Important Formulas - Stocks and Shares | IPMAT Mock Test Series - Commerce PDF Download

| Table of contents |

|

| Understanding Shares and Stocks |

|

| New Concepts |

|

| Important Terms to Understand |

|

| Important Formulas |

|

| Solved Examples |

|

Understanding Shares and Stocks

- When starting a business, you need money, called capital.

- In big companies, more than one person may invest. These investors are called partners or shareholders.

- Shareholders can easily sell their ownership in the company, while partners can't leave as easily.

- A share is like a certificate from the company saying you own a part of its profits.

New Concepts

- When a new business starts, shareholders initially share profits based on their investment or the number of shares they own. Shares are initially sold at a fixed price, known as face value.

- Later, when shares are traded, their value may differ from the face value. Brokers facilitate buying and selling shares for a fee based on the face value.

- Dividends, a portion of profits, are distributed to shareholders as a percentage of the face value of their shares.

- If a company needs more money later on and is profitable, it may issue shares at a higher value than the face value (premium) or lower than the face value (discount).

Important Terms to Understand

1. Joint Stock Company

To start a big business or an industry, a large amount of money is required. This may be beyond the capacity of one or two individuals. Hence, a number of individuals join hands to form a company called Joint Stock Company.

2. Stock Capital

The total amount of money required by the company is called the stock Capital.

It is the value of capital of a company, the unit of which is usually Rs. 100 unless stated otherwise. Stock is always bought, sold or held.

3. Shares or Stock

The whole capital of the company is divided into equal units. Each unit is called a share or a stock.

4. Shareholder or Stockholder

Each individual who purchases one or more shares is called a shareholder (stockholder) of the company.

The company issues share certificates to each of its shareholders indicating the number of shares allocated and the value of each share.

5. Face value

Face value of a share is the value printed on the share certificate. It is also called nominal value or par value.

The face value of a share always remains the same.

6. Market value

The stocks of different companies can be traded (bought or sold) in the market through brokers at stock exchanges. The price at which a stock is traded in the market is called its market value.

a. If the market value of a stock is higher than its face value, the stock is traded at a premium or above Par

b. If the market value of a stock is same as its face value, the stock is traded at par

c. If the market value of a stock is less than its face value, the stock is traded at a discount or below Par

The market value (trading price) of a share can vary time to time.

Let's consider an example . Assume that the face value of a company X is Rs.10 and it is now traded at a premium of Rs.2. Then its market value now is (Rs.10 + Rs.2) = Rs.12.

Similarly, if the company X having face value of Rs.10 is now traded at a discount of Rs.2, it means the market value of X now is (Rs.10 – Rs.2) is Rs.8

7. Dividend

The annual profit of a company is distributed among its shareholders. The distributed profit is called the dividend.

Dividends are declared annually, semi-annually and quarterly as per the company regulations.

Dividend on a share is normally expressed as a certain percentage of its face value. Sometimes, it is also expressed as a certain amount per share.

8. Brokerage

It is the sum of money paid to a stock dealer on the sale and purchase of stocks. It is paid on the face value.

Note: While buying, brokerage is added in the purchase price i.e. it increases the purchase price, whereas while selling, it is reduced from the selling price i.e. it reduces the selling price.

9. Number of shares held by a person

= Total Investment of the person/Investment in 1 share

= Total Income/Income from one share

= Total Face Value/Face value of 1 share

10. Stock at par: When the cash price or the selling price of the INR 10 stock is INR 10, the stock is said to be valued at par.

11. Stock above par

When the buying price or the selling price of INR 10 stock is more that INR 10, it is said to be valued at above par. In other words, it is said to be valued at a premium.

12. Stock below par

When the buying or the selling price of a stock is less than that of its face value, it is said to be sold at a discount. In other words, it is also said to be sold below par.

13. Cash

It is the money spent or received while buying or selling the stock. Cash is always invested or received. In other words, when cash is spent, it is also called investment.

14. What does the statement "Rs.100 , 8% stock at Rs.110" mean?

It means,

The face value of the stock = Rs.100

Market value (MV) of the stock = Rs.110

Annual dividend per share = 8% of the face value = (100×8)/100 = Rs.8

Ie, here , an investment of Rs.110 gives an annual income of Rs.8

Rate of interest per annum = Annual income from an investment of Rs.100 = 8×100/110 = 7.27%

Please note that generally investors invest in shares not merely because of this annual return. They also will have a capital gain if the market value the share goes higher.

15. What does this mean: 4 percent at 85?

It means that Rs. 100 stock can be purchased for Rs. 85 and Rs. 4 is the annual income on Rs. 100 stock or Rs. 85 investment or cash spent.

