Introduction to Macroeconomics and its Concepts | Economics Class 12 - Commerce PDF Download

| Table of contents |

|

| Introduction and Structure of MacroEconomics |

|

| Some Basic Concepts Of Macroeconomics |

|

| Point to Remember for Final Goods and Intermediate Goods |

|

| Important Points AboutIntermediate Goods |

|

Introduction and Structure of MacroEconomics

Macroeconomics (Concept)

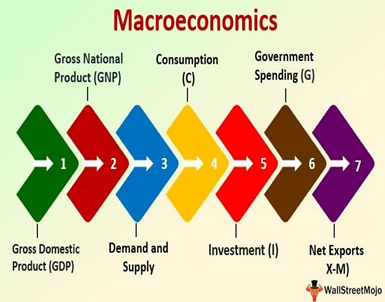

Macroeconomics is a branch of economics that studies how an economy—the market systems that operate on a large scale— overall behaves.

- Macroeconomics studies economy-wide phenomena such as inflation, price levels, rate of economic growth, national income, gross domestic product (GDP), and changes in unemployment.

- It is also called the ‘Income Theory’ or ‘Employment Theory’.

Structure of Macro economy

- As we know, Macroeconomics is concerned with economic problems at the level of an economy as a whole.

- Structure of Macroeconomics implies study of different sectors of the economy.

- An economy may be divided into different sectors depending on the nature of study.

(a) Producer sector engaged in the production of goods and services.

(b) Household sector engaged in the consumption of goods and services.

Note: Households are taken as the owners of factors of production.

(c) The government sector engaged in activities like taxation and subsidies.

(d) Rest of the world sector engaged in exports and imports.

(e) Financial sector (or financial system) engaged in the activity of borrowing and lending.

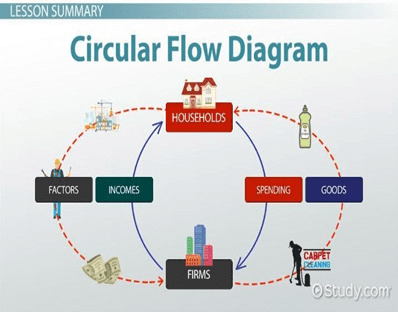

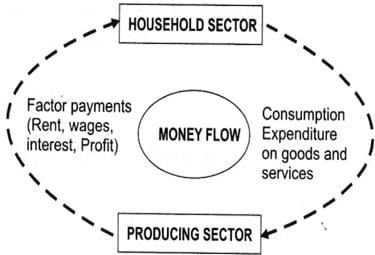

Circular flow of income

- It refers to flow of money, income or the flow of goods and services across different sectors of the economy in a circular form.

- There are two types of Circular flow:

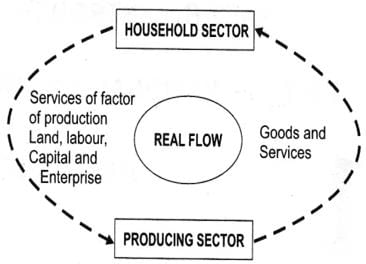

(1) Real/Product/Physical Flow

(2) Money/Monetary/Nominal FlowReal flow

- Real flow of income implies the flow of factor services from the household sector to the producing sector and corresponding flow of goods and services from the producing sector to the household sector.

- Let us consider a simple economy consisting only of 2 sectors:

(i) Producer Sector.

(ii) Household Sector.

- These two sectors are dependent on each other in the following ways:

- Producers supply goods and services to the households.

- Household (as the owners of factors of production) supplies factors of production (or factor services) to the producers.

- This interdependence can be explained with the help of the diagram given here.

Money Flow

- Money flow refers to the flow of factor income, as rent, interest, profit and wages from the producing sector to the household sector as monetary rewards for their factor services as shown in the flowchart.

- The households spend their incomes on the goods and services produced by the producing sector.

- Accordingly, money flows back to the producing sector as household expenditure as shown in the flowchart.

