NCERT Solution (Part - 2) - Accounts from Incomplete Records | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year PDF Download

Page Number : 477

Numerical Questions :

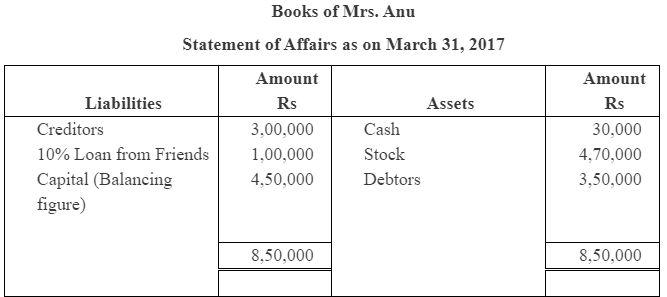

Question 6: Mrs Anu started firm with a capital of Rs 4,00,000 on 1st October 2016. She borrowed from her friends a sum of Rs 1,00,000 @ 10% per annum (interest paid) for business and brought a further amount to capital Rs 75,000 on March 31, 2017, her position was:

He withdrew Rs 8,000 per month for the year. Calculate profit or loss for the year and show your working clearly.

Answer :

Page Number : 478

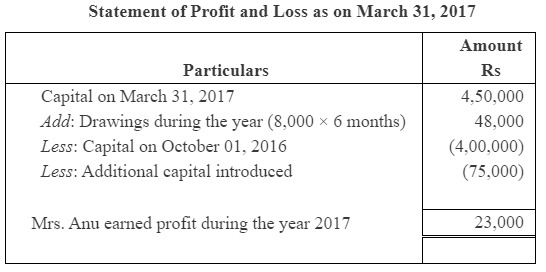

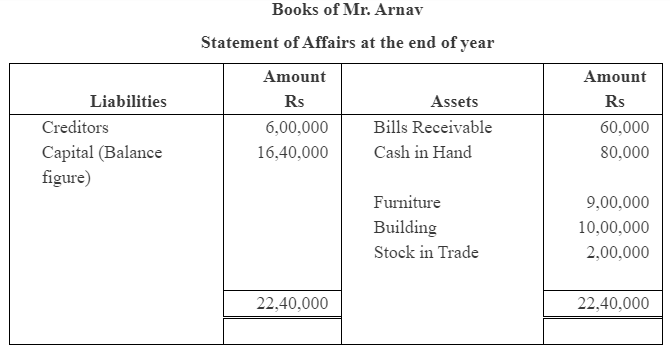

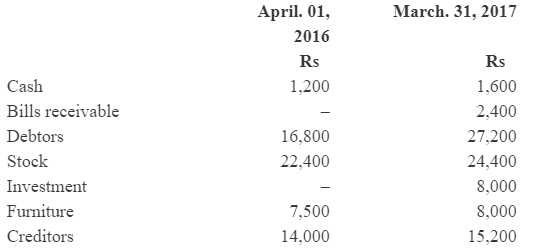

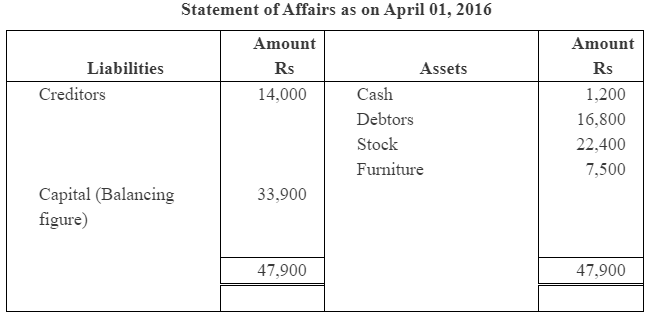

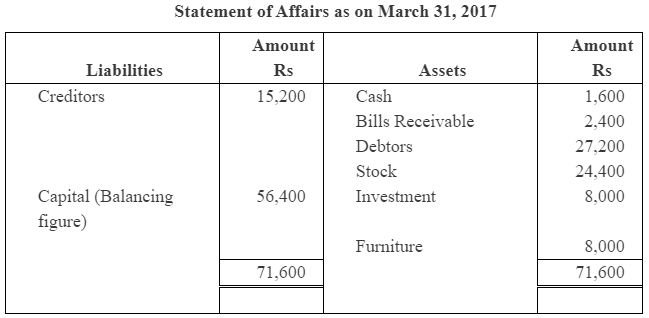

Question.7 : Mr. Arnav does not keep proper records of his business he provided following information, you are required to prepare a statement showing the profit or loss for the year.

