Important Questions - Admission of a Partner | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Question: 1

Andy and Bandy are partners in a firm sharing profits and losses in the ratio of 3:2. Candy is admitted for 1/5th share in profits of the firm. Calculate the new profit sharing ratio of the partners if,

(a) Candy gets it equally from Andy and Bandy

(b) C gets it from Andy and Bandy in the ratio of 2:1

(c) C gets it wholly from Andy

(d) C gets it wholly from Bandy. (e) C gets it 3/20 from Andy and 1/20 from Bandy.

Question: 2

Find out the sacrificing ratio and new ratio in the following cases:

(I) A and B are partners sharing profits and losses in the ratio of 4:3. C is admitted for 1/5th share. A and B decided to share equally in future. Calculate the new ratio and sacrificing ratio.

(II) A, B, C and D are in partnership sharing profits and losses in the ratio of 36:24:20:20 respectively. E joins the partnership for 20% share. A, B, C and D would in future share profits among themselves as 3/10: 4/10: 2/10 and 1/10. Calculate the new profit sharing ratio after E’s admission.

Question: 3

R and S are partners sharing profits in the ratio of 5 : 3. T was admitted. R Surrender 1/4 of his share and S 2/5 of his share in favour of T. Calculate the sacrificing ratio and the new ratios.

Question: 4 A and B are partners sharing profits in the ratio of 3 : 2. They admit C, a new partner who acquires 1/5th of his share from A and 4/25th share from B. Calculate the new profit sharing ratio and sacrificing ratio.

Question: 5

(a) A, B and C are partners sharing profits in the ratio of 2 : 2 : 1. D is admitted as a new partner for 1/6th share. C will retain his original share. Calculate the new profit-sharing ratio and sacrificing ratio.

(b) A and B axe partners sharing profits in the ratio of 5 : 3. C is admitted for 3/10th share of half of which was gifted by A and the remaining share was taken by C equally from A and B. Calculate new profit-sharing ratio.

Question: 6

A and B are partners in a firm sharing profits and losses in the ratio of 3 : 2. A new partner C is admitted. A surrenders 1/5th of his share and B 2/5th of his share in favour of C. For the purpose of Cs admission, goodwill of the firm is valued at Rs. 75,000 and pass entries a. C brings his share of goodwill in cash. {retained in the firm}

b. C brings his share of goodwill privately.

c. C brings his share of goodwill in cash. {goodwill is withdrawn by the partners}

d. C brings his share of goodwill in cash. { half of the goodwill is withdrawn by the partners}

e. C doesn’t brings his share of goodwill in cash.

f. C brings ¼ of his share of goodwill in cash.

g. C brings his share of goodwill in kind.

h. Goodwill appearing in the balance sheet was 80,000.

i. Goodwill appearing in the balance sheet was 70,000.

j. No Goodwill is appearing in the balance sheet.

k. Profit of the new firm after c admission was 750000

l. Loss of the firm was Rs.3,75,000.

[Ans.: New Ratio-12 : 6 : 7; Sacrifice Ratio-3 : 4; C'S Share of Goodwill-Rs. 27,000 (Rs. 75,000 x 7/25)

Question: 7

A,b & C are partners sharing profits of 5:4:1. Two new partners were admitted. The profits are now to be shared in 3:4:2:2:1. D is to pay Rs.60,000 for his share of goodwill and E doesn’t bring his share of goodwill. Both partners had bought Rs.80,000 as capital.

Question: 8

Any and Bany are partners in a firm sharing profits and losses as 7:5. On April 1, 2004 they admit dany as a new partner for 1/6 th share. The new ratio will be 13:7:4. Dany contributed the following asset towards his capital and for his share of goodwill. Stock Rs.60,000; Debtors Rs.80,000; Land Rs.2,00,000; Plant and Machinery Rs.1,20,000. On the date of admission of Dany, the goodwill of the firm was valued at Rs.7,50,000. Record the necessary journal entries in the books of the firm.

Question: 9

E and F were partners in a firm sharing profits in the ratio of 3:1. They admitted G as a new partner on 1-3-2005 for 1/3rd share. It was decided that E, F and G will share future profits equally. G brought Rs.50,000 in cash and machinery worth Rs.70,000 for his share of profit as premium for goodwill. Showing your calculations clearly, pass necessary journal entries in the books of the firm.

