Journal | Accountancy Class 11 - Commerce PDF Download

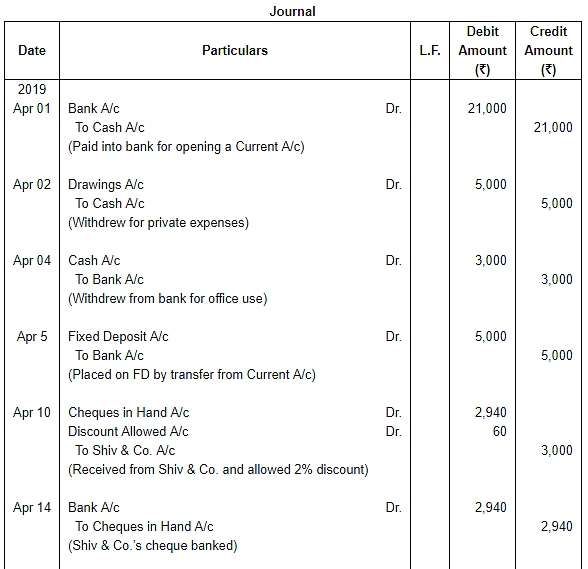

Q.1. Following transactions of Ramesh for April, 2018 are given below. Journalise them. Ans. Statement showing Journal Entries

Ans. Statement showing Journal Entries

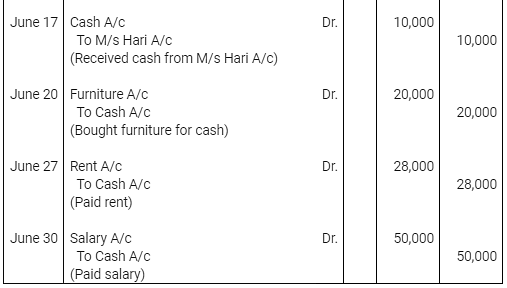

Q.2. Journalise the following transactions of Mr. Rahul: Ans.

Ans.

Q.3. Journalise the following transactions in the books of M/s. R.K. & Co.:

(i) Purchased goods at list price of Rs 20,000 from Vishal at 20% trade discount against cheque payment.

(ii) Purchased goods at list price of Rs 20,000 from Naman at 15% trade discount against cash.

(iii) Purchased goods at list price of Rs 30,000 from Amrit at 20% trade discount.

(iv) Purchased goods at list price of Rs 40,000 for Rs 35,000 for cash.

(v) Goods returned of list price Rs 10,000 purchased from Amrit.

(vi) Sold goods to Parul at list price of Rs 40,000 at 10% trade discount against cheque payment.

(vii) Sold goods to Aman at list price of Rs 30,000 at 10% trade discount against cash.

(viii) Sold goods to Pawan at list price of Rs 20,000 at 10% trade discount.

(ix) Sold goods to Yamini at list price of Rs 25,000 for Rs 23,000.

(x) Sold goods costing Rs 10,000 at cost plus 20% less 10% trade discount to Bhupesh.

(xi) Sold goods purchased at list price of Rs 50,000 less 15% trade discount sold at a profit of 25% less 10% trade discount against cheque.

(xii) Aman returned goods of list price of Rs 10,000 sold to him at 10% trade discount.

Ans. Statement showing Journal Entries of M/s R.K. & Co.

Points of Knowledge:

Working Notes:

Working Note 1: Calculation of Selling price

Selling Price = Cost Price + Profit- Trade Discount

= 10,000 + 2,000 – 1200 =10,800

Profit = 10,000(cost price) × 20%= 2,000

Calculation of Trade Discount =12000 × 10%=Rs 1,200

Working Note 2: Calculation of Purchase price and selling price

Purchase Price = List Price – Trade Discount

= 50,000 – 7,500 = 42,500

Trade Discount = 50,000 × 15% = Rs. 7,500

Sales Price = Purchase Price + Profit – Trade Discount

= 42,500 + 10,625 – 5312.5 = 47,812.5

Calculation of profit = 42,500 × 25% = Rs. 10,625

Calculation of Trade Discount = 53,125 × 10% =5,312.5

Q.4. Journalise the following transactions in the books of Bhushan Agencies:

(i) Received from Bharat cash Rs 20,000, allowed him discount of Rs 500.

(ii) Received from Vikas Rs 35,000 by cheque, allowed him discount of Rs 750.

(iii) Received from Akhil Rs 38,000 in settlement of his dues of Rs 40,000 in cash.

(iv) Received from Amrit Rs 50,000 by cheque on account against dues of Rs 60,000.

(v) Paid cash Rs 40,000 to suresh, availed discount of 2%.

(vi) Paid by cheque Rs 25,000 to Mehar and settled her dues of Rs 26,000.

(vii) Paid Rs 25,000 to Yogesh by cheque on account.

(viii) Purchased goods costing Rs 1,00,000 against cheque and availed discount of 3%.

(ix) Purchased goods costing Rs 60,000 from Akash & Co., paid 50% immediately availing 3% discount.

(x) Sold goods of Rs 30,000 against cheque allowing 2% discount.