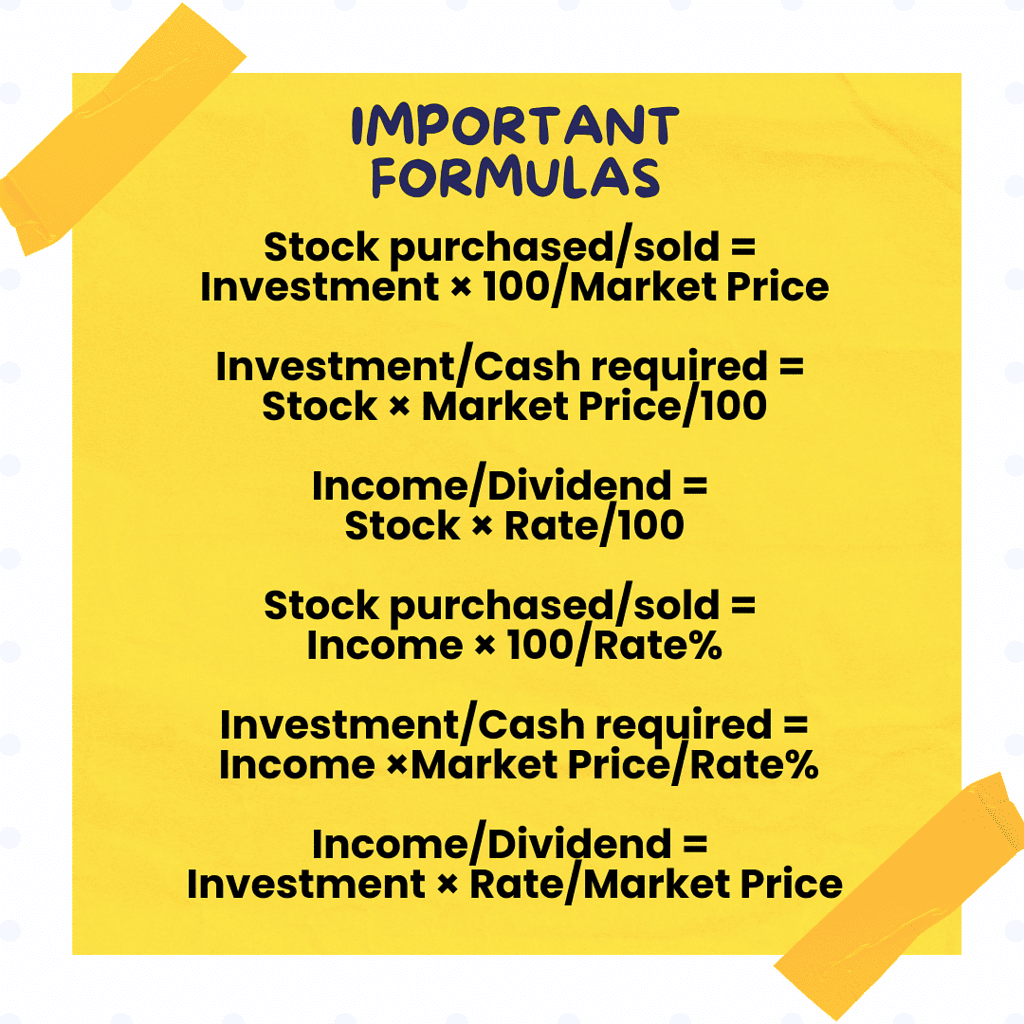

Important Formulas

- Stock purchased/sold = Investment × 100/Market Price

- Investment/Cash required = Stock × Market Price/100

- Income/Dividend = Stock × Rate/100

- Stock purchased/sold = Income × 100/Rate%

- Investment/Cash required = Income ×Market Price/Rate%

- Income/Dividend = Investment × Rate/Market Price

Solved Examples

Example 1: How much should a person invest in 5% stock at Rs. 114 to get a net income of Rs. 300 a year after paying an income tax of 5 paise in a rupee?

Sol: Gross income the person will get on Rs. 114 = Rs. 5. Tax to be paid on Rs. 5 = Rs. 0.25.

⇒ Net income = 5 – 0.25 = Rs. 4.75. Now apply the chain rule.

In order to get an income of Rs. 4.75, one should invest Rs. 114;

In order to get an income of Rs. 300, one should invest 300 ×(114/4.475) = Rs. 7200.

Example 2: Find the annual income obtained by investing Rs 3000 in 5% debentures of face value Rs 100 at Rs 125?

Sol: The number of debentures purchased = Rs. 3000/125

One debenture will give an income investment of Rs 100 × 5% = Rs 5. So total income = 5 × (3000/125) = Rs 120.

Example 3: A man sells Rs. 6000, 5% stock at 120 and invests the proceeds partly in 6% stock at 105 and partly in 12% stock at 140. He increases his income by Rs. 200. How much was invested in 12% stock at 140?

Sol: The original income that the man was getting was 5 × 6000/100 = Rs 300.

The value of the sales proceeds is Rs 6000 × 120/100 = Rs 7200.

His new income out of this is Rs 300 + 200 = Rs 500.

Let A be the amount invested in 12% stock. So amount invested in 6% stock is (7200 – A).

New income = A × 12/140 + (7200 – A) × 6/105 = 500. Solving we get A = 3100.

Example 4: Money is worth 10%. At what price should the stock which pays 11 percent be quoted?

Sol: The simple logic applicable is that the 11% the man earns should be 10% of his investment.

In order to earn Rs. 10, one can invest Rs. 100

In order to earn Rs. 11, one can invest Rs. 100 × (11/10) = Rs. 110. Hence the market price of the stock should be Rs. 110.

Example 5: How much should a person invest in 4% stock at Rs. 97 to get a net income of Rs. 700 a year after paying an income tax of 50 paise in a rupee.

Sol: Gross income the person will get on Rs. 97 = Rs. 4.

Tax to be paid on Rs. 4 = 0.50 Rs.

⇒ Net income = 4 – 0.50 = Rs. 3.50.

Now apply the chain rule.

In order to get an income of Rs. 3.50, one should invest Rs. 97; In order to get an income of Rs. 700, one should invest 700 × (97/3.50) = Rs. 19,400.

|

9 videos|39 docs|10 tests

|

FAQs on Important Formulas - Stocks and Shares - IPMAT Mock Test Series - Commerce

| 1. What is the difference between shares and stocks? |  |

| 2. How do you calculate the dividend yield of a stock? |  |

| 3. What is the formula for calculating the market capitalization of a company? |  |

| 4. How do you determine the earnings per share (EPS) of a company? |  |

| 5. What is the significance of the P/E ratio in stock analysis? |  |