Important Questions - Partnership Fundamentals | Crash Course of Accountancy - Class 12 - Commerce PDF Download

Question: 1

X,Y and Z are partners sharing profits in the ratio of 1/9 : 1/3 and 5/9, Calculate new ratio and gaining ratio. a) X retires b) Y retires and Z acquires full share of Y c) Z retires and X & Y acquires Z’s share equally d) Z retires and surrender 3/4th of this share in favour of X and remaining in favour of Y

Question: 2

P,R and S are in partnership sharing profits 4/8, 3/8 and respectively . It is provided under the partnership deed that on the death of any partner his share of goodwill is to be valued at one-half of the net profits credited to his account during the last 4 completed years (books of accounts are closed on 31st December R doed pm 1st January, 1985. The firm’s profits for the last 4 years were as follows: 1981 (Profit Rs.1,20,000); 1982 (Profits Rs.60,000);1983 (losses Rs.20,000) and 1984 (Profits Rs.80,000). 1. Determine the amount that should be credited to R in respect of his share of goodwill. 2. Pass a journal entry without raising goodwill account for its adjustment, assuring that profit sharing ratio between P and S in future will be 3:2 show your working clearly.

Question: 3

Arjun, Bhim and Nakul are partners sharing profits and losses in the ratio of 14: 5 : 6 respectively. Bhim retires and surrenders his 5/25th share in favour of Arjun. The goodwill of the firm is valued at 2 years purchase of super profits based on average profits of last 3 years. The profits for the last 3 years are Rs.50,000, Rs.55,000 and Rs.60,000 respectively. The normal profits for the similar firm are Rs.30,000. Goodwill already appears in the books of the firm at Rs.75,000. The profit for the first year after Bhim’s retirement was Rs.1,00,000. Give the necessary journal entries to adjust Goodwill and to distribute profits showing your workings clearly.

Question: 4

A,B and C and D are partners sharing profit in the ratio of 5:3:1. On retirement of C, goodwill was valued at Rs.3,60,000. C’s share of goodwill will adjusted into the Capital accounts of A,B and D. Pass necessary entry for the treatment of goodwill when new profit sharing ratio is decided at 9:2:1.

Question: 5

X,Y and Z are partners sharing profile and losses in the ratio of 3:2:1 retires selling his share to X and Z for Rs.16,000, Rs.10,000 being paid by X and Rs.6,000 by Z The profit for the year Y’s retirement is Rs.24,000 Pass entries to (a) record the sale of Y’s share to X and Z, and (b) distribute profit between X and Z.

Question: 6

A,B and C were partners. Their partnership deed provided that they were in share profits thus; A26 per cent; B34 per cent; C40 per cent; and that if a partner died, his capital should remain in the business for a stated period at a fixed rate of interest, but the deceased partner’s share should be credited with an amount Goodwill, based upon one and a half year’s average profits, for the five years prior to his death, but be subject to deduction of 5 per cent from the book debts. C died, and the profits of the firm for five years were agreed at Rs.20,000; Rs.30,000; Rs.15,000 (loss); Rs.5,000 (loss); and Rs.45,000 respectively. Book Debts stood at Rs.90,000.

Prepare a statement showing the amount of Goodwill to be credited to C’s Account and give the Journal entry in the firm’s book necessary to carry out the transactions.

(Hint: Total Goodwill Rs.22,500

Net Goodwill = 22,500-4,500(5% of book Debts) = Rs.18,000

C’s Share = 18,000∗ 40/100 = Rs.7,200)

Question: 7

The Balance Sheet of A, B & C who are partners in a firm sharing profits according to their capitals was as under:

Liabilities | Rs. | Assets | Rs. | |

Creditors | 12,600 | Buildings | 60,000 | |

A's Capital | 48,000 | Machinery | 30,000 | |

B's Capital | 24,000 | Stock | 10,800 | |

C's Capital | 24,000 | Debtors | 12,000 | |

General Reserve | 12,000 | Less: Provision | 600 | 11,400 |

Cash at Bank | 8,400 | |||

1,20,600 | 1,20,600 |

On that date B decided to retire from the firm and was paid for his share in the firm subject to the following:

(a) Building to be appreciated by 20%.