(xi) Sold goods of Rs 60,000 to Vimal received 50% of due amount allowing 2% discount.

Ans. Statement showing Journal Entries of Bhushan Agenchies

Points of Knowledge:

In 4th transection amount received from amrita Rs. 50,000; amount due with her now Rs 10,000.

Goods Purchased of Rs. 60,000. Half of it Rs. 60,000 × ½ = 30,000.

Discount received on cash payment = Rs. 30,000 × 3% = 900

Cash Amount Paid = 30,000 – 900 = Rs. 29,100

Goods Sold of Rs. 60,000. Half of it Rs. 60,000 × ½ = 30,000.

Discount allowed on cash payment = Rs. 30,000 × 2% = 600

Cash Amount Paid = 30,000 – 600 = Rs. 29,400

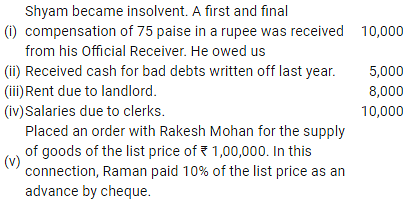

Q.5. Journalise the following transactions: ₹

Ans. Statement showing Journal Entries

Point of Knowledge:

1 rupee = 100 paisa

Amount recoverable = 10,000 × 75/100 = Rs. 7,500

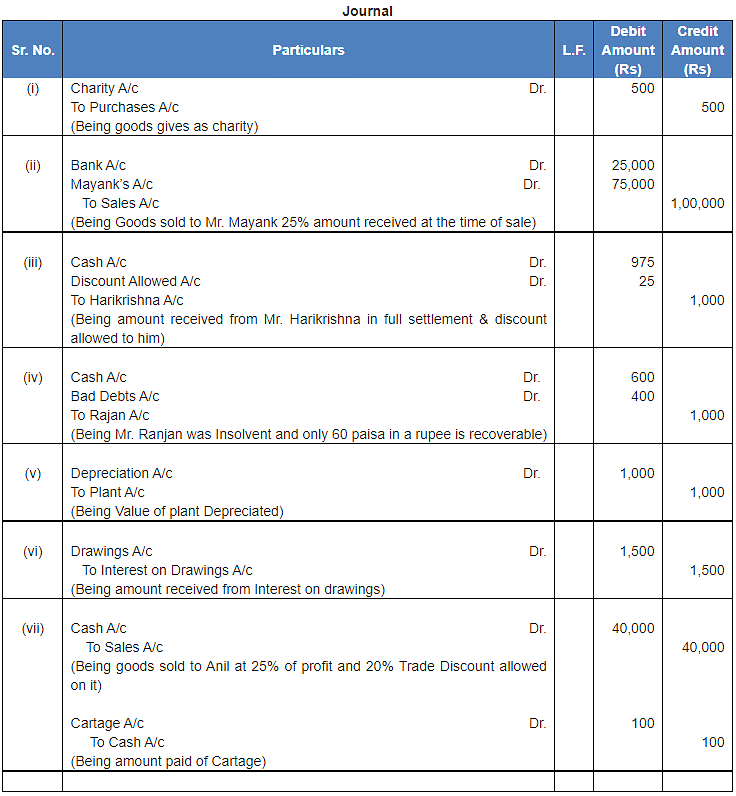

Q.6. Journalise the following entries:

(i) Goods costing ₹ 500 given as charity.

(ii) Sold goods to Mayank of ₹ 1,00,000, payable 25% by cheque at the time of sale and balance after 30 days of sale.

(iii) Received ₹ 975 from Harikrishna in full settlement of his account of ₹ 1,000.

(iv) Received a first and final dividend of 60 paise in a rupee from the Official Receiver of Rajan, who owed us ₹ 1,000.

(v) Charge interest on Drawings ₹ 1,500.

(vi) Sold goods costing ₹ 40,000 to Anil for cash at a profit of 25% on cost less 20% trade discount and paid cartage ₹ 100, which is not to be charged from customer.

Ans. Statement showing Journal Entries

Point of knowledge:

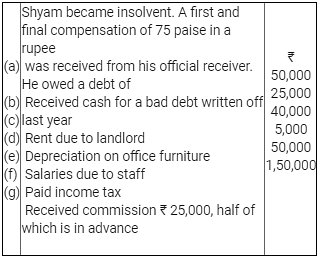

Q.7. Journalise the following transactions: Ans. Statement showing Journal Entries

