NCERT Exemplar Solutions: Comparing Quantities | Mathematics (Maths) Class 8 PDF Download

Multiple Choice Questions

Q1: Suppose for the principal P, rate R% and time T, the simple interest is S and compound interest is C. Consider the possibilities.

(i) C > S

(ii) C = S

(iii) C < S

Then:

(a) only (i) is correct.

(b) either (i) or (ii) is correct.

(c) either (ii) or (iii) is correct.

(d) only (iii) is correct.

Answer: (a)

Solution: Let Principal, P = Rs. 100, Rate = 10% and Time = 1 year

Simple interest (SI)= (P×R×T)/100 = (100×10×1)/100 = Rs.10

Since, Amount = P(1+R/100)T=100(1+10/100)1= 100(11/10) = Rs. 110

Compound interest (CI) = Amount – Principal = 110 -100 = 10

So, CI>SI

Q2: Suppose a certain sum doubles in 2 years at r % rate of simple interest per annum or at R% rate of interest per annum compounded annually. We have

(a) r < R

(b) R < r

(c) R = r

(d) can’t be decided

Answer: (b)

Solution: If the total amount received in 2yr is same for both simple interest and compound interest on same principal, then the rate of simple interest is greater than the rate of compound interest.i.e. R < r.

Q3: The compound interest on Rs 50,000 at 4% per annum for 2 years compounded annually is

(a) Rs 4,000

(b) Rs 4,080

(c) Rs 4,280

(d) Rs 4,050

Answer: (b)

Solution: P = Rs.50000, R = 4%, T = 2 years

A = P(1+R/100)T = 50000(1+4/100)2 = 50000(1+1/25)2

A = 50000(26/25)2 = 54080

Compound interest = A – P = 54080 – 50000 = Rs. 4080

Q4: If marked price of an article is Rs 1,200 and the discount is 12% then the selling price of the article is

(a) Rs 1,056

(b) Rs 1,344

(c) Rs 1,212

(d) Rs 1,188

Answer: (a)

Solution: Marked price = Rs.1200

Discount = 12%

Since, Discount = Discount% on Marked price

Discount price = 12% of 1200 = 12/100 × 1200 = 12 × 12 = 144

Selling price = Marked price-discount price = 1200 – 144 = Rs. 1056

Q5: If 90% of x is 315 km, then the value of x is

(a) 325 km

(b) 350 km

(c) 350 m

(d) 325 m

Answer: (b)

Solution: 90% of x is 315 km

90/100 × x = 315

X = 315 × 100/90 = 315 × 10/9 = 350

Q6: To gain 25% after allowing a discount of 10%, the shopkeeper must mark the price of the article which costs him Rs 360 as

(a) Rs 500

(b) Rs 450

(c) Rs 460

(d) Rs 486

Answer: (a)

Solution: Say, marked price = x

Cost price = Rs.360

As per the question;

x – [x×(10/100)] – [(25×360)/100] = 360

x – x/10 – 90 = 360

9x/10 = 360 + 90

9x = 4500

x = 500

Q7: If a % is the discount per cent on a marked price x, then discount is

(a) (x/a) × 100

(b) (a/x) × 100

(c) x × (a/100)

(d) 100/(x × a)

Answer: (c)

Solution: (Discount = Discount% on Marked Price)

Q8: Ashima took a loan of Rs 1,00,000 at 12% p.a. compounded half-yearly. She paid Rs.1,12,360. If (1.06)2 is equal to 1.1236, then the period for which she took the loan is:

(a) 2 years

(b) 1 year

(c) 6 months

(d) 1(1/2) years

Answer: (b)

Solution: P = Rs.100000, R = 12% per annum compounded half-yearly.

Amount = Rs.112360

Since we know,

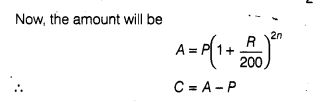

A = P (1+R/100)T

112360 = 100000(1+12/100)T

112360/100000 = (1+12/100)T

(1.1236)1 = (1.12)T

If we compare the base terms, 1.1236 is approximately equal to 1.12

Hence, T = 1 year.

Q9: For calculation of interest compounded half yearly, keeping the principal same, which one of the following is true.

(a) Double the given annual rate and half the given number of years.

(b) Double the given annual rate as well as the given number of years.

(c) Half the given annual rate as well as the given number of years.

(d) Half the given annual rate and double the given number of years.

Answer: (d)

Solution: If interest is compounded half-yearly, then R=R2 and T=2T=2n

So, half the given annual rate and double the given number of years. Hence, option (d) is correct.

