Introduction to Standard Costing | Crash Course for UGC NET Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Standard Cost |

|

| Standard Costing |

|

| Limitations of Standard Costing |

|

Introduction

The word standard simply means some norm, specification or target. It gives a reference point, bench mark, model or yardstick for comparison.

Standard costs are part of cost accounting system whereby standard cost is incorporated directly and formally into the manufacturing accounts. It is divided into two major parts (1) Historical Costs (2) Pre‐determined Costs. Historical cost means the actual cost or past cost and historical costing is a system in which actual costs incurred in the past are determined.

Historical costs have some limitations

(1) Such costs are obtained too late and cannot be used for price quotations.

(2) Historical costs do not serve the object of cost control, for the cost has already been incurred before cost records are available for management control.

(3) Historical costs do not provide any benchmark against which efficiency can be measured.

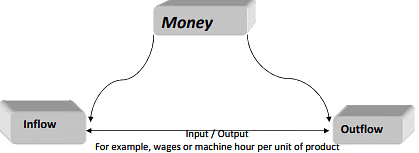

Standard costing is a technique which uses standard for costs and revenues for the purpose of control through variance analysis. Here, standards are performance expectations. Standard costing aims at eliminating waste and increasing efficiency in operation through setting up standards for production costs and production performance. In short, standard costing is a control device and not a separate method of product costing. It can be used with any method of product costing, job costing or process costing.

The objective of this chapter is to underscore the need of standard costing by highlighting its utility. Standard costing requires the historical costing for a comparative analysis which helps set the goals of standard costs. Standard costing is one of the most important tools to control costs. In this method, all costs are predetermined. Such predetermined costs are then compared with the actual costs and the difference between these costs known as variances.

Meaning:

The word standard means a 'norm' or a 'criterion'. Standard cost is thus a criterion cost which may be used as a yardstick to measure the efficiency with which actual cost has been incurred.

There is a constant process of development effected in business through the help of standard costing method since the standard costs set in are sensible, capable of being attained and are revised from time to time in accord with needs and requirements of the business enterprise.

1) Standard cost:

- Standard cost is a figure which represents an amount that can be taken as a typical of the cost of an article or other cost factor. It is established on the basis of planed operations, planed cost efficiency levels, and expected capacity utilization.

- Standard cost is a predetermined calculation of the presumed cost under the specified conditions. It is built up from an assessment of the value of cost elements. It correlates technical specification of material, labour and other cost to the price or wage rate which have occurred during the period in which the standard cost is to be determined.

- The standard cost is a predetermined cost which is calculated from management standard of efficient operation and relevant necessary expenditure. ‐ C.I.M.A. London

- The standard cost is a predetermined cost which determines what each product or service should cost under given circumstances. ‐ Brown and Howard

2) Standard Costing:

- A standard costing system is a method of cost accounting in which standard costs are used in recording certain transaction and the actual costs are compared with the standard cost to learn the amount and reason for variations from the standard. ‐ W.B. Lawrence

- Standard costing involves the preparation of cost based on pre‐ determined standards and continuous comparison of actual with them for the purpose of guidance and control. ‐ D. Joseph

3) Historical Costing:

- The term ‘Historical Cost’ is also known as Actual Cost. The meaning of this cost suggests the actual costs of products which have been incurred in their production.

- The experts maintain that, the production of products, the expenses like material, labour, overheads etc. should be paid first and then they should be recorded in books. So these total expenses are called historical costs or past costs.

- The figures relating to costs obtained at the end of the production process may have some definite value in rectifying past practices if they are properly analyzed.