Ans. Statement showing Journal Entries

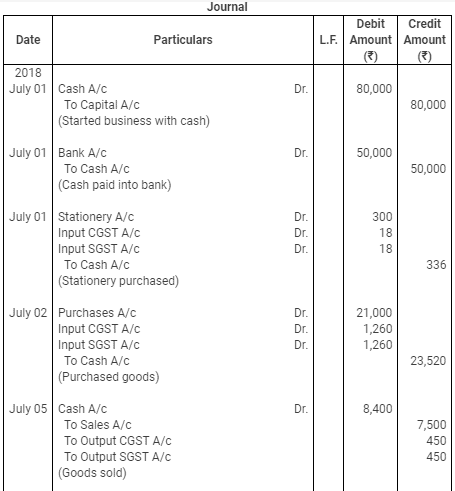

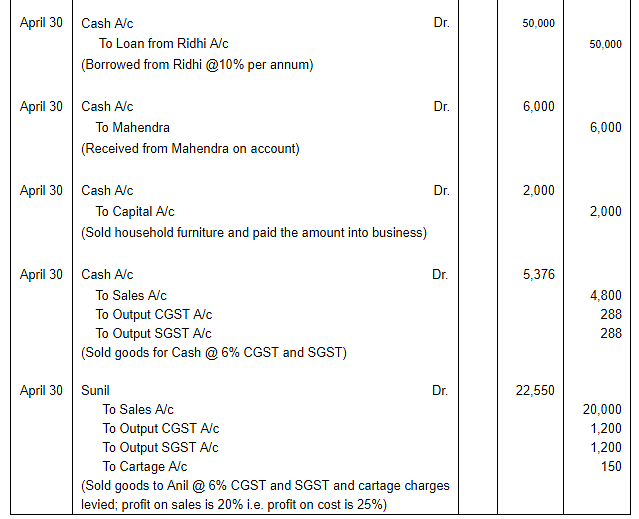

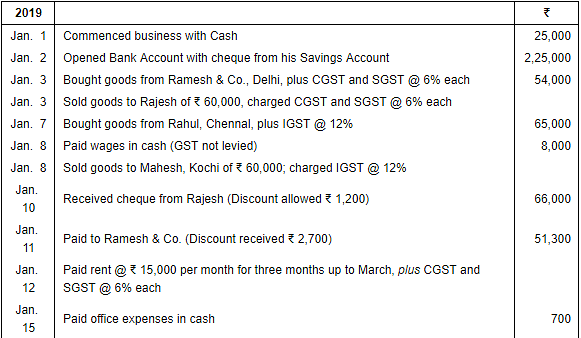

Q.8. Journalise the following transactions of Singh Enterprises, Delhi:

CGST and SGST @ 6% each is levied on Intra-state sale and purchase.

Ans.

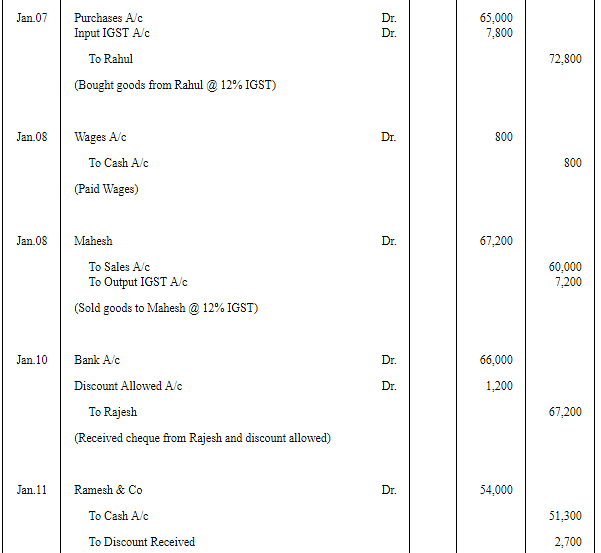

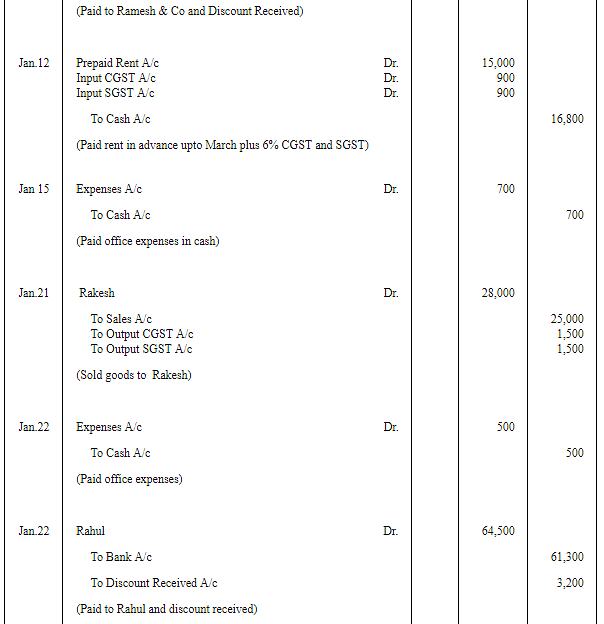

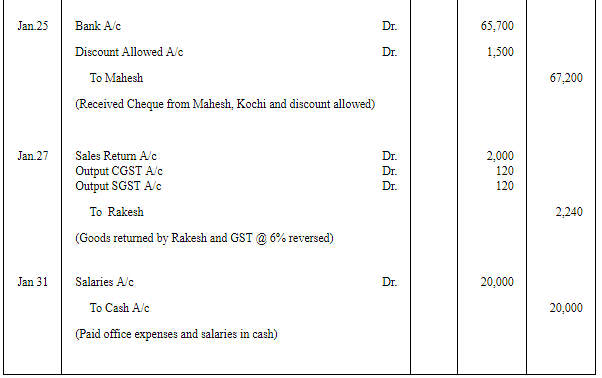

Q.9. Journalise the following transactions of Rakesh Agencies, Delhi (Proprietor Shri Rakesh):

Ans.

