NCERT Solution (Part - 3) - Depreciation, Provisions and Reserves | Accountancy Class 11 - Commerce PDF Download

Question 13: On October 01, 2010, a Truck was purchased for Rs 8,00,000 by Laxmi Transport Ltd. Depreciation was provided at 15% p.a. on the diminishing balance basis on this truck. On December 31, 2013 this Truck was sold for Rs 5,00,000. Accounts are closed on 31st March every year. Prepare a Truck Account for the four years

Answer:

Note: As per the solution, the profit on the sale of truck, as on December 31, 2013 is Rs 25,498; however, the answer given in the book is Rs 58,237.

Question 14: Kapil Ltd. purchased a machinery on July 01, 2011 for Rs 3,50,000. It purchased two additional machines, on April 01, 2012 costing Rs 1,50,000 and on October 01, 2012 costing Rs 1,00,000. Depreciation is provided @10% p.a. on straight line basis. On January 01, 2013, first machinery become useless due to technical changes. This machinery was sold for Rs 1,00,000, prepare machinery account for 4 years on the basis of calendar year.

Answer:

Question 15: On January 01, 2011, Satkar Transport Ltd, purchased 3 buses for Rs 10,00,000 each. On July 01, 2013, one bus was involved in an accident and was completely destroyed and Rs 7,00,000 were received from the Insurance Company in full settlement. Depreciation is writen off @15% p.a. on diminishing balance method. Prepare bus account from 2011 to 2014. Books are closed on December 31 every year.

Answer:

Question 16: On October 01, 2011 Juneja Transport Company purchased 2 Trucks for Rs 10,00,000 each. On July 01, 2013, One Truck was involved in an accident and was completely destroyed and Rs 6,00,000 were received from the insurance company in full settlement. On December 31, 2013 another truck was involved in an accident and destroyed partially, which was not insured. It was sold off for Rs 1,50,000. On January 31, 2014 company purchased a fresh truck for Rs 12,00,000. Depreciation is to be provided at 10% p.a. on the written down value every year. The books are closed every year on March 31. Give the truck account from 2011 to 2014.

Answer:

Note: As per solution, loss on truck one is as Rs 2,33,625; however, as per NCERT book, loss is of Rs 3,26,250.

Question 17: A Noida based Construction Company owns 5 cranes and the value of this asset in its books on April 01, 2017 is Rs 40,00,000. On October 01, 2017 it sold one of its cranes whose value was Rs 5,00,000 on April 01, 2017 at a 10% profit. On the same day it purchased 2 cranes for Rs 4,50,000 each. Prepare cranes account. It closes the books on December 31 and provides for depreciation on 10% written down value.

Answer:

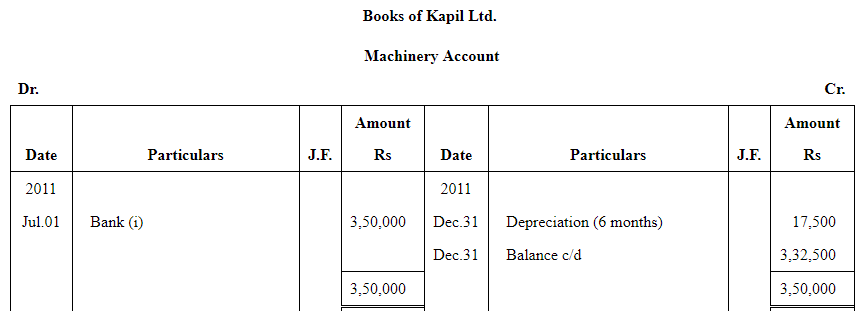

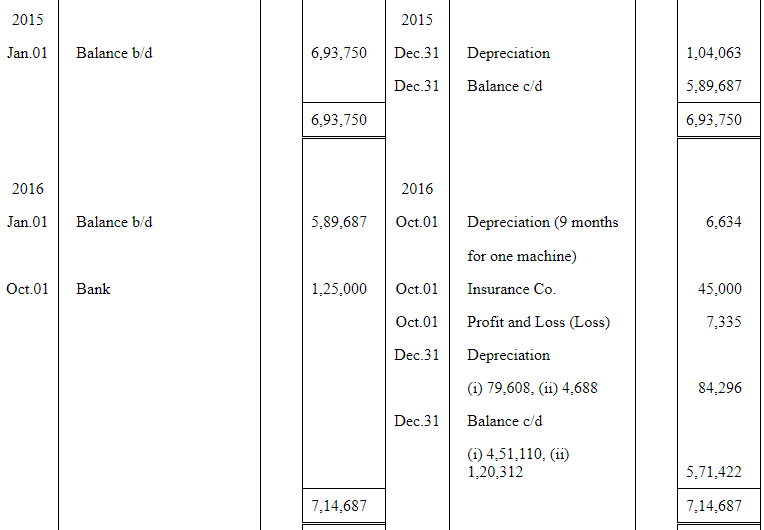

Question 18: Shri Krishan Manufacturing Company purchased 10 machines for Rs 75,000 each on July 01, 2014. On October 01, 2016, one of the machines got destroyed by fire and an insurance claim of Rs 45,000 was admitted by the company. On the same date another machine is purchased by the company for Rs 1,25,000.

The company writes off 15% p.a. depreciation on written down value basis. The company maintains the calendar year as its financial year. Prepare the machinery account from 2014 to 2017.

Answer:

Working Note:

Machine Costing Rs 75,000 sold on Oct.01, 2002

Question 19: On January 01, 2014, a Limited Company purchased machinery for Rs 20,00,000. Depreciation is provided @15% p.a. on diminishing balance method. On March 01, 2016, one fourth of machinery was damaged by fire and Rs 40,000 were received from the insurance company in full settlement. On September 01, 2016 another machinery was purchased by the company for Rs 15,00,000.

Write up the machinery account from 2016 to 2017. Books are closed on December 31, every year.

Answer:

Working Note:

Page No 287:

Question 20: A Plant was purchased on 1st July, 2015 at a cost of Rs 3,00,000 and Rs 50,000 were spent on its installation. The depreciation is written off at 15% p.a. on the straight line method. The plant was sold for Rs 1,50,000 on October 01, 2017 and on the same date a new Plant was installed at the cost of Rs 4,00,000 including purchasing value. The accounts are closed on December 31 every year.

Show the machinery account and provision for depreciation account for 3 years

Answer:

Question 21: An extract of Trial balance from the books of Tahiliani and Sons Enterprises on Marc 31 2017 is given below:

Additional Information:

- Bad Debts proved bad; however, not recorded amounted to Rs 2,000.

- Provision is to be maintained at 8% of debtors

Give necessary accounting entries for writing off the bad debts and creating the provision for doubtful debts account. Also, show the necessary accounts.

Answer:

Question 22: The following information is extracted from the Trial Balance of M/s Nisha Traders on 31 March 2017. Additional Information

Additional Information

Bad Debts Rs 500

Provision is to be maintained at 2% of Debtors

Prepare bad debts account, Provision for bad debts account and profit and loss account.

Answer:

|

82 videos|161 docs|42 tests

|

FAQs on NCERT Solution (Part - 3) - Depreciation, Provisions and Reserves - Accountancy Class 11 - Commerce

| 1. What is depreciation? |  |

| 2. How is depreciation calculated? |  |

| 3. What are provisions and reserves? |  |

| 4. What is the difference between provisions and reserves? |  |

| 5. Why are depreciation, provisions, and reserves important in financial accounting? |  |

|

Explore Courses for Commerce exam

|

|