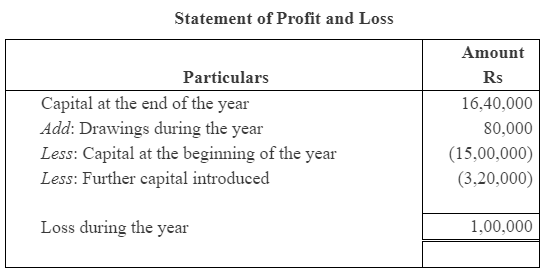

Ascertainment of statement of affairs at the beginning and at the end of the year and calculation of profit or loss.

Answer :

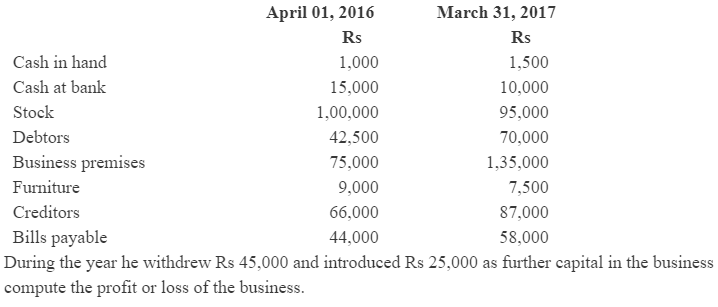

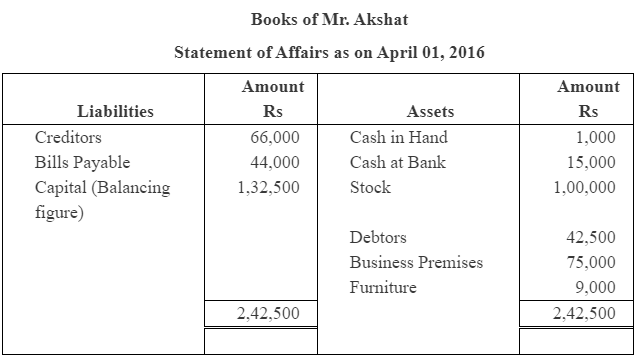

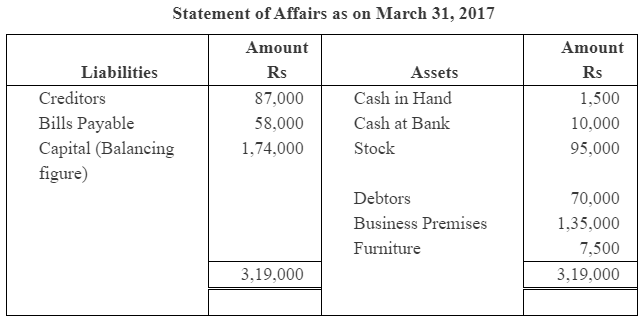

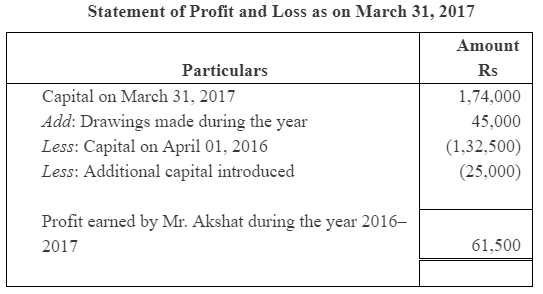

Question.8 : Mr. Akshat keeps his books on incomplete records following information is given below:

Answer :