Ans.

Q.10. Journalise the following transactions of Ram Delhi

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @12% on inter-state sale and purchase.

Ans. Statement showing Journal Entries of Mr. Ram

Point of Knowledge:

IGST applied on intrastate sale as in buyer from Delhi and supplier from UP. So Simply Input of IGST directly applied @ 12%.

Q.11. Following transactions of Ramesh Delhi for April, 2018 are given below. Journalise them.

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @12% on inter-state sale and purchase.

Ans.

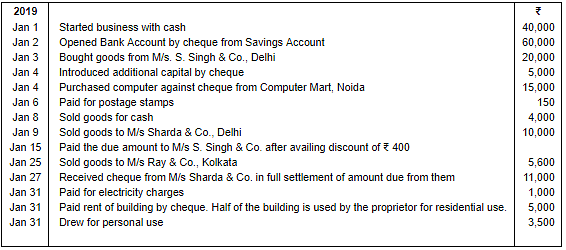

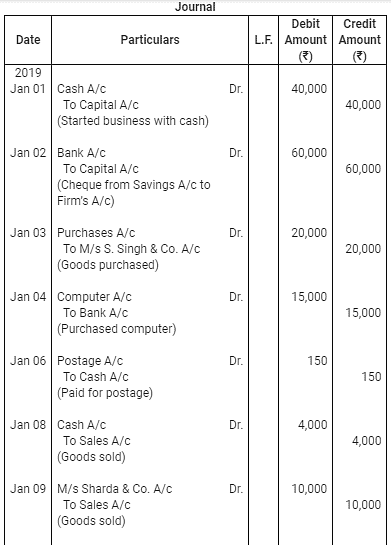

Q.12. Journalise the following transactions of Satish, Noida (UP): Ans.

Ans.

Note: There is an error in the question as the amount paid by M/s Sharda & Co. against goods sold can be eaqual to or less than the amount due but not more. Thus, taken to be as ₹10,000 instead of ₹11,000.

Note: There is an error in the question as the amount paid by M/s Sharda & Co. against goods sold can be eaqual to or less than the amount due but not more. Thus, taken to be as ₹10,000 instead of ₹11,000.

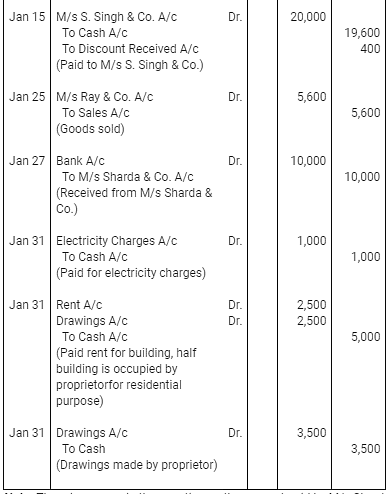

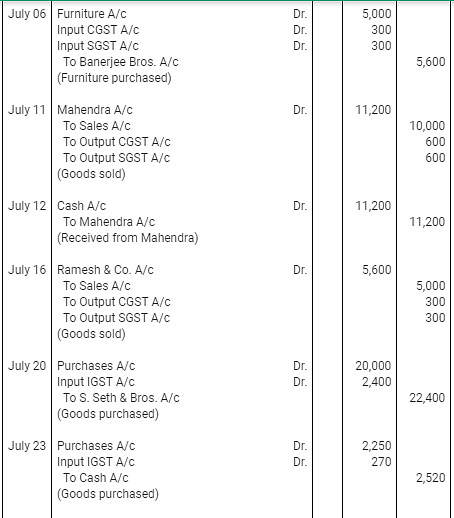

Q.13. Following are the transactions of R.Singh & Co., Kanpur (UP) for the month of July, 2018. You are required to Journalise them: Ans.

Ans.

Q.14. Record the following transactions in the Journal of Ashoka Furniture Traders, Ludhiana (Punjab): CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @ 12% on inter-state sale and purchase.

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @ 12% on inter-state sale and purchase.

Ans. Statement showing Journal Entries of Ashoka Furniture Traders

Note: The amounts of entries dated Feb 10 and Feb 15 for payment to Singh & Co. and received from Rakesh respectively are exceeding. Hence, the amount for both the entries would be tallied from their earlier related entries.