Question: 10

Hemant and Nishant were partners in a firm sharing profits in the ratio of 3 : 2. Their capitals were Rs. 1,60,000 and Rs.1,00,000 respectively. They admitted Somesh on 1st April, 2013 as a new partner for 1/5th share in the future profits. Somesh brought Rs. 1,20,000 as his capital. Calculate the value of goodwill of the firm and record necessary Journal entries for the above transactions on Somesh admission.

Question: 11

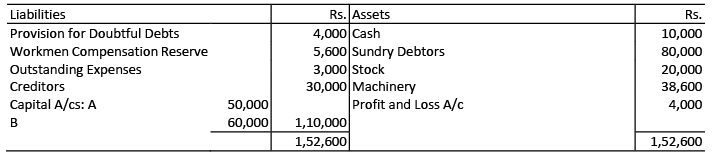

A and B are partners in a firm sharing profits and losses in the ratio of 3:2. On 31st March, 2009, their Balance Sheet was as under:

Liabilities | Rs. | Assets | Rs. |

Creditors | 70,000 | Bank | 40,000 |

Capital A/cs: | Debtors | 1,20,000 | |

A 1,50,000 | Stock | 60,000 | |

B 80,000 | 2,30,000 | Furniture | 50,000 |

Goodwill | 30,000 | ||

3,00,000 | 3,00,000 | ||

On the above dateC is admitted as apartner. A surrendered 1/6th of his share and B 1/3rd of his share in favour of C. Goodwill is valued at Rs.1,20,000. C brings in only 1/2 of his share of goodwill in cash and Rs.1,00,000 as his capital. Following adjustments are agreed upon:

(i) Stock is to be reduced to Rs.56,000 and furniture by Rs.5,000.

(ii) There is an unrecorded asset worth Rs.20,000.

(iii)One month’s rent of Rs.15,000 is outstanding.

(iv)A creditor for goods purchased for Rs.10,000 has been omitted to be recorded although the goods had been correctly included in stock.

(v) Insurance premium amounting to Rs.8,000 was debited to P &L A/c, of which Rs.2,000 is related to the period after 31st March, 2009.

You are required to prepare Revaluation Account, Partner’s Capital Accounts and the Balance Sheet of the new firm. Also calculate the new profit sharing ratio.

Questions: 12

Following is the Balance Sheet of Subash and Asha as at 31st March, 2016 sharing profits in the ratio of 3 : 2:

Liabilities | Rs. | Assets | Rs. | ||

Creditors | 10,000 | Debtors | 22,000 | ||

Employees' Provident Fund | 8,000 | Less: Provision for Doubtful Debts | 1,000 | 21,000 | |

General Reserve | 30,000 | Stock | 11,000 | ||

Workmen Compensation Reserve | 15,000 | Bank | 21,000 | ||

Capital A/cs: | Land and Building | 18,000 | |||

Subash | 15,000 | Plant and Machinery | 12,000 | ||

Asha | 10,000 | 25,000 | Advertisement Expenditure | 5,000 | |

88,000 | 88,000 | ||||

They admit Tanya as a partner on 1st April, 2016 for 1/6th share in the profits. It was decided that:

(i) Value of Land and Building be increased by Rs. 3,000.

(ii) Value of Stock be increased by Rs. 2,500.

(iii) Provision for Doubtful Debts be increased by Rs. 1,500.

(iv) Liability against Workmen Compensation Reserve was determined at Rs. 20,000.

(v) Tanya brought in as her share of goodwill Rs. 10,000 in cash.

(vi) Tanya was to bring in further cash of Rs. 15,000 as her capital.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the new firm.

Questions: 13

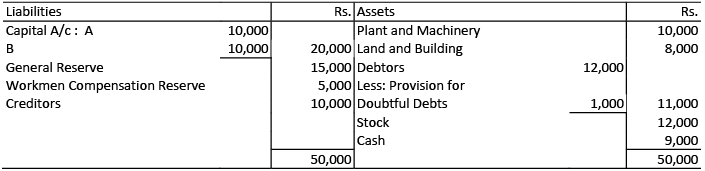

A and B are partners in a firm. Their Balance Sheet as at 31st March, 2016 was:

On 1st April, 2016, they admitted C as a new partner on the following conditions:

(i) C brings in Rs. 40,000 as his share of capital but he is unable to bring any amount for goodwill.

(ii) The new profit-sharing ratio between A, B and C will be 3 : 2 : 1.

(iii) Claim on account of Workmen Compensation is Rs. 3,000.

(iv) To write off Bad Debts amounting to Rs. 6,000.

