NCERT Solution (Part - 1) - Bills of Exchange | Accountancy Class 11 - Commerce PDF Download

Quick Recap

A Bill of Exchange and Promissory Note both are legal instruments which facilitate the credit sale of goods by assuring the seller that the amount will be recovered after a certain period. Both of these legal instruments under the Negotiable Instruments Act, 1881. There are 3 parties to a bill of exchange: Drawer, Drawee, Payee.

Let’s look at the NCERT solutions for Bills of Exchange.

Page Number: 332

Short answers:

Q1: Name any two types of commonly used negotiable instruments.

Answer: The two types of commonly used negotiable instruments are:

1. Cheques

2. Bills of exchange

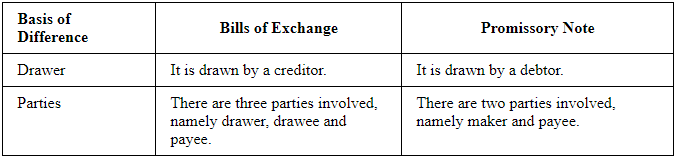

Q2: Write two points of distinction between bills of exchange and promissory note.

Answer:

Q3: State any four essential features of bill of exchange.

Answer: The four essential features of bills of exchange are:

1. It must be a written document.

2. It is an unconditional order to pay by the drawer to the drawee.

3. The maker of bill must sign it, without which it will not be a legal proof.

4. The amount to be paid along with its expiry date must be specifically mentioned (both

in figures and words) in a bill of exchange.

Q4: State the three parties involved in a bill of exchange.

Answer: The following three parties are involved in a bill of exchange.

1. Drawer who makes the bill

2. Drawee who accepts the bill

3. Payee who receives the payment

Q5: What is meant by maturity of a bill of exchange?

Answer: Maturity of a bill means a date on which the bill is due for payment. Maturity date of the bill differs on the basis of the terms and conditions of the bill. There are three types of bill, viz. after date bill, after sight bill and at sight bill.

1. After date bill: In case of after date bill, the payment of the bill is made on the maturity date of the bill. The maturity date of the bill is ascertained by adding three days of grace period with the specified period of the bill (which starts from the date of drawing). For example, if a bill is drawn on 1st March, 2011 and payable after one month; its maturity date is 4th April. If the maturity date happens to be a gazetted holiday, then the bill is due for payment one day before. However, if the maturity date happens to be a casual holiday, then the bill is due for payment after one day.

2. After sight bill: In case of after sight bill, the payment of the bill is made on the maturity date of the bill. The maturity date of the bill is ascertained by adding three days of grace period with the specified period of the bill (which starts from the date of acceptance by the drawee). For example, if a one month bill is drawn on 1st March, 2011 and is accepted by the drawee on 5th March, 2011; its maturity date is 8th April. In this case, the date of the bill starts from 5th March and notfrom 1st March. If the maturity date happens to be a gazetted holiday, then the bill is payable one day before. However, if the maturity date happens to be a casual holiday, then the bill is payable after one day.

3. At sight bill: In case of at sight bill, the due date of the bill is considered as and when the bill is presented for payment by the holder of the bill. In this case, there is no grace period. The bill becomes due whenever it is presented for payment.

Q6: What is meant by dishonour of a bill of exchange?

Answer: Dishonour of a bill happens when the acceptor of the bill fails to make the payment on the date of maturity of the bill. Hence, liability of the acceptor is restored. Entries made for recording dishonour of the bill of exchange are reverse of the entries of recording drawing of the bill.

In the books of drawer

Q7: Name the parties to a promissory note

Answer: The parties to a promissory note are given below.

1. Promissor, who makes the note and undertakes to pay the amount of promissory note.

2. Payee, who receives the payment.

Q8: What is meant by acceptance of a bill of exchange?

Answer: A bill is drawn in favour of a person from whom the amount is due. In other words, a bill of exchange is drawn by the creditors on his/her debtors to make payment of specific amount, on a mentioned date. Generally, a bill is drawn by a seller to a purchaser. Purchaser accepts the bill for the amount due on account of the credit sales. The bill may be accepted for the amount due other than credit purchases, such as commission payable, salary outstanding, etc. A bill cannot come into existence without the acceptance of a debtor.

Q9: What is Noting of a bill of exchange.