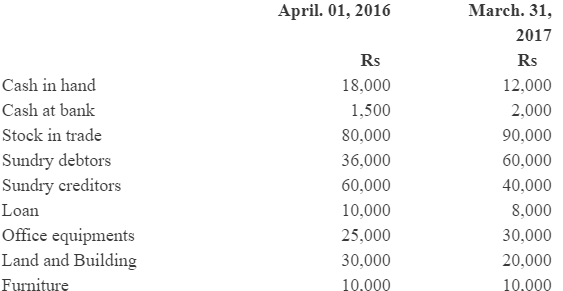

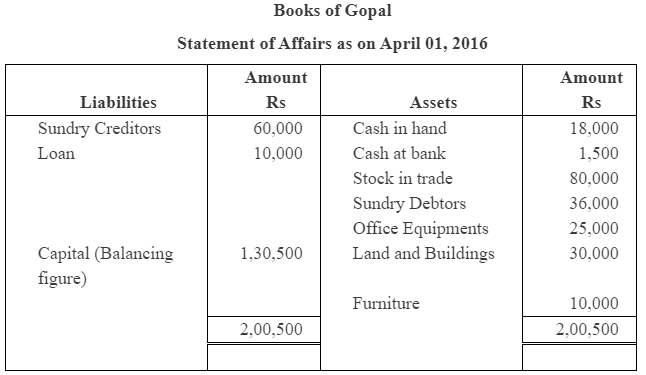

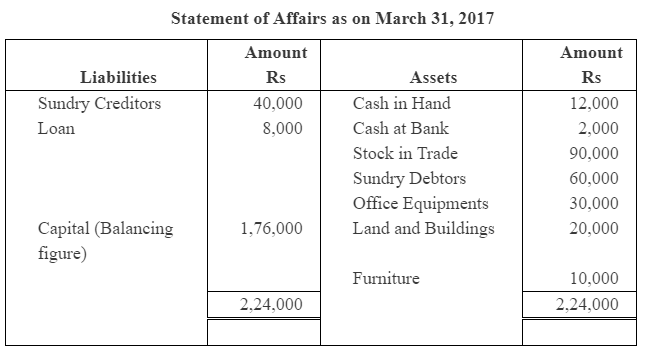

Question.9 : Gopal does not keep proper books of account. Following information is given below:

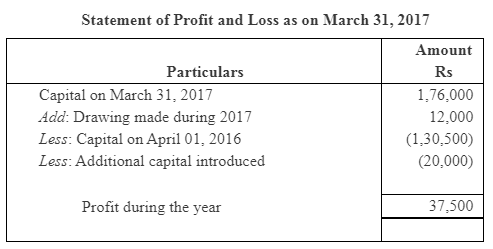

During the year he introduced Rs 20,000 and withdrew Rs 12,000 from the business.Prepare the statement of profit or loss on the basis of given information

Answer :

Note: As per the solution, the profit during the year should be Rs 37,500; whereas, the profit given in the book is Rs 53,500.

Page Number : 479

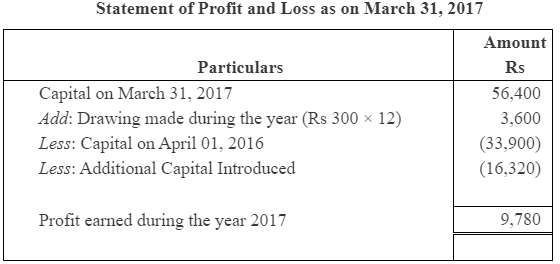

Question.10 : Mr. Muneesh maintains his books of accounts from incomplete records. His books provide the information:

He withdrew Rs 300 per month for personal expenses. He sold his investment of Rs 16,000 at 2% premium and introduced that amount into business.

Answer :

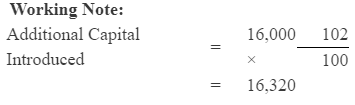

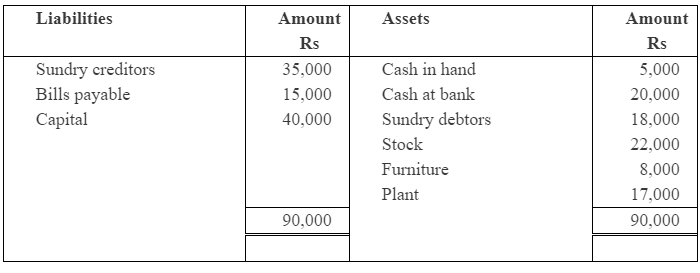

Question.11 : Mr. Girdhari Lal does not keep full double entry records. His balance as on April 01, 2006 is as.