(b) Provision for Doubtful Debts to be increased to 15% on Debtors.

(c) Machinery to be depreciated by 20%.

(d) Goodwill of the firm is valued at Rs. 43,200 and the retiring partner's share is adjusted through the Capital Accounts of remaining partners.

(e) The Capital of the new firm be fixed at Rs. 72,000.

Required: Prepare Revaluation Account, Capital Accounts of the partners and the Balance Sheet after retirement of B.

Question: 8

The Balance Sheet of X, Y and Z who were sharing profits in the ratio of 5 : 3 : 2 as at 31st March, 2016 is as follows:

Liabilities | Rs. | Assets | Rs. | |

Creditors | 50,000 | Cash at Bank | 40,000 | |

Employees' Provident Fund | 10,000 | Sundry Debtors | 1,00,000 | |

Profit and Loss A/c | 85,000 | Stock | 80,000 | |

Capital A/cs: X | 40,000 | Fixed Assets | 60,000 | |

Y | 62,000 | |||

Z | 33,000 | 1,35,000 | ||

2,80,000 | 2,80,000 | |||

X retired on 31st March, 2016 and Y and Z decided to share profits in future in the ratio of 3:2 respectively.

The other terms on retirement were:

(a) Goodwill of the firm is to be valued at Rs. 80,000.

(b) Fixed Assets are to be depreciated to Rs. 57,500.

(c) Make a Provision for Doubtful Debts at 5% on Debtors.

(d) A liability for claim, included in Creditors for Rs. 10,000, is settled at Rs. 8,000.

The amount to be paid to X by Y and Z in such a way that their Capitals are proportionate to their profit-sharing ratio and leave a balance of Rs. 15,000 in the Bank Account.

Prepare Profit and Loss Adjustment Account , Partners' Capital Accounts & balance sheet.

Question: 9

X, Y and Z are partners in a firm sharing profits in the ratio of 3 :1 : 2. On 31st March, 2016, their Balance Sheet was:

Liabilities | Rs. | Assets | Rs. | ||

Bills Payable | 12,000 | Freehold Premises | 40,000 | ||

Sundry Creditors | 28,000 | Machinery | 30,000 | ||

General Reserve | 12,000 | Furniture | 12,000 | ||

Capital A/cs: | Stock | 22,000 | |||

X | 30,000 | Sundry Debtors | 20,000 | ||

Y | 20,000 | Less: Provision for Doubtful Debts | 1,000 | 19,000 | |

Z | 28,000 | 78,000 | Cash | 7,000 | |

1,30,000 | 1,30,000 | ||||

Z retires from the business and the partners agree to the following:

(a) Freehold premises and Stock are to be appreciated by 20% and 15% respectively.

(b) Machinery and Furniture are to be depreciated by 10% and 7% respectively.

(c) Provision for Doubtful Debts is to be increased to Rs. 1,500.

(d) Goodwill of the firm is valued at Rs. 21,000 on Z's retirement.

(e) The continuing partners have decided to adjust their capitals in their new profit-sharing ratio after retirement of Z. Surplus/deficit, if any, in their Capital Accounts will be adjusted through cash a/c .

Question: 10

The Balance Sheet of X. , Y and Z sharing profits and losses in the ratio of 2 : 3 : 2, is given below:

Liabilities | Rs. | Assets | Rs. |

Capital Accounts: | Land and Buildings | 2,40,000 | |

X | 2,40,000 | Machinery | 3,60,000 |

Y | 3,60,000 | Closing Stock | 1,20,000 |

Z | 2,40,000 | Sundry Debtors 1,32,000 | |

Workmen Compensation Reserve | 18,000 | Less: Provision 12,000 | 1,20,000 |

Sundry Creditors | 60,000 | Cash at Bank | 1,20,000 |

Employee Provident Fund | 42,000 | ||

9,60,000 | 9,60,000 |

On same date X desired to retire on the following terms:

(a) Land & Buildings be appreciated by 30%.