Answer: When a bill is presented for payment and acceptor fails to make payment, the bill gets dishonoured. In order to keep a legal proof of dishonour, the bill gets noted by the

Notary public (which is approved by the government). In exchange of the Notary

service, Notary public charges fees, known as Noting charges. Notary public notes the

following facts:

1. Date and amount of the bill

2. Reasons for dishonour

3. Amount of Noting charges

Q10: What is meant by renewal of a bill of exchange?

Answer: When an acceptor of a bill does not have sufficient fund to meet the obligations of the bill on time, he/she requests the drawer for extension (of time) for payment. If the drawer agrees, then a new bill is drawn which is known as renewal of bill. Generally, a bill is renewed on the condition that the drawee has to pay interest for the extended period.

Q11: Give the performa of a Bills Receivable Book.

Answer:

Q12: Give the performa of a Bills Payable Book.

Answer:

Q13: What is retirement of a bill of exchange?

Answer: When a holder receives the amount of a bill before the maturity date on the request of the acceptor, then it is called retirement of the bill of exchange. Holder of the bill may give discount for such earlier payment. This discount is termed as 'rebate'.

Entry in the books of the holder of the bill

Q14: Give the meaning of rebate.

Answer: If the drawee expresses his/her wish to pay the bill before the due date to the holder, and if the holder accepts his/her request, then on account of the early payment, the

holder may give some discount. This discount is termed as rebate. In other words, rebate is a discount given by the holder to the drawee (or acceptor) for his/her request of early payment of the bill before the due date. It is an expense for the drawer and hence, is debited to the drawer's books. On the other hand, as it is a gain for the acceptor of bill, so it is credited in the drawee's books.

Entry in the books of drawer of the bill:

Q15: Give the performa of a Bill of Exchange.

Answer: Performa of a Bill of exchange is given below.

Page Number: 332

Long answers:

Q1: A bill of exchange must contain an unconditional promise to pay. Do you agree with a statement?

Answer: According to Negotiable Instrument Act, 1981, "A bill of exchange is defined as an instrument in writing, containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of, a certain person or to the bearer of the instrument."

A bill of exchange contains an unconditional promise to pay a certain sum of money on an agreed date to the drawer or the bearer by the drawee of the bill.

An unconditional order to pay: It is one of the important characteristic of a negotiable instrument. Unconditional order implies no condition should be attached by the acceptor regarding the payment. The conditions like, payment of bill (only in case of profit on sales), payment of bill (only if the prices of goods increase), etc. should not be attached with the bill. Moreover, the language of the bill should not be ambiguous.

Q2: Briefly explain the effects of dishonour and noting of a bill of exchange.

Answer:

When a bill is presented for payment and the acceptor fails to make the payment, the bill gets dishonoured. In this situation, liability of the acceptor is restored.

Entry in the books of drawer (if Noting charges are not paid):

Noting charges are charged by the notary public for keeping a proof that the bill is dishonoured. The noting charges are paid by the holder of the bill but actually due on the drawee or the acceptor of the bill.

Notary public notes the below given facts.

1. Date and amount of bill

2. Reasons for dishonour

3. Amount of noting charges

Effect of Noting charges in the books of holder of bill (if Noting charges are paid):

Q3: Explain briefly the procedure of calculating the date of maturity of a bill of exchange? Give example.

Answer: The procedure to calculate the date of maturity of a bill of exchange is given below.

1. Ascertain the date on which the bill will be honoured.

2. Add three days of grace to the above date.

For example, a bill with maturity period of one month is drawn on 1st July and due date is 1st September. Then add 3 days of grace and payment will be made on 4th September.

Days of grace depend on the following situations:

1. Declared holidays: If the payment day happens to be a national holiday or Sunday, then the preceding day becomes the payment day.

For example,

1. If a bill is drawn on 12th July and its due date is 12th August, then after adding 3 days of grace the maturity day is 15th August. However, as 15th August is a national holiday; so, 14th August becomes the payment day.

2. If a bill is drawn on 1st May and the maturity period is of one month, then the due date is 1st June. After adding 3 days of grace, the payment date becomes 4th June. However, if 4th June happens to be a Sunday, then the payment will be made on 3rd June.

2. Undeclared holidays: If the payment day happens to be an emergency holiday, then the succeeding day becomes the payment day. For example, if a bill is drawn on 1st May and is payable after 15 days, then, after adding 3 days of grace period, the due date becomes 18th May. However, if a national strike is declared on 18th May, then 19th May becomes the due date of the bill.

Q4: Distinguish between bill of exchange and promissory note.

Answer:

Q5: Briefly explain the purpose and benefits of retiring a bill of exchange to the debtor and the creditor.