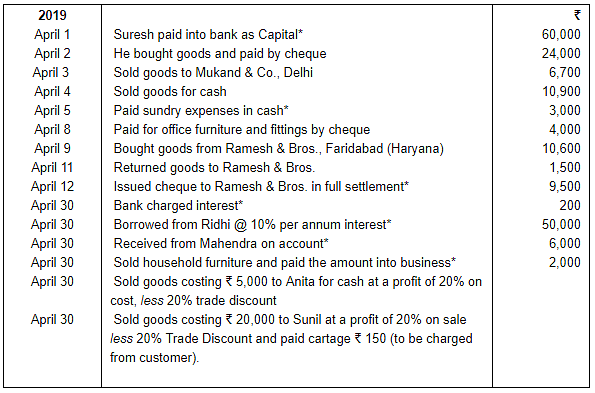

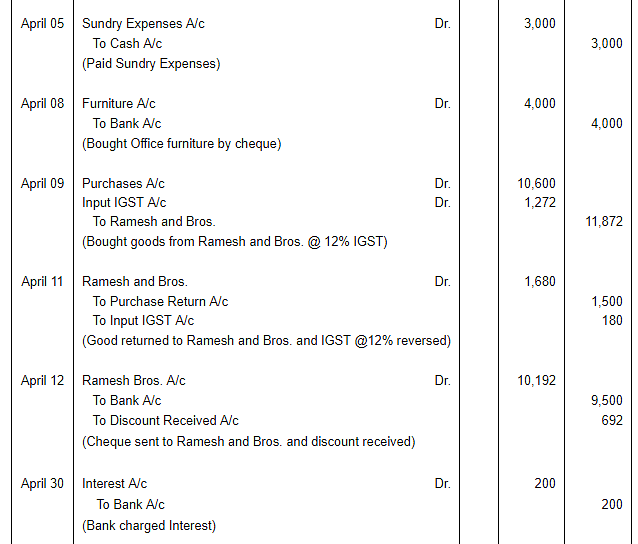

Q.15. Enter the following transactions in the Journal of Suresh, Delhi who trades in ready-made garments:

CGST and SGST is levied @ 6% each on intra-state sale and purchase. IGST is levied @ 12% on inter-state sale and purchase. Out of the above, transactions marked with (*) are not subject to levy of GST.

Ans.

Q.16. M/s. Auto Aid, Delhi purchased 500 pieces of car horns @ ₹ 200 each less 10% Trade Discount plus IGST @ 12% from M/s Auto Horns, Chandigarh. What is the invoice value?

Ans. Calculation of Invoice Value

Q.17. M/s. Vaish Traders, Delhi purchased 500 Parker Pens @ ₹ 200 each less Trade Discount @ 15% from Luxor Pens Ltd., Delhi. CGST and SGST was levied @ 6% each. Further, Cash Discount was allowed @ 5% as the payment was made within specified time. What will be the amount of trade discount and cash discount?

Ans. Calculation of Total Amount Payable

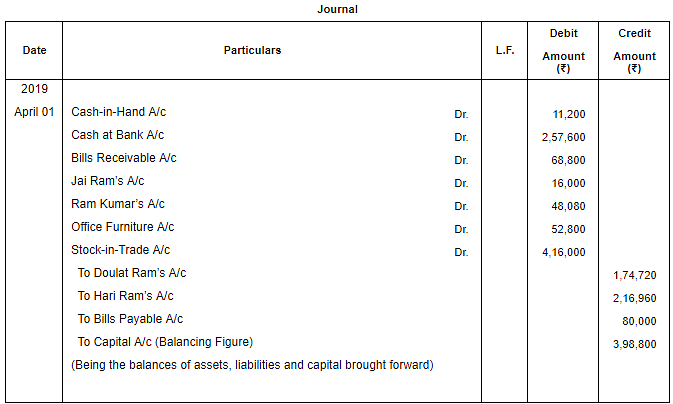

Q.18. On 1st April, 2019, the position of Rahman was as follows: Cash-in Hand ₹ 11,200; Cash at bank ₹ 2,57,600; Bills Receivable ₹ 68,800; Jai Ram (Dr.) ₹ 16,000; Ram Kumar (Dr.) ₹ 48,080; Office Furniture ₹ 52,800; Stock-in-Trade ₹ 4,16,000; Doulat Ram (Cr.) ₹ 1,74,720, Hari Ram (Cr.) ₹ 2,16,960; Bills Payable ₹ 80,000. What was the amount of capital of Rahman on that date? Pass the Journal entry to Open his books.

Ans. Therefore, the amount of Capital of Rahman on 1st April, 2019 is ₹3,98,800.

Therefore, the amount of Capital of Rahman on 1st April, 2019 is ₹3,98,800.

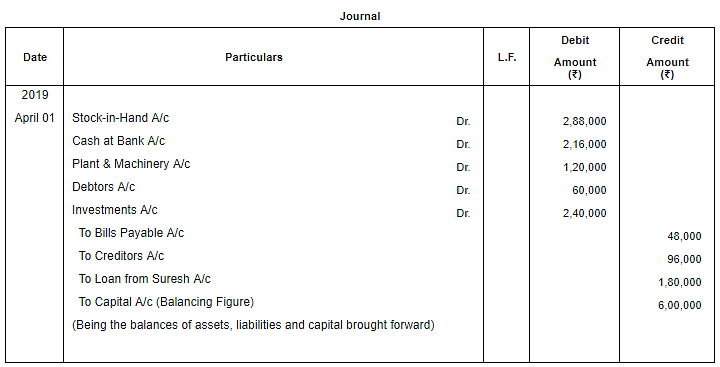

Q.19. On 1st April, 2019, the position of Tendulkar was as follows: Stock-in-Hand ₹ 2,88,000; Bills Payable ₹ 48,000; Cash at Bank ₹ 2,16,000; Plant and Machinery ₹ 1,20,000; Debtors ₹ 60,000; Creditors ₹ 96,000; Investment ₹ 2,40,000, Loan from Suresh ₹ 1,80,000. What was the amount of Tendulkar's capital on the date? Pass an opening Journal entry.

