NCERT Solution (Part - 1) - Accounts from Incomplete Records | SSC CGL Tier 2 - Study Material, Online Tests, Previous Year PDF Download

Page Number : 476

Short answers :

Question.1 : State the meaning of incomplete records?

Answer : Accounts that are not recorded as per the double entry system are known as

incomplete records. According to Kohler (Dictionary for Accountants), single entry

system is defined as, " A system of book-keeping in which as a rule, only records of

cash and of personal accounts are maintained; it is always incomplete double entry,

varying with circumstances."

Many small-sized business firms maintain incomplete records of their business transactions. They do not maintain proper books of accounts and mainly prepare books like, Cash Book, personal accounts (of debtors and creditors) and Balance Sheet at the end of the year. They maintain books as per their needs. This system is also known as defective double entry system. The preparation of financial statements is neither as easier nor as effective, as it is under double entry system. Consequently, accurate profit or loss is not possible to ascertain.

Question.2 : What are the possible reasons for keeping incomplete records?

Answer : The possible reasons for keeping incomplete records are:

1. Simple method: Proprietors, who do not have the proper knowledge of accounting

principles, find it much convenient and easier to maintain their business records under

this system.

2. Less time consuming: Maintaining books according to the single entry system is less time consuming, as only few books are to be maintained. Further, the books are not as comprehensive as they are under double entry system.

3. Less expensive: It is an economical mode of maintaining records, as there is no need to appoint specialised accountant.

4. Flexible: Owner may record transactions as per his/her own needs. It can be easily adjusted or changed whenever needed.

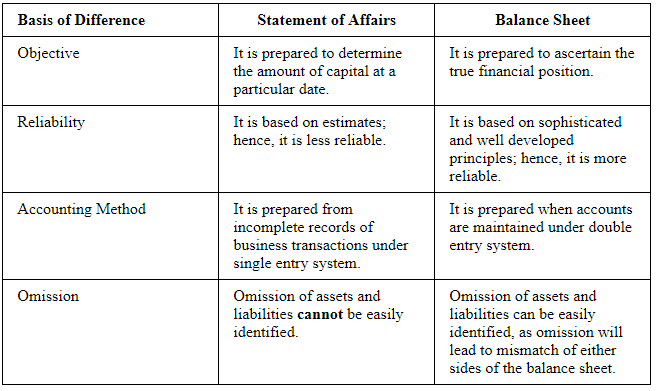

Question.3 : Distinguish between statement of affairs and balance sheet.

Answer : Difference between Statement of Affairs and Balance Sheet

Question.4 : What practical difficulties are encountered by a trader due to incompleteness of accounting records?

Answer : The following are the difficulties that are encountered by a trader due to incompleteness of accounting records.

1. Accuracy of accounts: Arithmetical accuracy of accounts can not be ascertained, since proper records of accounts are not maintained. Consequently, Trial Balance cannot be prepared.

2. Encourages fraud: As the arithmetical accuracy cannot be determined; so, this encourages fraud and provides sufficient scope for bluffing and carelessness.

3. Difficult to ascertain correct profit or loss: Since all expenses and income are not recorded, true profit or loss cannot be correctly ascertained.

4. Difficult to analyse the true financial position: As profit or loss cannot be ascertained easily, so the Balance Sheet cannot be easily prepared. Hence, the absence of Balance Sheet will not reflect the true financial position of the business.

5. Difficulty in comparison: Due to the incomplete records and non-availability of previous years' data, comparison isnot possible. By the same token, comparisons with other firms are also not possible.

6. Unacceptable to tax authorities: It does not reflect the true and acceptable presentation of expenses and revenues. Hence, these are not acceptable by the tax authorities.

7. Raising funds: Since analysis of solvency, profitability and liquidity of business cannot be done, it is difficult to raise fund from outside.

Long answers:

Page No 476:

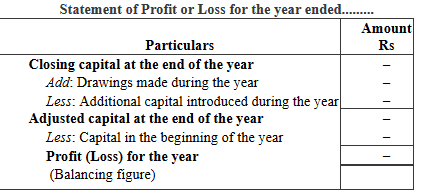

Question.1 : What is meant by a 'statement of affairs'? How can the profit or loss of a trader be ascertained with the help of a statement of affairs?

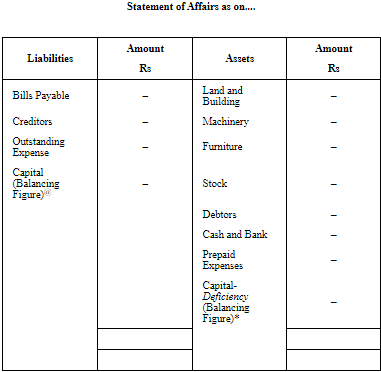

Answer : A Statement of Affairs resembles Balance Sheet; however, it is not called a Balance Sheet. The statement of affairs is a Statement of Assets and Liabilities. The main difference between a Statement of Affairs and a Balance Sheet is that while the former is prepared on the basis of physical counts and improper source documents, the latter is prepared purely on the basis of ledger accounts. Thus, the authentication and relevance of the latter is guaranteed. The excess of assets over liabilities (i.e., balancing figure) is denoted as the capital of the firm. The performa of the statement of affairs is presented below.

