Key Notes: Bank Reconciliation Statement | Accountancy Class 11 - Commerce PDF Download

Bank Reconciliation Statement

Bank Reconciliation Statement is prepared to reconcile the difference between the bank Balance shown by the Cash Book and Bank Pass Book.

Learning Objectives

- Meaning of Bank Reconciliation statement.

- Causes of Differences in Bank Balance as per Cash Book and Pass Book.

- Importance of Bank Reconciliation Statement.

- Procedure of preparation of bank Reconciliation statement

- Preparation of Adjusted Cash Book.

Definition: A schedule showing the items of difference between the bank statement and the bank column of Cash Book is known as Bank Reconciliation Statement.

Causes of Differences in Cash Book and pass Book

(A) Transactions recorded in Cash Book but not in Pass Book.

(B) Transactions recorded in Pass Book but not in Cash Book.

(C) Others transactions errors.

(A) Transactions recorded in Cash Book but not in Pass Book

(i) Cheques issued but not presented for payment in the bank.

(ii) Cheqes deposited or paid into the bank for collection but not yet credited by bank.

(iii) Cheqes deposited but dishonored.

(iv) Working Debit or credit entered

(B) Transactions recorded in Pass Book but not in Cash Book :-

(i) Interest allowed by the Bank

(ii) Interest on overdraft, bank charges and commission etc. charges by Bank.

(iii) Direct deposit by the customers into Bank.

(iv) Interest, dividednd etc. collected by the Bank.

(v) Direct payment made by the Bank on behalf of customer as per standing instruction.

(C) Other transactions :-

(i) Error in totaling or balancing of Cash Book.

(ii) Transactions recorded twice in Cash Book.

(iii) Transactions recorded twice in Pass Book.

(iv) Error of recording by wrong amount.

(v) Error of recording in wrong side like Debit instead of credit and vice-versa.

Need and importance

- It helps in locating and rectifying the errors or omissions committed either by the firm or by the bank.

- Customer becomes sure of the correctness of the bank balance shown by the cash book.

- Facilitates the preparation of amended or revised Cash Book.

- Reduces the chances of fraud by the staff of the firm or bank.

- Helps in keeping a track of the cheques deposited for collection.

Procedure of preparing Bank Reconciliation Statement

A Bank Reconciliation Statement is prepared when we get the duly completed Pass Book from the Bank.

- First of all tally the Debit side entries of the cash book with the Credit side entries of the Pass Book and vice versa.

- Tick the items appearing in both the books.

- Unticked items will be the points of differences.

- A BRS is then prepared by taking either the balance as per Cash Book or Pass Book as a starting point.

Important points

- If the Starting point is Cash Book Balance then the ending point will be Pass Book Balance.

- If the starting point is Pass Book Balance then the ending point will be the Balance as per Cash Book.

- Debit Balance as per Cash Book or Credit Balance as per Pass Book, means that the firm has that much amount of deposit at the bank ->also called favorable balance -> write the amount under + items.

- Credit Balance as per Cash Book or Debit Balance as per Pass Book, means that this much amount has seen withdrawn in excess of deposit -> also called overdraft or unfavorable balance -> write the amount under items.

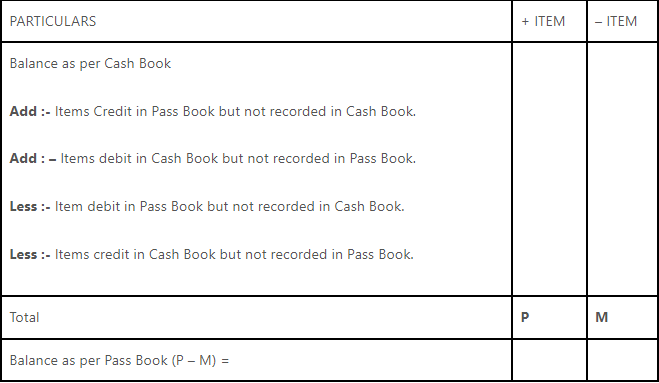

Method of preparing BRS starting with the Balance/overdraft as per Bank Column of Cash Book.

Bank Reconciliation Statement as on .

Note:

- If total of Plus Items is more than the total of () items – >Difference is Credit Balance or favorable balance as per Pass Book.

- Where as if the – items total is more than the + items total > Difference is Debit Balance or overdraft as per Pass Book.

- If BRS is started with Balance as per Cash Book then ending point is Balance as per Pass Book and Vice-Versa.

- Debit balance of Cash Book means favorable balance or – Balance

- Debit balance of Pass Book means unfavorable balance or – balance.

- Credit balance of Pass Book means favorable balance or + balance

Ready Reference

Items which increase the pass Book Balance or decreases the Cash Book Balance)

- Cheques issued but not yet presented.

- Credits made by the bank for Interest.