Q10: Shyama purchases a scooter costing Rs 36,450 and the rate of sales tax is 9%, then the total amount paid by her is:

(a) Rs 36,490.50

(b) Rs 39,730.50

(c) Rs 36,454.50

(d) Rs 33,169.50

Answer: (b)

Solution: Scooter cost Rs.36450 at the rate of sales tax = 9%.

Total cost of scooter paid by Shyama = 9% of 36450 + 36450 = (9/100 × 36450) + 36450

= 3280.5 + 36450

= 39730.5

Q11: The marked price of an article is Rs 80 and it is sold at Rs 76, then the discount rate is:

(a) 5%

(b) 95%

(c) 10%

(d) appx. 11%

Answer: (a)

Solution: Marked price = Rs. 80

Sold price = Rs.76

We know that,

Selling price = Marked price – Discount

Discount = Marked price – Selling price

Discount = Rs.80-Rs.76 = Rs.4

Discount % = 4/80 x 100 = 5%

Q12: A bought a tape recorder for Rs 8,000 and sold it to B. B in turn sold it to C, each earning a profit of 20%. Which of the following is true:

(a) A and B earn the same profit.

(b) A earns more profit than B.

(c) A earns less profit than B.

(d) Cannot be decided.

Answer: (c)

Solution: Cost price of tape recorder bought by A = Rs.8000

Cost price of tape recorder for B =20% profit on cost price for A

= 20/100 x 8000 + 8000

= 20 x 80 + 8000

= 1600 + 8000

= Rs.9600

Cost price of tape recorder sold to C = 20% profit on cost price for B

= 20/100 x 9600 + 9600

=1929 + 9600

= Rs.11520

Here, profit for A= Rs.1600 Profit for B = Rs.1920

So, A earns less profit than B.

Q13: Latika bought a teapot for Rs 120 and a set of cups for Rs 400. She sold teapot at a profit of 5% and cups at a loss of 5%. The amount received by her is:

(a) Rs 494

(b) Rs 546

(c) Rs 506

(d) Rs 534

Answer: (c)

Solution: Price of teapot = Rs. 120

Price of set of cups = Rs. 400

Latika sold teapot at a profit of 5%

Selling price of teapot = 5/100 x 120 + 120

= 120/20 +120

= 6 + 120 = Rs.126

Also, cups were sold at a loss of 5%.

Now, selling price of cups = 400 –5/100 x 400

= 400 – 20

= Rs. 380

Therefore, total amount received = Rs. 126 + Rs. 380 = Rs. 506

Q14: A jacket was sold for Rs 1,120 after allowing a discount of 20%. The marked price of the jacket is:

(a) Rs 1440

(b) Rs 1400

(c) Rs 960

(d) Rs 866.66

Answer: (b)

Solution: Let marked price = x

Discount = 20%

Selling price = 1120

Hence, 1120 = x – x× 20/100

1120 = x – x/5

1120 = 4x/5

x = (1120×5)/4 = 1400

Q15: A sum is taken for two years at 16% p.a. If interest is compounded after every three months, the number of times for which interest is charged in 2 years is:

(a) 8

(b) 4

(c) 6

(d) 9

Answer: (a)

Solution: Rate of interest is compounded after every three months. Thus, the time period for amount in a year will be 4 times.

If amount is taken for 2 year, then 4×2 = 8 times charged in 2 year.

Q16: The original price of a washing machine which was bought for Rs 13,500 inclusive of 8% VAT is:

(a) Rs 12,420

(b) Rs 14,580

(c) Rs 12,500

(d) Rs 13,492

Answer: (a)

Solution: The original price of the washing machine = Rs.13500

VAT = 8%.

The original price of the washing machine including of 8% VAT

= 13500-13500 x 8/100

= 13500-135 x 8

= 13500-1080

= Rs.12420

Q17: Avinash bought an electric iron for Rs 900 and sold it at a gain of 10%. He sold another electric iron at 5% loss which was bought Rs 1200. On the transaction he has a:

(a) Profit of Rs 75

(b) Loss of Rs 75

(c) Profit of Rs 30

(d) Loss of Rs 30

Answer: (c)

Solution: Price of electric iron = Rs. 900

Sold at 10% profit

Now, selling price of the electric iron = (10/1000) x 900 + 900 = 90+ 900 = Rs.990

Another electric iron sold at 5% loss.