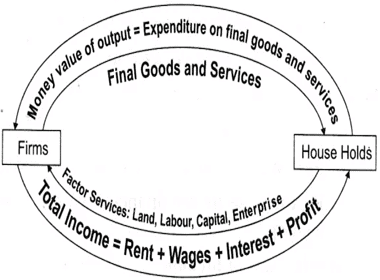

Circular Flow Of Income In Two Sector Model

The following assumptions with regard to a simple economy with only two sector of economics activity are:

(1) There are only two sectors in the economy; that is, household and firms.

(2) Household supply factor services to firms.

(3) Firms hire factor services from Households. (4) Households spend their entire income on consumption.

(4) Households spend their entire income on consumption.

(5) Firms sell all that is produced to the households.

(6) There is no government or foreign trade.

Such an economy described above has two types of markets.

(a) Market for goods and services, that is product market.

(b) Market for factors of production, factor market.

As a result we can derive the following, in the case of our simple economy:

(a) Total production of goods and services by firms = Total consumption of goods and services by Household Sector.

(b) Factor Payments by Firms = Factor Incomes of Household Sector.

(c) Consumption expenditure of Household sector = Income of Firm.

(d) Hence, Real flows of production and consumption of Firms and households = Money flows of income and expenditure of Firms and Households.

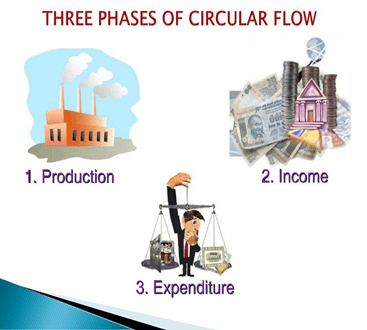

Phases Of Circular Flow

There are three types of phases of Circular flow.

Production Phase

(a) In this phase, firms produce goods and services with the help of factor services.

(b) If we study it in term of the quantity of goods and services produced, it is a Real Flow.

(c) But, it is a Money flow, if we study it in terms of the market value of the goods produced.

Distribution Phase

(a) Income phase. This phase involves the flow of factor income (rent, wages, interest and profits)

(b) It means the flow of income in the form of rent, interest, profit and wages, paid by producer sector to the household sector. It is a Money Flow.

Disposition Phase

(a) Disposition means expenditure made. This phase deals with expenditure on the purchase of goods and services by households and other sectors.

(b) This is a Money Flow from other sectors to the producer sector.

These phases are illustrated in the figure given here.

Some Basic Concepts Of Macroeconomics

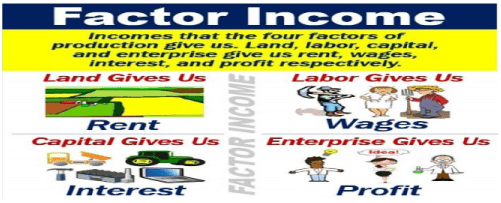

1. Factor Income

- Factor income is income received from the factors of production: the inputs used in the production of goods or services in order to make an economic profit.

- Factor income on the use of land is called rent, income generated from labour is called wages, and income generated from capital is called profit.

- It is a bilateral [Two-Sided] Concept.

- It is included in National Income as it contribute something in the flow of goods and services.

Examples: Rent, interest, wages and profit.

2. Transfer Income

- Money from the government in the form of benefits (= payments for people who cannot find a job or are too ill to work), subsidies (= money given to reduce the cost of producing food, a product, etc.), etc., paid for by taxes: Many households receive transfer income from the state

- It is a unilateral [one-sided] concept.

- It is not included in National Income as it does not contribute anything in the flow of goods and services.

- Examples: Old Age Pension, Scholarship, Unemployment allowance.

There are two types of transfers:

(i) Current transfers

(ii) Capital transfers

Current Transfers

- Transfers made from the income of the payer and added to the income of the recipient (who receive) for consumption expenditure are called current transfers.

- It is recurring or regular in nature.

For example, scholarships, gifts, old age pension, etc.

Capital Transfers

- Capital transfers are defined as transfers in cash and in kind for the purpose of investment to recipients, made out of the wealth or saving of the donor.