* When liabilities are more than assets, then the balancing figure is denoted by Capital - Deficiency in the assets side of the statement of affairs.

@ When the assets' balance exceeds liabilities' balance, the balancing figure is denoted by Capital in the liabilities side of the statement of affairs.

For ascertaining profit or loss, if capital in the beginning is not given, then opening statement of affairs is prepared in order to calculate the capital in the beginning. Once the opening capital and closing capital is calculated, a Statement of Profit or Loss is prepared to determine the amount of profit earned or loss incurred during the accounting period.

Question.2 : Is it possible to prepare the profit and loss account and the balance sheet from the incomplete book of accounts kept by a trader'? Do you agree? Explain.

Answer : The Profit and Loss Account and the Balance Sheet can be prepared from the

incomplete book of accounts through Conversion Method. According to this method,

incomplete records are converted into double entry records. In case of incomplete

records, details of some transactions are easily available like cash sales, cash

purchases, creditors, debtors; however, there are number of transactions, the details of

which may not be available directly. Yet, these details can be found out indirectly or

logically. Some of the important items that are vital for preparing Balance Sheet are

given below.

1. Opening Capital

2. Closing Capital

3. Credit Purchases

4. Cash Purchases

5. Credit Sales

6. Cash Sales

7. Payment from Debtors

8. Payment to Creditors

9. Opening Stock

10. Closing Stock

Below given are the steps included in the conversion method in a chronological order.

1. If opening capital is not given, then the first step is to prepare opening Statement of Affairs that gives the Opening Capital.

2. The second step is to prepare Cash Book that gives the opening or the closing cash and bank balance.

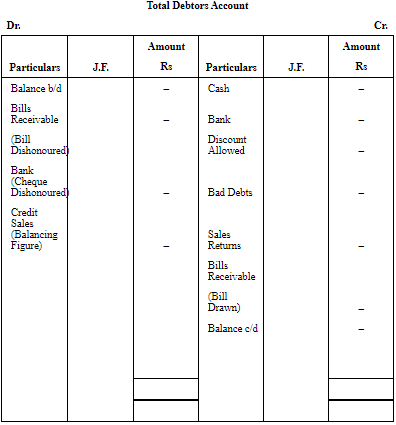

3. The next step is to prepare Total Debtors Account. It is prepared in order to find out one of the missing figures, such ascredit sales, opening debtors, closing debtors and cash received from debtors.

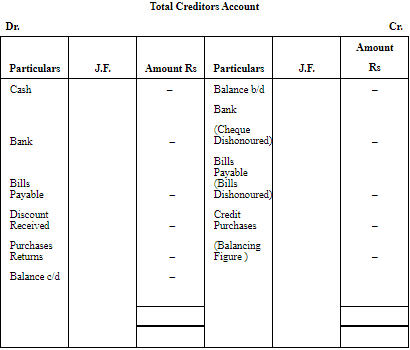

4. The subsequent step is to prepare Total Creditors Account to ascertain one of the missing figures, such as credit sales, opening creditors, closing creditors and cash paid to the creditors.

5. The last step is to prepare final accounts. On the basis of the missing figures ascertained in each of the above steps, along with other mentioned information, Trading and Profit and Loss Account and Balance Sheet can be prepared.

Question.3 : Explain how the following may be ascertained from incomplete records:

(a) Opening capital and closing capital

(b) Credit sales and credit purchases

(c) Payments to creditors and collection from debtors

(d) Closing balance of cash.

Answer : 1. Opening capital and closing capital: Opening capital can be ascertained by preparing opening statement of affairs at the beginning of the accounting period and closing capital can be ascertained by preparing closing Statement of Affairs at the end of the accounting period.

* When liabilities are more than assets, capital appears in assets side, as it is balancing figure.

@ When the assets' balance exceeds liabilities' balance, the balancing figure is denoted by capital in the Liabilities side of the Statement of Affairs.

2. Credit Sales and Credit Purchases: Credit sales are ascertained as the balancing figure of the Total Debtors Account and Credit Purchases are ascertained as the balancing figure of the Total Creditors Account.

3. Payment to creditors and collection from debtors: Payment to the creditors are ascertained from the Total Creditors Account as a balancing figure and collection from debtors are ascertained from the Total Debtors Account as a balancing figure.

4. Closing balance of cash: Closing balance of cash is ascertained from the Cash Book, which shows all receipts in the debit side and all payments in the credit side during an accounting year and the balancing figure of the cash book is the closing balance of cash.

