue, cost of goods sold, operating expenses, and non-operating expenses can all affect the profit for the year. Any errors in recording transactions in these accounts can result in misstated profit figures.

| 3. How do errors on a statement of financial position impact profit and financial position? |  |

Ans. Errors on a statement of financial position can impact profit by misstating assets, liabilities, and equity. This can result in inaccurate profit figures as well as misleading information about the company's financial position.

| 4. What are some common types of errors that can impact profit? |  |

Ans. Common types of errors that can impact profit include mathematical errors, recording transactions in the wrong account, omitting transactions, and incorrect classification of expenses or revenues.

| 5. How can businesses prevent errors from impacting profit and financial position? |  |

Ans. Businesses can prevent errors by implementing strong internal controls, conducting regular reconciliations, having multiple levels of review for financial statements, and investing in training for staff responsible for financial reporting.

Related Searches