- It is non recurring or irregular in nature.

For example, investment grant, capital gains tax, war damages, etc.

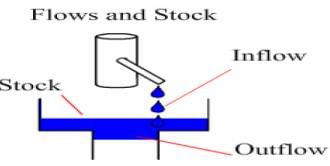

Stock

- Any economic variable which is calculated at a particular point of time is known as stock.

- It is static in nature, i.e., it do not change.

- There is no time dimension in stock variables.

- For example, Distance, Amount of Money, Money Supply, Water in Tank, etc.

Flow

- Any economic variable which is calculated during a period of time is known as flow.

- It is dynamic in nature, i.e., it can be changed.

- There is time dimension in flow variables.

- For example, Speed, Spending of Money, Water in River, Exports, Imports, etc.

Economic territory or Domestic Territory

- According to the United Nations, economic territory is the geographical territory administered by a government within which persons, goods and capital circulate freely.

- The above definition is based on the criterion “freedom of circulation of persons, goods and capital”.

- Clearly, those parts of the political frontiers (or boundaries) of a country where the government of that country does not enjoy the above “freedom” are not to be included in economic territory of that country.

- One example is embassies. Government of India does not enjoy the above freedom in the foreign embassies located within India.

- So, these are not treated as a part of economic territory of India.

- They are treated as part of the economic territories of their respective countries.

- For example the U.S. embassy in India is a part of economic territory of the U.S.A. Similarly, the Indian embassy in Washington is a part of economic territory of India.

- International organizations like UNO, WHO, etc. located within the geographical boundaries of a country.

- In layman terms, the domestic territory of a nation is understood to be the territory lying within the political frontiers (or boundaries) of a country.

- But in national income accounting, the term domestic territory is used in a wider sense.

- Based on ‘freedom’ criterion, the scope of economic territory is defined to cover:

- Fishing vessels, oil and natural gas rigs and floating platforms operated by the residents of a country in the international waters where they have exclusive rights of operation.

- For example, Fishing boats operated by Indian fishermen in international waters of Indian Ocean will be considered a part of domestic territory of India.

- Embassies, consulates and military establishments of a country located abroad.

- For example, Indian Embassy in Russia is a part of the domestic territory of India.

- ‘Consulate’ is an office or building used by consul (an officer commissioned by the government to reside in a foreign country to promote the interest of the country to which he belongs).

Citizenship

- Citizenship is basically a legal concept based on the place of birth of the person or some legal provisions allowing a person to become a citizen.

- It means, Indian citizenship can arise in two ways:

- When a person is born in India, he acquires automatic citizenship of India.

- A person born outside India applies for citizenship and Indian Law allows him to become Indian Citizen.

Normal Resident/Resident

- A Normal resident, whether a person or an institution, is one whose centre of economic interest lies in the economic territory of the country in which he lives.

- The centre of economic interest implies in two things:

(i) The resident lives or is located within the economic territory for more than one year.

(ii) The resident carries out the basic economic activities of earnings, spending and accumulation from that location. - There is a difference between the terms normal resident (resident) and citizen (or national).

- A person becomes a national of a countiy because he was born in the country or on the basis of some other legal criterion.

- A person is treated resident of a country on the basis of economic criterion.

- It is not necessary that a resident must also be the national of that country.

- Even foreigners can be the residents if they pass the above stated economic criterion.

- For example, a large number of Indian nationals have settled in U.S.A., England, Australia, etc. as residents (and not as nationals) of these countries.

- For India, they are Non-resident Indians (NRI) but continue to remain Indian nationals.

Following are not included under the category of Normal residents:

- Foreign visitors in the country for such purposes as recreation, holidays, medical treatment, study tours, conferences, sports events, business etc. (they are supposed to stay in the host country for less than one year. In case they continue to stay for one year or more in the host country, they will be treated as normal residents of the host countiy).

- Crew members of foreign vessels, commercial travelers and seasonal workers in , the country (Foreign workers who work part of the year in the country in response to the varying seasonal demand for labour and return to their households and border workers who regularly cross the frontier each day or somewhat less regularly, (i.e. each week) to work in the neighbouring country are the normal residents of their own countries.