Page No : 476

Numerical questions :

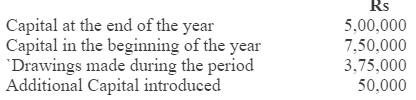

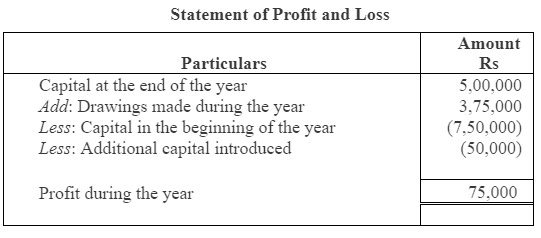

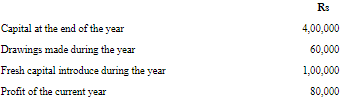

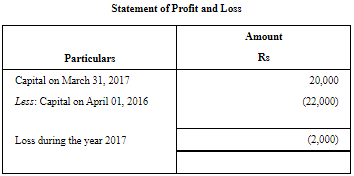

Question.1 : Following information is given below prepare the statement of profit or loss:

Ans

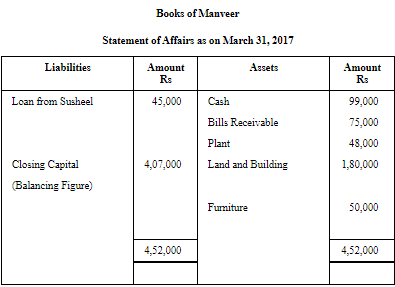

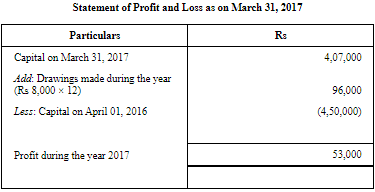

Question.2 : Manveer started his business on January 01, 2016 with a capital of Rs 4,50,000. On December 31, 2017 his position was as under:

He owned Rs 45,000 from his friend Susheel on that date. He withdrew Rs 8,000 per month for his household purposes. Ascertain his profit or loss for this year ended December 31, 2017.

Answer :

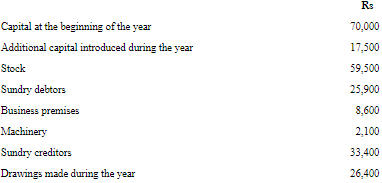

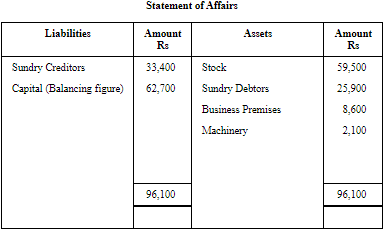

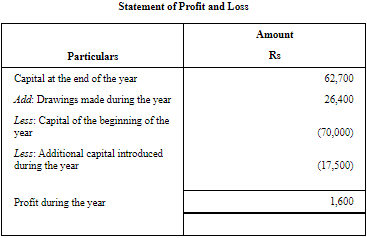

Question.3 : From the information given below ascertain the profit for the year:

Answer :

Question.4 : From the following information, calculate capital at the beginning:

Answer : Capital in the beginning = Capital at the end + Drawings - (Fresh Capital Introduced + Profit)

= 4,00,000 + 60,000 - (1,00,000 + 80,000)

= Rs 2,80,000

Note: As per the solution, the profit should be of Rs 2,80,000; but, the answer given in the book is Rs 2,60,000.

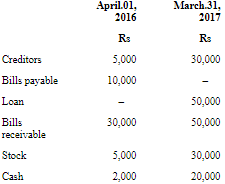

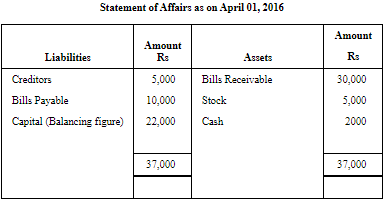

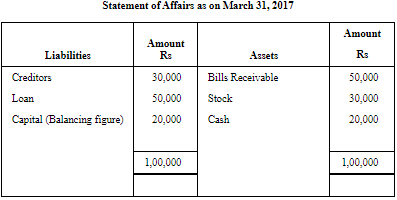

Question.5 : Following information is given below: calculate the closing capital

Calculation of profit or loss and ascertainment of statement of affairs at the end of the year (Opening Balance is given)

Answer :

Capital on March 31, 2017 (Closing) is Rs 20,000

|

1595 videos|1637 docs|920 tests

|

FAQs on NCERT Solution (Part - 1) - Accounts from Incomplete Records - SSC CGL Tier 2 - Study Material, Online Tests, Previous Year

| 1. What is Incomplete Records in Accounting? |  |

| 2. What are the methods used to prepare Trading and Profit and Loss Account in Incomplete Records? |  |

| 3. What are the advantages of Incomplete Records? |  |

| 4. What are the limitations of Incomplete Records? |  |

| 5. What are the steps involved in preparing Trading and Profit and Loss Account in Incomplete Records using the Statement of Affairs method? |  |