NCERT Solution (Part - 3) - Trial Balance and Rectification of Errors | Accountancy Class 11 - Commerce PDF Download

Page No 230:

Question 10 : Rectify the following errors :

(a) Credit sales to Mohan Rs 7,000 were posted to Karan.

(b) Credit purchases from Rohan Rs 9,000 were posted to Gobind.

(c) Goods returned to Rakesh Rs 4,000 were posted to Naresh.

(d) Goods returned from Mahesh Rs 1,000 were posted to Manish.

(e) Cash sales Rs 2,000 were posted to commission account.

Answer :

Question 11 :

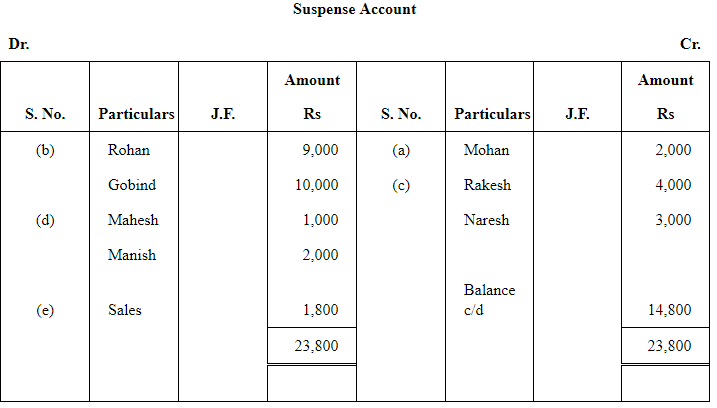

Rectify the following errors assuming that a suspense account was opened.

Ascertain the difference in trial balance.

(a) Credit sales to Mohan Rs 7,000 were posted to the credit of his account.

(b) Credit purchases from Rohan Rs 9,000 were posted to the debit of his account as Rs 6,000.

(c) Goods returned to Rakesh Rs 4,000 were posted to the credit of his account.

(d) Goods returned from Mahesh Rs 1,000 were posted to the debit of his account as Rs 2,000.

(e) Cash sales Rs 2,000 were posted to the debit of sales account as Rs 5,000.

Answer :

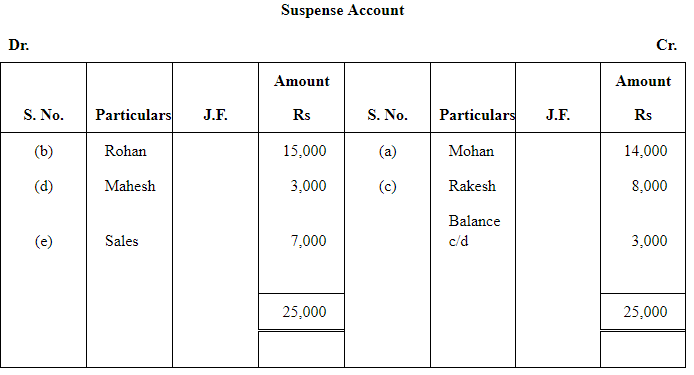

Question 12 : Rectify the following errors assuming that a suspense account was opened. Ascertain the difference in trial balance.

(a) Credit sales to Mohan Rs 7,000 were posted to Karan as Rs 5,000.

(b) Credit purchases from Rohan Rs 9,000 were posted to the debit of Gobind as Rs 10,000.

(c) Goods returned to Rakesh Rs 4,000 were posted to the credit of Naresh as Rs 3,000.

(d) Goods returned from Mahesh Rs 1,000 were posted to the debit of Manish as Rs 2,000.

(e) Cash sales Rs 2,000 were posted to commission account as Rs 200.

Answer :

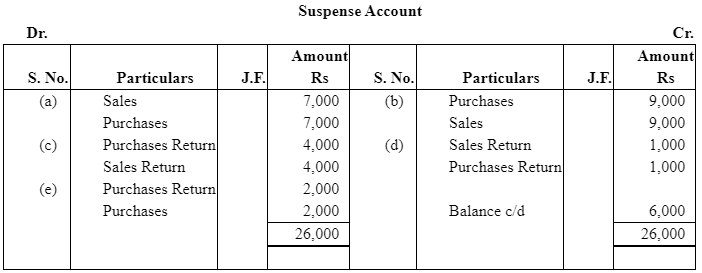

Question 13 : Rectify the following errors assuming that suspense account was opened. Ascertain the difference in trial balance.

(a) Credit sales to Mohan Rs 7,000 were recorded in Purchase Book. However, Mohan's account was correctly

(b) Credit purchases from Rohan Rs 9,000 were recorded in sales book. However, Rohan's account was correctl

(c) Goods returned to Rakesh Rs 4,000 were recorded in sales return book. However, Rakesh's account was cor

(d) Goods returned from Mahesh Rs 1,000 were recorded through purchases return book. However, Mahesh's correctly credited.

(e) Goods returned to Naresh Rs 2,000 were recorded through purchases book. However, Naresh's account was correctly debited.