His position at the end of the year is:

He withdrew Rs 500 per month out of which to spent Rs 1,500 for business purpose. Prepare the statement of profit or loss.

Answer :

Page Number : 480

Numerical Questions :

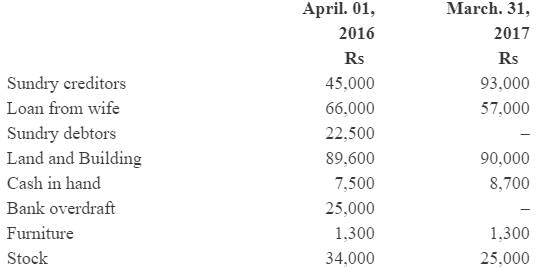

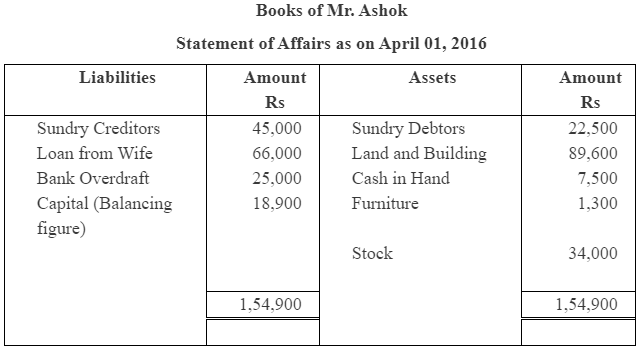

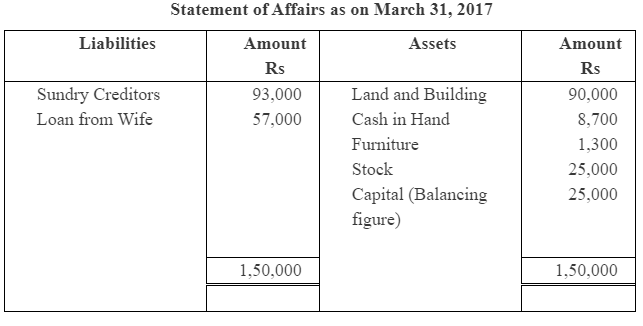

Question.12 : Mr. Ashok does not keep his books properly. Following information is available from his books.

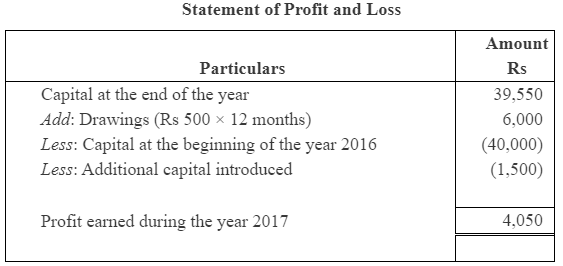

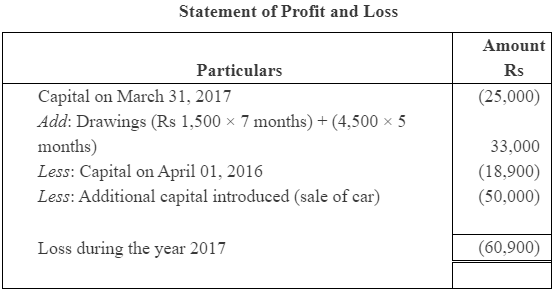

During the year Mr. Ashok sold his private car for Rs 50,000 and invested this amount into the business. He withdrew from the business Rs 1,500 per month upto October 31, 2016 and thereafter Rs 4,500 per month as drawings. You are required to prepare the statement of profit or loss and statement of affair as on March 31, 2017.

Answer :

Note: As per the solution, the loss incurred during the year 2011 is Rs 60,900; while the answer given in the book shows Rs 57,900.