Ans. Therefore, the amount of Capital of Tendulkar on 1st April, 2019 is ₹6,00,000.

Therefore, the amount of Capital of Tendulkar on 1st April, 2019 is ₹6,00,000.

Q.20. M/s. Auto Help, Delhi purchased 500 pieces of motor cycle horns at ₹ 100 each plus IGST @ 12% from M/s G.S., Auto, Ghaziabad, (UP). Trade terms settled were: Trade Discount will be allowed @ 10% and Cash Discount @ 5% if payment is made within 7 days. M/s. Auto Help made the payment after 30 days. Determine the amount of Trade Discount and Cash Discount.

Ans. Statement showing Journal Entries of M/s. Auto Help

Note: No cash discount will be allowed as the payment is received after the stipulated time period of 7 days.

Note: No cash discount will be allowed as the payment is received after the stipulated time period of 7 days.

Q.21. Name the accounts to be credited along with the amount for payment to Ajay of ₹ 4,800 by cheque in full settlement of ₹ 5,000.

Ans.

Q.22. Pass Journal entry for sale of goods by Rahul, Delhi to Anish, Delhi for ₹ 10,000 less 10% Trade Discount and 2% Cash Discount. Assume payment is received at the time of sale. CGST and SGST is levied @ 6% each.

Ans. Statement showing Journal Entries of Rahul

Working Notes:

Q.23. Pass Journal entry for purchase of goods by Amrit, Delhi from Ayur Products, Agra, (UP) for ₹ 25,000 less Trade Discount @ 15% plus IGST @ 12%.

Ans. Statement showing Journal Entries of Amrit

Working Notes:

Q.24. Pass Journal entry for purchase of goods by Amrit, Delhi from Add Gel Pens, Delhi for ₹ 15,000 less Trade Discount 10% and Cash Discount 3%. CGST and SGST is levied @ 6% each. Assume payment is made at the time of purchase.

Ans. Statement showing Journal Entries of Amrit

Working Notes:

Q.25. Mittal Cycles purchased 100 cycles from Hero Cycles, Ludhina (Punjab) @ ₹ 1,200 per cycle plus IGST @ 12%. Hero Cycles allowed 10% Trade Discount and 3% Cash Discount if payment is made within 14 days. Mittal Cycles received 10 cycles damaged during transit, which it returned. Mittal Cycles settled the payment in 10 days time.

Pass Journal entries for the above transactions.

Ans. Statement showing Journal Entries of Mittal Cycles

Q.26. Oswal Woollen Mills, Amritsar (Punjab) sold shawls to Gupta Shawls, Jaipur as per details: Sold 100 shawls @ Rs 200 per shawl on 4th January, 2018, IGST is levied @ 12%. Trade Discount 25% and Cash Discount 5% if full payment is made within 14 days. Gupta Shawls sent 50% of the payment on 14th January, 2018 and balance payment on 10th February,2018. Pass Journal entries.

Ans. Statement showing Journal Entries of Oswal Woollen Mills

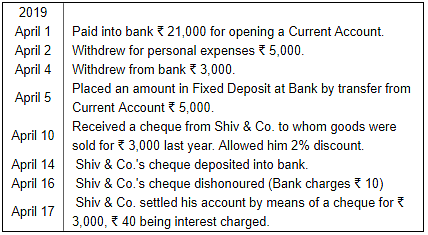

Page No 8.74:

Q.27. Journalise the following transactions in the books of Ashok:

(i) Received ₹ 11,700 from Hari Krishan in full settlement of his account for ₹

12,000.

(ii) Received ₹ 11,700 from Shyam on his account for ₹ 12,000.

(iii) Received a first and final dividend of 70 paise in the rupee from the

official receiver of Rajagopal who owed us ₹ 7,000.

(iv) Paid ₹ 2,880 to A.K. Mandal in full settlement of his account for ₹ 3,000.(v) Paid ₹ 2,880 to S.K. Gupta on his account for ₹ 3,000.

Ans.

Q.28. Journalise the following transactions:

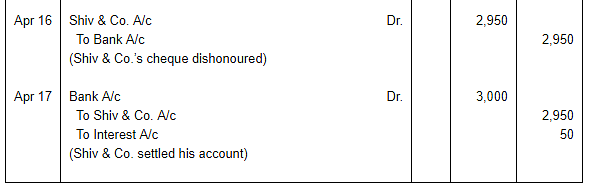

Ans.

Note for Apr 17: Cheque of Rs 2,940 dishonoured. Bank charged Rs 10 (to be recovered from Shiv & Co.). Total due from Shiv & Co. Rs 2,950. New cheque received for Rs 3,000, so interest charged should be Rs 50 (not Rs 40, as given in the book).