(v) Creditors are to be paid Rs. 2,000 more.

(vi) Rs. 2,000 be provided for an unforeseen liability.

(vii) Outstanding Expenses be brought down to Rs. 1,200.

(viii) Goodwill is valued at 1½ years' purchase of the average profit of last three years, less Rs. 12,000. The profits of last three years amounted to Rs. 10,000; Rs. 20,000 and Rs. 30,000 respectively.

Prepare Revaluation Account, Capital Accounts of Partners and the Balance Sheet.

Question: 14

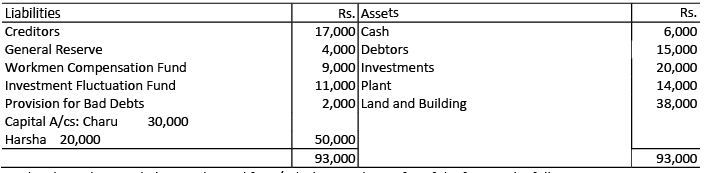

Charu and Harsha were partners in a firm sharing profits in the ratio of 3: 2. On 1st April, 2014, their Balance Sheet was as follows:

On the above date Vaishali was admitted for 1/4th share in the profits of the firm on the following terms:

(i) Vaishali will bring Rs. 20,000 for her capital and Rs. 4,000 for her share of goodwill rjremium.

(ii) All debtors were considered good.

(iii) The market value of investments was Rs. 15,000.

(iv) There was a liability of Rs. 6,000 for Workmen Compensation.

(v) Capital Accounts of Charu and Harsha are to be adjusted on the basis of Vaishali's capital by opening Current Accounts.

Prepare Revaluation Account, Partners' Capital Accounts & balance sheet.

Question: 15

A and B were partners in a firm sharing profits in the ratio of 3:2. They admitted C as a new partner for 1/6th share in the profits C was to bring Rs.40,000 as is capital and the capitals of A and B were to be adjusted on the basis of C’’s capital saving regard to profit sharing ratio. The balance sheet of A and B as on 31.3.2006 was as follows:

The other terms of agreement on C’’s admission were as follows:

(i) C will bring Rs.12,000 for his share of goodwill.

(ii) Building will be valued at Rs.1, 85,000 and machinery at Rs.40,000.

(iii) A provision of 6% will be created on debtors for had debts.

(iv) Capital accounts of A and B will be adjusted by opening Current Accounts.

Prepare Revaluation Account. Partners Capital Account and the Balance Sheet of A, B and C.

[Ans. Loss on Revaluation Rs.19,000; New Ratio 3:2:1; Capital Account A Rs.1, 20,000, B Rs.80,000 and C Rs.40,000; Current Account A Rs.40,176 (Cr.) and B Rs.6,784 (Cr.); Balance Sheet Total Rs.3, 42,960.]

Question: 16

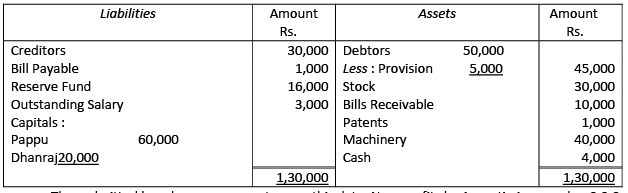

Pappu and Dhanraj were partners in a firm sharing profits in the ratio of 3:1 their balance sheet was as follows:

They admitted leander as a new partner on this date. New profit sharing ratio is agreed as 3:2:3. Leander brings in proportionate capital after the following adjustments:

(i) Leander brings Rs.16,000 as his share of goodwill.

(ii) Provision for doubtful debts is to be reduced by Rs.2,000.

(iii) There is an old typewriter valued at Rs.2,400. It does not appear in the books of the firm. It is now to be recorded.

(iv) Patents are valueless.

Prepare Revaluation Account, Capital Accounts and the Opening Balance Sheet of Pappu. Dhanraj and Leander.

[Ans. Profit on Revaluation Rs.3,400: Balances of Capital Accounts, Pappu Rs.90,550; Dhanraj Rs.24,850 and Leander Rs.69,240. Total of B/S Rs.2, 18,640.]

