GST Exam > GST Notes > Learn About GST : Updates and Rules > List of Services at 5% Rate - Rate Lists for Services

List of Services at 5% Rate - Rate Lists for Services | Learn About GST : Updates and Rules PDF Download

5% GST Rate for Services

Services with Full GST Input Tax Credit at 5% GST:

- Selling space for advertisement in print media.

- Job work services related to the printing of newspapers.

Services with Input Tax Credit of Input Services at 5% GST:

- Transport of goods by rail.

- Transport of passengers by rail (excluding sleeper class).

- Transportation of goods by vessel, including services provided by a person in a non-taxable territory to another person in a non-taxable territory, from outside India to the customs station of clearance in India.

- Transport of passengers by air in economy class.

- Transport of passengers, with or without accompanied belongings, departing from or arriving at a Regional Connectivity Scheme Airport.

- Leasing of aircraft by scheduled airlines for scheduled operations.

Services at 5% GST with No Input Tax Credit:

- Services of goods transport agencies (GTA) for transportation of goods, excluding used household goods for personal use.

- Services of goods transport agencies for transportation of used household goods for personal use.

- Renting of motor cabs (18% GST applies if fuel cost is borne by the service recipient).

- Transport of passengers by air-conditioned contract/stage carriage, excluding motor cabs or radio taxis.

- Supply of tour operators' services.

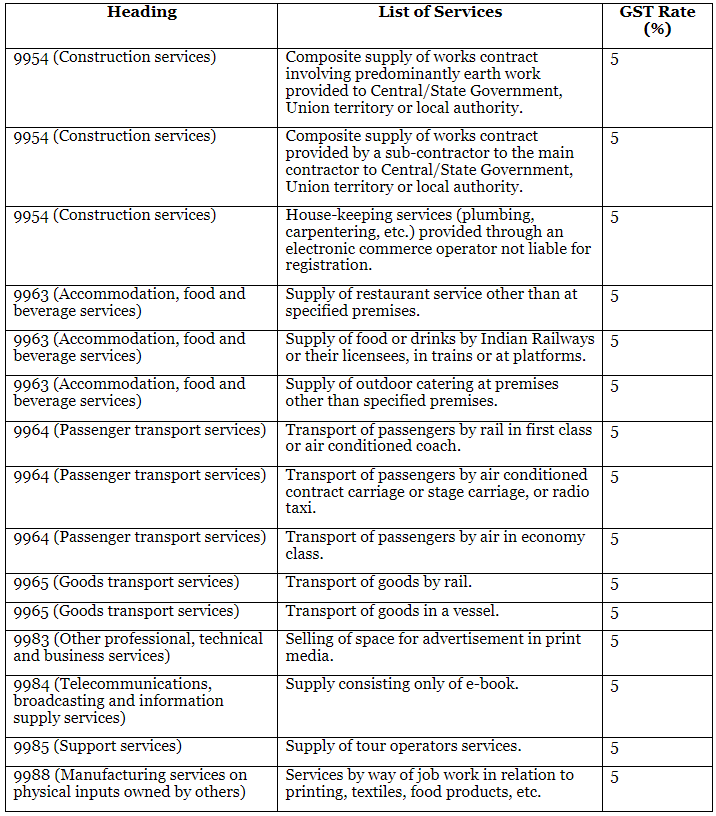

List of Services and GST Rates

The document List of Services at 5% Rate - Rate Lists for Services | Learn About GST : Updates and Rules is a part of the GST Course Learn About GST : Updates and Rules.

All you need of GST at this link: GST

FAQs on List of Services at 5% Rate - Rate Lists for Services - Learn About GST : Updates and Rules

| 1. What types of services are covered under the 5% GST rate? |  |

Ans. The 5% GST rate applies to specific services, including transportation of goods, certain healthcare services, and services provided by small businesses. It is important to refer to the official GST rate list for a comprehensive overview of which services qualify for this reduced rate.

| 2. How is the 5% GST rate calculated on services? |  |

Ans. The 5% GST rate is calculated based on the total service charge before any discounts or additional fees. For example, if the service cost is $100, the GST would be $5, making the total amount payable $105.

| 3. Are there any exemptions for services under the 5% GST rate? |  |

Ans. Yes, certain services may be exempt from GST altogether or may attract a different rate. For instance, educational services and some healthcare services might not incur GST. It is advisable to check the specific exemptions listed by the GST authorities.

| 4. Can businesses claim input tax credit on services taxed at 5% GST? |  |

Ans. Yes, businesses can claim input tax credit on services taxed at the 5% GST rate, provided they are registered under GST and the services are used for business purposes. This helps in reducing the overall tax liability.

| 5. How does the 5% GST impact consumers availing of these services? |  |

Ans. The 5% GST rate makes certain services more affordable for consumers compared to higher tax rates. This lower rate can encourage consumption of these services, benefiting both consumers and service providers by potentially increasing demand.

Related Searches