Q.29. Journalise the following in the books of Amit Saini, Gurugram

(Haryana):

(i) Goods of ₹ 5,000 were taken by him for personal use.

(ii) ₹ 2,000 due from Sohan were bad debts.

(iii) Goods of ₹ 6,000 were destroyed by fire and were not insured.

(iv) Paid ₹ 4,000 in cash as wages on installation of machine. (GST is not to be levied).

(v) Sold goods to Arjun of Delhi of list price ₹ 20,000. Trade discount @ 10%

and cash discount of 5% was allowed. He paid the amount on the same day and

availed the cash discount.

(vi) Received ₹ 2,000 from Ramesh, whose account was written off as bad debts.

(vii) Goods costing ₹ 1,000 given as charity.

(viii) Received ₹ 9,750 from Ramesh in full settlement of his account of ₹ 10,000.

(ix) Paid rent in advance ₹ 4,000.

CGST and SGST is to be levied on intra-state sale @ 6% each and IGST @ 12%

on inter-state sale.

Ans.

Q.30. Journalise the following transactions in the books of Mohan, Delhi:

(i) Raj of Alwar, Rajasthan who owed Mohan ₹ 25,000 became insolvent and received 60 paise in a rupee as full and final settlement.

(ii) Mohan owes to his landlord ₹ 10,000 as rent.

(iii) Charge depreciation of 10% on furniture costing ₹ 50,000.

(iv) Salaries due to employees ₹ 20,000.

(v) Sold to Sunil goods in cash of ₹ 10,000 less 10% trade discount plus CGST

and SGST @ 6% each and received a net of ₹ 8,500.

(vi) Provided interest on capital of ₹ 1,00,000 @ 10% per annum.

(vii) Goods lost in theft ₹ 5,000, which were purchased paying IGST @ 12%

from Alwar, Rajasthan.

Ans.

Q.31. Pass Journal entries in the books of Puneet, Delhi for the following:

(i) Received an order from Karan & Co. for supply of goods of ₹ 50,000.

(ii) Received an order from AK & Co. for goods of ₹ 1,00,000 along with a cheque for ₹ 25,000 as advance.

(iii) Paid to staff ₹ 40,000 against outstanding salary of ₹ 60,000.

(iv) Sold goods to Bharat, Kaithal (Haryana) of ₹ 10,000 plus IGST @ 12% out

of which 1/5th were returned being defective.

(v) Cheque of ₹ 20,000 issued by Feroz was dishonoured.

(vi) Received 40 paise in a rupee from Feroz against the above dues.

(vii) Received a cheque of ₹ 25,000 from Mohan after banking hours.

(viii) Purchased goods from Barun of Chandigarh of ₹ 10,000 plus IGST @ 12%

and sold them to Arun of Shimla (HP) at ₹ 22,400, including IGST @ 12%.

(ix) Arun returned goods of ₹ 6,720, including IGST which were returned to

Barun.

(x) ABC & Co. purchased 10 TV sets @ ₹ 20,000 per set and paid IGST @ 12%.

It sold all the sets @ ₹ 25,000 per set plus CGST and SGST @ 6% each.

(xi) Paid insurance of ₹ 12,000 plus CGST and SGST @ 6% each for a period of

one year.

(xii) Sold personal car for ₹ 1,00,000 and invested the amount in the firm.

(xiii) Goods costing ₹ 1,00,000 were destroyed in fire. Insurance company admitted the claim for ₹ 75,000. These goods were purchased within Delhi.

(xiv) Purchased machinery for ₹ 56,000 including IGST of ₹ 6,000 and paid cartage thereon ₹ 5,000 and installation charges ₹ 10,000.

(xv) Goods costing ₹ 40,000 sold to Mr. X at a profit of 20% on sales less 10% Trade Discount plus CGST and SGST @ 6% each and received a cheque under

2% cash discount.

(xvi) Purchased machinery from New Machinery House for ₹ 50,000 and paid it by means of a bank draft purchased from bank. Paid charges ₹ 500.