Example: Nepal. - Officials, diplomats and members of the armed forces of a foreign country.

- International bodies like World Bank, World Health Organisation or International Monetary Fund are not considered residents of the country in which these organisations operate but are treated as residents of international territory. However, the staffs of these bodies are treated as normal residents of the country in which the international body operates. For example, international body like World Health Organisation located in India is not normal resident of India but Americans working in its office for more than a year will be treated as normal residents of India.

- Foreigners who are the employees of non-resident enterprises and who have come to the country for purposes of installing machinery or equipment purchased from their employers. (They are supposed to stay for less than one year. In case they continue to stay for one year or more, they will be treated as normal residents of the host country).

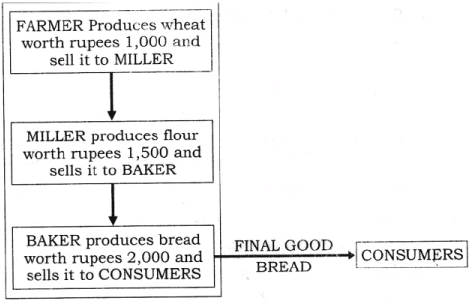

Final Goods

- These are the goods that are used for:

(i) Personal Consumption (like bread purchased by consumer household), or

(ii) Investment Or Capital Formation (like building, machinery purchased by a firm). - In other words, final goods are those, which require no further processing and are available in an economy for consumption purpose or investment. These give direct satisfaction to a consumer.

- According to production boundary, if a good crosses the imaginary line around the production unit and reaches to final consumer or investment made by a producer within the imaginary line of production unit is known as the final good.

Intermediate Goods

- These are the goods that are used for:

(i) Further processing (like sugar used for making sweets); or

(ii) Resale in the same year (If car purchased by car dealer for resale). - In other words, intermediate goods are the ones, which require further processing and are not available in an economy for the purpose of consumption. These goods give indirect satisfaction to a consumer.

- According to the production boundary, if a good does not cross the imaginary line around the production unit and reaches to other firm within the production boundary, is known as intermediate good.

Point to Remember for Final Goods and Intermediate Goods

Basis of Classification

- If a good is used for:

(a) Personal consumption; or

(b) Investment - Then it is a final good, whereas,

if a good is used for:

(i) Further processing; or

(ii) Resale in the same year, then it is known as intermediate good. - Thus, the basis of classification between these two goods is not the commodity itself, but the use made of it.

- For example, bread used by a consumer household is a final goods, but the same used by a bakery for making a sandwich is a intermediate goods.

Production Boundary

- Production boundary plays a vital role to differentiate between intermediate and final goods. The production boundary is the imaginary line around the production unit.

- According to the production boundary, if a good crosses the imaginary line around the production unit and reaches to final consumer or investment made by a producer within the imaginary line of production unit, it is known as final good.

- As against it, if a good does not cross the imaginary line around the production unit and reaches to other firm within the production boundary, it is known as intermediate good.

Important Points About

Intermediate Goods

- As far as intermediate consumption of general government is concerned, it’s purchased goods ranges from ordinary writing paper, pencils and pens to sophisticated fighter aircrafts.

- The goods and services purchased include both durable goods and non-durable goods and services.

- The intermediate consumption of the general government includes the following items:

- Value of all Non-durable Goods and Services such as petrol, electricity, lubricants, stationery, soaps, towels etc. including repair and maintenance of capital stock: Non-durable goods and services are those which have an expected life time of use of less than one year.

- Repair and maintenance of capital stock mean expenditure incurred for maintaining fixed assets and keep them in good working order.

- This includes the expenditure on new parts of the fixed assets. The life of the new parts may be around one year or slightly more and the value should be relatively small.

- For example, replacement of the tyres of a truck is an intermediate consumption, but not the replacement of its engine.