Question: 17

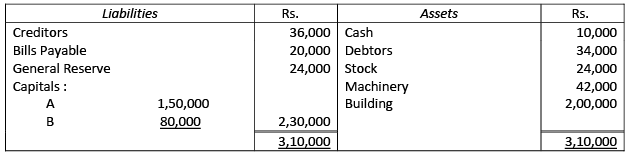

Following is the Balance Sheet as at 31st March, 2016 of A and B, who share profits and losses in the ratio of 3 : 2:

On 1st April, 2016, they agreed to admit C into partnership on the following terms:

(i) Provision for Doubtful Debts would be increased by Rs. 2,000.

(ii) Value of Land and Building would be increased to Rs. 18,000.

(iii) The value of Stock would be increased by Rs. 4,000.

(iv) The liability against the Workmen Compensation Reserve is determined at Rs. 2,000. (v) C brought in as his share of goodwill Rs. 10,000 in cash.

(vi) C would bring in further cash as would make his capital equal to 20% of the total capital of the new firm after the above revaluation and adjustments are carried out.

Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of the firm after C’s admission.

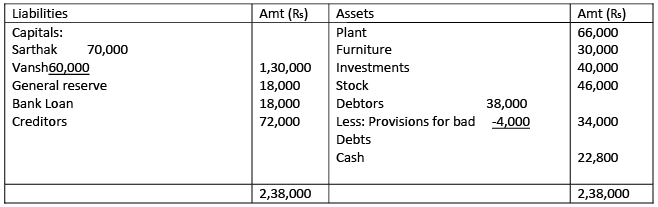

Question: 18

Sarthak and Vansh are partners sharing profits in the ratio of 2:1. Since both of them are specially abled, sometimes they find it difficult to run the business on their own. Mansi, a common friend, decides to help them. Therefore they admit her into partnership for 1/3rd share in profits. She brings ₨ 60,000 for goodwill and proportionate capital. At the time of admission of Mansi, the Balance Sheet of Sarthak and Vansh was as under:

It was decided to:

(i) Reduce the value of Stock by ₨ 10,000.

(ii) Plant is to be valued at ₨ 80,000.

(iii) An amount of ₨ 3,000 included in Creditors was not payable.

(iv) Half of the Investments were taken over by Sarthak and remaining were valued at ₨ 25,000. Prepare Revaluation Account, Partners' Capital Accounts and Balance Sheet of reconstituted firm.

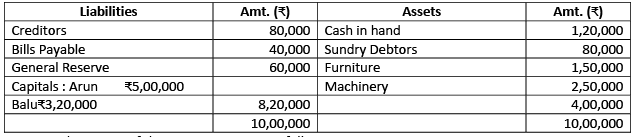

Question: 19

Arun and Balu are partners in a firm sharing profits in the ratio of 2:1. They admitted Chetan as a new partner for 1/4th share in profits. Chetan will bring ₹3,00,000 for his capital and the capitals of Arun and Balu will be adjusted in their profit sharing ratio. For this current accounts will be opened. The Balance Sheet of the firm on 31.3.2012 before Chetan’s admission was as follows:

Balance Sheet of Arun and Balu as at 31.3.2012

Other terms of the agreement were as follows:

(i) Chetan will bring ₹1,20,000 for his share of goodwill.

(ii) Building was revalued at ₹4,50,000 and machinery at ₹2,30,000.

(iii) A provision of 6% was to be made on Debtors for bad debts.

Prepare Revaluation Account, Partners’ Capital Accounts, Partners’ Current Accounts and the Balance Sheet of the new firm.

Question: 20

A and B are in partnership sharing profits and losses in the ratio of 3 : 2. The capitals of A and B before adjustments are Rs. 41,400 and Rs. 30,600 respectively. Firm's Goodwill Rs. 30,000, Loss on Revaluation of Assets and Liabilities Rs. 3,000, General Reserve Rs. 9,000. They admit C as a partner who contributes Rs. 21,000 as capital for 1/5th share of profits to be acquired equally from both A and B. The capital accounts of old partners are to be adjusted on the basis of the proportion of C's capital to his share in the business. Calculate the amount of actual cash to be paid off or brought in by the old partners for the purpose and pass the necessary journal entries.

[Ans. A pays Cash Rs. 4,500, B withdraws Cash Rs. 4,500]

|

79 docs|43 tests

|

FAQs on Important Questions - Admission of a Partner - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is the purpose of admitting a partner in a commerce business? |  |

| 2. How can a partner be admitted in a commerce business? |  |

| 3. What factors should be considered before admitting a partner in a commerce business? |  |

| 4. How does the admission of a partner affect the ownership structure of a commerce business? |  |

| 5. What are the legal formalities involved in admitting a partner in a commerce business? |  |