Answer: When a holder receives the amount of a bill before the maturity date on request of the acceptor, it is called retirement of the bill of exchange. Holder of the bill may give discount for such earlier payment. This discount is termed as 'rebate'.

Rebate is given by the holder to the acceptor of the bill on account of payment before the due date. Rebate is a loss for the holder of the bill; so, it is debited in the books of the holder when payment is received.

Acceptor of the bill gets rebate for the payment made before the due date. The rebate is a gain for the drawee; so, it is credited in the books of the drawee.

(Bill paid before the due date and rebate received for early payment)

Q6: Explain briefly the purpose and advantages of maintaining of a Bills Receivable Book.

Answer: Bills Receivable Book is a special purpose book that is maintained to keep records of bills received from the debtors. It contains details such as acceptor's name, date of bill, due date, amount, etc. for future references. It is totalled periodically and its balance is transferred to the debit side of the bills receivable account.

Benefits of Maintaining the Bill Receivable Book

1. Availability of information: All the information related to the bills receivable, such as amount, due date, etc., are recorded at one place and hence are easily accessible.

2. Possibility of fraud: Since all the bills are recorded at one place, possibility of fraud is minimised.

3. Responsibility: The person who maintains the bills receivable book will also be responsible for any errors or omissions. Therefore, higher degree of accountability and responsibility exists. Also, if any error is detected, then it can be fixed quickly.

4. Time efficient: Recording of bills receivable through the bills receivable book takes lesser time than that of journal entry. Therefore, it saves time of the accountant in recording numerous transactions of repetitive and routine nature.

Q7: Briefly explain the benefits of maintaining a Bills Payable Book and state how is its posting is done in the ledger?

Answer: A Bills Payable Book is a special purpose book, maintained to keep records of acceptance of bills, given to the creditors. It contains details of the amount, date of bill, due date, to whom acceptance is given, etc., for future references. It is totalled periodically and its balance is transferred to the credit side of the bills payable account.

Benefits of Maintaining Bills Payable Book

1. Availability of information: All the information related to the bills payable are recorded at one place, such as the amount, due date, etc.

2. Possibility of fraud: Since all the bills are recorded at one place, possibility of fraud is minimised.

3. Responsibility: All the transactions are recorded by the same person. Therefore, errors can be easily detected and rectified. This leads to a higher degree of responsibility and accountability of the accountant.

Page Number: 333

Numerical questions:

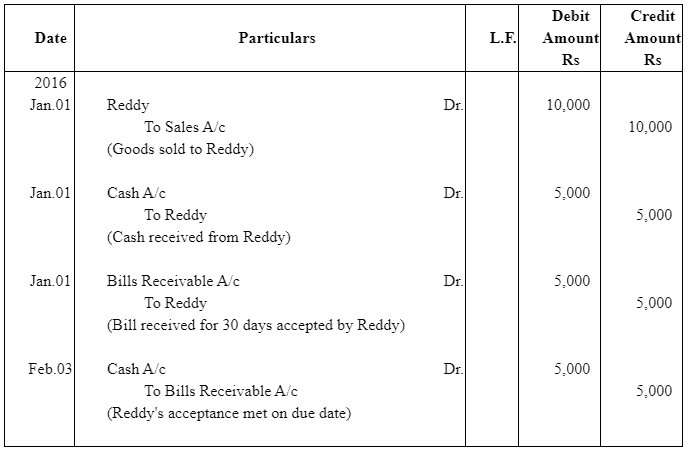

Question 1: On Jan 01, 2016 Rao sold goods Rs 10,000 to Reddy. Half of the payment was made immediately and for the remaining half Rao drew a bill of exchange upon Reddy payable after 30 days. Reddy accepted the bill and returned it to Rao. On the due date Rao presented the bill to Reddy and received the payment Journalise the above transactions in the books Rao and prepare of Rao’s account in the books of Reddy.

Answer:

Books of Rao | ||||||

Journal |

|

64 videos|153 docs|35 tests

|

FAQs on NCERT Solution (Part - 1) - Bills of Exchange - Accountancy Class 11 - Commerce

| 1. What is a bill of exchange? |  |

| 2. What are the types of bills of exchange? |  |

| 3. What are the parties involved in a bill of exchange? |  |

| 4. What is the difference between a bill of exchange and a promissory note? |  |

| 5. What is dishonor of a bill of exchange? |  |

|

Explore Courses for Commerce exam

|

|