Levy and Collection | Goods and Services Tax (GST) - B Com PDF Download

Section 9(1) of CGST Act, 2017 provides that there shall be levied of tax called Central Goods and Services Tax on all intra-State supplies of goods or services or both, except on the supply of alcoholic liquor for human consumption, on the value determined under section 15 of the CGST Act, 2017 and at such rates, not exceeding 20%, as may be notified by the Government on the recommendation of the Council and collected in such manner as may be prescribed and shall be paid by the taxable person.

It means maximum GST rate not exceeding 40% (i.e. CGST 20% and SGST 20%) on all intra-state supplies of goods or services. Section 5(1) of IGST Act, 2017, provides that there shall be levied of a tax called Integrated Goods and Services Tax (IGST) on all inter-State supplies of goods or services or both at such rates not exceeding 40%. IGST on goods imported into India shall be levied and collected in accordance with the provisions of Section 3 of the Customs Tariff Act, 1975.

Section 9(2) of CGST Act, 2017, GST will be levied on the supply of:

- Petroleum crude,

- High speed diesel,

- Motor spirit (commonly known as petrol),

- Natural gas and

- Aviation turbine fuel

Shall be levied with effect from such date as may be notified by the Government of India on the recommendation of the GST Council (similar provision under section 5(2) of IGST Act, 2017). Section 9(3) of CGST Act, 2017 the Government may, on the recommendation of the GST Council, may notify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis (similar provision under section 5(3) of IGST Act, 2017).

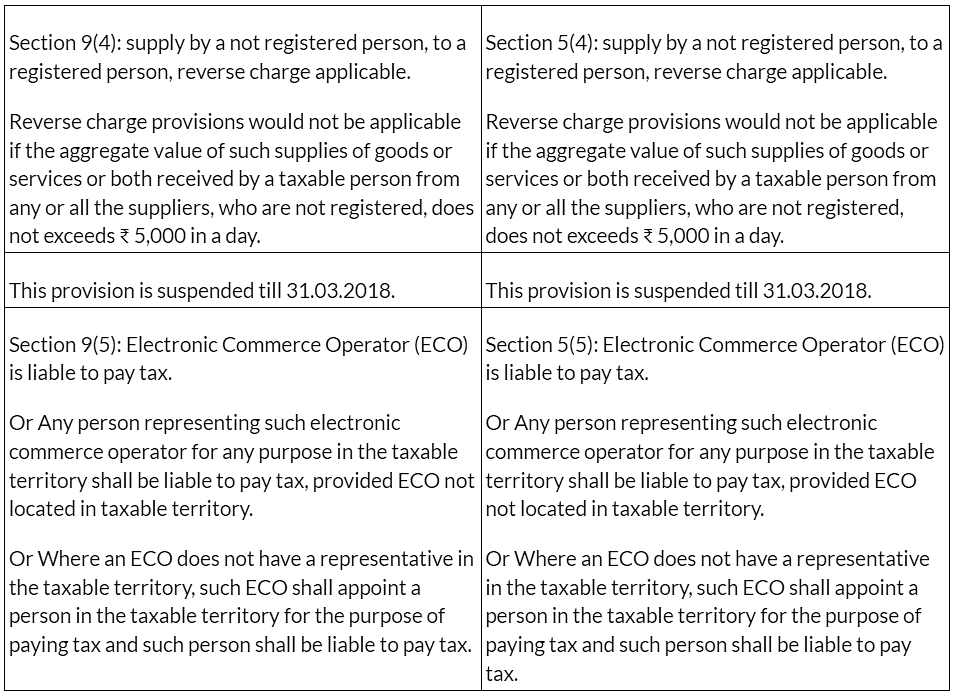

Section 9(4) of CGST Act, 2017, central tax (i.e. CGST) in respect of the supply of taxable goods or services or both by a supplier, who is not registered, to a registered person shall be paid by such person on reverse charge basis as the recipient (Similar provision under section 5(4) of IGST Act, 2017). This provision suspended till 31.03.2018.

Note: Reverse charge provisions would not be applicable if the aggregate value of such supplies of goods or services or both received by a taxable person from any or all the suppliers, who are not registered, does not exceeds ₹ 5,000 in a day (Vide Notification No. 8/2017 Dt. 28.06.2017).

Section 9(5) of CGST Act, 2017 Electronic Commerce Operator (ECO) is liable to pay tax. If ECO does not have a physical presence in the taxable territory, any person representing such electronic commerce operator for any purpose in the taxable territory shall be liable to pay tax. Provided further that where an ECO does not have a representative in the taxable territory, such ECO shall appoint a person in the taxable territory for the purpose of paying tax and such person shall be liable to pay tax (similar provision under section 5(5) of IGST Act, 2017)

Summary

|

130 videos|45 docs|14 tests

|

|

Explore Courses for B Com exam

|

|