- Amount directly deposited by the customers in our bank A/c.

- Interest and dividend collected by the bank.

- Cheques paid into the bank but omitted to be recorded in the Cash – Book.

Items which, decreases the pass Book Balance or increase the Cash Book Balance)

- Cheques sent to the bank for collection but not yet credited by the – bank.

- Cheques paid into the bank but dishonoured.

- Direct payments made by the bank.

- Bank charges, commission etc. debited by the bank.

- Cheques issued but omitted to be recorded in the Cash Book.

Explanation

- Balance as per Cash Book means favourable Balance, hence + Item.. If nothing (i.e. Debit or Credit) is written the Balance given, it is treated as favourable.

- Cheques were deposited into the bank for Rs. 5,000 but credited by the bank for Rs. 1,000 in the month of July, implies that cheques for Rs. 4,000 (5,000-1,000) are entered in the Cash Book but not in the Pass Book Increasing the Cash Book Balance by Rs. 4,000 as compared to Pass Book. Hence to get pass Book Balance from the Cash Book Rs. 4,000 will have to be deducted.

- Cheques issued but not presented for payment till 31st July is for Rs. 13800 entered more on the credit side of Cash Book as compared to Pass Book -> Cash book Balance is less by Rs. 13,800 as compared to Pass Book -> Item

- (a) Bank charges of Rs. 150 entered in the Pass Book -> decrease the Balance of Pass Book. To reach Pass Book Balance from Cash Book Balance, this item has to be deducted i.e. minus item.

(b) Interest credited by the Bank Rs. 400 interest in Pass Book Increases the, balance of Pass Book, hence to reach the Balance from cash book and this item is to be added + item. - Direct deposit by a customer Rs. 2,500 Increase the Pass Book Balance plus item.

- Payment made by the bank for insurance premium decreases the Pass Book Balance Minus Item.

- Items total Rs. 36,700 is more than-item total Rs. 5,350 by Rs. 31,350. Hence the difference of Rs. 31,350 will be + item i.e. Favourable Balance or Cr. balance as per Pass Book.

Important points :

- Starting and Ending points are reversed compared to Example No. 1. Hence + items (x) items are interchanged.

- Favourable balance whether of Cash Book or Pass Book is always a + items

- If + items total is more the-items total then the difference in the two totals is always a favourable Balance

- Where as if + items total is less than the – items total then the difference in the two totals is overdraft.

Important points

- Overdraft whether as per Cash Book or Pass Book is always a (-) items.

- Starting and Ending points are interchanged as compared to Example No. 2 hence + items and (-) are also interchanged.

- Here (-) items total is more as compared to (+) items total, therefore, the difference in the two balance is a negative items i.e. overdrafts as per Cash Book.

Amended Cash Book Method

Introduction: So far we have studied the preparation of Bank Reconciliation Statement simply by reconciling the causes of differences between the Cash Book and Pass Book. In actual practice adjustments are done in the Cash Book by comparing the Bank column of Cash Book with the Bank Statement and after that, B.R. Statement is prepared. It is called Amended Cash Book Method.

Procedure

- Adjusted Cash book prepared starting with the Balance of the Cash Book given in the question.

- All errors that have been committed in the Cash Book will have to be rectified by passing adjusting entries in the Cash Book.

Usual of General Errors are

(a) Overcasting or Undercasting of Debit/Credit Column of Cash – Book.

(b) Cheques deposited or Issued but omitted to be entered in the Cash Book.

(c) Incorrect amount (if any) entered in the Cash Book.

(d) Entries on the correct side or in the wrong column of Cash Book.

(e) Any amount recorded twice in the Cash Book.

Certain amounts for which Bank has debited our A/c will be recorded on the Credit side of Cash Book. Such items are

(a) Interest charged by the bank on overdraft, etc.

(b) Debits made by the bank for the bank charges, commission etc.

(c) Direct payments made by the Bank on behalf of the A/c holder.

(d) Cheques sent for collection but dishonoured.

Cash Book is then balanced: and the new Balance of the Cash book is taken as the starting point for preparing the B.R. Statement.

Important:

It should be noted that the following items must not be recorded in the Amended Cash Book.

- Cheques deposited into the Bank but not yet credited by the Bank.

- Cheques Issued but yet not presented for payment.

Points to Remember

- Amended or adjusted Cash Book is started with the given balance of bank as per Cash Book.

- Closing Balance of the adjusted Cash Book is the opening balance of bank Reconciliations statement.

- Entry for the dishonour of the cheques of Rs. 200 is not done.

(a) In the Cash Book as it was dishonoured after 31st Dec.

(b) In Bank Reconciliation Statement it is included in the adjustment (Rs. 3,100-2,500)

Methodology Suggested

Teachers are suggested to show the actual Bank Statement to students and the topic can be explained through discussion and Project Method.

|

61 videos|154 docs|35 tests

|