(b) Machinery be depreciated by 30%.

(c) Bad debts Rs. 22,200.

(d) The claim on account of Workmen Compensation Fund was estimated at Rs. 9,600.

(e) Goodwill of the entire firm be valued at Rs. 1,68,000. Y and Z decided to share the future profits & losses in the ratio of 3 : 4.

(f) The total capital of the firm is to be the same as before retirement. Individual capitals be in their profit sharing ratio.

(g) Amount due to X is to be settled by paying Rs. 60,000 in cash and balance by transferring to loan account.

Required: Prepare Revaluation Account, Capital Accounts of Partners, Balance Sheet of New Firm.

Question: 11

The Balance Sheet of A, B and C sharing profits in the ratio of 2:3:5 is given below:

Liabilities | Rs. | Assets | Rs. | |

Creditors | 42,000 | Bank | 27,000 | |

A's Capital | 48,000 | Debtors | 24,000 | |

B's Capital | 42,000 | Less: Provision | 3,000 | 21,000 |

C's Capital | 36,000 | Stock | 30,000 | |

Building | 84,000 | |||

Profit & Loss A/c | 6,000 | |||

1,68,000 | 1,68,000 |

On the above date C retired from the firm due to his illness on the following terms:

(a) Building was to be depreciated by Rs. 24,000.

(b) Provision for doubtful debts was to be maintained at 20% on debtors.

(c) Salary outstanding Rs. 3,000 was to be recorded and creditors Rs. 2,400 will not be claimed.

(d) Goodwill of the firm was valued at Rs. 43,200.

(e) C was to be paid Rs. 9,000 in cash, through bank and the balance was to be transferred to his loan account.

Required: Prepare Revaluation Account, Capital Accounts of Partners, Balance Sheet of New Firm.

Question: 12

P,Q and R are in partnership sharing profits in the ratio of 3:2:1. R retires. Following balance appeared in their books.

Goodwill | 12,000 | ||

Bank | 10,000 | ||

Other Assets | 70,000 | ||

Creditors | 14,000 | ||

Capitals: P Q | 40,000 | ||

R | 92,000 |

20,000

18,000

92,000

Goodwill is agreed at Rs.30,000. Sufficient money is to be introduced so that R is paid off and leave Rs.4,000 in cash at bank. P and Q are to provide such sum as will make their capitals proportionate to their share to profits. Prepare necessary entries and the new balance sheet.

Question: 13

A, B and C are partners in a firm. A retires on 1st January, 1993. On the date of retirement, Rs. 80,000 is due to him in all. It is agreed to pay him this amount in instalments every year at the end of the year. Prepare A’s Loan a/c in the following cases:

(i) Four yearly instalments plus interest @10% p.a.

(ii) Three annual instalments of Rs. 25,000 each which already include interest @ 10% p.a. on the outstanding balance of each year and the balance including interest is paid in the fourth year.

Question: 14

Mishra, Puri and Khurana are partners in a firm sharing profits in proportion of 3:1:2 respectively. The Balance Sheet on April 1, 2003 was as follows:

Liabilities | Rs. | Asses | Rs. | |

Bills Payable | 12,000 | Freehold premise | 40,000 | |

Sundry Creditors | 18,000 | Machinery | 30,000 | |

Reserve | 12,000 | Furniture | 12,000 | |

Capital Accounts: | Stock | 22,000 | ||

Mishra | 30,000 | Sundry Debtor 20,000 | ||

Puri | 30,000 | Less: Reserve for | ||

Khurana | 28,000 | 88,000 | bad debts 1,000 | 19,000 |

Cash | 7,000 | |||

1,30,000 | _ | 1,30,000 | ||

Khurana retires from the business and the partners agree to the following revaluation:

(a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

(b) Machinery and furniture are to be depreciated by 10% and 7% respectively.