Answer :

Question 14 : Rectify the following errors:

(a) Furniture purchased for Rs 10,000 wrongly debited to purchases account.(b) Machinery purchased on credit from Raman for Rs 20,000 was recorded through purchases book.

(c) Repairs on machinery Rs 1,400 debited to machinery account.

(d) Repairs on overhauling of secondhand machinery purchased Rs 2,000 was debited to Repairs account.

(e) Sale of old machinery at book value of Rs 3,000 was credited to sales account.

Answer :

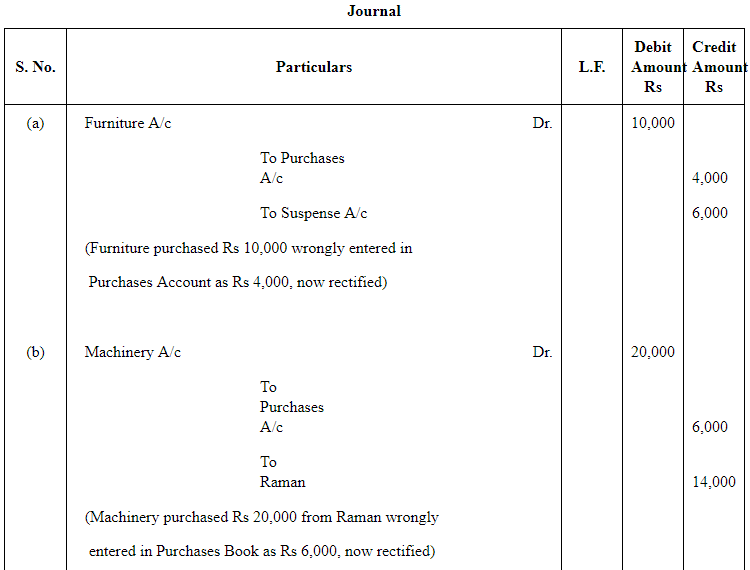

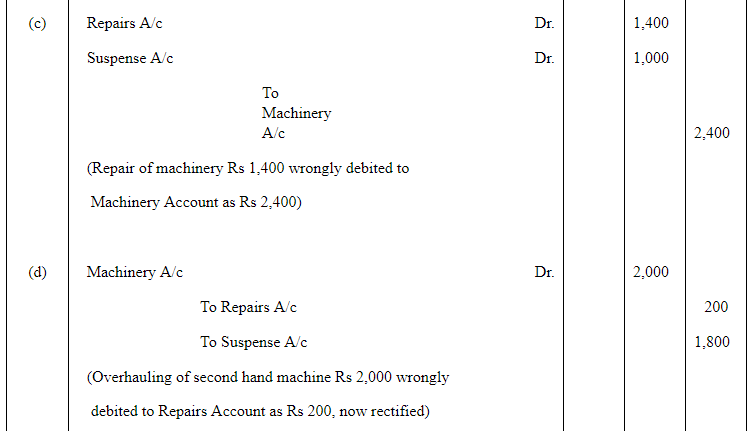

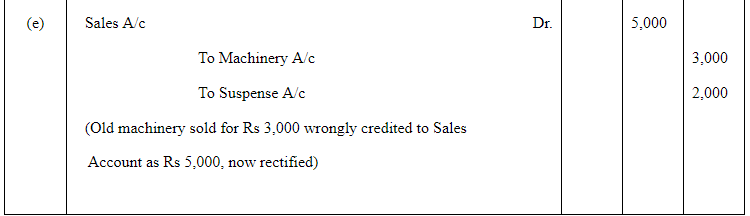

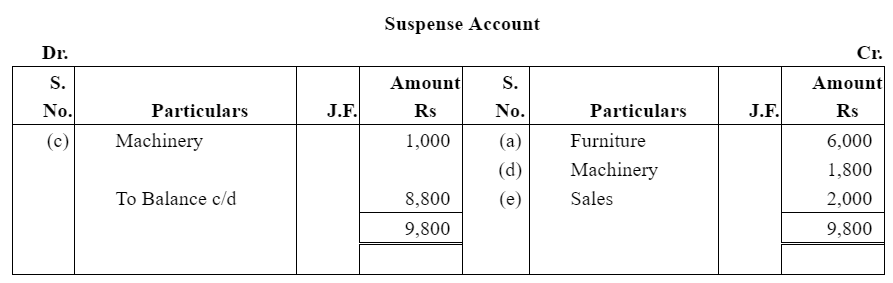

Question 15 : Rectify the following errors assuming that suspension account was opened. Ascertain the difference in trial balance.

(a) Furniture purchased for Rs 10,000 wrongly debited to purchase account as Rs 4,000.

(b) Machinery purchased on credit from Raman for Rs 20,000 recorded through Purchases Book as Rs 6,000.