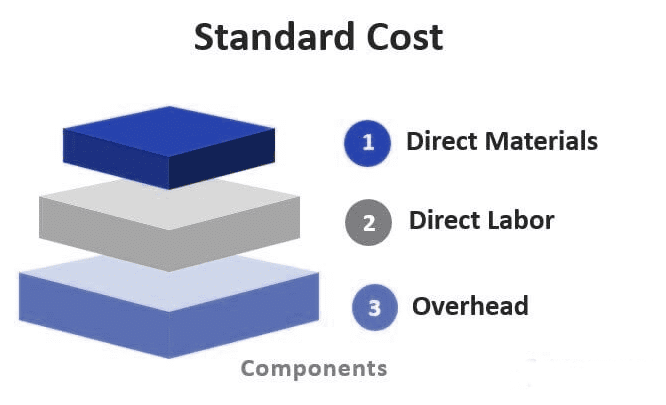

Standard Cost

Standard costs are called pre‐determined costs. The different standards regarding all the elements of costs, i.e., material, labor and overheads, are determined on the basis of historical cost and many other factors. These factors are cautiously studied before determining the standards. The standard committee will generally consist of production manager, purchase manager, personal manager, and other functional heads. It is possible that the standard cost decided by the manager could be idle, normal or expected. The idle standard cost may refer to an estimate of the cost under perfect competition. It is competed on the basis that there is no scrap, no idling of machinery or breakdown and so on. On the other hand, expected standard cost is based upon the attainable result. Standard Costs are not simple average but they are set with due care after careful study and observation of production activity in the past and the present.

Standard Costing

Standard costing is a perfect system of controlling the costs and measuring efficiency and its development. It is a technique of cost reduction and cost control. It helps to provide valuable guidance in several management functions such as formulating policies, determining price level, etc. The essence of standard costing is to set objectives and targets to achieve them, to compare the actual costs with these targets. Standard Costing is used to ascertain the standard cost under each element of cost, i.e., materials, labours, overhead. It can eliminate all kinds of waste. Through the application of this costing it can be ascertained whether or not the activities of production are going on according as the pre‐determined plan.

Objectives of Standard Costing

- To institute a control mechanism on all the elements of costs that affect production and sales

- To measure different operational efficiencies and check the wastages

- To improve the delegation of authority and generate a sense of responsibility among the employees

- To develop a cost consciousness in the employees

- To presume the production costs, sales and profit

- To avail the benefits of 'Management by exception.'

- To bring about a vivid progressive vision and sagacious decision making at each managerial level.

Advantages of Standard Costing

- Proper Planning: It helps to apply the principle of “Management by exception”. That is, the management need not worry over those activities which proceed in tandem plans. It is only on the issues of exceptions that they have to concentrate.

- Efficient Cost Control: Standard Costing is a tool for the management to gain reduction in the cost and control over it. Under this technique, differences are analyzed and responsibilities are determined.

- Motivational Factor: Labour efficiency is promoted and they are destined to be cost conscious. Standards provide incentives and motivation to work with greater effort. This increases efficiency and productivity.

- Comparison of Forecasting and Outcome: A target of efficiency is set for the employees and the cost consciousness is stimulated. Since the process of standard costing allow an appraisal to be made of personnel, machines and method of working, current inefficiencies come to the notice and get eliminated.

- Inventory Control: Standard costing facilitates inventory control and simplifies inventory valuations. This ensures uniform pricing of stocks in the form of raw materials, work‐in‐progress and finished goods.

- Economical System: Standard costing system is economical system from the viewpoint that it does not require detailed records. It also des not require a big staff. It results in the reduction in paper work in accounting and needs very few records. Thus, there is saving of time as well as money.

- Helpful in Budgeting: Budgets are prepared on the basis of standard costing. Standards which are set up in respect of materials, labour and overheads, are helpful in preparing various budgets. For example, flexible budget, sales budget, etc.

- Helps Formulate Policies: This technique is a valuable aid to the management in determining prices and formulating production policies. Standard costing equips cost estimates while planning the production of new products.

- Helps Distinguish Activities: Standard costing helps in distinguishing between skilled and unskilled activities. So the skilled worker only gives pays attention to improving the activities of the unskilled workers.

- Eliminates Wastage: Through fixing standard, certain waste such as material wastage, idle time, lost machine hours, etc. are reduced.