(c) Bad debts reserve is to be increased to Rs. 1,5000.

(d) Goodwill is valued at Rs. 21,000 on Khurana’s retirement.

(e) The continuing partners have decided to adjust their capitals in their new profit sharing ratio after retirement of Khurana. Surplus / deficit, if any, in their capital accounts will be adjusted through current accounts.

Prepare necessary ledger accounts and draw the Balance Sheet of reconstituted firm.

Question: 15

The Balance Sheet of Sindhu, Rahul and Kamlesh, who were sharing profits in the ratio of 3:3:4 respectively as on 31st March 2012 was as follows:

Liabilities | Amt (Rs) | Assets | Amt (Rs) |

General reserve | 10,000 | Cash | 32,000 |

Bills payable | 20,000 | Stock | 88,000 |

Loan | 24,000 | Investments | 94,000 |

Capitals : Sindu Rs 1,20,000 Rahul Rs 1,00,000 Kamlesh Rs 80,000 | 3,00,000 | Land & Building Sindu's Loan | 1,20,000 20,000 |

3,54,000 | 3,54,000 |

Sindhu died on 31st July 2012. The partnership deed provided for the following on the death of a partner:

(a) Goodwill of the firm be valued at two years' purchase of average profits for the last three years which were ₨ 80,000

(b) Sindhu's share of profit till the date of his death was to be calculated on the basis of sales. Sales for the year ended 31st March 2012 amounted to ₨ 8,00,000 and that from Is' April to 31st July 2012 ₨ 3,00,000. The profit, for the year ended 31st March 2012 was ₨ 2,00,000.

(c) Interest on capital was to be provided 6% p.a.

(d) According to Sindhu's will, the executors should donate his share to ‘MatriChhaya—an orphanage for girls'.

Prepare Sindhu's Capital Account to be rendered to his executor.

Also identify the value being highlighted in the question.

Question: 16

dev, Swati and Sanskar were partners in a firm sharing profits in the ratio of 2 : 2 : 1. On 31-3-2014 their Balance Sheet was as follows :

Liabilities | Amount Rs | Assets | Amount Rs | |

Trade payables | 17,000 | Building | 1,04,000 | |

Bank Loan | 13,000 | Inventory | 16,000 | |

Capitals : | Trade Receivables | 23,000 | ||

Dev | 77,000 | Cash | 40,000 | |

Swati | 37,000 | Profit & Loss A/c | 57,000 | |

Sanskar | 46,000 | 2,10,000 | ||

2,40,000 | 2,40,000 | |||

On 30th June, 2014 Dev died. According to partnership agreement Dev was entitled to interest on capital at 12% per annum. His share of profit till the date of his death was to be calculated on the basis of the average profits of last four years. The profit of the last four years were:

Years | Profit Rs |

2010-2011 | 2,04,000 |

2011-2012 | 1,80,000 |

2012-2013 | 90,000 |

On 1-4-2014, Dev withdrew Rs 15,000 to pay for his medical bills. Prepare Dev's account to be presented to his executors.

Question: 17

Khanna, Seth and Mehta were partners in a firm sharing profits in the ratio of 3 : 2 : 5. On 31-12-2013 the Balance Sheet of Khanna, Seth and Mehta was as follows:

Liabilities | Rs. | Assets | Rs. |

Khanna's Capital | 3,00,000 | Goodwill | 3,00,000 |

Seth's Capital | 2,00,000 | Land and Building | 5,00,000 |

Mehta's Capital | 5,00,000 | Machinery | 1,70,000 |

General Reserve | 1,00,000 | Stock | 30,000 |

Loan from Seth | 50,000 | Debtors | 1,20,000 |

Creditors | 75,000 | Cash | 45,000 |

Profit and Loss A/c | 60,000 | ||

12,25,000 | 12,25,000 |

On 14th March 2014, Seth died.