Ans. Statement showing Journal Entries of Puneet

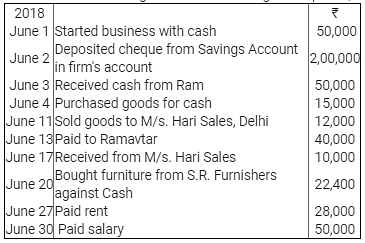

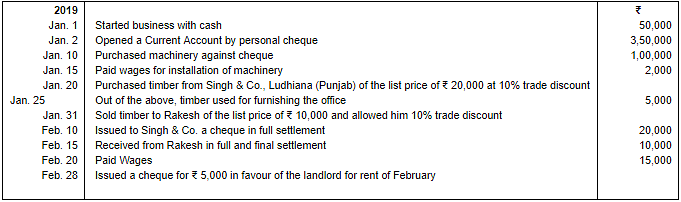

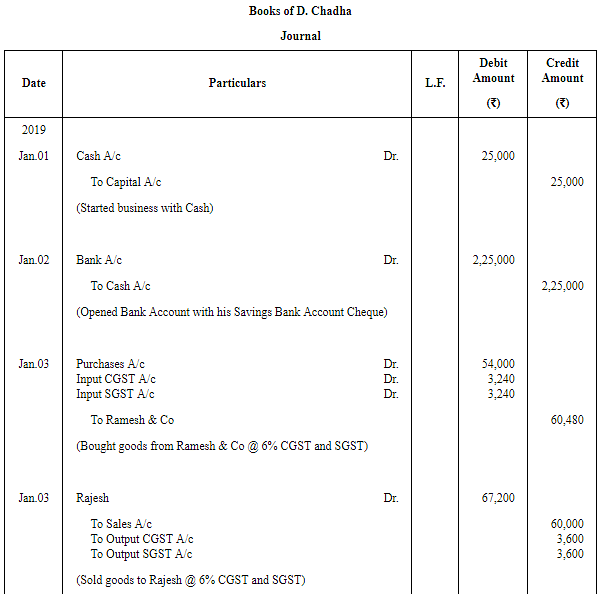

Q.32. D.Chadha, Delhi commenced business on 1st January, 2019. His transactions for the month are given below. Journalise them. He will close his books on 31st March each year.

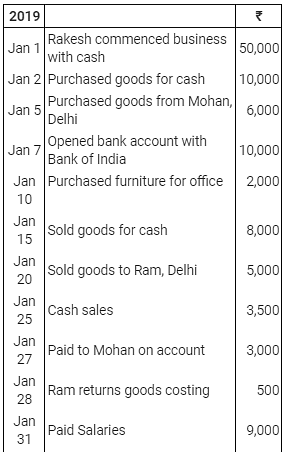

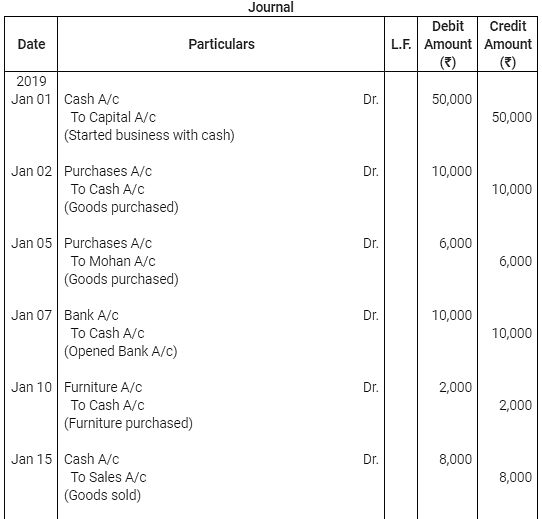

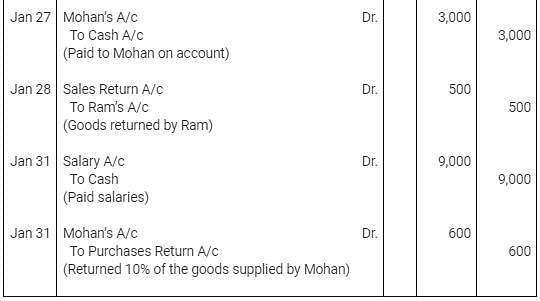

Ans.

Q.33. Journalise the following transactions in the books of Manoj Store:

(i) Purchased goods from Ramesh ₹ 20,000 less Trade Discount at 20% plus IGST @ 12% .

(ii) Sold goods costing ₹ 7,000 to Krishna for ₹ 9,000 plus IGST @ 12%.

(iii) Sold goods for ₹ 10,000 and charged IGST @ 12% against cheque.

(iv) ₹ 5,000 were deposited into Savings Account.

(v) Machinery costing ₹ 4,00,000 for which order was placed earlier paying

advance of ₹ 40,000. The balance amount was paid as follows:

(a) An old machine (personal) valued at ₹ 30,000 was given in exchange;

(b) Issued a cheque from his savings account for ₹ 1,30,000; and

(c) Balance by issue cheque from firm's bank account.

(vi) Paid wages ₹ 2,500 for installation of machine.

Ans.

Note:

- For purchasing new machine proprietor exchanged his old machine and issued a cheque of Rs. 1,30,000 from Saving A/c, it will increase the Proprietor’s Capital A/c

- Withdrawn a sum of Rs. 5,000 from the business and deposited in Saving A/c, it will be treated as drawings.

Q.34. Pass the Opening Entry from the following Balance Sheet as at 31st March, 2018 of Vikas: Ans.

Ans.

Point of Knowledge:

|

64 videos|152 docs|35 tests

|

FAQs on Journal - Accountancy Class 11 - Commerce

| 1. What is the importance of conducting market research for a business? |  |

| 2. How can businesses collect data for market research? |  |

| 3. What are the key factors to consider when analyzing market research data? |  |

| 4. How can market research help businesses identify new opportunities? |  |

| 5. What are the potential challenges businesses may face in conducting market research? |  |

|

Explore Courses for Commerce exam

|

|