NCERT Solution (Part - 2) - Finacial Statements of a Company | Additional Study Material for Commerce PDF Download

Page No 173:

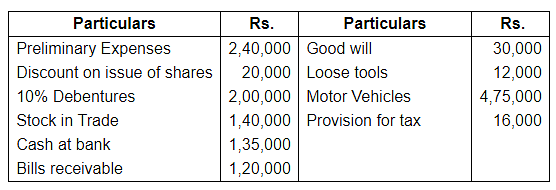

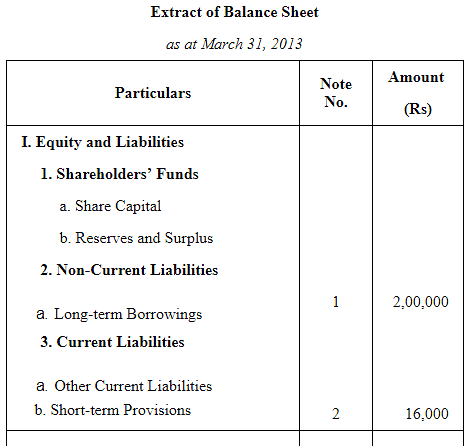

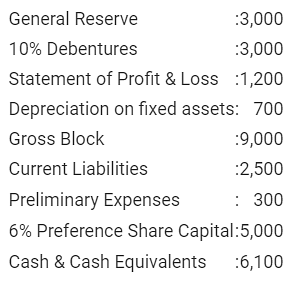

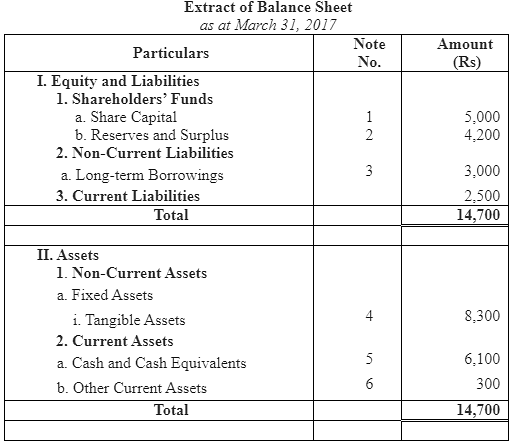

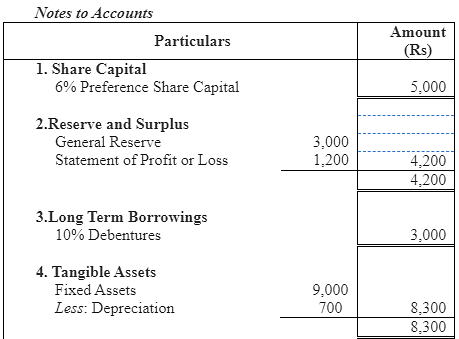

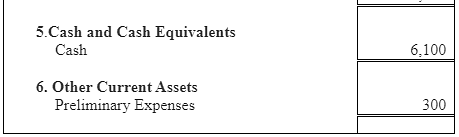

Question 1: Show the following items in the balance sheet as per the provisions of the Companies Act, 2013 in Schedule III:

ANSWER:

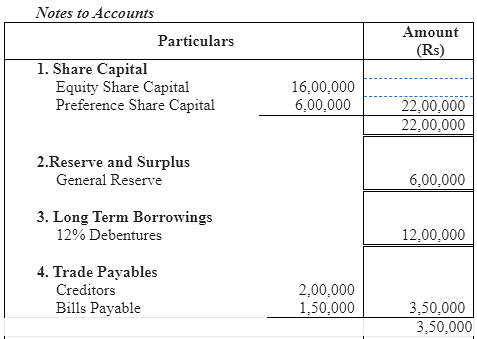

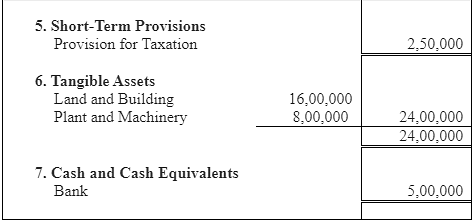

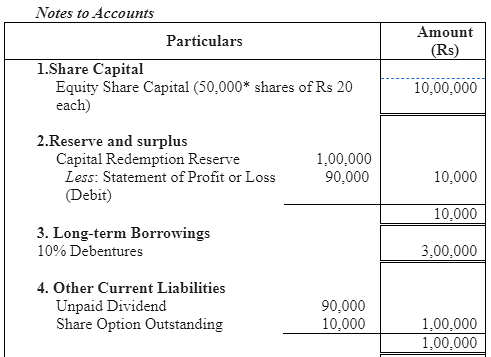

Notes to Accounts

Page No 174:

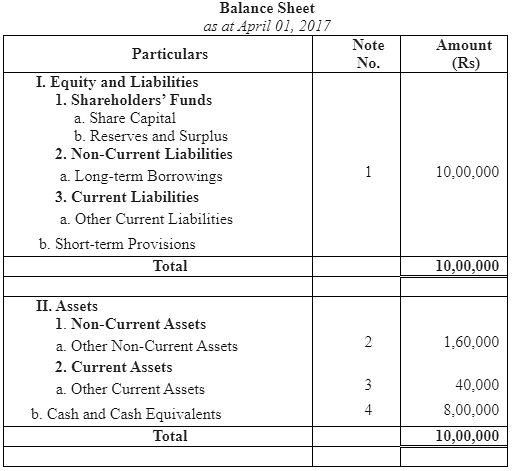

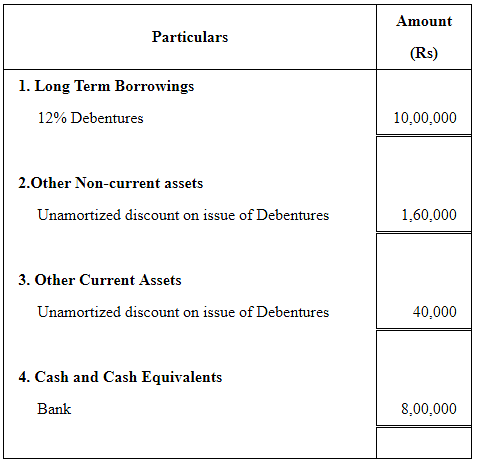

Question 2: On 1st Aril, 2017, Jumbo Ltd. issued 10,000; 12% debentures of Rs. 100 each a discount of 20%, redeemable after 5 years. The company decided to write-off discount on issue of such debentures over the life time of the Debentures. Show the items in the balance sheet of the company immediately after the issue of these debentures.

ANSWER:

Notes to Accounts

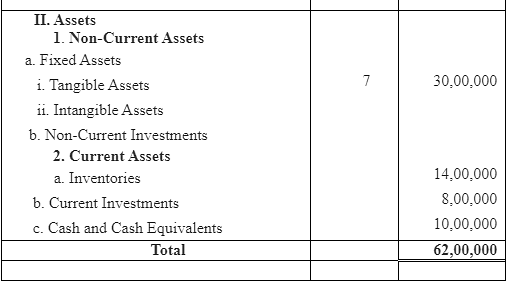

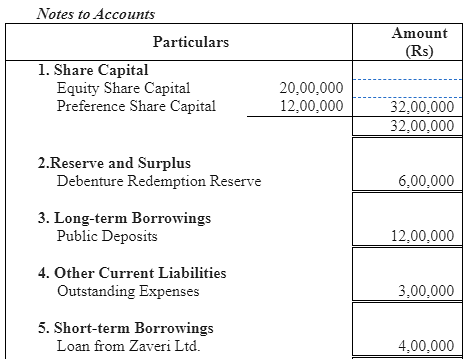

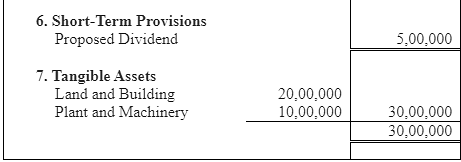

Question 3: From the following information prepare the balance sheet of Gitanjali Ltd., as per the (Revised) Schedule VI:

Inventories Rs. 14,00,000; Equity Share Capital Rs. 20,00,000; Plant and Machinery Rs. 10,00,000; Preference Share Capital Rs. 12,00,000; Debenture Redemption Reserve Rs. 6,00,000; Outstanding Expenses Rs. 3,00,000; Proposed Dividend Rs. 5,00,000; Land and Building Rs. 20,00,000; Current Investments Rs. 8,00,000; Cash Equivalent Rs. 10,00,000; Short term loan from Zaveri Ltd. (A Subsidiary Company of Twilight Ltd.) Rs. 4,00,000; Public Deposits Rs. 12,00,000.