Cost price of another electric iron = Rs.1200

Thus, selling price of the electric iron = 1200 – 1200 x (5/100) = 1200 – 60 = Rs.1140

Total cost paid by Avinash for purchasing electric irons = Rs.900 + Rs.1200 = Rs.2100

Total received amount = Rs.990 + Rs.1140 = Rs. 2130

Therefore, his profit = Rs.2130- Rs.2100 = Rs.30

Q18: A TV set was bought for Rs 26,250 including 5% VAT. The original price of the TV set is

(a) Rs 27,562.50

(b) Rs 25,000

(c) Rs 24,937.50

(d) Rs 26,245

Answer: (b)

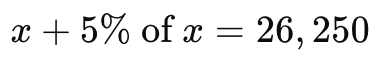

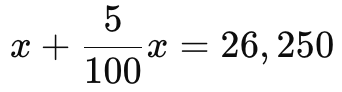

Solution: Cost price of TV set = Rs. 26250.

VAT including = 5%

Let the original price be x.Cost Price including VAT = Original Price + VAT on Original Price

Since VAT is 5% of the original price, we express this as:Therefore, original price of TV set is = Rs. 25,000

Q19: 40% of [100 – 20% of 300] is equal to:

(a) 20

(b) 16

(c) 140

(d) 64

Answer: (b)

Solution: 40% of [100 – 20% of 300]

= 40% × [100 – (20/100×300)]

= 40% × [100 – 60]

= 40/100 × 40

= 16

Q20: Radhika bought a car for Rs 2,50,000. Next year its price decreased by 10% and further next year it decreased by 12%. In the two years overall decrease per cent in the price of the car is

(a) 3.2%

(b) 22%

(c) 20.8%

(d) 8%

Answer: (c)

Solution: Radhika bought a car for Rs. 250000.

Cost price = Rs.250000

Its price decreased next year for 10%.

Thus, new price = 250000 – (10/100) × 250000

= 250000 – 25000 = 225000

Again, the price of car decreased by 12% next year. So the price will be:

=225000 – 225000 × (12/100)

= 225000 – 27000

= 198000

So, the overall decrease in percentage of car price = (250000-198000)/250000 × 100

= (52000/250000) × 100 = 520/25 = 20.8%

Fill in the blanks

Q21: ________ is a reduction on the marked price of the article

Answer: Discount

Q22: Increase of a number from 150 to 162 is equal to increase of ____ per cent.

Answer: 8%

Solution: Increase of a number from 150 to 162 = 162-150 = 12

Percentage of increased number = 12/150 × 100 = 120/15 = 8%

Q23: 15% increase in price of an article, which is Rs.1,620, is the increase of ____.

Answer: Rs.212

Solution: Let x is the price of the article.Thus, as per given question;

1620 = x + x × (15/100)

1620 = 115x/100

115x = 1620 × 100

x = (1620×100)/115

x = 1408

Hence, increase in price = 1620 – 1408 = 212.

Q24: Discount = _______-_______.

Answer: Discount = Marked Price – Selling Price.

Q25: Discount = Discount % of ______.

Answer: Discount = Discount % of Marked Price.

Q26: _____ is charged on the sale of an item by the government and is added to the bill amount.

Answer: Sales tax

Q27: Amount when interest is compounded annually is given by the formula ______.

Answer: A = P(1+R/100)T [P = Principal, R = Rate, T = time]

Q28: Sales tax = tax % of _______.

Answer: Bill amount

Q29: The time period after which the interest is added each time to form a new principal is called the _______.

Answer: Conversion period

Q30: ______ expenses are the additional expenses incurred by a buyer for an item over and above its cost of purchase.

Answer: Overhead

Q31: The discount on an item for sale is calculated on the _______.

Answer: Marked price

Q32: When principal P is compounded semi-annually at r % per annum for t years, then Amount = ______.

Answer: A = P(1+R/200)2t

Q33: Percentages are equal to fractions with _________ equal to 100.

Answer: Denominator

Q34: The marked price of an article when it is sold for Rs. 880 after a discount of 12% is ______.

Answer: Rs.1000

Solution: Selling price = Rs.880

Discount percentage = 12%

Let x be the marked price.

Since, discount is calculated on marked price, thus;

x – x × (12/100) = 880

88x /100 = 880

x = 10 × 100 = 1000

Q35: The compound interest on Rs 8,000 for one year at 16% p.a. compounded half yearly is ______, given that (1.08)2 = 1.1664.

Answer: Rs. 9331.2

Solution: Principal = Rs.8000

Time period = 1 year

Rate = 16% = 16/100 = 0.16

Amount = P ( 1+r/n)nt

n = 2 (compounded half yearly in a year)

A = 8000(1+0.16/2)2×1 = 8000 (1+0.08)2 = 8000 (1.08)2

A = 8000 × 1.1664

A = 9331.2

Q36: In the first year on an investment of Rs. 6,00,000 the loss is 5% and in the second year the gain is 10%, the net result is ____.

Answer: 627000

Solution: Investment amount = 600000

Loss in first year = 5%.

