List of Small Finance Banks in India | SBI PO Prelims & Mains Preparation - Bank Exams PDF Download

Overview

RBI granted "in-principle" approval to the 10 applicants to set up Small Finance. Reserve Bank gets 72 applications for small banks.

Small Finance Banks in India

- The small banks are to provide a whole suite of basic banking products such as deposits and supply of credit, but in a limited area of operation. Key features of the Small Finance Bank guidelines are:

1. Objective: The objective for these Small Banks is to increase financial inclusion by the provision of savings vehicles to under-served and unserved sections of the population, supply of credit to small farmers, micro and small industries, and other unorganized sector entities through high technology-low cost operations.

2. Registration: The small bank shall be registered as a public limited company under the Companies Act, 2013.

3. Committee on Small Banks : Usha Thorat Committee

4. Validity: The “in-principle” approval granted will be valid for 18 months to enable the applicants to comply with the requirements under the Guidelines and fulfill other conditions as may be stipulated by the RBI.

5. Eligibility: Resident individuals with 10 years of experience in banking and finance, companies, and Societies will be eligible as promoters to set up small banks. NFBCs, microfinance institutions (MFIs), and Local Area Banks (LABs) can convert their operations into those of a small bank.

6. Capital Requirement: The minimum paid-up equity capital for small finance banks shall be Rs. 100 crore.

7. Operation: Small banks will offer both deposits as well as loan products. They cannot set up subsidiaries to undertake non-banking financial services activities. For the first three years, 25 percent of branches should be in unbanked rural areas. For the initial three years, prior approval will be required for branch expansion.

8. Loans & Advances: The maximum loan size and investment limit exposure to single/group borrowers/issuers would be restricted to 15 percent of total capital funds. Loans and advances of up to Rs 25 lakhs, primarily to micro-enterprises, should constitute at least 50 percent of the loan portfolio.

9. Foreign Shareholding: The foreign shareholding in the small finance bank would be as per the Foreign Direct Investment (FDI) policy for private sector banks as amended from time to time.

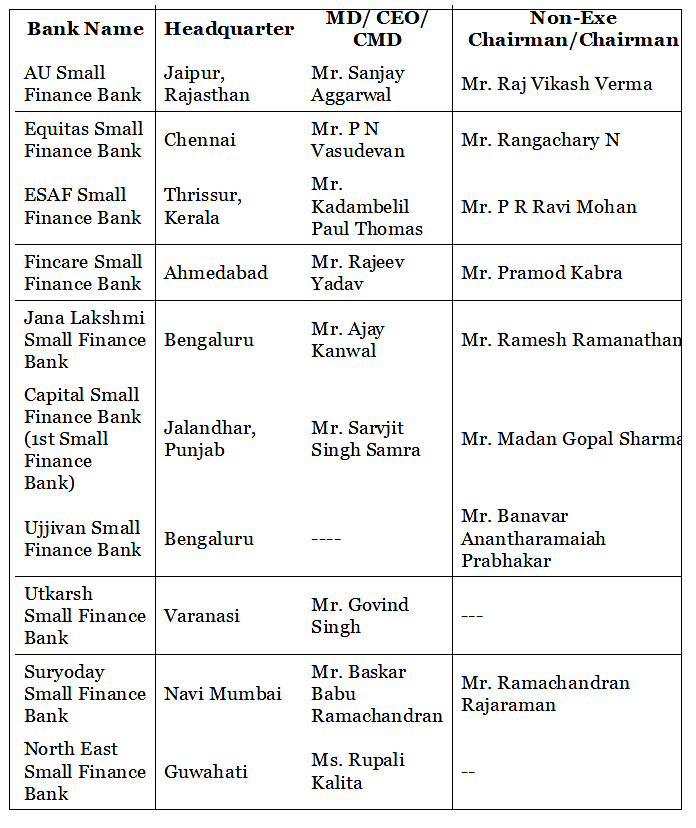

10. List of Small Finance Banks in India

|

628 videos|824 docs|280 tests

|

|

628 videos|824 docs|280 tests

|

|

Explore Courses for Bank Exams exam

|

|