The partnership deed provided that on the death of a partner the executor of the deceased partner is entitled to:

(i) Balance in Capital Account;

(ii) Share in profits upto the date of death on the basis of last year's profit;

(iii) His share in profit/loss on revaluation of assets and re-assessment of liabilities which were as follows:

(a) Land and Building was to be appreciated by Rs. 1,20,000.

(b) Machinery was to be depreciated to Rs. 1,35,000 and Stock to Rs. 25,000.

(c) A provision of 2 1/2% for bad and doubtful debts was to created on debtors;

(iv) The net amount payable to Seth's executors was transferred to his loan account which was to be paid later.

Prepare Revaluation Account, Partners Capital Accounts, Seth's Executors A/c and the Balance Sheet of Khanna and Mehta.

Question: 19

X, Y and Z were partners in a firm sharing profits and losses in the ratio of 5 : 3 : 2. On 31st March, 2014 their Balance Sheet was as follows:

Liabilities | Rs. | Assets | Rs. |

x. 's Capital | 75,000 | Building | 50,000 |

Y's Capital | 62,500 | Patents | 15,000 |

Z's Capital | 37,500 | Machinery | 75,000 |

Sundry Creditors | 42,500 | Stock | 37,500 |

Debtors | 20,000 | ||

Cash in Bank | 20,000 | ||

2,17,500 | 2,17,500 |

Z died on 31st July, 2014. It was agreed that: (i) Goodwill will be valued at 2,5 years' purchase of the average profits of the years, which were : I Rs. 32,500, II Rs. 30,000, III Rs. 40,000, IV Rs. 37,500 (2013-2014). (ii) Machinery be valued at Rs. 70,000; Patents at Rs. 20,000 and Building at Rs. 62,500. (iii) For the purpose of calculating Z's share of profits in the year of his death the profits in 2014-2015 should be taken to have been accrued on the same as in 2013-2014. (iv) A sum of Rs. 17,500 was paid immediately to the executors of Z and the balance was paid in four half yearly installments together with interest @ 12% starting from 31st January, 2015.

Give the necessary Journal entries and Prepare Z's executors' account till the payment of instalment due on 31st January, 2015.

Questions: 20

Risha and Nisha were partners. The partnership deed provides:

i) That the accounts be balanced on 31st December each year.

ii) The profits be divided as follows: Risha one-half, Nisha one-third and carried to Reserve account one-sixth.

iii) That is the event of death a partner, her executor will be entitled to the following:

(a) The capital to her credit at the date of death.

(b) Her proportion of profit to date of death based on the average profits of the last three completed years.

(c) Her share of goodwill based on three years’ purchase of the average profits for the three preceding years.

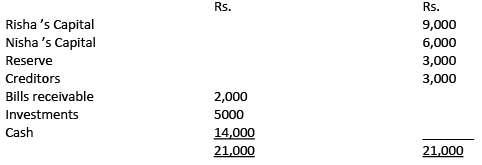

On 31st December, 2006 the Trial Balance was as under:

The profits for the three years were : 2004 Rs.4,200;2005 Rs.3,900 and 2006 Rs.4,500 Nisha died on 31 st May, 2007. Draw up the deceased Partner’s Capital A/C and Executor’s A/C.

|

79 docs|43 tests

|

FAQs on Important Questions - Partnership Fundamentals - Crash Course of Accountancy - Class 12 - Commerce

| 1. What is a partnership in commerce? |  |

| 2. How is a partnership different from other business structures? |  |

| 3. What are the advantages of forming a partnership in commerce? |  |

| 4. What are the potential disadvantages of a partnership in commerce? |  |

| 5. How can a partnership in commerce be dissolved? |  |