ANSWER:

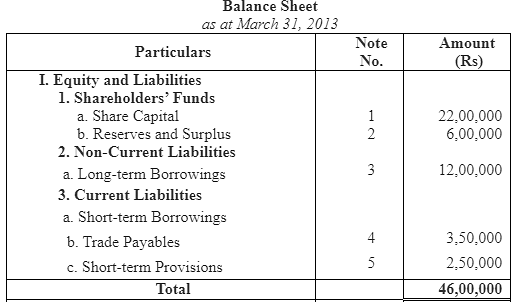

Question 4: From the following information prepare the balance sheet of Jam Ltd. as per the (revised) Schedule VI:

Inventories Rs. 7,00,000; Equity Share Capital Rs. 16,00,000; Plant and Machinery Rs. 8,00,000; Preference Share Capital Rs. 6,00,000; General Reserves Rs. 6,00,000; Bills payable Rs. 1,50,000; Provision for taxation Rs. 2,50,000; Land and Building Rs. 16,00,000; Noncurrent Investments Rs. 10,00,000; Cash at Bank Rs. 5,00,000;Creditors Rs. 2,00,000; 12% Debentures Rs. 12,00,000.

ANSWER:

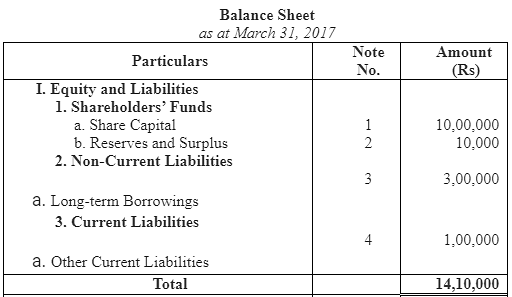

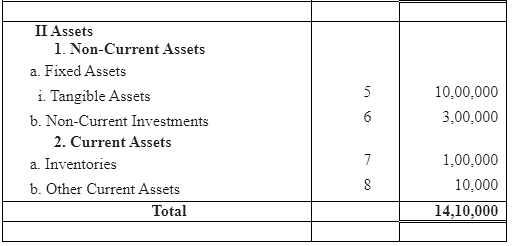

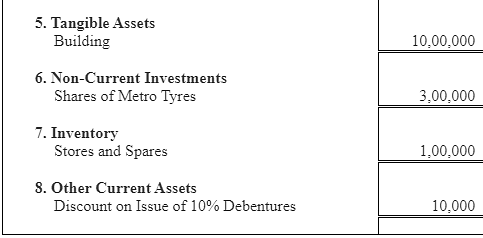

Question 5: Prepare the balance sheet of Jyoti Ltd. as at March 31, 2017 from the following information:

Building Rs. 10,00,000; Investments in the shares of Metro Tyers Rs. 3,00,000; Stores & Spares Rs. 1,00,000; Discount on issue of 10% debentures Rs. 10,000; Statement of Profit and Loss (Dr.) Rs. 90,000; 5,00,000 Equity Shares of Rs. 20 each fully paid-up; Capital Redemption Reserve Rs. 1,00,000; 10% Debentures Rs. 3,00,000; Unpaid dividends Rs. 90,000; Share options outstanding account Rs. 10,000.

ANSWER:

*Note: There is a misprint in the book. The number of equity shares issued must be 50,000 so that both the sides of the Balance Sheet stand equal.

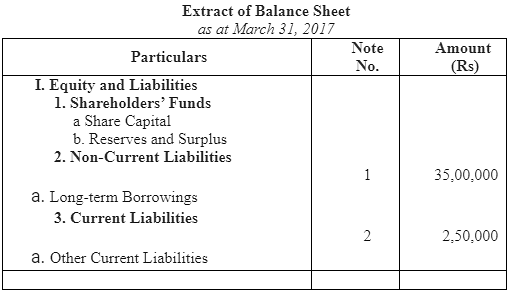

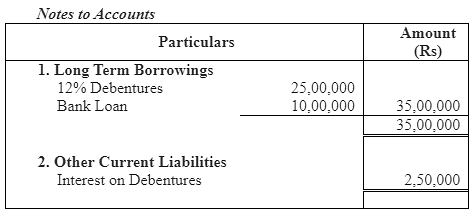

Question 6: Brinda Ltd. has furnished the following information:

(a) 25,000, 10% debentures of Rs. 100 each;

(b) Bank Loan of Rs. 10,00,000 repayable after 5 years;

(c) Interest on debentures is yet to be paid.

Show the above items in the balance sheet of the company as at March 31, 2017.

ANSWER:

Page No 175:

Question 7: Prepare a balance sheet of Black Swan Ltd., as at March 31, 2017 form the following information:

ANSWER:

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 2) - Finacial Statements of a Company - Additional Study Material for Commerce

| 1. What are financial statements of a company? |  |

| 2. What is the purpose of financial statements? |  |

| 3. How often are financial statements prepared? |  |

| 4. What is the difference between the balance sheet and income statement? |  |

| 5. How do financial statements help investors in decision-making? |  |

|

Explore Courses for Commerce exam

|

|