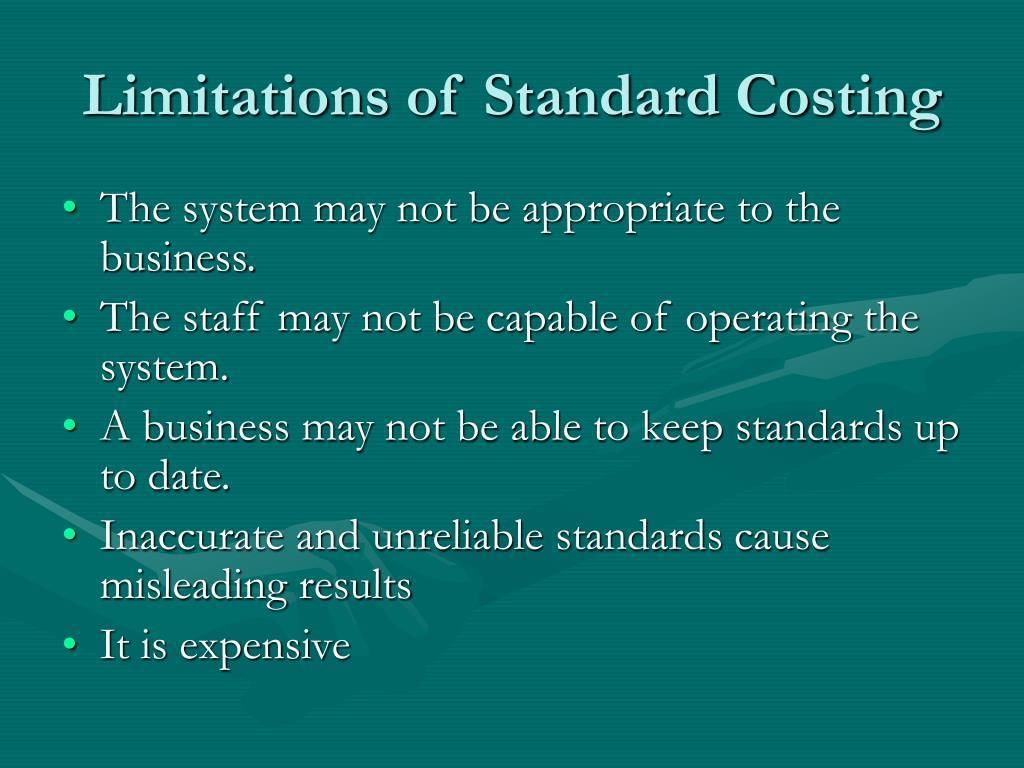

Limitations of Standard Costing

- Costly System: Because the Standard Costing requires highly skillful and competent personnel, it becomes a costly system too. For the same experts are paid high remuneration.

- Difficulties in Fixation of Standard: It is always difficult to determine precise standard costs in a given situation which will coincide with actual cost when operations are over. Standard cost are determined partly by the past experience and partly by the cost projections based on advanced statistical techniques. Thus, uncertainties revolve around standards.

- Constraint for Service Industry: Standard costing is applied for planning and controlling manufacturing costs. Thus, it cannot be applied in a service industry.

- Consistency of Standard: because the standards of marginal costing fluctuate and vary time to time, it is difficult to always sustain and continue the same standards.

- Unsuitable for Non‐standardised Products: Standard costing is expensive and unsuitable for job manufacturing industries as they manufacture non standardized products such as catering, tailoring, printing, etc.

- Relatively Fixed Standards: A business may not be able to keep standards up‐to‐date. In other words, a business may not revise standards to keep pace with the frequent changes in manufacturing conditions. Firms may avoid revising standards as it is a costly affair.

- Difficulties for Small Industries: Establishment of standards and their implementation involve initial high costs. Standards have to be revised and new standards be fixed involving larger costs. Thus, small firms find it expensive to operate standard costing system. This system is not fit for each type of industries.

- Discouragement for Workers: Sometimes the employees and workers are discouraged when the standards are fixed at a high level. The unreal high standards may adverse by effect the morale of workers rather than working as an incentive for better efficiency.

- Inaccurate Diverse Results: Inaccurate and unreliable standards cause misleading results and thus may not enjoy the confidence of the users of this system.

Preliminaries of Establishment of Standard Cost System

The following four points are usually considered for setting up a standard cost system in a business:

1) Setting up Cost Center: Introducing Standard Cost System is requires first of all to establish cost centers with their well‐designed ambit of work. In the process there should be no ambiguity about the responsibility of each cost center so that their responsibility may be identified.

A cost center is a location; people or item of equipments for cost may be ascertained and used for the purpose of cost control.

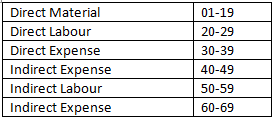

2) Classification of Accounts: Accounts are classified in order to assist collection and analysis. To use the system of standard costing effectively, all accounts have to be classified on the basis of their functions, items of revenue nature, assets and liabilities, etc. Codes are given for each item and each account along with elements of cost with this end in view, codes may be used. A code is a symbolic representation of any particular item of information.

For example,

3) Types of Standards: Basically, there are two types of standard:

(a) Current Standard

(b) Basic Standard

(a) Current Standard: It is established for the use over a diminutive period of time and is related to current circumstances. Such a standard remains in operation for a limited period and belongs to the current conditions. These standards are revised at regular intervals. Current standard are of three types like (i) Ideal standards, (ii) Expected standards, and (iii) Normal standards.