- Expenditure on Military Equipment missiles, rockets, bombs, warships, submarines, military aircrafts, tanks, missile carriers and rocket-launchers etc. whose function is to release weapons. Military vehicles and light weapons.

- Value of goods received from foreign governments in form of gifts or as transfers. Examples of these transfers in kind are food, clothing, medicines, vegetable oils, butter, toys sent by the government of one country to the other in times of natural calamities or as a token of goodwill and friendship between two countries.

Research and development

- Commodities consumed. In research and exploratory activities (like oil exploration in different parts of India by the Oil and Natural Gas Commission) or improving the technology of a particular production process.

- Commodities used in basic scientific research.

- Advertisements, market research and public relationship meant for improving the goodwill of the business enterprises.

- Business expenses of the employees on tours and entertainment.

Final goods can be classified into two groups:

(1) Consumption Goods.

(2) Capital Goods.

Consumption Goods

- Meaning: Consumption goods are those which satisfy the wants of the consumers directly. For example, cars, television sets, bread, furniture, air-conditioners, etc.

- Categories of Consumption Goods:

- Durable goods: These goods have an expected life time of several years and of relatively high value. They are motor cars, refrigerators, television sets, washing machines, air-conditioners, kitchen equipments, computers, communication equipments etc.

- Semi-durable goods: These goods have an expected life time of use of one year or slightly more. They are not of relatively great value.

Examples are clothing, furniture, electrical appliances like fans, electric irons, hot plates and crockery. - Non-durable goods: Goods which can not be used again and again, i.e., they lose their identity in a single act of consumption are known as non-durable goods. These are foodgrains, milk and milk products, edible oils, beverages, vegetables, tobacco and other food articles.

- Services: Services are non-material goods which satisfy the human wants directly. They cannot be seen or touched, i.e., they are intangible in nature. These are medical care, transport and communications, education, domestic services rendered by hired servants, etc.

Capital Goods

- Capital goods are defined as all goods produced for use in future productive processes.

For example, all the durable goods like cars, trucks, refrigerators, buildings, aircrafts, air-fields and submarines used to produce goods and are ready for sale in the market are a part of capital goods. - Stocks of raw materials, semi-finished and finished goods lying with the producers at the end of an accounting year are also a part of capital goods.

- Some more examples of capital goods are machinery, equipment, roads and bridges.

- These goods require repair or replacement over time as their value depreciate over a period of time.

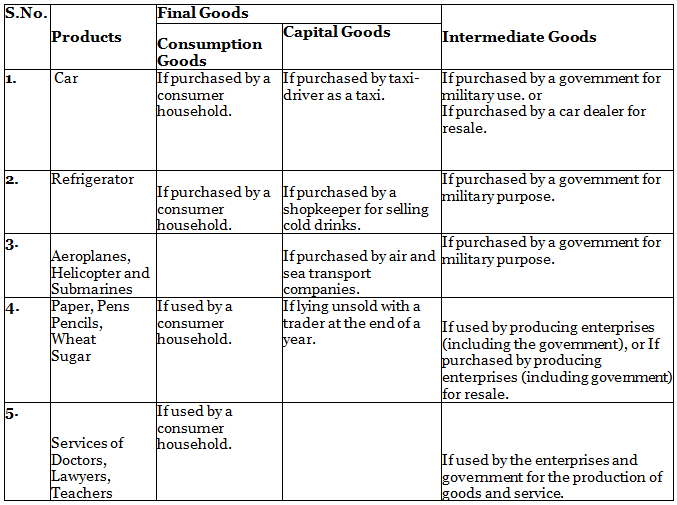

Q. Differentiate between final goods and intermediate goods on the basis of end used classification of goods and services with example.

Ans.

|

69 videos|377 docs|57 tests

|

FAQs on Introduction to Macroeconomics and its Concepts - Economics Class 12 - Commerce

| 1. What is the structure of Macroeconomics? |  |

| 2. What are some basic concepts of Macroeconomics? |  |

| 3. What is the difference between final goods and intermediate goods? |  |

| 4. What are some important points about intermediate goods? |  |

| 5. Why is understanding macroeconomics important? |  |