NCERT Solution (Part - 3) - Accounting for Partnership : Basic Concepts | Additional Study Material for Commerce PDF Download

Numerical Questions : Page No - 105 :

Q11:

Rahul, Rohit and Karan started partnership business on April 1, 2013 with capitals of Rs 20,00,000, Rs 18,00,000 and Rs 16,00,000, respectively. The profit for the year ended March 2014 amounted to Rs 1,35,000 and the partner’s drawings had been Rahul Rs 50,000, Rohit Rs 50,000 and Karan Rs 40,000. The profits are distributed among partner’s in the ratio of 3:2:1. Calculate the interest on capital @ 5% p.a.

Answer :

Interest on Capital

Rahul = 20,00,000 × 5/100 = Rs 1,00,000

Rohit = 18,00,000 × 5/100= Rs 90,000

Karan = 16,00,000 × 5/100 = Rs 80,000

Q12 :

Sunflower and Pink Rose started partnership business on April 01, 2006 with capitals of Rs 2,50,000 and Rs 1,50,000, respectively. On October 01, 2006, they decided that their capitals should be Rs 2,00,000 each. The necessary adjustments in the capitals are made by introducing or withdrawing cash. Interest on capital is to be allowed @ 10% p.a. Calculate interest on capital as on March 31, 2007.

Answer :

Product Method

Sunflower

01 April 2013 to 30 September 2013 | 2,50,000 × 6 = | 15,00,000 |

01 October 2013 to 31 March 2014 | 2,00,000 × 6 = | 12,00,000 |

| Sum of Product | 27,00,000 |

Pink Rose

01 April 2013 to 30 September 2013 | 1,50,000 × 6 = | 9,00,000 |

01 October 2013 to 31 March 2014 | 2,00,000 × 6 = | 12,00,000 |

| Sum of Product | 21,00,000 |

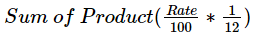

Interest on Capital =

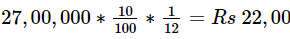

Interest on Sunflower's Capital =

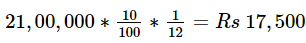

Interest on Pink Rose's Capital =

Alternative Method:

Simple Interest Method

Sunflower

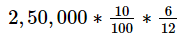

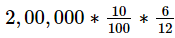

April 01, 2013 to September 30, 2013 |  | = |

Rs 12,500

|

October 01, 2013 to March 31, 2014 |  | = |

Rs 10,000

|

| Interest on Sunflower’s Capital | Rs 22,500 | |

Pink Rose

April 01, 2013 to September 30, 2013 |  | = |

Rs 7,500

|

October 01, 2013 to March 31, 2014 |  | = |

Rs 10,000

|

| Interest on Pink Rose’s Capital | Rs 17,500 | |

Question 13:

On March 31, 2006 after the close of accounts, the capitals of Mountain, Hill and Rock stood in the books of the firm at Rs 4,00,000, Rs 3,00,000 and Rs 2,00,000, respectively. Subsequently, it was discovered that the interest on capital @ 10% p.a. had been omitted. The profit for the year amounted to Rs 1,50,000 and the partner’s drawings had been Mountain: Rs 20,000, Hill Rs 15,000 and Rock Rs 10,000. Calculate interest on capital.

Answer :

Generally interest on Capital is calculated on opening balance of capital. If additional capital is not given.

| Mountain | Hill | Rock |

Closing Capital | 4,00,000 | 3,00,000 | 2,00,000 |

Add: Drawings | 20,000 | 15,000 | 10,000 |

Less: Profit (1:1:1) | (50,000) | (50,000) | (50,000) |

Opening Capital | 3,70,000 | 2,65,000 | 1,60,000 |

Interest on Capital

Mountain | 3,70,000 × (10/100)= Rs 37,000 |

Hill | 2,65,000 × (10/100)= Rs 26,500 |

Rock | 1,60,000 × (10/100)= Rs 16,000 |

Q14 :

Following is the extract of the Balance Sheet of, Neelkant and Mahdev as on March 31, 2013:

Balance Sheet as at March 31, 2013 | |||

| Amount |

| Amount |

Liabilities | Rs | Assets | Rs |

Neelkant’s Capital | 10,00,000 | Sundry Assets | 30,00,000 |

Mahadev’s Capital | 10,00,000 |

|

|

Neelkant’s Current Account | 1,00,000 |

|

|

Mahadev’s Current Account | 1,00,000 |

|

|

Profit and Loss Apprpriation |

|

|

|

(March 2007*) | 8,00,000 |

|

|

| 30,00,000 |

| 30,00,000 |

During the year Mahadev’s drawings were Rs 30,000. Profits during 2013 is Rs 10,00,000. Calculate interest on capital @ 5% p.a for the year ending March 31, 2013.

* As per the question, this year should be March 2013

Answer:

Interest on Capital

Neelkant's 10,00,000* (5/100)= Rs 50,000

Mahadev's 10,00,000 * (5/100)= Rs 50,000

Note: In this question, as the balances of both Partner's Capital Account and of Partner's Current Account are mentioned, so it has been assumed that the capital of the partners is fixed.

As we know, when the capital of the partners is fixed, drawings and interest on capital does not affect the capital balances of the partners. Rather, it would affect their current account balances. Therefore, in this case, capital at the beginning (i.e. opening capital) and capital at the end (i.e. closing capital) of the year would remain same. Thus, the interest on capital is calculated on fixed capital balances (given in the Balance Sheet of the question).

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 3) - Accounting for Partnership : Basic Concepts - Additional Study Material for Commerce

| 1. What are the basic concepts of accounting for partnership? |  |

| 2. What is a partnership deed and why is it important? |  |

| 3. How are capital accounts maintained in a partnership? |  |

| 4. What is a profit and loss appropriation account in a partnership? |  |

| 5. How are financial statements prepared for partnerships? |  |

|

Explore Courses for Commerce exam

|

|