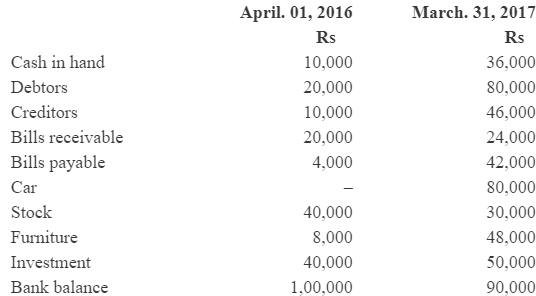

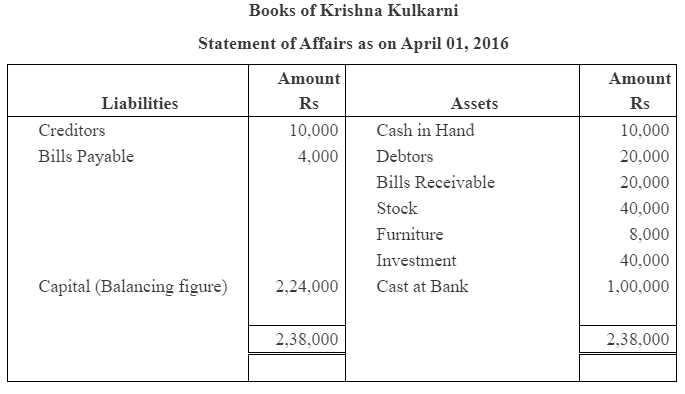

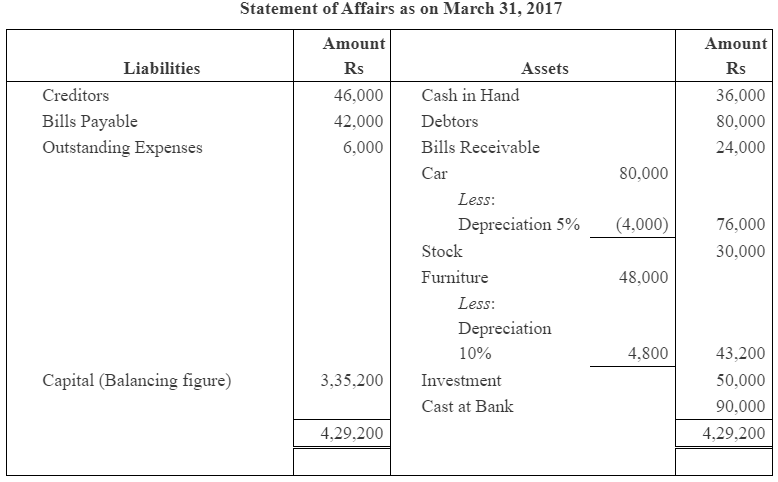

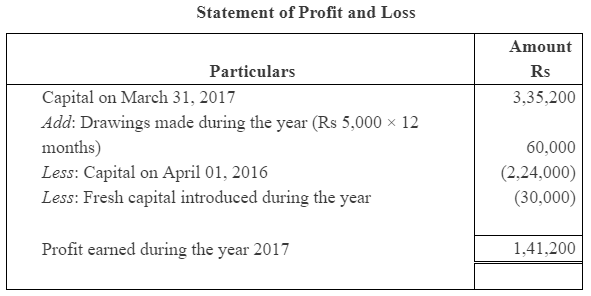

Question.13 : Krishna Kulkarni has not kept proper books of accounts prepare the statement of profit or loss for the year ending December 31, 2017 from the following information:

The following adjustments were made:

(a) Krishna withdrew cash Rs 5,000 per month for private use.

(b) Depreciation @ 5% on car and furniture @10%.

(c) Outstanding Rent Rs 6,000.

(d) Fresh Capital introduced during the year Rs 30,000.

Answer :

|

1597 videos|1643 docs|920 tests

|

FAQs on NCERT Solution (Part - 2) - Accounts from Incomplete Records - SSC CGL Tier 2 - Study Material, Online Tests, Previous Year

| 1. What is meant by accounts from incomplete records? |  |

| 2. Why do businesses use accounts from incomplete records? |  |

| 3. What are the limitations of accounts from incomplete records? |  |

| 4. How are financial statements prepared using accounts from incomplete records? |  |

| 5. What are the key differences between accounting from complete records and accounting from incomplete records? |  |