So, investment in first year = 600000 – (5/100) x 600000 = 600000 – 30000 = 570000

In second year, the gain is 10%.

So, net result = 570000 + (10/100) x 570000 = 570000 + 57000 = 627000

Q37: If amount on the principal of Rs 6,000 is written as 6000 [1+5/100]3 and compound interest payable half yearly, then rate of interest p.a. is ____ and time in years is ______.

Answer: Rate – 10% and 1.5 years

Q38: By selling an article for Rs 1,12,000 a girl gains 40%. The cost price of the article was _______.

Answer: Rs.80000

Solution: Selling price of the article = ₹112000

Gain% = 40%

Say, x is the cost price of the article.

Since, cost price = selling price – profit % on cost price

Therefore, Selling price = cost price + profit % on cost price

Hence,

112000 = x + x × (40/100)

112000 = x + (2/5)x

112000 = 7x/5

x = (112000 × 5)/7

x = 80000

Q39: The loss per cent on selling 140 geometry boxes at the loss of S.P. of 10 geometry boxes is equal to ______.

Answer: 20/3%

Solution: Say, the selling price of one geometry box = Rs.1

So, the selling price of 140 geometry boxes = 1 × 140 = Rs.140

Selling price of 10 geometry boxes = Rs.10

Loss = Rs. 10

Loss percentage = Loss/CP × 100

= 10/(140+10) × 100

= 10/150 × 100

= 20/3%

Q40: The cost price of 10 tables is equal to the sale price of 5 tables. The profit per cent in this transaction is ______.

Answer: 100%

Solution: Say, the cost price of one table is Rs.1

Cost price of 10 tables = Sale price of 5 tables (Given)

Sale price of 5 tables profit = cost price of 5 tables = Rs. 5

Profit percentage = Profit/CP × 100

= 5/5 × 100 = 100%

Q41: Abida bought 100 pens at the rate of Rs 3.50 per pen and pays a sales tax of 4%. The total amount paid by Abida is ______.

Answer: Rs.364

Solution: Number of pens = 100

Rate of per pen = Rs.3.50

Cost of 100 pens = 100 × 3.50 = 350

Sales tax on pen = 4%

Total amount paid = 350 × (4/100) + 350

= 350 × 1/25 + 350

= 14 + 350

= 364

Q42: The cost of a tape-recorder is Rs 10,800 inclusive of sales tax charged at 8%. The price of the tape-recorder before sales tax was charged is _______.

Answer: Rs.10000

Solution: Cost of tape recorder = Rs.10800

Say, the cost before including the tax = x

Therefore,

x + x×(8/100) = 10800

(100x+8x)/100 = 10800

108x = 1080000

x = 10000

Q43: 2500 is greater than 500 by _______.

Answer: 400%

Solution: 2500 – 500 = 2000

Percentage increase in 500 to 2500 = (2000/500) × 100

= 2000/5 = 400

Q44: Four times a number is a ____ increase in the number.

Answer: 300%

Solution: Let the number be x

Four times of number = 4x

4x is greater than x by = 4x – x = 3x

Percentage increase in x = 3x/x × 100 = 300%

Q45: 5% sales tax is charged on an article marked Rs 200 after allowing a discount of 5%, then the amount payable is ______.

Answer: Rs.199.50.

Solution: Marked price = Rs. 200

Discount = 5%

Selling price = 200 – (5/100) × 200

= 200-10

= 190

Selling price including 5% tax = 190+(5/100)×190

= 190 + 9.5

= Rs. 199.5

True Or False

Q46: To calculate the growth of a bacteria if the rate of growth is known, the formula for calculation of amount in compound interest can be used.

Answer: True

Q47: Additional expenses made after buying an article are included in the cost price and are known as Value Added Tax.

Answer: False

Q48: Discount is a reduction given on cost price of an article.

Answer: False

Q49: Compound interest is the interest calculated on the previous year’s amount.

Answer: True

Q50: C.P. = M.P. – Discount.

Answer: False

|

81 videos|423 docs|31 tests

|

FAQs on NCERT Exemplar Solutions: Comparing Quantities - Mathematics (Maths) Class 8

| 1. What are the key concepts covered in the NCERT Exemplar Solutions for Comparing Quantities? |  |

| 2. How can I use the NCERT Exemplar Solutions to improve my understanding of comparing quantities? |  |

| 3. Are the NCERT Exemplar Solutions beneficial for exam preparation? |  |

| 4. What types of questions can I expect in the Comparing Quantities chapter of the exam? |  |

| 5. How can I effectively solve problems related to profit and loss using NCERT Exemplar Solutions? |  |