(c) Repairs on machinery Rs 1,400 debited to Machinery account as Rs 2,400.(d) Repairs on overhauling of second hand machinery purchased Rs 2,000 was debited to Repairs account as Rs 200

(e) Sale of old machinery at book value Rs 3,000 was credited to sales account as Rs 5,000.

Answer :

Question 16 : Rectify the following errors:

(a) Depreciation provided on machinery Rs 4,000 was not posted.

(b) Bad debts written off Rs 5,000 were not posted.

(c) Discount allowed to a debtor Rs 100 on receiving cash from him was not posted.

(d) Discount allowed to a debtor Rs 100 on receiving cash from him was not posted to discount account.

(e) Bill receivable for Rs 2,000 received from a debtor was not posted.

Answer :

Question 17 : Rectify the following errors:

(a) Depreciation provided on machinery Rs 4,000 was posted as Rs 400.

(b) Bad debts written off Rs 5,000 were posted as Rs 6,000.

(c) Discount allowed to a debtor Rs 100 on receiving cash from him was posted as Rs 60.

(d) Goods withdrawn by proprietor for personal use Rs 800 were posted as Rs 300.

(e) Bill receivable for Rs 2,000 received from a debtor was posted as Rs 3,000.

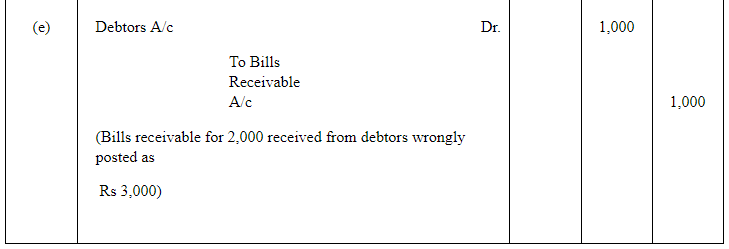

Answer :

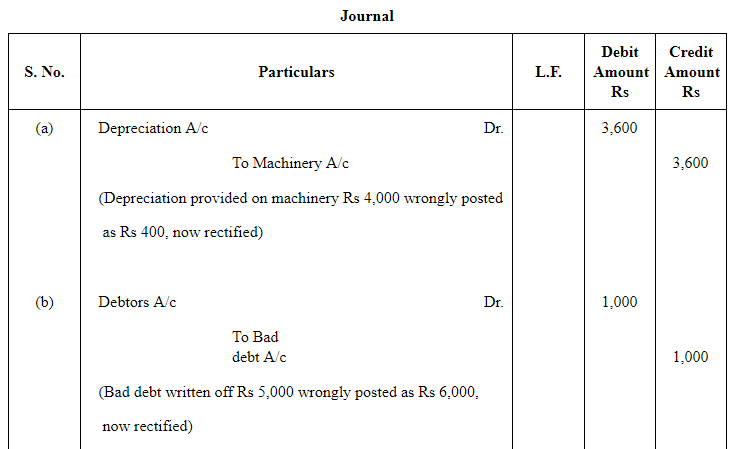

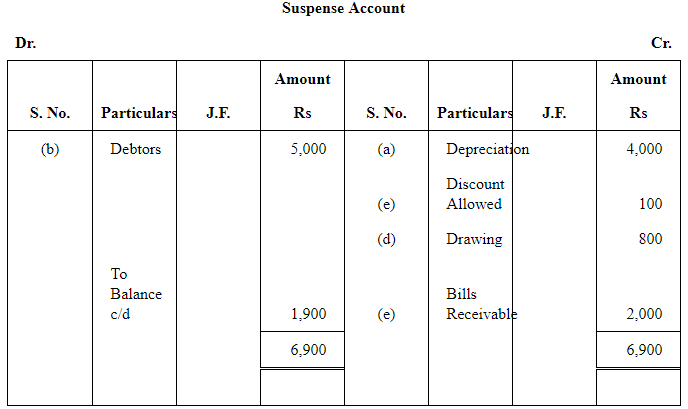

Question 18 : Rectify the following errors assuming that suspense account was opened. Ascertain the difference in trial balance.

(a) Depreciation provided on machinery Rs 4,000 was not posted to Depreciation account.

(b) Bad debts written-off Rs 5,000 were not posted to Debtors account.

(c) Discount allowed to a debtor Rs 100 on receiving cash from him was not posted to discount allowed account.

(d) Goods withdrawn by proprietor for personal use Rs 800 were not posted to Drawings account.

(e) Bill receivable for Rs 2,000 received from a debtor was not posted to Bills receivable account.

Answer :

|

64 videos|153 docs|35 tests

|

FAQs on NCERT Solution (Part - 3) - Trial Balance and Rectification of Errors - Accountancy Class 11 - Commerce

| 1. What is the purpose of a trial balance in accounting? |  |

| 2. How do you prepare a trial balance? |  |

| 3. What are the types of errors that can occur in a trial balance? |  |

| 4. How can errors in a trial balance be rectified? |  |

| 5. What is the significance of a balanced trial balance? |  |

|

Explore Courses for Commerce exam

|

|