(i) Ideal standards: This is a hypothetical standard which is rather not practicable to attain. This ideal is clearly unrealistic and unattainable. It pre‐ supposes that the performance of men, materials and machines is perfect and thus makes no allowance for the loss of time, accident, wastage of materials and any other type of waste of materials and any other type of waste or loss. Such standards have the advantage of establishing a goal which, however, is not always attainable in practice. As such it is having a little practical value.

The standard which can be attained under the most favourable condition possible.‐ I.C.M.A

(ii) Expected or practical standards: Such standards are likely to be expected or utilized in the future period. Such standards are based on expected performance after making a reasonable allowance for unavoidable losses and other inevitable lapses from perfect efficiency. So it is most generally used standard and is best suited for cost control.

This standard can be anticipated as well as attained in future in sync with the specified budget. ‐ I.C.M.A

(iii) Normal standards: It is also known as ‘Past Performance Standard’ because it is based on the average performance in the past. It should be attainable and it provides a challenge to the staff. The aim of such a standard is to eliminate the variations in the cost which arise out of trade cycle. The average standard can be anticipated as well as attained in a future period of time.

Preferably, it should be long enough to cover one trade‐ cycle. ‐ I.C.M.A

(b) Basic standards: This is a standard which is established for use unaltered for an indefinite time. It is similar to an index number against which all results are measured. Variances from basic standards show trends of deviations of the actual cost. However, basic standards are of no practical utility from the point of view of cost control and cost ascertainment. This standard is set on a long‐term basis and seldom revised.

It is an underlying standard from which current standard can bedeveloped.‐ I.C.M.A

(i) Setting the Standard: The process of setting standard is a valuable activity in itself. The success of standard costing system depends on the reliability, accuracy and acceptance of the standards. If standards have been properly set and maintained, they are a sound basis for determining cost for various purposes. While setting the standards, the following points should be taken into consideration: duration of use of standard, reasonable standard of performance, level of activity. For the given units standard sets for the following items are (i) direct material cost, (ii) direct wage cost, (iii) direct expense, (iv) factory variable overhead cost, (v) selling and distribution variable cost,(vi) selling price and sales margin.

- Standards for Material: It includes

(1) Determination of standard quantity of material required, and

(2) Determination of standard price per unit of material. - Material Quantities: After establishing the standard quality of material, it is more important and necessary to establish the standard regarding quantity of each material. Generally, quantities are expressed in terms of kilograms, feet, units and so forth.

- Standards for Labour: This standard is determined with regard to the current rate of pay and any anticipated variations. It should be fixed for each grade of labour and for each operation involved. The standard hours are fixed for all categories of labour i.e., for skilled and unskilled labour. In these standards, number of hours and workers are established.

- Material Prices: This is a forecast of the average prices of material during the future period. This standard is quite difficult to establish because prices are regulated more by the external factors than by the company management. While setting standard prices, the past experiences, existing prices and anticipations should closely examine. Price of material in the past, current prices and fluctuating trends are the base for determining standard of price.

- Setting for Overheads: Setting standard for overheads is more complex than the development of material and labour standards. It is estimated for variable overheads and fixed overheads.

(a) Variable Overheads: It may be recalled that variable overhead has been defined as a cost which tends to vary directly with the volume of output. It is assumed that the overhead rate per unit is invariable, irrespective of the quantity produced, so it is necessary to calculate only a standard cost per unit or per hour.

(b) Fixed Overheads: Fixed overhead tends to be unaffected by variations in the volume of output. Therefore it is required to determine total fixed overhead for the period and budgeted production in units. - Standard Hour: Production is usually articulated in physical units such as tons, pounds, gallons, numbers, kilograms, liters, etc. When a company is manufacturing different types of products, it is almost impossible to increase the production, which cannot be expressed in the same unit. Standard hour means a hypothetical hour, which represents the amount of work that should be performed in one hour under standard conditions.

|

157 videos|236 docs|166 tests

|

FAQs on Introduction to Standard Costing - Crash Course for UGC NET Commerce

| 1. What is standard costing? |  |

| 2. What are the components of standard cost? |  |

| 3. What are the advantages of standard costing? |  |

| 4. How does standard costing help in performance evaluation? |  |

| 5. What are the limitations of standard costing? |  |